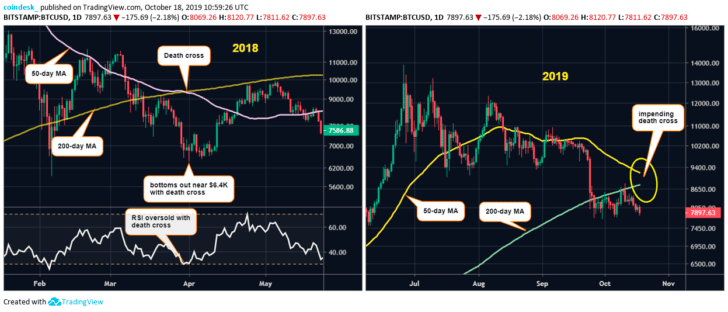

Next week, the so-called "cross" should appear on the daily chart of bitcoindeath" (whenThe 50-day moving average crosses above the 200-day moving average.) If confirmed, this cross would be the first since March last year, writes Coindesk analyst Omkar Godbole.

The cross of death is a long-term bearish indicator. This is a lagging indicator, which in practice often leads traders to fall into the trap, as shown in the graph below.

50-day moving average fell below200-day moving average March 31, 2018 (top left). The sale ended at around $ 6,400 and the price of bitcoin rose to a maximum of about $ 10,000 in the first week of May.

Please note that the relative strength index(RSI) oversold when an intersection occurred. The market is often oversold at the time the intersection is confirmed, since MAs are based on past data, and intersections are the result of price rallies or sales.

In mid-September 2015, the rollback of bitcoin fromA high of about $ 250 also ended around $ 220 with confirmation of the death cross. In the following weeks, cryptocurrency was trading in the range of $ 220–250, after which the bull market began at the end of October 2015. This was followed by a rapid rise to a historic high of $ 20,000 by December 2017.

The upcoming crossover could also turn out to be a bear trap, since by then bitcoin is likely to be oversold, dropping more than 40% from its June 13,800 high.

In addition, do not forget about the reductionmining rewards in May 2020. Bitcoin may repeat history and demonstrate a rapid rise in price six months before this event, as noted by a popular analyst under the nickname 100trillionUSD.

We are at about 6 months before May 2020 #bitcoin halving.

In 2012 btc jumped from $ 5 to $ 12 (2.3x) in those 6 months before the halving. In 2016 btc jumped from $ 350 to $ 650 (1.7x). pic.twitter.com/DKSQBOO2TD

- Plan₿ (@ 100trillionUSD) October 16, 2019

Thus, bitcoin is likely to remain indefense before crossing. As the bearish sentiment is strong enough, in anticipation of the intersection confirmation, a deeper decline is possible below the 100-week moving average at $ 7755 to support at around $ 7430 (multiple daily lows in early June). The forecast will become bullish if the price rises above $ 8820, canceling bearish lower highs.

</p>