Since 2020, institutional interest has been a leading force in the demand for Bitcoin – people are investing in itevenpension funds.However, many companies, for a number of reasons, do not want to work directly with cryptocurrency exchanges, which is why they have to turn to related instruments (for example, stocks of Grayscale funds). This leads to high commission costs.

Image Source:BofA Global Research

A compromise solution is trading in sharesexchange traded funds (ETFs) that are available directly on the stock exchange. Earlier this year, several Bitcoin ETFs were successfully launched in Canada, where the largest funds now manage over $ 2 billion.

When investing in ETFs on Bitcoin, you do not needworry about cold storage methods for cryptocurrency, and transactions on the stock exchange are under the same protection and supervision as transactions in stocks. The disadvantage is the asset management fee, but its size varies from fund to fund in the range from 1.00% to 0.40%.

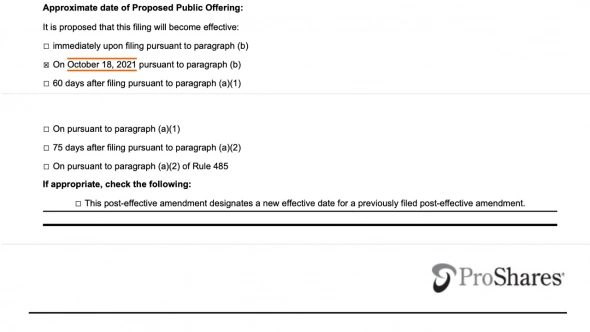

In the US, applications for the creation of ETFs on Bitcoin have becometo arrive in 2013, and only now there are clear signs of the imminent launch of one of them. The regulator represented by the SEC is not obliged to loudly announce the imminent resolution of a new exchange-traded instrument. However, on Friday, Proshares, after making the changes required by the SEC, sent an adjusted application, where the start of the fund's launch is October 18, 2021.

Image Source:cointelegraph.com

The application has not yet been approved, and this is only a Bitcoin futures ETF, not a spot instrument. However, this step is also important on the way to the recognition of cryptocurrency as an investment instrument.

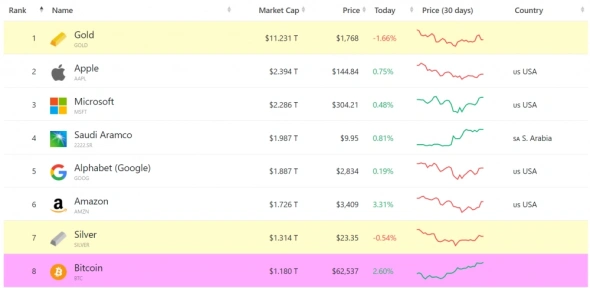

Image Source: Cryptocurrency ExchangeStormGain

Bitcoin is close to updating its historicalmaximum, its capitalization exceeds $ 1 trillion, and in the near future it may become more expensive than all the silver mined in the world. The emergence of new exchange instruments will lead to an increase in demand for cryptocurrency.

Image source: companiesmarketcap.com

What do you think is better to invest in silver or Bitcoin? Let us know in the comments!

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)