The introduction of Bitcoin to the world ten years ago as a new financial system aroused great interest in the field.monetary economy.After a century of completely nationalized money production systems and about five decades of government standardization of fiat paper money, the battle for a sustainable currency seemed long lost. A return to gold, even in the circles of Austrian and free market thinkers, was becoming an increasingly less practical approach, and it seemed that there was nothing left to do but wait for the inevitable collapse of the modern monetary system, which we have perhaps approached several times already.[1] . The struggle in the intellectual arena also appears to be over, both from an academic and general public point of view. With very rare exceptions, such as in the case of Friedrich Hayek, most prominent economists recognized by the public were followers of the Keynesian monetary approach. Therefore, they supported monetary nationalism [2] and the introduction of paper money as legal tender, both as a cost-effective alternative to gold and as a means for government financing and fine-tuning. national economy.

While the public and scientific struggle forstable money could be declared a loser, the development of new technologies led to the opening of new frontiers, and the search for a digital alternative to money began. A small, unorganized group of mostly individual computer scientists and cryptographers called the Cypherpunks began exploring new possibilities for computer networks and cryptography with the goal of making people more free, which included attempts to create open digital money. Thanks to the pioneering work of David Chaum (DigiCash) on digital payments and various other subsequent research and practical initiatives, especially Adam Back (HashCash), Wei Dai (b-money), Nick Szabo (Nick Szabo) (BitGold) and Hal Finney (RPOW), such attempts to introduce digital money have begun to accumulate. These efforts, although interesting in their merits, failed either to create a workable system or to gain sufficient momentum to have any significant impact on financial matters.

The introduction of Bitcoin, around the end of 2008,perhaps the most important turning point in money matters since 1971, when the Bretton Woods system collapsed, which led us to the immutable paper standard today. Although not immediately, the growth of Bitcoin as a new form of money began to accelerate. Now, about ten years after its creation, it regularly makes headlines and is even discussed in the US Congress. Bitcoin's wild success attracted a lot of attention to the field of the monetary economy and revived the lost battle for stable money.

At first, Bitcoin received only negligible attention and an exceptionally skeptical reaction from both sides, who considered it to be nothing more than a bubble or a passing trend.

However, over time and every year, growthBitcoin accelerated, it began to receive some attention, gaining its intellectual allies and rivals. Of all economic schools, the Bitcoin phenomenon seemed to fit only under the theory of the Austrian school. There, he is still still being discussed with great enthusiasm among his many supporters and skeptics.

On the other hand, within the framework of all otherBitcoin is still largely viewed as a bubble, a «market irrationality» or a trend that is about to collapse. The incompatibility of Bitcoin as money not backed by government authority with their economic theories in general and their ideas about monetary economics in particular completely blinded them to the mere possibility of new money like Bitcoin emerging. Despite fairly little (but growing) support and strong academic opposition, Bitcoin has continuously developed and established its currency status as more economically significant than many national currencies [3].

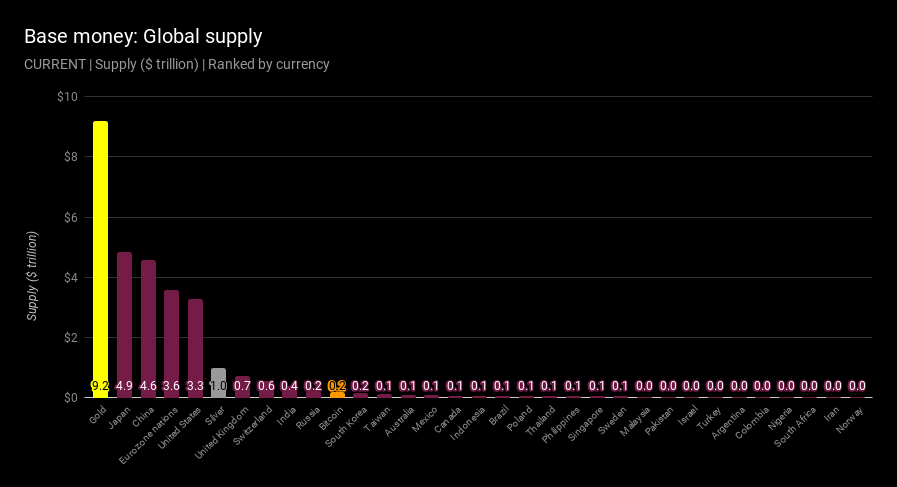

Figure 1. Bitcoin market capitalization compared to national currencies and precious metals.

At the moment, it has already become clear that Bitcoincan no longer be ignored, but should be carefully studied and investigated. It seems that an understanding of his nature can reveal both the reasons for his success and the approximate expectation of what awaits him in the future. In the previous two articles [4] I set out some basics of understanding the economics of money, their nature and essence from the point of view of the Austrian school. We started by studying the nature of money as the best-selling product that imposes the lowest economic costs on its holders for future exchanges. Then we continued to study various factors affecting the feasibility (market attractiveness) of goods, and, therefore, the likelihood of their appearance as money on the market [5]. In this article, we use this knowledge and apply it to Bitcoin, exploring it from the point of view of the monetary economy.

The monetary properties of Bitcoin

General monetary properties affecting suitabilitygoods for use as money, such as its divisibility, portability and durability, are usually inherent in the physical composition of the goods. The physical limitations caused by this over the years greatly influenced the specific nature of money. For example, the physical restriction of dividing gold into small enough denominations for use in low-value transactions prevented its (physical) use in many transactions, forcing people to resort to less valuable metals such as silver and copper, and later to money certificates.

The emergence of Bitcoin as the first digital formmoney allowed us to bypass these «physical» limits of money and scale them to the almost limitless limits of the digital sphere. In order to understand how Bitcoin allows us this improvement in monetary properties, a basic understanding of how it works and how Bitcoin is represented digitally is required. Bitcoin, in its “primary” form, is software that automates the achievement of consensus on ownership (the conditions under which one is allowed to spend) units of Bitcoin. In other words, Bitcoin in its crude form — This is a list of the amounts spent and the conditions for their expenditure.

Because Bitcoin, unlike previousof monetary assets is based not on physical possession but on agreement on the terms of its expenditure, we must divide the discussion of its limitations into two levels of consensus. The first, which is usually called on-chain, — this is the level of global consensus that we have just described. It is the final source of truth for determining ownership of Bitcoin units. By its nature, being binding on all its participants, the level of global consensus is relatively rigid and restrictive. So this gives us a somewhat moderate degree of improvement in terms of monetary properties. For example, Bitcoin's divisibility is represented here by one "satoshi", which is equivalent to one hundred millionth of a Bitcoin. The division process itself requires changing the spending conditions assigned to the associated units, that is, they must be «spent» in order to divide.

It should be noted that, despite the limitationunit size, it can be scaled, if necessary, by changing the mechanism of global consensus. Such changes, although extremely difficult and expensive, are nonetheless feasible and provide us with a certain level of improvement of the asset itself as new needs arise over time [6]. The ability to change the technical monetary properties of an asset is an unprecedented opportunity introduced by Bitcoin, and already gives it a significant advantage over its predecessors.

The second, called off-chain (off-chain),leverages the nature of Bitcoin as both a consensus-based digital asset and programmable software, allowing collaborators to create a «subsection» Bitcoin consensus and make transactions in this subsection using various mechanisms. If we consider Bitcoin's portability as an example, while it can undeniably be moved cheaply and easily between physical locations, the transfer of actual ownership (changing the terms of spending) of Bitcoin at the on-chain level is somewhat limited, allowing for roughly around 600,000 final settlements ( transfer of ownership) per day. However, since transactions are usually concluded between collaborating entities willing to see the transaction through to completion, the off-chain layer allows them to use different constructs to reach consensus. Thus, it allows them to scale transaction throughput to the almost infinite limits of physical movement of electronic data. There are many variations of such designs, many of which are currently in the research and development stage, each offering very different trade-offs for the parties to the transaction. Prominent examples are «Lightning Network» [7], offering non-trusted and instant transactions, mostly with some liquidity restrictions, and «sidechains» (sidechains) such as «Liquid», which offers benefits such as high-speed and confidential transactions and asset issuance under the control of a federation of trusted entities managing a consensus subchain for their clients.

To conclude the analysis of monetary attributesWith Bitcoin, we see how the transition of a monetary asset from the physical to the digital realm allows us to achieve not only unprecedented improvements, but also a high level of flexibility in the monetary properties of the asset. Thus, we can conclude that Bitcoin, in terms of its «innate» properties, unprecedentedly surpasses all its predecessors. With this in mind, it appears that Bitcoin deserves further investigation into its suitability as money. So we'll continue with what is probably the most controversial and innovative aspect of Bitcoin — its production and supply.

Bitcoin Production

Before Bitcoin appeared, the task of producing digital money on the market seemed almost impossible from the point of view of the authors of the monetary economy.

Professor Jörg Guido Hülsmann (Prof.Jörg Guido Hülsmann, an Austrian economist specializing in monetary economics, expressed this widely held belief in one of his books. He states that «an economic good that is defined entirely in terms of bits and bytes is unlikely to ever be spontaneously produced in a free market» [8]. Coincidentally, he published this in October 2008, two months after the Bitcoin article was first published, and about three months before the first Bitcoins appeared.

The invention of Bitcoin really requiredsearching for a solution to a problem that had not been resolved at that time — the ability to create a digital deficit with controlled supply (solving the “double spending problem”), without depending on a trusted entity. The creator of Bitcoin solved this problem by introducing a mechanism now commonly called «Nakamoto Consensus» [9] — which is the solution to the problem under discussion. The basic idea is open competition between computers to find a solution to a mathematical problem. This problem is similar to a lottery in the sense that the only known way to find a solution — it is a random guess and the chance of finding a solution remains the same for each guess. This process requires computational power, which is mainly limited by the availability of energy for computing machines. Adam Back originally proposed a similar process as part of the HashCash system in 1997. Bitcoin works similarly to this proposed mechanism, but the critical point where Bitcoin excels is in the ability to set a strict schedule for the production of new units.

Bitcoin achieves this using peer to peera consensus network (of which we spoke above), to ensure compliance with and verification of monetary rules and schedules, as well as automatic periodic adjustment of the computational work necessary for the production of new units, which regulates the complexity of tasks and, therefore, the production speed in accordance with the schedule.

Unlike previous monetary assets, suchlike gold, silver and seashells, which were based on certain physical limitations and shortages of their production, as well as in contrast to the existing paper money system, which relies on a reliable issuer (central bank) to make money, Bitcoin relies on a purely mathematical system for its production. This feature allows you to objectively and universally verify the reliability of a Bitcoin unit and ensures fair and open competition in its production. Anyone can freely participate (and stop participating) in this competition, consuming computing power, having a probable chance to produce Bitcoin, which is directly proportional to the calculations.

Money production and external factors

Historically, the production of the substance of money has alwayswas costly, both directly and indirectly. For example, livestock, which was used as money in many nomadic societies, was expensive to raise («production») and led to some completely unexpected side costs, mainly due to the great need for pastures necessary for its cultivation [10]. Let's take gold as another example. It is also very expensive to produce, since the gold mining process requires processing many tons of soil just to obtain a small amount of this precious metal. The side costs of gold mining are also very unpleasant due to the possible military takeover of gold mines and dangerous and sometimes forced labor, which leaves us with many economic and ethical problems.

Marco Polo was perhaps the first to introduceto the Western world, the seemingly impressive concept of paper money that he observed in China [11]. Since he made this discovery, the appetite of rulers, bankers and intellectuals for easy money has been constantly growing. The first European experiment with light paper money took place in 1661, when the Swedish central bank Stockholms Banco began issuing banknotes. This practice led to the bank's failure just three years later, but this failure seems to have only increased the desire for new experiments on the part of rulers and bankers. As for the intelligentsia, the desire to make money production more «efficient» was obvious from the very beginning of the development of political economy. The idea does find support from early economists such as Adam Smith and John Law, who viewed the use of precious metals as an inefficient process [12]. They, along with many other economists, especially of our time, sought to make the production of money cheaper, and therefore more efficient, by replacing the substance of money with such cheap alternatives as paper. They believed that such an alternative monetary system could function in the same way as the precious metal system, only with a much lower share of production costs. This difference between production costs and «face value» money is exactly what we can call «easy» money, which we must distinguish from «hard» money. So, from this superficial point of view, the difference is that easy money has little cost to produce, while hard money is expensive to produce.

The problem of easy money and the reason why suchtheir theoretical supporters, like David Ricardo, opposed the implementation of this concept [13] — these are external factors, hidden costs and risks that it entails. It is well known and generally accepted that truly easy money could never appear on a free market. This is due to the fact that for any product, market participants will be ready to increase production and its costs until the moment when it is no longer profitable to increase production. This means that if we tried to establish an easy money system in a free market, market participants would begin to produce it in such quantities that the value of each unit of money was approximately equal to the cost of its production, canceling the supposed «efficiency» easy money. Thus, all attempts to introduce an easy money system required the government to grant a monopoly privilege over the production of money to a specific entity, usually known as the central bank. Since market participants were legally barred from participating in the production of money, proponents of easy money believed that they could successfully reduce the cost of money production to the simple cost of printing paper notes.

However, such an almost intrusive look of theseeconomists on direct and very noticeable costs of money production did not allow them to discern the many hidden costs of easy money. The first, and probably most obvious concern that Ricardo expressed was the risk of abuse of the system. From numerous scenarios of hyperinflation to less visible moral dangers [14], the easy money trap brought various risks and was repeatedly abused by those who had the opportunity to take advantage of this. This problem alone should clear up the easy money trap. Efficiency of easy money is low in comparison with the fatal risks and moral damage that they cause. However, there are two more aspects in which the fallacy of cheap money is discovered.

The second aspect we can consider is— these are the actual costs of operating such a system. With the bloated bureaucratic structures typical of all government agencies, and with hundreds of thousands of central bank employees, it is hardly disputed that the supposedly «cheap» and an efficient paper money system today is indeed more efficient than hard money [15]. In this regard, it should also be noted that gold mining for monetary purposes still continues to a large extent. Thus, these additional costs of the cheap money system come primarily in addition to, rather than instead of, the costs of the previous hard money system. The problem gets even worse when we realize the important fact that, although regulation has excluded market participants from the direct production of money itself, they will still spend as many resources as are still beneficial for forecasting and influencing the policies of central banks. Proponents of easy money have apparently not taken into account the willingness of market participants to continue to extract maximum benefit from the production of money, and the jobs of many analysts, economic forecasters and lobbyists are a result of this indirect inefficiency of easy money.

The third and most important problem thatcause easy money — it is manipulation of the market process. The market uses money as a tool to allocate resources, with money holders directing the market according to their needs and demands. However, when using easy money, its producer (the central bank) has the right to unduly influence the distribution of resources. In essence, we can say that he practically takes control of the market because he can cheaply create money for himself to direct resources as he sees fit. Thus, in an easy money economy, the power to allocate resources shifts from the market to those who control the central bank. This market distortion gradually shifts the entire economy into a mode of indirect central planning. Combined with the moral hazards associated with the production of cheap money, this process is accelerated even further, which entails the destructive consequences of central economic planning, veiled under the guise of market phenomena.

As we can see, easy money does not reduce spending onmoney production and do not make them more efficient in any sense. The only function they perform is to directly reduce the explicit costs of producing money, while disproportionately increasing the hidden, implicit ones. Two main conclusions can be drawn from this analysis. The first and more obvious: easy money is not only ineffective, but can also be destructive due to risks and external factors. Secondly, it should be noted that we should strive to ensure that the process of money production is obvious and transparent in order to minimize such risks and unexpected external effects.

When looking at Bitcoin, what immediately catches your eye isone of its remarkable features — it is the process of its production. The most significant and expensive part of Bitcoin production, as discussed above, is the process of turning energy into electricity and converting it into computing power. While all types of manufacturing require the use of energy, most other processes require it to be applied in very indirect ways and, more importantly, in very specific locations. For example, producing gold requires both a lot of human labor and many complex types of machines, but more importantly, it requires miners to use them in specific places (gold mines). Thus, not only does gold pose a lot of challenges to its production process, but it also forces people to mine it only in certain places. Bitcoin production, on the other hand, allows anyone anywhere in the world [16] where there is an unused energy source to use it to produce Bitcoin. This unique Bitcoin production process has three main advantages, which we will discuss here.

Firstly, it makes competition for productionmoney more fair and open than ever, eliminating many spatial restrictions and providing a truly effective process of market competition. Secondly, by making the production process so simple and straightforward, Bitcoin reduces the hidden costs and externalities associated with the money production process. This reduction of external factors makes the system much more stable as a whole and allows us to better understand the consequences of its use. Thirdly, the production of Bitcoins, eliminating territorial restrictions, allows the use of energy sources that were previously unsuitable for use due to such restrictions. Ruthless competition in the production of Bitcoins forces its producers (often called miners) to minimize their costs in order to be more efficient than their competitors. This competition requires them to constantly search for the most efficient energy production process, which will minimize the subsequent cost, and both theoretically and in practice it seems that this most efficient source should be found in renewable energy sources. Energy naturally available from these sources, such as sunlight, water, wind, and many others, is much cheaper than traditional sources, since it is abundant and mostly not used. Although transportation costs for such energy limit its applicability for many everyday purposes, the production of bitcoins does not have such territorial restrictions. Thus, the production of bitcoins contributes to profitable financing and the development of renewable energy sources and stimulates progress in the field of energy production [17]. Therefore, it is not surprising that most of the energy used to produce Bitcoins comes from renewable sources [18], making the production of bitcoins perhaps one of the cleanest sectors of the economy.

To summarize, we can say that for reasonsdiscussed above, the production of Bitcoin appears to be the most desirable money production process of all. The fact that it is hard money, coupled with its simple and transparent production process, open and direct competition and seemingly positive externalities, makes it vastly superior to any of its predecessors. The second important consideration, which is usually associated with the process of money production — it is a matter of their proposal and that is our next topic of discussion.

Bitcoin offer

Due to the fact that Bitcoin is basedon a software asset, its supply, unlike previous natural money [19], is under the complete control of Bitcoin users. This is essentially a critical part of its consensus rules, and is limited to approximately 21 million units of Bitcoin. This is usually called «monetary policy» Bitcoin and is powered by the economic activity of each participant in the Bitcoin network. The decentralization of Bitcoin as a peer-to-peer network means that there is no central entity with the authority to dictate Bitcoin's monetary policy. While it is theoretically possible to change this policy, such a change in practice is not likely or even possible and is therefore outside the scope of this article.

Bitcoin's politics stand in stark contrast tothe prevailing policies of central banks today. Since their inception, these institutions have pursued a policy of constantly increasing the money supply. Such expansionary policies are generally justified as necessary for the «common good», since they allegedly allow the government and its «highly skilled» economists to promote economic growth, reduce unemployment and combat the business cycle — a task they have failed miserably over the past hundred years, during which these problems seem to have only gotten worse [20]. In current discussions, Bitcoin's monetary policy is generally considered by most to be quite radical. Many critics of Bitcoin argue that the lack of a flexible monetary policy, that is, a policy that can be changed according to the perceived needs of emerging circumstances, prevents Bitcoin from ever gaining significant adoption.

However, the point of view about the need or evenThe need for flexible policies began to receive significant support only in the last hundred years. Therefore, it is relatively new compared to the thousands or perhaps tens of thousands of years of the existence of money [21]. Moreover, upon closer examination, the modern experiment with flexible monetary policy, conducted and managed by central banks, could not achieve any of the goals that were set [22]. The list of these unfulfilled promises from our central bankers includes the inability to tame the business cycle, the inability to maintain a consistently low unemployment rate and the complete inability to maintain the value of money and the general price level [23].

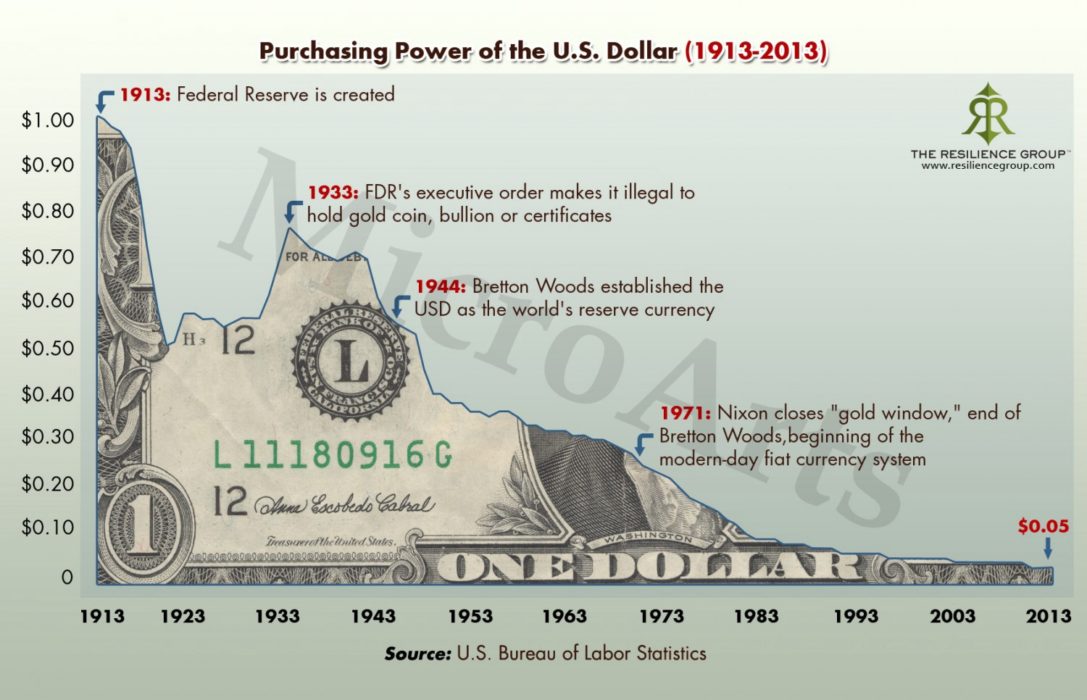

Figure 2. Purchasing power of the US dollar (1913–2013). During this period, the US dollar has lost at least 95% of its purchasing power.

Justification of a flexible monetary policy,which many today take for granted as a necessity, is completely unconvincing in terms of its real merits and results. Moreover, her completely indisputable failures before this modern attempt are not even mentioned [24]. Moreover, this statement becomes even weaker if we take into account more than 50 economic collapses caused by hyperinflation only in the last century, which could not have occurred if it were not for the existence of an elastic monetary policy [25,26].

A complete critique of the ills of modern centralbanks and the errors on which their theories are based is beyond the scope of this article. The interested reader can find references to such works in the footnotes [27]. For our present purposes, we will focus on the most prominent arguments about why elastic monetary policy is undesirable and why Bitcoin's limited supply is its advantage over its predecessors. Let's start by exploring the idea of «need» in elastic monetary policy. As mentioned above, in light of the experience of its past failures and when considering the spectacular success of the gold standard, which prevailed during La Belle Époque (Belle Epoque) and ended around the time of the creation of the Federal Reserve System, there appears to be no empirical basis for the actual "necessity" » elastic monetary policy. However, despite the lack of evidence for such a need, one might argue that such a policy would generally be desirable. Therefore, we will now move on to further study this issue.

In our previous discussion of easy money,which, in principle, are money with such a flexible monetary policy, we have already formulated some of their diseases. These include serious moral hazard and the potential danger of abuse and destruction of the system. Now we will omit these voiced problems and focus on yet another, more general argument against this type of policy, which concerns the epistemological errors of such centralized planning of money and credit proposals [28].

Let's assume that those in chargemonetary policy, have managed to resist all temptations to abuse it and are doing everything possible to help the economy. They have enormous amounts of data and information about supposedly true indicators at their disposal. Their job is to use all this knowledge and experience to adjust prices and encourage people to make economic decisions in accordance with what they (the central planning team) think will have the most positive impact on the economy. In other words, they use their influence on the supply of money and credit in the economy to regulate the behavior of prices and the unemployment rate. The task of these central planners is to predict the impact of possible monetary policy on the parameters they would like to adjust (CPI, unemployment, etc.) and follow the most «optimal» their option.

However, this means that they need more than justto predict the consequences of their actions, but also any reactions to them, and, consequently, any further reactions to these consequences. All attempts to predict and model the most optimal monetary policy, even assuming that such an optimal policy exists, will fail due to the very nature of the economy, which is a collection of individuals acting and, most importantly, reacting, trying to provide for themselves . The actions and reactions of people themselves are largely unpredictable, and attempts to predict the consequences of such reactions to changes, and subsequent reactions to changes caused by these previous reactions, are simply ridiculous [29].

Failure of central banks to make forecastsin economics becomes even more apparent when we consider the limitations of the data they may have. In the sphere of social phenomena in general and economic phenomena in particular, the result largely depends on all human actions involved in the process of their formation. While we know how to measure certain parameters with high precision, we do not have the ability to measure many other data relevant to the economic actions of individuals. Hayek explained this limitation of knowledge using the example of prices and wages, saying: «These prices and wages will be determined by the influence of the specific information possessed by each of the participants in the market process—a sum of facts which in their totality cannot be known by anyone. scientific observer, nor any other individual brain [30].» Lack of access to so many important facts has caused most economists to completely ignore their significance, echoing the words of Hayek: «They [economists] are happy to go on inventing that the only factors they can measure are the only ones that matter [31].& #187; Central banks, as we see, inevitably begin their task with an extremely incomplete picture of the past and present. Thus, their efforts to predict economic outcomes are doomed to fail from the start, because even if they had proper methods to make predictions from data, they cannot take into account all the data that influences human actions, and, as we have seen, every single action has the potential to have a devastating impact on the entire process.

The only forecast I can withthe confidence to do is that central banks, while continuing to intervene in the supply of money and loans, will continue to cause unexpected behavioral reactions, and as a result they will hopelessly fool themselves with their forecasting efforts - I put Bitcoin on this accurate forecast.

As long as monetary policyelastic, we are guaranteed to suffer from such epistemic errors and failures in forecasting, and economic crises will inevitably follow. The economy is an interdependent system, and any artificial intervention will lead to unexpected side effects, the impact of which will be further exacerbated by further intervention. For over a hundred years, economists have been trying to plan the money supply, and with each intervention a new crisis began. Then maybe now is the right time to confront this failure, to recognize that the economy is too complex for forecasting by the central planner, and to allow individuals to make their own decisions to form a complete picture of their actions [32].

To date, we have dispelled all fears.Bitcoin’s relatively inelastic monetary policies have proven to be superior to elastic policies. However, someone might argue that a static inflation rate, for example, 2% per year, could still be a viable option instead of a strictly limited limit [33].

Although it’s probably true that Bitcoin can stillwork well even without a strictly limited supply; such inflation seems undesirable and even harmful. Monetary inflation, although not necessarily harmful in itself, has highly nonlinear and complex effects, the impact of which, as we have seen, cannot be fully predicted. The desire of some to mess around with such a complex system that they don’t understand or, even worse, believe that they understand, is at best not harmful, but can easily become destructive. In addition, if we investigate more deeply, it turns out that there is no justification for expansionary policies in the first place.

When we understand the nature of money itself and itsappearance on the market, such inflation seems very undesirable. Money appears because of their ability to reduce exchange costs, and an important reason for this is their ability to maintain their value over time. It is well known that an increase in the money supply reduces the cost of each unit, its purchasing power and, thus, increases the cost of its use in deferred transactions. Thus, inflationary policies can hinder the adoption of Bitcoin, making it less useful for transactions, and will not give us any benefit [34]. On the contrary, a policy leading to inflation can reduce the accuracy of economic calculations, as well as reduce cash savings and stimulate spending, which we have already proved in an earlier article as undesirable.

In this part, we covered the basics of the process.Bitcoin production and its monetary policy. We discussed the idea of making money and its external effects, as well as how Bitcoin has the preferred manufacturing process of all as solid money. We investigated the trap of easy money, or rather, the trap of having an elastic monetary policy, and showed how Bitcoin managed to avoid such problems.

Finally, we also saw how actual the toughThe policy adopted as a Bitcoin rule, with its finite, limited supply on the market, serves as its advantage and stimulates appropriate economic initiatives for saving and capital accumulation, as well as being a reliable measure for economic calculations.

So far we have studied «innate»characteristics of Bitcoin, and have so far come to very positive conclusions. We will continue to delve deeper into the monetary rationale for Bitcoin, moving on to examine the external factors that influence the essence of money, and look at them from Bitcoin's perspective.

Adopting Bitcoin Legislation

In one of the previous articles, we highlighted three importantexternal factors affecting the adoption of monetary substance: legislation, society structure and epistemological considerations. Now we will look at each of these factors and try to understand how they affect Bitcoin as money, starting with the legislative aspect.

Even a superficial investigation of the terminationthe use of precious metals as a single monetary substance will show us what the influence of the legislative bodies led to this. With the initial monopoly status granted to gold over other precious metals in most countries, and its further transfer under the control of central banks, the legislative authorities influenced the specific choice of metallic money. Thanks to this centralization of power, they were subsequently able to effectively withdraw accumulations in gold (Decree 6102) [35], preventing any of their everyday use. The last connection between our money and gold was finally broken by Decree 11615 [36], issued by President Nixon in 1971. This order completed the long process of transitioning from metallic money to an incorrigible paper standard. This last example shows us how powerful the influence of civil authorities on our choice of money can be, and with the modern system of sovereign currencies, these authorities do not seem to like the challenge Bitcoin has made.

Although Bitcoin's legal problems seemincredibly complex, that’s exactly what it was designed for. From the very beginning, Bitcoin was created in the spirit of freedom and liberties of cipher banks, using cryptography to achieve liberation from oppression. These problems, in the first place, became the reason for the creation of Bitcoin. For more than half a century, we have been living under the oppression of a fiat paper monetary system, and any attempt to introduce a competing system has been thwarted [37]. On the contrary, Bitcoin was created with all these past failures in mind and is designed to survive such threats. As its creator explained:

«Many people automatically discountelectronic currency due to the large number of projects that have failed in this area since the 1990s. I hope it is obvious to everyone that the collapse of those systems was due solely to their centralized nature. I think this is the first time we've tried to create a decentralized, trustless system.»[38]

Bitcoin Production and Service Processvery open and provides material incentives to participants corresponding to the real demand for the use of Bitcoin by paying transaction fees [39]. The Bitcoin storage mechanism using private key cryptography makes it resistant to confiscation attempts. Together with the requirement to keep verification costs extremely low, we see how all these design decisions are aimed at ensuring that Bitcoin survives and even flourishes wherever there is economic and financial oppression.

This «legislation-resistant»The nature of Bitcoin is so strong and reliable that one US Congressman, Patrick McHenry, even went so far as to call Bitcoin an "Unstoppable Force". Continuing that «We [the government] should not try to hold back this innovation; governments cannot stop this innovation, and those who have tried have already failed [40]». While there are many other legislators who do not share this view, this bold statement underscores the idea of Bitcoin and the mission of those it has brought under its banner. We may not yet know whether Bitcoin can truly withstand the legal challenges and government pressures it will surely face, but one thing is clear — this is that Bitcoin is our best attempt. This legal resistance of Bitcoin is probably its most significant improvement over previous hard money and is its real advantage [41].

Now, assuming governments understandThe whole difficulty with stopping Bitcoin, there is a possibility that they will decide to use it because of the financial incentives it provides. Even though they have eliminated the use of gold as money from our daily lives, governments, mainly through their central banks, are still massively stockpiling it in growing quantities, holding approximately 17% of the total above-ground gold reserves [42]. ]. Once Bitcoin becomes significant enough, there is a chance that governments will purchase it as a gold alternative, floating it for their international currency transactions, or as a hedging tool for «store of value» [43]. Another option for the government to monetize Bitcoin's success — this is through direct or indirect participation in its mining, as they control many of the richest sources of energy production. Such mining operations will benefit both governments, as an additional source of income, and will help Bitcoin, the mining process of which is very energy-intensive, to ensure the security of its network. While such action on behalf of governments appears unlikely in the short to medium term, it remains a highly plausible option in the long term.

Social Globalization and Bitcoin

The second significant external factor that wedesignated, is the predominant social structure, with the modern one tending to globalization and international cooperation. Understanding the needs of such a transition in society is very important in determining what kind of money should serve such a society. Today's society is rapidly moving towards urbanization, and most of the world's population lives in cities [44]. The role that the Internet plays in our daily lives is also becoming increasingly important. With more than 4 billion Internet users [45], the effect this technology has on society appears to be superior to most previous inventions in terms of coverage and impact.

Although society is more interconnected than ever, the worldIt is in a serious state of monetary disintegration (disunity) at a level unprecedented for hundreds of years. If in the past most currencies were simply different weights of precious metals, and therefore almost universally accepted in trade, today we have hundreds of incompatible paper currencies that destroy the world market and damage the global division of labor. In the current conditions, any interstate social cooperation requires currency exchange. This imposes additional costs, complicating and distorting economic calculations, and requires more relying on financial institutions. To this issue, we can add the problem of settlement of transactions. Due to the costs and regulations associated with moving currencies across national borders, such calculations are very expensive and require a centralized process through several intermediaries.

With the transformation of society into a globallyinterconnected and with the ever-increasing number of electronic transactions carried out throughout the world, the need for money native to the digital environment is becoming stronger and more widespread. Settling payments with strangers without trusting financial intermediaries or central banks issuing currencies is currently an impractical process. Additionally, such a process simply cannot be accomplished with any monetary system we have ever had before Bitcoin. As a completely electronic commodity, Bitcoin allows payments to be made anywhere in the world, without the need for trusted payments. It does not require expensive international physical shipping and is easy to store and use from anywhere at minimal cost. Looking at the modern structure of society, there appears to be a real need for trustless, natively digital money, and this will likely drive the adoption of Bitcoin as a «decentralized alternative to Central Banking [46]».

Understanding Bitcoin — epistemic barrier to Bitcoin adoption

Our final consideration is that we mustto discuss before we can complete this study concerns the third prominent external factor influencing the essence of money, the epistemic one. Unlike previous money such as gold, furs or cattle, Bitcoin has no «practical» use other than for monetary purposes. In this way it is similar to collectible money such as wampum and various seashells, and also to today's paper money. In a more traditional, although not economically accurate, sense, it has no «intrinsic value». The debate about whether such intrinsic value is necessary or, more precisely, whether it exists at all, is beyond the scope of this study and is inappropriate here [47].

What is important for us to understand epistemicThe obstacles for Bitcoin is that due to the lack of such widespread practical use, and unlike the (perhaps) natural beauty of sea shells or the legislative promotion of paper fiat money, there is nothing that promotes the use of Bitcoin, thereby its initial accumulation, other than its monetary use. Thus, it can be said that there are only two forces driving the adoption of Bitcoin, «economic» and «epistemic», without any «indirect utility» playing a role. What I call here the economic power of Bitcoin, — this is what we have discussed so far and concerns the economic incentives for using Bitcoin and the advantages it provides over traditional systems.

Second, «epistemic» force touchesand our understanding of money in general, and Bitcoin in particular, and the use of existing knowledge when making economic decisions. That is, the more we understand money, its origin and nature, the better our decisions will be in this regard. The epistemic power I am discussing here is the motivation for using Bitcoin, which comes not from the direct and immediate (or expected to be immediately available) benefits of Bitcoin, but from what is expected to eventually come from understanding Bitcoin and its advantages. While at the very beginning of Bitcoin I believe that most of its holders participated purely because of the epistemic motive, I think that today economic power is what tempts most people to come, but epistemics — this is what motivates them to stay. This process mainly occurs during «supply shocks» (halvings) of Bitcoin, after which we have so far witnessed a sharp increase in the price of Bitcoin. This increase in price (economic factor) brings massive attention to Bitcoin, but after the hype wears off, what many are still interested in is — it is the understanding and vision of Bitcoin (the epistemic factor). However, true adoption of Bitcoin will likely only occur when the economic power of Bitcoin is so great that it makes the epistemic (understanding of Bitcoin) unnecessary for people to use it as part of their daily lives.

This last topic is the one I think is the mostimportant in the article because unlike others, this is the only topic where I see Bitcoin at a significant disadvantage. While for gold, its established history of millennia of use as money is generally a sufficient proxy for understanding why it works so well, Bitcoin lacks that luxury. On the other hand, fiat paper money, whose «established history» plagued by failure and economic collapse, manage to circumvent this epistemic problem by providing direct funding to the academic economics department, as well as serving as their most important employment option. Fiat money provided such scientists with highly respected, influential, and highly paid jobs, and they in turn created the epistemological basis for such a monetary system and validated it with their “credentials.” In contrast, Bitcoin, being hard money, does not have the budget to create such a «science» for itself and does not provide economists with such influential jobs, but basically replaces their current work. It is therefore not surprising that very little has been written in favor of Bitcoin, especially in academic circles, as mentioned above.

Without sufficient resources to understand money andBitcoin, the only factor contributing to its adoption would be economic. Even if it alone is enough, it certainly will not work well enough, and the transition to Bitcoin may seem unlikely before the modern system collapses on its own, which makes the transition extremely unpleasant and unnecessary. However, the more resources there are for understanding Bitcoin, and the better people understand Bitcoin's rationale, the faster they will act to accept it, and therefore, the sooner and smoother the transition to its use will occur.

Today, after more than a century of existenceCentral Bank, the general understanding of money is completely distorted, and even more so in most scientific discussions, where they still believe that they can «tune» economy through its complex mathematical models and inflation targets. The last crisis of 2008 shook confidence in the current system, and rightly so, but most of the alternatives offered to the public for understanding money have only exacerbated the mistakes of the current system. Statements such as «the state can make whatever it wants into generally accepted money» or «money is just a general illusion», are now very common even among many Bitcoin supporters, and this only shows how much work remains to be done in explaining Bitcoin and money. The point and purpose of this article is to show how important it is to explain money in general, and Bitcoin in particular, to others in order to succeed as a peaceful revolution itself [49].

Conclusions - the emergence of Bitcoin

The last ten years have been some of the mostinteresting to observe in terms of monetary economics. During this period, we witnessed the first money product, which was invented (invented) and not opened by the free market, and the amazingly fast process of its monetization. What began as a seemingly just another ill-fated offer from the Cypherpunks mailing list [50] has turned into a fully functioning money system that actively serves millions of people around the world. In this article, we examined the general factors that influence the attractiveness of money, therefore, their adoption in the market, and examined how Bitcoin is doing compared to its predecessors. Now, to complete the full cycle of Bitcoin analysis, we will briefly consider the process of its appearance from the very beginning to its possible development in the future.

When Bitcoin first launched, and throughoutFor the first few months of its existence, it had no price and transactions with it were conducted primarily for software testing. Moment «from zero to one» for Bitcoin came when its first exchange rate was published in October 2009, meaning it had exchange value for the first time. Shortly thereafter, Bitcoin's small early adopters began exchanging it, giving it an initial price and breathing life into the system. Since they were willing to spend money to make Bitcoin a reality while almost no one knew what Bitcoin would become, they must have been quite motivated by the very vision of Bitcoin's potential. Thus, the circulation of Bitcoin began not because it was somehow «useful» means, not due to government decree, but due to the voluntary actions of their early adopters, who valued the opportunity to create a new monetary system more than the money they had to spend to make Bitcoin's illusory potential a reality [51].

Moving on, note that, whileBitcoin had some exchange value, the number of possible exchanges available to it was quite small, since the demand for it, as a medium of exchange, was just beginning to take shape. This means that initially people had to wait a significant amount of time compared to traditional paper money in order to exchange it. That is, they had to hold him so that he would spread. Here lies the main reason that the containment of Bitcoin and its limited offer were and still are critical to its success. Without a tough inelastic policy, the uncertainty that would accompany Bitcoin’s containment due to the risk of monetary inflation and subsequent depreciation would be too high and prevent it from seeing any meaningful spread.

Bitcoin's monetary stability — This is what,allowing people to own it confidently, knowing that their wealth will not dissolve. Additionally, its limited supply means that as its adoption increases, Bitcoin is bound to become more valuable without being negatively affected by inflation, which would reduce its value. Thus, Bitcoin's limited supply is itself a strong economic incentive for its adoption and adoption by those who understand its superiority as a monetary asset and thus expect demand for it to increase over time. Satoshi himself understood this perfectly, writing:

«Instead of changing the sentence,to fix the price at one level, the supply is predetermined, thereby changing the value. As the number of users grows, the value of each coin increases. This has the potential for positive feedback; as the number of users increases, the value increases.» [52]

Today Bitcoin circulates with muchfaster than in the past, and it has much more capacity for exchange. However, Bitcoin still has a long way to go to become a widely used monetary system. The monetization process, like all other social cooperation phenomena, is a non-linear process, accelerating and benefiting from each additional use. Thus, Bitcoin's circulation rate and daily usage are not expected to become significant in the very near future, but should accelerate in the long term. Looking at the progress made to date, there is every reason to believe that Bitcoin will be able to reach the kind of “critical mass” needed to achieve sufficient growth acceleration to become accepted money around the world.

Bitcoin is currently growing the mostsignificantly in two areas. The first is the Internet, where he has a «home advantage», the second — in countries that do not have even minimal economic freedom. In the latter case, in countries such as Turkey, Iran and Argentina, we can see Bitcoin providing some degree of immediate relief from the economic oppression imposed on those living there. The tighter the capital controls and the higher the inflation rate, the greater the benefit of using Bitcoin as a government-resistant alternative becomes. Therefore, while we cannot know with certainty how Bitcoin will grow, it seems likely that the emergence of Bitcoin as money will continue largely in economically oppressed countries whose citizens need Bitcoin to protect their wealth the most, and will continue to grow most significantly where economic crises occur. It appears that at this stage, Bitcoin is the free market commodity that is most effective at demonstrating its value proposition in the absence of free markets. Authoritarian attempts to restrict it only encourage its use, and so it seems that Bitcoin truly deserves to be called «antifragile» money.

References

[1]: The crises of the 1980s and 2008 are vivid examples of such collapses that seem to easily turn into a disaster for the system.

[2]: Friedrich A. HayekHayek): «By monetary nationalism I mean the doctrine that a country's share of the world supply of money should not be determined by the same principles and by the same mechanism as those which determine the relative amounts of money in its various regions or localities. » — «Monetary Nationalism and International Stability» (1937), page 4.

[3]: See both sources - the chart below and further relevant metrics provided by Crypto-Voices here.

[4]: The Nature of Money and The Substance of Money.

[5]:The principles of our money analysis come from the work of Carl Menger. Mainly from his «Principles of Economics» (1871), chapter VIII, and «On the Origins of Money» (1892).

[6]:Such changes, although difficult to coordinate and implement, have previously been made to the Bitcoin protocol after achieving sufficient consensus. See BIP16 (P2SH) and BIP141 (Segregated Witness) as prime examples of such changes, which improved Bitcoin's monetary properties by adding consensus rules to the protocol. The method is known as «soft-fork».

[7]: Refer to the following website for a detailed list of resources for more information about the Lightning Network: https://www.lopp.net/lightning-information.html

[8]: Jörg Guido Hülsmann, «The Ethics of Money Production» (2008).

[9]: For a more complete definition of the problem and solution presented in the Nakamoto Consensus, see the Bitcoin whitepaper.

[10]: See Bezant Denier's article for a historical study of these externalities: https://www.bdratings.org/l/war-externalities-of-livestock-money/

[eleven]:Thomas Wright, «The Travels of Marco Polo, the Venetian» (1854), especially page 168. Also see this short thread for a summary of Marco Polo's notes on paper money, and this blog post for a deeper understanding.

[12]:For some thoughts on paper money from these authors, see Jörg Guido Hülsmann, «The Ethics of Money Production» (2008), pages 79–81, Robert Minton, «John Law: The Father of Paper Money» (1975).

[13]: See David Ricardo, «The High Price of Bullion, a Proof of the Depreciation of Bank Notes«(1810)

[14]: For an economic perspective on moral hazard, see Jörg Guido Hülsmann, «The Political Economy of Moral Hazard» (2006).

[15]: See Milton Friedman, «The Resource Cost of Irredeemable Paper Money» (1986).

[16]:With the existence of various data transfer mechanisms, a prime example of which is the Bitcoin satellite launched by Blockstream, there are virtually no barriers to participating in the Bitcoin mining process from anywhere in the world.

[17]: See this article by Daniel Wingen)about the Bitcoin production process and how it can positively impact the environment and sustainable energy production.

[18]: Seemining analysis from CoinShares for more details: https://coinshares.co.uk/bitcoin-mining-cost/ See also this 2-part post on their blog: https://medium.com/coinshares/an-honest -explanation-of-price-hashrate-bitcoin-mining-network-dynamics-f820d6218bdf https://medium.com/coinshares/beware-of-lazy-research-c828c900b7d5

[19]: Jörg Guido Hülsmann:«In-kind money can be called any type of money that is used by interacting persons on a voluntary basis.» — «The Ethics of Money Production» (2008), page 24.

[20]:A good example of this abject incompetence can be seen in these two quotes from former US Federal Reserve Chair Janet Yellen, who said in 2017 that: «I would say there will never be another financial crisis again. Maybe I shouldn't go that far, but I really don't think so. I believe we are much safer now. And I hope that, at least during our lifetime, this will not happen again.»

And less than a year later she expressed absolutelyanother opinion, saying that «I am not sure that we are moving in the right direction. There are still a lot of holes left, and then there is the deregulation process. That's why I'm worried that we might get another financial crisis.

[21]: On the history of money, see Nick Szabo, «Shelling Out» (2002)

[22]: See this article by Mark Hendrickson about the Federal Reserve's 100-year failure to achieve any of its goals.

[23]: During the existence of the Federal Reserve, the US dollar has lost at least 95% of its purchasing power.

[24]: See for examples the Chinese Yuan in the 13th century, Assignats in France, and the Continental Dollar in America.

[25]: Here you will find a list of 58 collapses caused by hyperinflation in the last century.

[26]:Although there was a recorded case of hyperinflation during the time of the Roman Empire, which used specie, this does not contradict what is being said here, since the blame in such cases is still attributed to the serious debasement of money by the governments of the time, which amounts to their monetary politics», in modern terms

[27]: For such criticism, see: Jesús Huerta de Soto - «Money, Bank Credit, and Economic Cycles» (2006), Jörg Guido Hülsmann - «The Ethics of Money Production» (2008), Friedrich A. Hayek - «Denationalisation of Money: The Argument Refined» (1990), Murray N. Rothbard - «What Has Government Done to Our Money?» (1963).

[28]: For an excellent critique on this subject, see Friedrich A. Hayek, «The Pretence of Knowledge» (1974).

[29]: A relevant discussion of the pitfalls of using predictions and models in complex fields in general and economics in particular can be found in the works of Nassim N. Taleb.

[30]: Friedrich A. Hayek, «The Pretence of Knowledge» (1974).

[31]: Friedrich A. Hayek, «The Pretence of Knowledge» (1974).

[32]: On this subject, see Friedrich A. Hayek, «The Use of Knowledge in Society» (1945).

[33]:While Bitcoin does have monetary inflation today, it is only a temporary phase that distributes the initial ownership of Bitcoins, and as we have seen, is done according to a strictly defined schedule. It is therefore possible to ignore this initial inflation and discuss Bitcoin's long-term, constant policy, which is based on a constant supply.

[34]: For a full critique of inflationary monetary policy, see here — Ludwig von Mises, «The Theory of Money and Credit» (1912), chapter VII part 3 - Inflationism.

[35]:Executive Order 6102, issued by President Franklin D. Roosevelt on April 5, 1933, prohibited the «accumulation» gold and effectively ordered the confiscation of most private gold holdings.

[36]: Executive Order 11615, issued by President Richard Nixon on August 15, 1971, as part of the so-called «Nixon Shock» , abolished the convertibility of the US dollar into gold.

[37]: Notable examples were e-gold, closed in 2008, and Liberty Reserve, closed in 2013.

[38]: Satoshi Nakamoto in response to a comment on the P2P Foundation Forum.

[39]: For how transaction fees help Bitcoin protect itself from governments, see this post by Eric Voskuil).

[40]: https://cointelegraph.com/news/bitcoin-an-unstoppable-force-us-congressman-tells-crypto-hearing

[41]:To be effective, this legal resistance had to be accompanied by a sufficient improvement in monetary properties to prevent centralized risks of ownership. See this article from The Bitcoin Observer for a more complete explanation of this.

[42]: https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold

[43]: Next article, «The Bullish Case for Bitcoin» by Vijay Boyapati lays out the possibility of such a scenario in more detail.

[44]: https://ourworldindata.org/how-urban-is-the-world

[45]: https://wearesocial.com/blog/2019/01/digital-2019-global-internet-use-accelerates

[46]: Saifedean Ammous, «The Bitcoin Standard: The Decentralized Alternative to Central Banking» (2018)

[47]: On this topic in relation to Bitcoin, see Conner Brown, «Bitcoin Has No Intrinsic Value - and That’s Great.»

[48]: In this article «Shelling Out:The Origins of Money» Nick Szabo suggests the possibility that our natural attraction to such collectibles, which we attribute to their “beauty,” is not simply “accidental,” but an instinct developed from their useful as primitive money.

[49]: See Nic Carter, «A Most Peaceful Revolution».

[50]: Apart from Hal Finney, most of the reactions Satoshi initially received were very skeptical. See the original discussion on The Cryptography Mailing List.

[51]: See this nice short post from Ross Ulbricht),called «Bitcoin Equals Freedom».

[52]: Satoshi Nakamoto in response to a comment on the P2P Foundation forum.