According to the observations of Arcane Research analysts, the number of search queries for the phrase “Buy Bitcoin” is steadily growing.contracts on unregulated derivatives exchanges are trading above the spot price, while the “fear and greed index” is held at August marks.

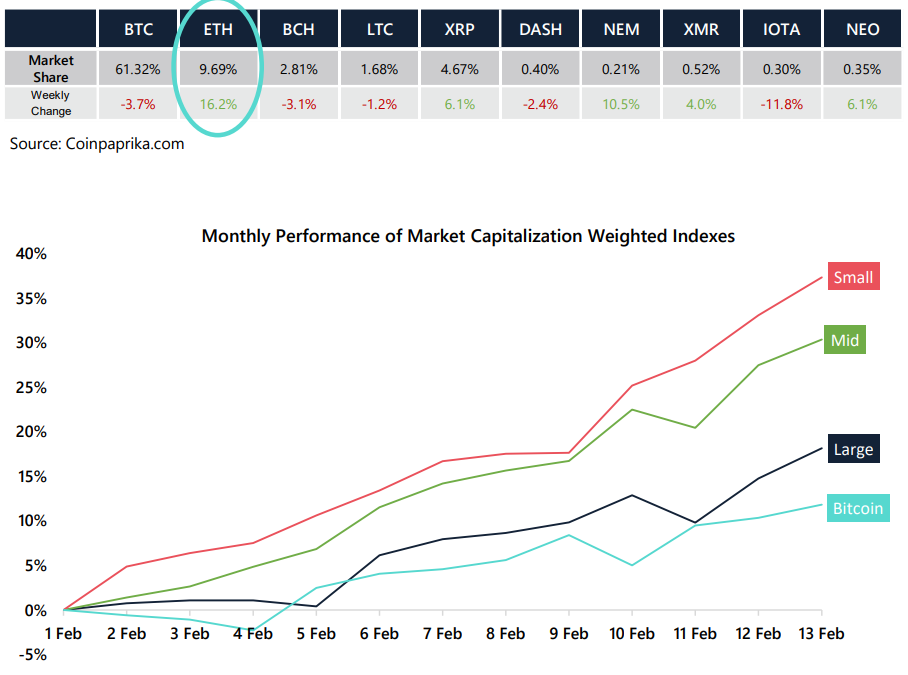

Experts note a significant decrease in the Bitcoin dominance index - to around 61%. The decrease in the market share of the first cryptocurrency was due to the ongoing rally of many altcoins.

Low-cap coins rose nearly 40% in two weeks

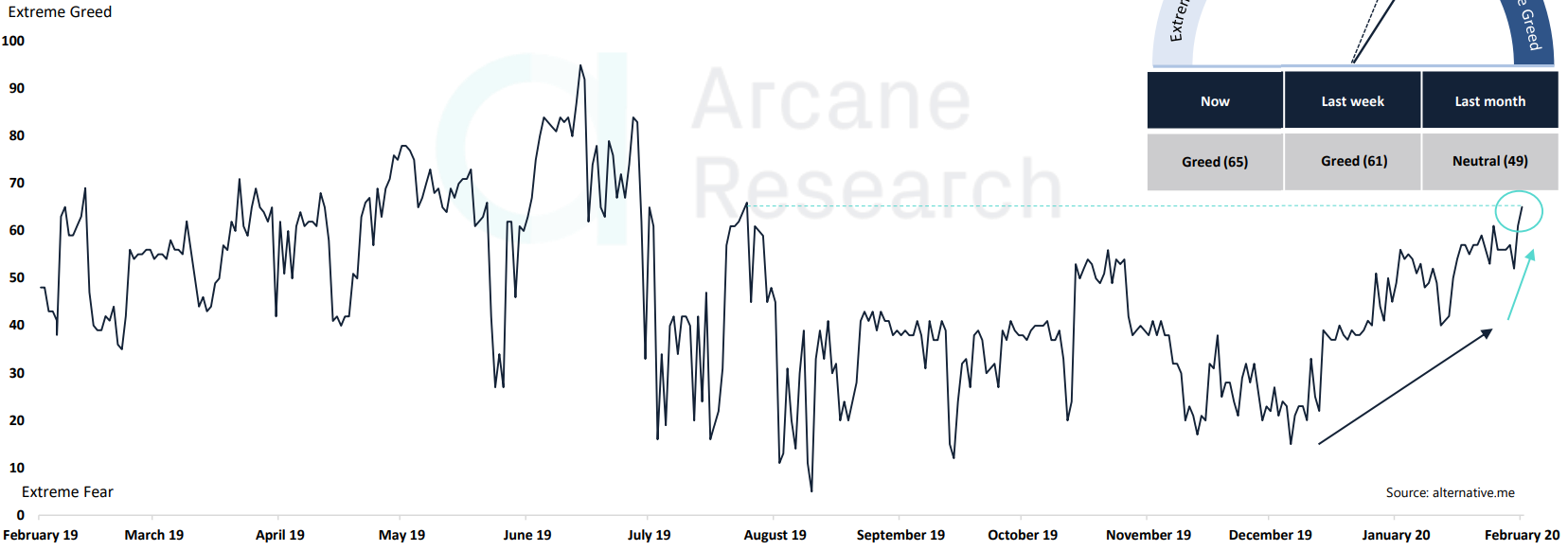

The cryptocurrency “index of fear and greed” has already reached 65, corresponding to the August marks:

The degree of “greed” of the index was higher than the current one only in June-July last year - after the bitcoin price suddenly reached $ 13,000.

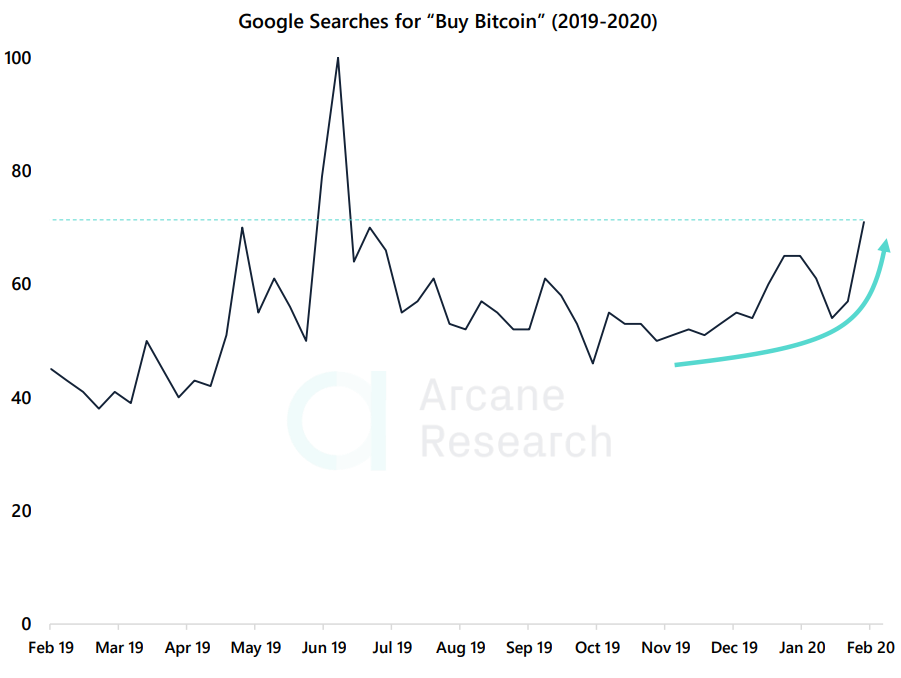

The number of Google searches for the phrase “Buy Bitcoin” follows an uptrend:

An increase in the value of this indicator may indicatethe fact that bitcoin is attracting new investors. Unlike the extremely volatile June growth, a gradual increase in the indicator looks more organic.

“This may mean that interest in buying Bitcoin is less driven by FOMO [loss of profit syndrome]”, - analysts share their thoughts.

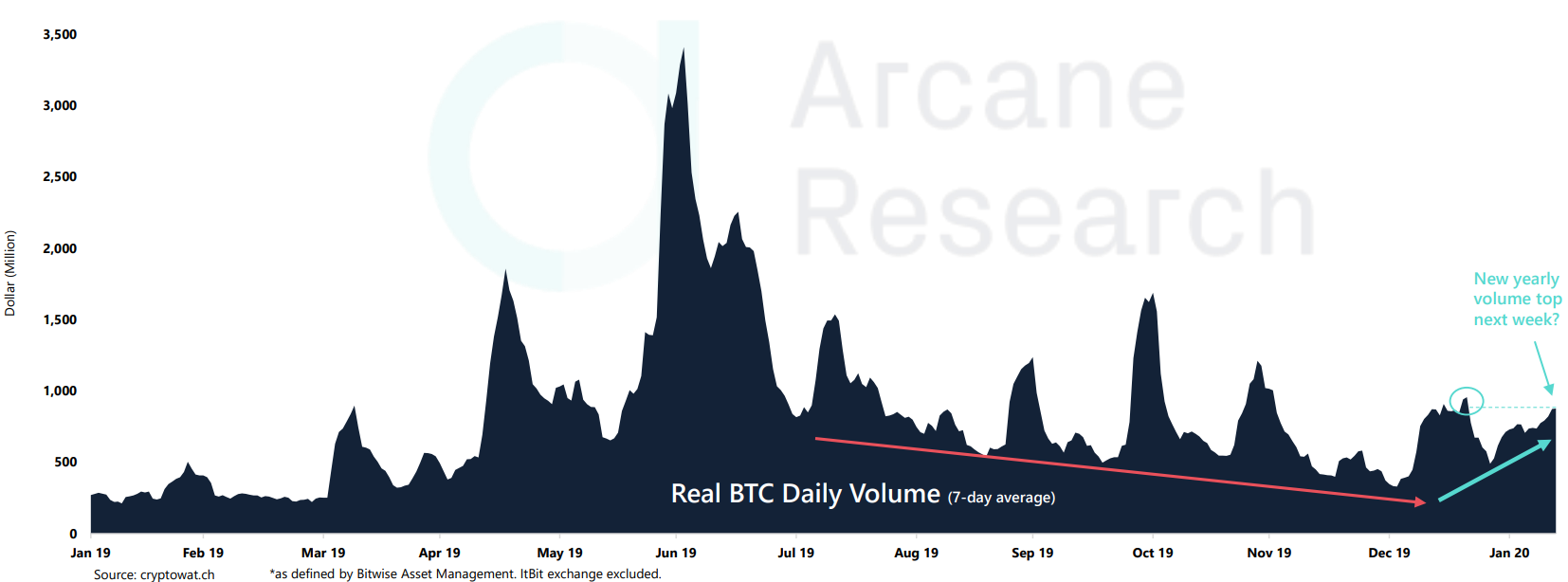

Researchers do not exclude the possibility that next week the volume of trading on Bitwise rating exchanges will update the maximum of 2020:

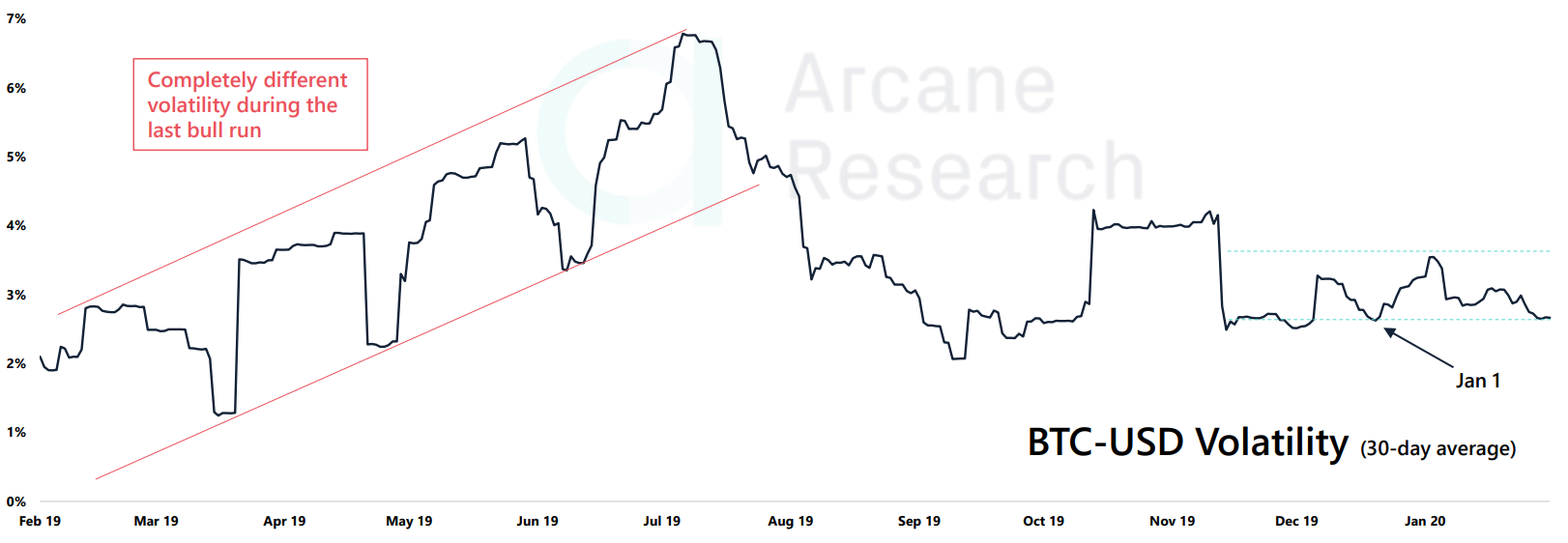

Arcane Research also finds it noteworthy that despite rising prices, volatility is now significantly lower than last summer.

This may indicate that over time the market is becoming more mature.

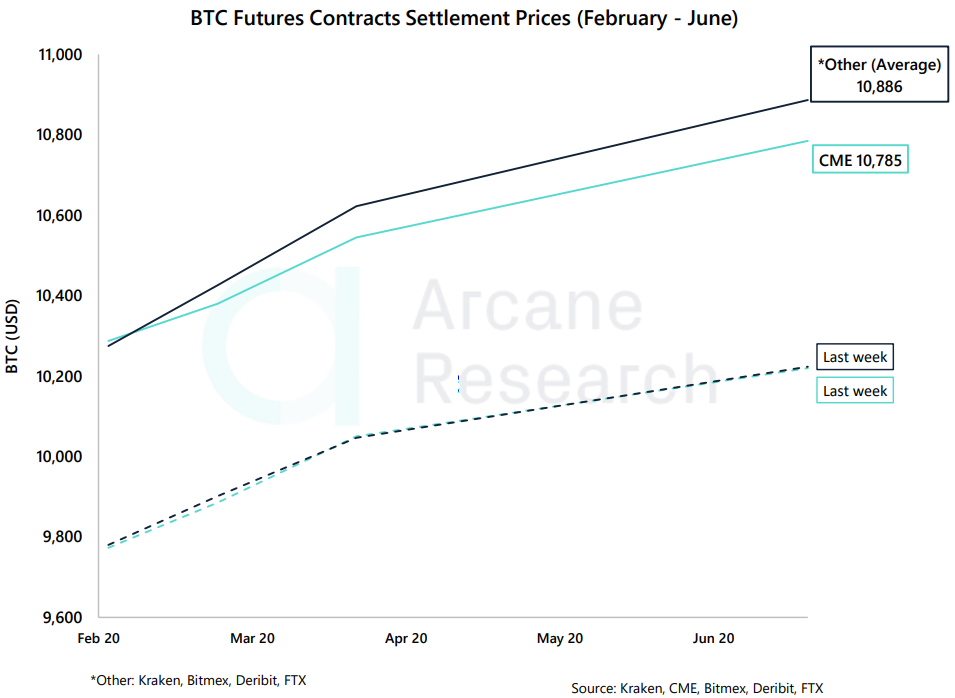

Analysts also note that the contango on unregulated futures platforms is significantly higher than on CME:

In particular, the difference with respect to the spot price for the June contracts is 6%. This may indicate an optimistic mood among retail investors.

Recall that in a previous report Arcane Research reported an increase in open interest and trading volumes on the Chicago Mercantile Exchange (CME).