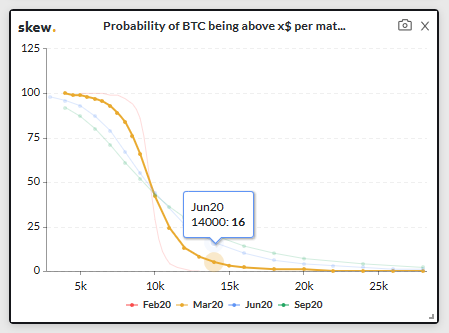

The likelihood that Bitcoin will exceed $14,000 by June 2020 has increased by 16%. Experts believe thatOn the way to this figure, the cryptocurrency may face short-term declines.

Last week the struggle between retailers andinstitutional investors in bitcoin futures resumed as premium rates on retail exchanges exceeded CME. Due to the fact that the general market is showing bearish trends, overall sentiment remains quite positive.

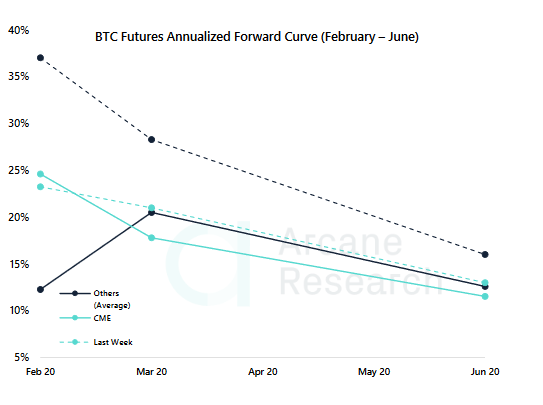

According to the latest Arcane Research report,Premium rates for Bitcoin contracts on the CME and other retail exchanges expiring in March and June 2020 have fallen. CME premium rates for March 2020 and June 2020 fell to 1.78% and 4.07%, respectively, while collective rates for other retail institutions fell to 2.05% and 4.44%.

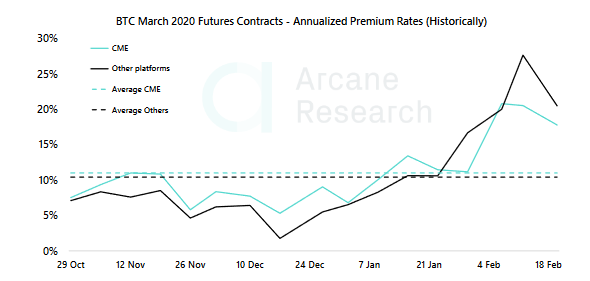

Despite falling rates, retail traders are clearly more optimistic than institutional ones.

Looking through the annual forward scheduleBTC futures, you can see that premium rates on CME and other exchanges have also leveled off. This is quite interesting as it happens after CME rates dominated others at the beginning of the year.

However, if you carefully follow the annualwith premium rates for BTC contracts for March 2020 over the past 5 months, it can be noted that since the beginning of 2020, rates on retail exchanges have exceeded CME values, which indicates that retail traders perceive the cryptocurrency market in a bullish trend.

Bullish mood can also be determined on the chartBitcoin Probability Index. In accordance with it, there is a possibility that by June bitcoin will reach $ 14,000, that is, almost a summer maximum of 2019.

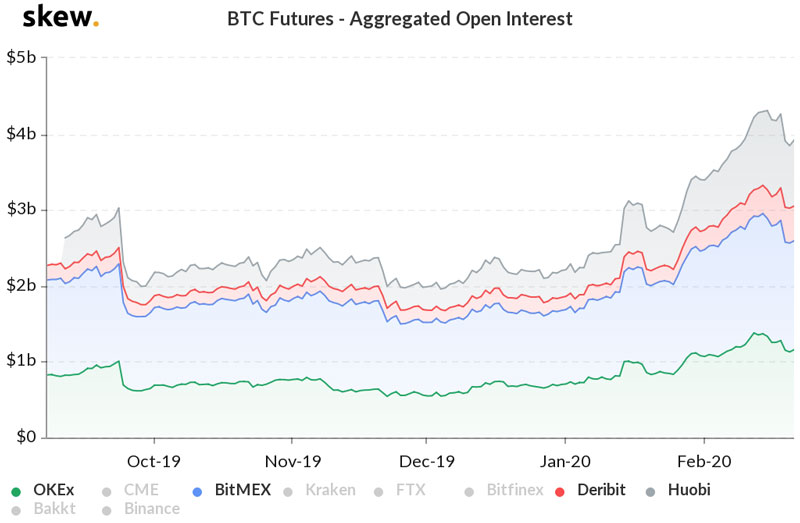

Regarding the growing bullish trend onretail exchanges, further details can be obtained from the Bitcoin futures chart. According to the chart below, on February 14, the combined open interest on OKEx, Huobi, BitMEX, and Deribit recorded all-time highs of $1.4 billion, $1.6 billion, $379 million, and $1 billion, respectively.

Despite the drop in bitcoin prices, on February 21, the aggregate open interest remained at a record high for all exchanges, with Deribit exceeding the previous maximum of $ 469 million.

This situation clarifies the increase in premium rates on retail exchanges for BTC futures contracts, as retail investors continue to actively trade cryptocurrency during the bullish rally in 2020.

</p>Rate this publication