Bitcoin has no value

This is perhaps the main argument of cryptocurrency critics. It cannot be usedor somehow physically use it. Because of this, the real value of Bitcoin supposedly should be zero.

Following this logic, banknotes in your walletalso cost absolutely nothing. When the US dollar moved away from the gold standard in 1971, money ceased to be supported by gold. In fact, this allowed central banks to create new money “out of thin air”. After the abolition of the gold standard, dollar inflation only increased.

Do not be surprised - money is conditional enoughconcept. Banknotes acquire their value only due to the fact that they can be spent almost everywhere in the country. They are a universal product.

Bitcoin (BTC) is really not backed up by anything. However, the maximum number of cryptocurrency coins is limited, that is, it can not be created forever. Plus it can not be faked, so the "fake" bitcoins do not exist.

Bitcoin is simply the best money. Money that cannot be uncontrollably printed by central banks. Money that cannot be censored or confiscated. Money that has no borders and is not controlled by any state.

Bitcoin gives everyone equal access and does not discriminate on the basis of geographical location, age, gender or religion. The real value of Bitcoin is financial freedom.

Bitcoin is a bubble

In 2017, cryptocurrency for a short periodtime has grown almost 20 times, reaching a historic high of $ 20 thousand. Then, at almost the same rate, the BTC price fell below $ 6,000.

In traditional markets, such sharp ups andfalls in asset value are called “bubbles.” Usually, after the formation of a bubble, the asset becomes cheaper for a long time and hangs at the bottom. Fortunately, Bitcoin managed to win almost all of its positions. Last year, the coin went up to 14 thousand dollars before a new fall.

On a relatively small scale, these sharpprice movements really look like bubbles. In fact, Bitcoin is in a very long growth phase. Ten years ago, cryptocurrency cost almost nothing, but now they are ready to give thousands of dollars for it.

Bitcoin is based on the deflation mechanism: every year for everyone who wants to buy coins, there is less BTC, so the price of cryptocurrency is growing in the long term. But traditional currencies can depreciate as much as you like. Especially against the backdrop of recent events in the world.

Let us recall that recently the US Federal Reserve and central banksEurope has announced the ability to print an infinite number of banknotes to support the global economy during the coronavirus pandemic. The more ordinary money is in circulation, the less its real value will become. The advantages of Bitcoin here are obvious.

Bitcoin will never replace money

Bitcoin is too slow, confirmation of transactions can take several hours, cryptocurrency is very inconvenient to pay for goods - you’ve probably heard about this more than once.

Most people do not realize that when theyare calculated for a cup of coffee with a credit card, the money from their account does not instantly go to the seller’s account. First, the payment system counts the digital debt obligation, which may remain open months after the transaction.

That is, the concept of money in your account is rathercompletely virtual concept. With the development of technologies such as the Lightning Network, the Bitcoin blockchain can also process relatively large transaction flows in a matter of seconds. Moreover, this figure increases over time.

Bitcoin cannot exist without the Internet

The Internet is an important component for the cryptocurrency network, but even without it, it will continue to exist.

The size of Bitcoin transactions allows you to transferthem even with the help of radio waves and satellites. Yes, you heard right—Bitcoin can be transmitted over the radio. All you need is a 7 MHz and 40 m antenna and the JS8call application.

Government may destroy Bitcoin

Earlier, in some countries, strict bans were introduced in relation to the main cryptocurrency. Now these restrictions are gradually being removed.

In February 2018 it became known thatThe Indian government will tighten control over the circulation of cryptocurrencies. The bans were indeed introduced, but already in March 2020, the Central Bank of India officially allowed cooperation between commercial banks and cryptocurrency firms.

As practice shows, resistanceThe spread of crypto brings practically no advantages for the state. But the support of the industry, on the contrary, has a positive effect on the economy. For example, one of the factors in Japan's GDP growth in 2017 was the adoption of Bitcoin.

This is logical - a complete ban on BTC turnover incountry will only lead to black market growth. But the recognition of cryptocurrency as a class of assets allows the government to get another source of replenishment of the budget through taxes from crypto investors. That is, destroying Bitcoin is not profitable.

Bitcoin is bad for the environment

Critics say that with the increase in the number of bitcoin miners, the network's demand for electricity is growing. Most of it is produced at harmful thermal power plants.

In 2019, researchers from the University of New Mexico published a report on the environmental impact of Bitcoin. Cryptocurrency does contribute to the emission of harmful substances into the Earth’s atmosphere.

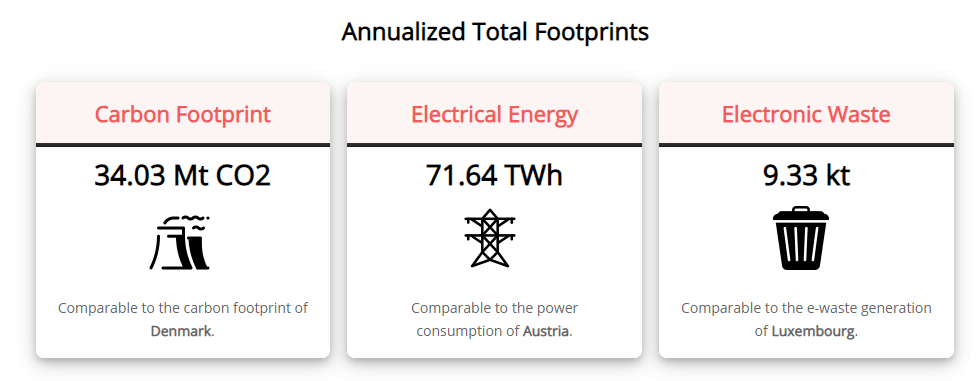

According to the Digiconomist portal, the Bitcoin network is “responsible” for the release of more than 34 megatons of carbon dioxide into the Earth’s atmosphere:

However, Bitcoin alone is not an incentive.for electricity providers to increase their momentum - and this is very important to understand. Just surpluses of previously not consumed resources, which one way or another would have been worked out in vain, including those used to power the Bitcoin network.

Bitcoin will outperform another cryptocurrency

It is believed that BTC was the first of its kind. Allegedly, he is only a pioneer, and some other cryptocurrency will gain popularity in the future.

Bitcoin is not quite the first of its kind. Before his appearance, there were attempts to create something similar - the first analogue of cryptocurrency could appear back in the nineties of the previous century. However, all these projects failed due to problems with centralization and security.

After Bitcoin first came into focuspublic attention, many developers began to create their own cryptocurrencies. At the same time, they promised that the new coins will be “better and faster” Bitcoin. Until today, no other coin has managed to occupy a dominant place in the industry.

Bitcoin is not safe, exchanges are constantly hacking

News headlines about the next major cryptocurrency exchange being hacked will scare anyone away from the industry. However, Bitcoin itself has never been hacked.

Yes it is. The system created by Satoshi Nakamoto is safer than any bank in the world. If BTC will be stored on your hardware wallet, even with physical access to the device, attackers are unlikely to be able to withdraw bitcoins themselves.

Bitcoin cannot be counterfeited:The release of new coins occurs according to a schedule strictly predetermined by the protocol, which absolutely no one can violate. Bitcoin is almost impossible to “close.” As long as at least one miner is active on the network, the system will continue to live.

But with exchanges really a problem. If you store your cryptocurrencies on the trading floor, you can really lose them. Centralized exchanges so far dominate the industry, but they have clear alternatives in the form of decentralized trading floors.

Only criminals and drug dealers use Bitcoin

The most interesting thing is that criminals are among the first to master new technologies. So it was with the Internet, wire transfers and other things.

At the dawn of its history, bitcoin reallymany bought only for the sake of spending cryptocurrency on illegal goods or services. Over time, the ecosystem has grown, and now only 1 percent of transactions are related to illegal activities.

The main users of the crypt were traders,who speculate on it on the stock exchanges. The industry includes large companies, hedge funds and even entire cryptocurrency banks. Moreover, very soon you will be able to spend bitcoins in almost any payment terminal in the world. A debit card from the Binance cryptocurrency exchange will help with this.

Bitcoin is too expensive

Many people are hesitant to buy cryptocurrency becausethey think it's too expensive. They look at the price and think that they have already “missed the train” with potential profits. For example, today the cryptocurrency rate is $6,900. Naturally, most do not have that kind of money for a one-time investment. Especially in a tool that is not entirely clear.

Let us remind you once again - you can always buy partBitcoin coins. Each Bitcoin is made up of hundreds of millions of indivisible parts called satoshis. You can purchase at least one satoshi - that is, 0.00000001 bitcoin. Now for about 50 dollars it is quite possible to buy more than 700 thousand satoshi or 0.007 bitcoin. This amount is much more realistic - you can even afford to lose it.

Do not think that you missed absolutely everythingopportunities in the industry. Less than 15 percent of Americans and less than 1 percent of all people in the world own the main cryptocurrency. If its capitalization continues to grow and reaches the level of gold capitalization, the value of BTC can grow at least 25 times.

If you now invest a hundred in cryptodollars, then in this scenario, in a few years this investment could increase to $2,500. So it’s not too late to contact her and think about buying coins.

Let us clarify that this may not happen. Or something else may happen: both pleasant and not so pleasant. Niche predictions don’t work, we already know that.

Another interesting fact: if you divide the maximum number of BTC by the entire population of the Earth, then each person will receive only 269 thousand satoshi. In reality, this figure will be much less, because about a quarter of all bitcoins mined to date have already been lost forever.

</p>Rate this publication