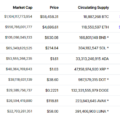

This week in the spotlight of Cred and DonAlt, authors of the Technical Roundup: cascading liquidations in BTC/USD and new tradingranges for this pair, as well as Ethereum in pairsto USD and BTC, which continues to demonstrate relative strength against the background of Bitcoin and the crypto market in general. In conclusion, the authors will offer their point of view on the prospects of the market, taking into account the wave of liquidations and the washout of borrowed capital.

https://coinmarketcap.com/coins/views/all/

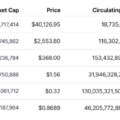

Bitcoin Breakout Reaches Support

Chart executed in TradingView

Chart executed in TradingView

BTC / USD went down, you know.

Very aggressive weekend night saledropped the BTC price straight to the next support (and at the moment and below). The movement was aggravated by the cascading liquidations of longs and the liquidity crisis in general (here one cannot fail to note the impeccable timing for such a movement).

After a sharp movement dropping keyAs futures are back to baseline, the market tends to consolidate and move into mean reversion — in other words, range trades.

For us in the current situation, two ranges are relevant.

The first is short-term, with daily support$48.3K and resistance at $51.8K. V-shaped reversals from such formations are quite rare, so we expect the short-term range to be in play for at least this week. For any short-term trading, the preferred setups and logic for trading in ranges are: buy at support / sell at resistance.

The second range is weekly, with an upper limit ofthe area of $56-60 thousand and the lower one - at $32-38 thousand. The price broke above the upper limit, but was unable to hold on to new levels. This usually implies a high probability of a move to the opposite, lower end of the range. At the time of writing, the market is trading at intermediate support, approximately coinciding with the midline of this macro range, located in the ~$40+ thousand area.

Another factor to keep in mind isis that Ethereum still looks technically stronger than Bitcoin, as we'll discuss later. And as long as this is the case, it makes sense for those who have decided to position themselves on the crypto market in the expectation of strength to give preference to Ethereum, at least this is how it looks today.

Quite a lot of information. Is it up or down?

Price Action After Futures Markets Crashusually quite inconvenient. Most often, this is a period of “haircut”, probably also “filling” the space of the largest candlestick “wick” and trading at the minimums designated by it. Our expectations are for trading in the range between $48.3K and $51.8K. If the market breaks through its upper limit, then we expect strong resistance at $56K. Most likely, we will see somewhat duller times here in the near term, and we are still inclined towards defensive positioning on BTC/USD.

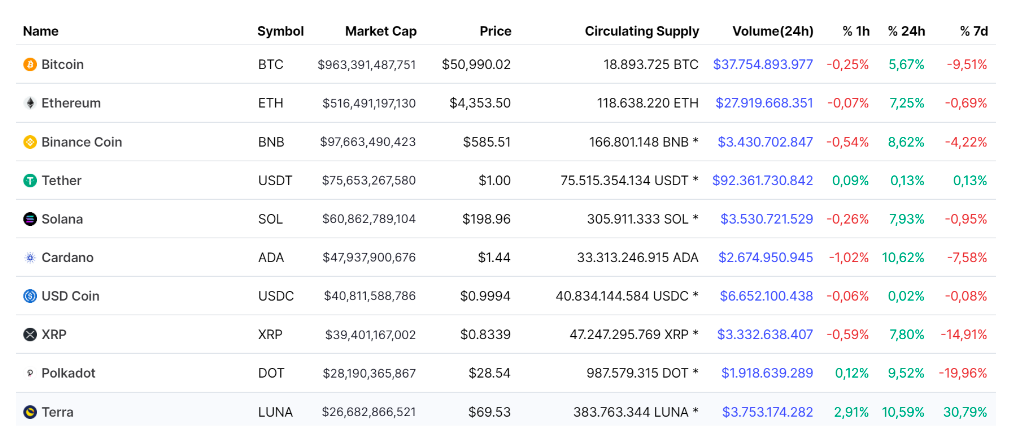

ETH / USD: $ 4000 retest

Chart executed in TradingView

Chart executed in TradingView

ETH / USD also dropped sharply, but the recovery here was significantly more confident.

Despite a large liquidation wave, at the close of the weekly candlestick, ETH / USD held the high of the previous range ($ 4000) as support.

This is impressive.

We said last week that the scenario withWith a retest of $ 4000, we are not very happy with it. However, if we consider that the retest took place against the background of a general market decline and the level was kept at the same time, we cannot ignore such a sign of strength.

The expectation of strength from Ethereum / dollar still seems to us a reasonable assumption - as long as the $ 4000 level is held.

For shorter-term trading, the market offersthe range is $ 3950-4480. Given how strong the ETH / BTC pair looks, it wouldn't be that difficult to justify a breakout of resistance and a continuation of the trend in the pair against the dollar. However, reasonable caution does not hurt here either. The high of the range is still resistance until proven otherwise.

In summary, the $ 4000 level has been withheld despitestrong liquidation fall of the entire crypto market. This is compelling evidence of Ethereum's relative strength. Full confirmation of this thesis would be a breakout of the high of the current range at $ 4480. Any weakness with a close below $ 4000 on the higher timeframes is a bearish signal.

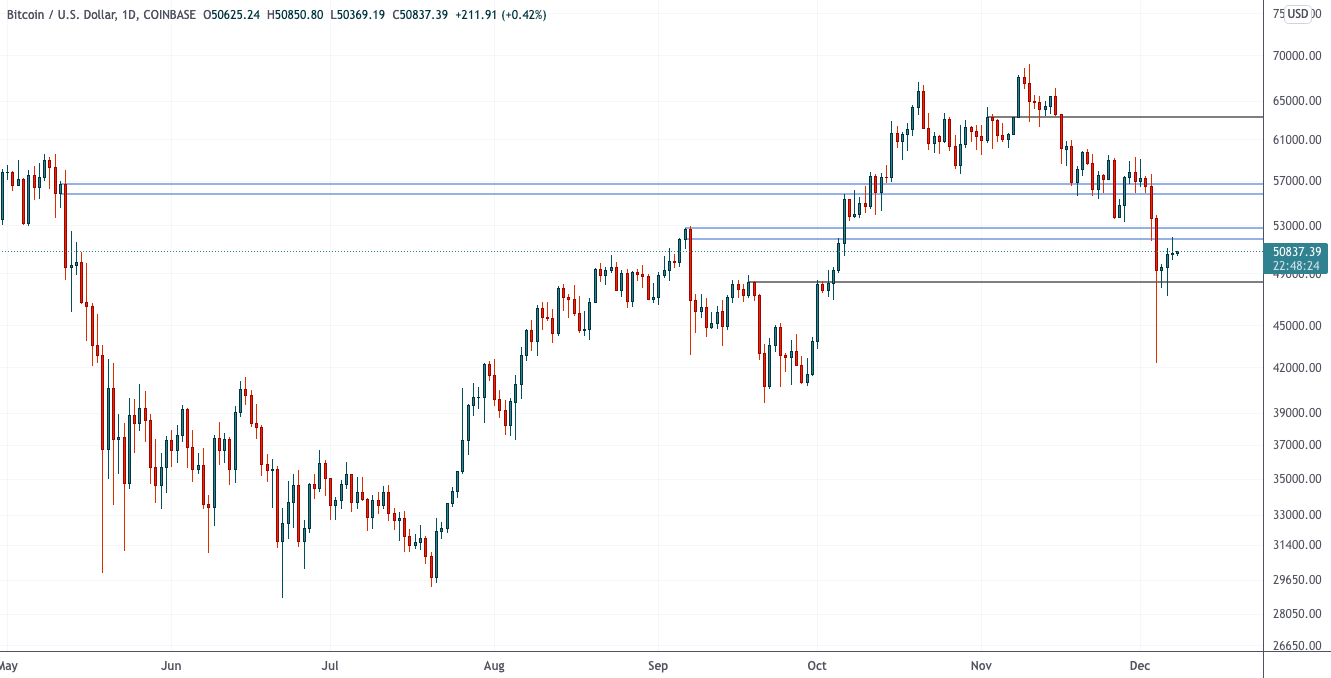

ETH / BTC is accelerating

Chart executed in TradingView

ETH / BTC still looks strong.

The price made a larger high on the weekly chart and reached the top of the range at ₿0.084.

Now the market has come to resistance, and the current setup is by definition less attractive than last week - simply in terms of risk / reward ratio.

However, given that ETH/USD managedto absorb a sell-off of this magnitude and close above $4,000 while Bitcoin failed to hold the equivalent $58K level, continued momentum in ETH/BTC would not look unreasonable. In the end, Ethereum held key support, Bitcoin did not.

Until ₿0.084 turns into somethingan unsuccessful breakout, and in the absence of a close below $ 4000 in the pair against the dollar, continued upward momentum in ETH / BTC looks more likely than a reversal, albeit with a worse risk / reward ratio given the resistance of ₿0.084.

We would also like to recall our argument aboutmarket cycles voiced last week. This divergence between BTC and ETH is either a transition into a completely new paradigm compared to April-May (less likely), or a sign that we are approaching the top of a macrocycle (more likely). Although on higher timeframes ETH / BTC looks like the most beautiful chart in the entire crypto market today, our approach remains generally defensive, given the weakness in BTC / USD.

Dream scenario: Sell in dollars at the top of ETH / BTC and travel somewhere in the tropics.

Futures: reset key figures to base values

As for the current state of the futures market, we would like to point out three points.

First, negative funding right awayafter liquidations does not mean that the movement has been confirmed by fundamental spot selling and the market has entered a bearish phase. The funding rate is the product of the difference between the price of a futures contract and the price of an index (usually based on multiple spot markets). In the context of large-scale liquidations, futures at the extremes trade significantly above / below the spot markets, because the amplitude of movement in them is exacerbated by (cascading) liquidations. As a result, negative financing is quite expected after a strong collapse, since the amplitude of the movement in futures is wider than in the spot. That is, it is more a consequence of the market structure than a positioning indicator.

Second.The BTC / USD pair, after large-scale liquidations, tends to decline in the short and medium term. Price trades in a range and very often fluctuates around the lows of a large candle or liquidation wick. Instant V-reversals are rare in this context. Thus, we expect that range trading setups will perform better in the short term than trend trading techniques.

Finally, we'd rather see the formationsome re-accumulation base (where funding is negative and aggressive market positioning is absorbed by sideways movement) before any convincing bottom structure can be talked about. A rise in price in the face of increasingly negative funding is also an acceptable option for the same, although spending more time in the range gives more confidence in the generated support.

However, such liquidations usually do notlead to an immediate reversal of the trend, so the formation of some kind of awkward range for the redistribution of coins from aggressive sellers of futures to capital allocators would be a welcome event. At the same time, Ethereum looks more interesting than Bitcoin, in which it is more likely to "haircut" in an uncomfortable trading range.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>