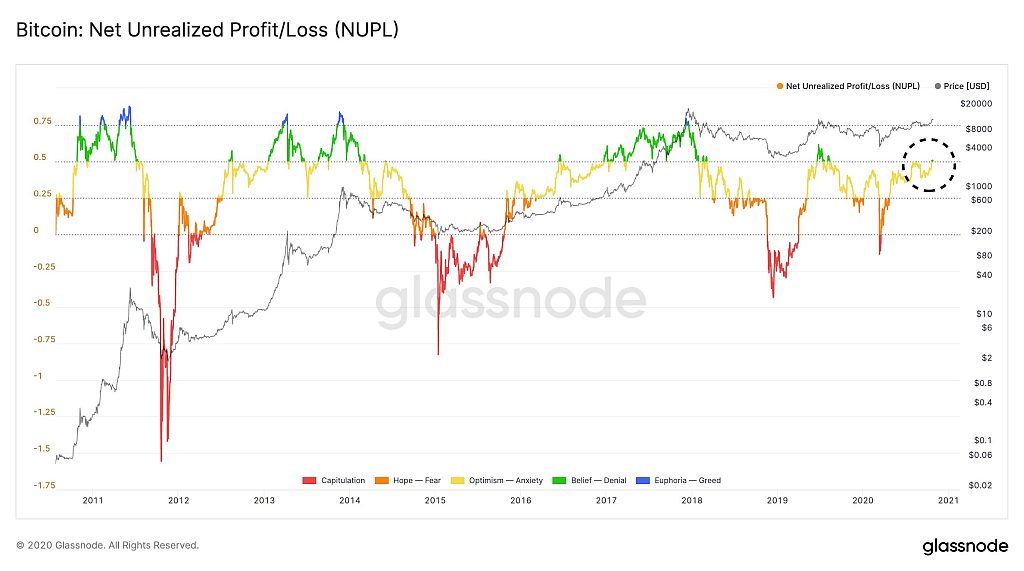

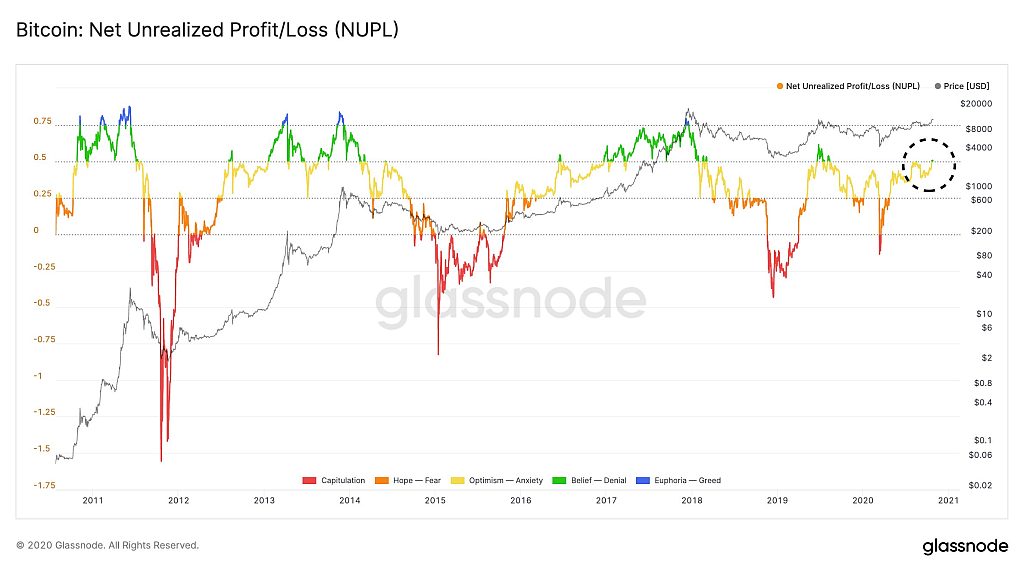

Bitcoin (BTC) could be in the early phase of a new major bull cycle, as a key metric hintsnetworks for October 27-28. The dominant cryptocurrency entered the "zone of confidence" that has historically marked the start of explosive rallies.

According to Glassnode, the last cleanunrealized profit / loss reached the zone of confidence in June 2019. The next month, bitcoin rose from about $ 7,500 to $ 13,868, more than 80%.

Essentially a metric of pure unrealizedprofit measures how many bitcoin holders are in profit or loss. If the indicator rises, it means that more investors are making a profit from the moment they buy BTC.

The Glassnode researchers calculate this by estimating the price of bitcoin when a new address is entered, not on the assumption that newly created addresses usually mean newly acquired BTC.

«The number of UTXOs in profit/loss is calculated in a simple way: we simply count all existing UTXOs whose price at the time of creation was lower or higher than the current price», - the researchers explained.

Currently, more than 50% of Bitcoin's market capitalization is unrealized profits. This means that the vast majority of BTC holders and investors are in the black.

«Bitcoin investor sentiment:last week the net unrealized profit/loss was in the “confidence” zone. Currently, more than 50% of BTC's market capitalization is made up of unrealized gains, a level not seen since August 2019.

#Bitcoin investor sentiment: Net Unrealized Profit/Loss (NUPL) has been in the «Belief» zone for the past week.

Currently, over 50% of the $ BTC market cap consists of unrealized profits - a level not seen since August 2019.

Live chart: https://t.co/EuOBJjVonO pic.twitter.com/kGd8uF42xk

- glassnode (@glassnode) October 27, 2020

Throughout 2017, bitcoin remained in the zoneconfidence over a long period compared to the 2019 rally. There is a possibility that a similar extended accumulation phase could occur in 2021 due to the post-halving cycle.

Analysts often associate the 2017 price increase withpost-halving cycle. In July 2016, bitcoin experienced the second halving in its history. Since he determines the rate at which new BTC is mined, this directly affects his supply. A year after the halving, BTC began to rise.

The last halving took place in May 2020. If the situation repeats itself, BTC may continue to rise until the second half of 2021.

In the short term, analysts and traders expect the bitcoin price to decline in a healthy consolidation phase.

Santiment researchers speculate that on-net and social metrics are warning signs, possibly because BTC is overheating:

«This weekend was dedicated to analysisBTC stability above 13 thousand dollars. At the moment, intranet and social indicators show more alarming than encouraging signs.

? Our update this weekend was all about analyzing$BTC‘s sustainability above $13k. As of now, our on-chain and social metrics are showing more concerning signs than encouraging. See for yourself what this sudden shift to positive crowd sentiment means. https://t.co/V8HBDnyzU4 https://t.co/9H7rRK31PB

- Santiment (@santimentfeed) October 26, 2020

Unlike the 2017 bull rally, the currentthe rise in BTC should be considered more sustainable. The rally has already established many major support and resistance levels, making a major correction less likely.

5

/

5

(

1

voice

)