This week's focus is on Cred and DonAlt, the smug boomers from Technical Roundup: A Moderate PullbackFromresistance in the bitcoin/dollar pair and similarthe situation with the retest of the $3000 area in Ethereum/dollar. At the end of the review, the authors try to give some additional context to this period of difficult macroeconomic conditions in global markets.

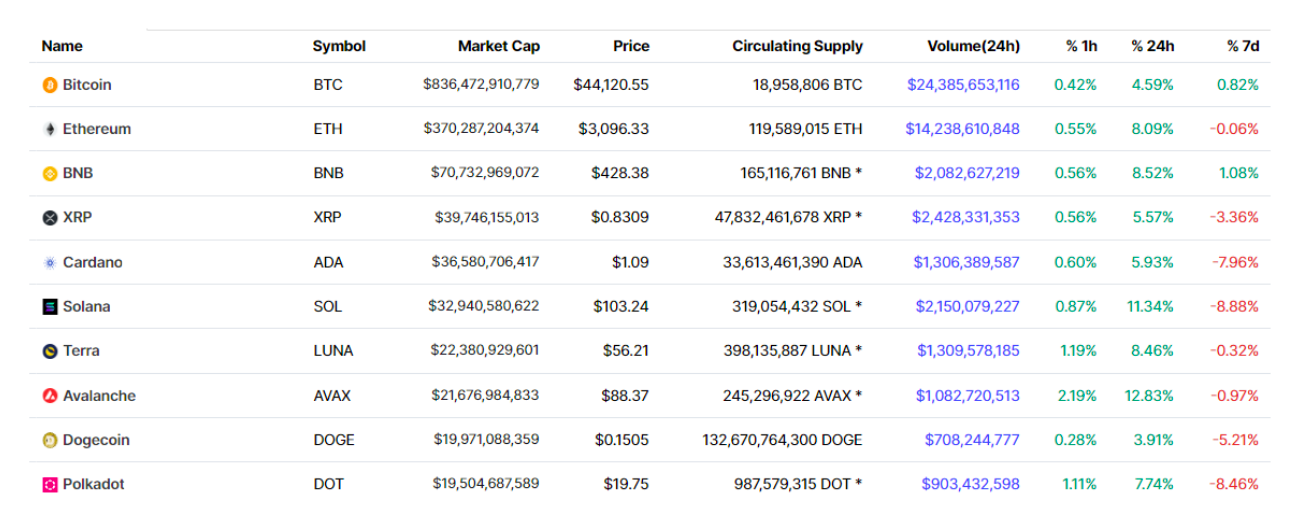

https://coinmarketcap.com/coins/views/all/

Bitcoin consolidates near the middle of the range

BTC/USD is still trading near the middle of its trading range ($46k) on the weekly chart. The market suggested there was some pullback from this area, but the movement came out insignificant.

~$46K+ is the resistance and also the middle of the range with immediate support in the $38-40K area and the nearest target level if the resistance is broken in the $56-60K area.

We avoided expressing any expressed opinionmid-range ($46K) on the way down, and see no reason to do so on the way up. Technically this is resistance, but we usually avoid placing any bets in the middle. The best opportunities are almost always at the edges of the range, not in the middle.

This is a boring opinion, but in a boring market, being selective about setups tends to be rewarded.

Putting aside technical analysis a little,macroeconomic factors beyond our control and specialization continue to have a very strong impact on prices. The main culprits here are the likelihood of more urgent action by the Fed and geopolitical tensions. The U.S. Indices look depressing and Bitcoin/USD has shown commendable relative strength so far, given the circumstances.

What could (for a change) make our weekly review more interesting?

The first option is a strong recovery higherthe middle of the range ($46K) on the weekly chart, which would significantly increase the likelihood of a move to $56-60K. The second option is a fall to support ($38-40K), which would mean a return to the structurally significant level of the greater low, which is exactly would be worth discussing.

Everything else, at least for our purposes, is akin to flipping a coin at best.

Be that as it may, our analysis of the youngertimeframe shows that most of the selling on the Sunday and Monday headlines was well absorbed by the BTC/USD market, and another upward push looks apt. Structures on higher timeframes still have more weight, but this time I wanted to add at least a little color to the review due to lower timeframes.

Ethereum stuck to $3000

ETH/USD is also testing the middle of its range at $3,000.

As in BTC/USD, the obvious thesis of a bearish retest "worked", that is, it stopped the price, but the market has already returned to the retest of the same area. This puts both markets in a difficult position.

We are essentially seeing a weak reaction to resistance, which is a bullish sign, but acting on this right now is buying below resistance on the higher timeframes.

DonAlt(a)'s argument is that it's betterwait for these mid-range levels to be breached and/or act as support if you are in a buying position, but you will most likely need to act very quickly and settle for a sub-optimal entry.

It makes sense.

Be that as it may, for ETH/USD the levels seem to be perhaps clearer than for BTC/USD (although the picture in ETH/BTC still does not give reasons for optimism).

$3,050–$3,310 is a stumbling block, but above that, there will be almost no obstacles on the way to $4,000.

Accordingly, trading in anticipation of continuationbullish momentum in major cryptocurrencies could essentially look like this: BTC/USD above $47k on the weekly chart likely suggests a move towards $56-60k, ETH/USD above $3310 on the weekly chart likely suggests a move towards $4000.

Although, this is probably all empty fantasy, given that the markets are still under resistance and we write about the highs of the range at the first appearance of a green candle.

Macro crap will pass

The title is emphatically frivolous, but we'd like to add some perspective to the last few difficult months in the market.

The current macro environment sucks.

The crypto market is getting bigger and bigger"institutional", it no longer exists in a vacuum. Significant changes are taking place in the financial landscape. It was obvious at the beginning of 2020 and it is obvious now.

We do not see a real prospect for ourselves to becomeexperts in the field of macroeconomics, geopolitics, infectious diseases and what is still relevant today in the world of traditional finance. Even keeping track of all sectors of the crypto market has become impossible in the last year or so, let alone become some kind of multidisciplinary genius.

Most of the comments about the macro environment that you see somewhere (including ours, of course) are forced unqualified generalizations.

The risks to markets and asset prices are real, andinflation looks more stable than expected. Central banks will respond by raising rates, and doing so on an accelerated schedule, which is generally not good for risky assets.

But so what? In a fairly long term, we will forget about these negative factors, just as we forgot about the collapse of the markets during the first wave of the spread of COVID.

It may last longer and make the market cycle crappier, but we don't think it's some new and permanent property.

For a long time, the market was so stupid that it seemed to make sense to deliberately lower IQ in order to get the most out of this market.

Now the market is difficult.

But at some point he will become stupid again.

You need to survive and wait out, which, as a rule,involves some combination of 1) being able to handle both extremes of volatility (not being overly leveraged and overtrading in tight ranges) and 2) not betting everything on altcoins that won't live to the next point (or technically will, but it's not yet clear in what state) .

As for the rest, this macro-crap will also pass and result in the next period of an absurdly stupid market.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>