This week, Cred and DonAlt, the self-righteous boomers and authors of the Technical Roundup mailing list, are discussingA breakout below the midpointrange in BTC / USD, as well as a retest of support in ETH / USD.

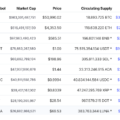

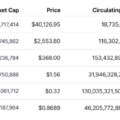

https://coinmarketcap.com/coins/views/all/

Bitcoin below mid-range

BTC/USD closed below the mid-range on the weekly timeframe ($46K).

“Technically”, the market has also reached the support zone,hovering near the bottom of the daily range ($40.5K) and just above weekly support ($38.2K). This appears to be a sufficient combination of support levels to justify some bounce in a market that has been moving almost in a straight line.

How we got here is also important.The middle of the range was broken down and in the process the price formed a lower low on the weekly timeframe. As a result, the market structure is bearish and bounces are expected to be directed against the main trend until the opposite is confirmed.

As for catalysts, the Americanthe stock market is falling and the crypto market has followed. It probably won't last forever, and there were some tentative signs of divergence on Monday as the bitcoin / dollar held on amid yet another downtrend in traditional markets. Further evidence of this relative strength (stocks down, crypto up or sideways) could be signs of a local low forming.

In addition, there is a suspicion that when tradersDog-tokens from crypto-twitter are beginning to be somehow overly interested in the macro-agenda, the market is probably approaching at least a short-term reversal. Remember Evergrande?

This is quite a lot of information. Let's now try to structure it into ideas.

As already said, the middle of the range ($46 thousand).) is now resistance. There is also some overlap in this area with the levels of our favorite meme moving averages (50-week and 200-day). Accordingly, if the mid-range level is restored, this will be a good prerequisite for a rebound to the untested [weekly] resistance in the $55+ thousand area.

Alternative to Positioning Over Resistanceis a buy deep in support, where the idea's invalidation level is often clearer and the market offers the highest risk-to-reward ratio (we affectionately call these levelsdo-or-die). In our opinion, this would certainly happen in the untested weekly support of $32-38k.

To sum it up, we can say that $40 thousand.- this is a decent round level for a rebound if the crypto market is able to move counter to the stock market or if the decline in the stock market stops. The market is already down 40% from its last high and the likelihood of a rebound is quite high. However, the market structure is bearish. For us and for our money, tradable setups occur either above $46K (signal that momentum has some strength and promise) or closer to $30K (higher timeframe support). In principle, we are not against the movement of $40 —> 46k, but there's not much to catch there (especially since the price has already moved away from support).

Ethereum is testing defining support level

ETH / USD follows a failed breakout pattern in BTC / USD.

The high of the $ 4000 range as support was lost and the market closed at the next weekly higher low ($ 3050–3310).

At the same time, ETH / BTC also closed below the breakout level on the weekly chart.

This puts Ethereum in a rather precarious position. It no longer looks so convincing in a pair against bitcoin and against the dollar it seems to reproduce the decline in BTC / USD with some lag.

A close below $ 4000 was a bearish setup, andnow this level is resistance. If the market recovers above $ 4,000, the likelihood of a second unsuccessful breakout will be rather small, and the likelihood of continuation will increase significantly.

Meanwhile, the mentioned weekly support of $3050-3310 is the only structurally significant area above ~$2000. At least it looks pretty neat: $4000, $3000 and $2000…

The market has formed a small range.$ 3050–3310 is support, $ 4000 is resistance. At the same time, $ 4000 looks somehow very generous, given some structures on smaller timeframes in the $ 3600-3800 area.

If the market offers something clear at the extremelevel of support ($ 3050) and / or convincingly recovers above its upper border ($ 3310), then we can assume some probability of movement to $ 4000. The closure was so-so (get used to the "technical" terminology - okay, so-so), so this has to be determined on an intra-week basis. Decent time to buy, if it happens, then there.

As in our commentary on BTC / USD, the likelymovement from $ 3000 to $ 3600 will be directed against the trend. Moreover, we believe that the market has a lot of better setups to offer. A weekly close above $ 4,000 would be extremely compelling. The fall to $ 2,000 would be hard to ignore, too.

To summarize, Ethereum/USD is at support.Just like Bitcoin/Dollar. It is reasonable to expect a rebound here, but this is not our ideal area to look for a setup. In any case, there is resistance nearby at $46K (closer to $3600-3800 for Ethereum).

The stock market movement this week, as well as the strength or weakness of the crypto market relative to it, can probably provide a better signal-to-noise ratio than "technical" levels.

In essence, there is a likelihooda rebound (a fairly deep correction, a likely rebound in stocks + some narrative exhaustion), but we don't expect it to be big enough to play on.

Self-righteous boomers, what to take from us.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>