Despite a 150% rise from the March lows, many crypto traders still maintainMacro bearish sentiment towards bitcoin.

For example, the CEO of Euro PacificCapital and well-known gold advocate Peter Schiff argues that with the future rally in gold, Bitcoin will continue to be in the grip of a bear market. However, Schiff added that the $ 3,200 lows reached by BTC in 2018 are unlikely to last long.

Luckily for the bulls, Bitcoin is set to show an important technical signal that preceded the BTC macro rally in 2016-17.

According to the cryptanalyst, Bitcoin's Macro Moving Average Divergence Convergence (MACD) is about to cross the green zone.

For the bulls, this situation will mark a great victory. The formation of such a signal was observed before the start of the rally in late 2016 - early 2017, during which Bitcoin rose from $ 1,000 to $ 20,000. A similar signal was also formed in 2019, before the rally to $ 14,000.

A potential MACD crossover is not the only signal that a long-term bullish scenario is possible.

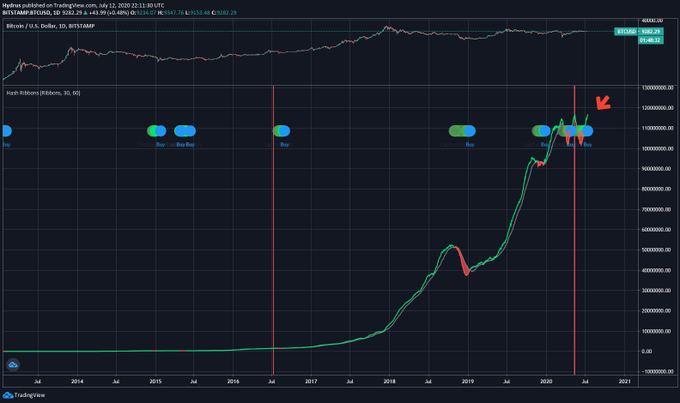

Last Sunday, digital asset manager Charles Edwards noted that his Hash Ribbons indicator shows a signal to buy bitcoin:

"The #Bitcoin Hash Ribbons has just confirmed a 'buy' signal.It will probably be a very long time before the next signal... And so the great race of the bulls begins."

This is important because this signal was preceded byparabolic price rally of BTC. In analytical studies published last year, Edwards found that each such scenario resulted in an upward movement in price with an average increase of up to 5520%.

Other analysts note that fundamentalsmarket indicators also point to a bullish scenario. Nexo's Anthony Trenchev still argues that Bitcoin could reach $50,000 by the end of 2020. He attributes the surge to central bank money printers being active and block rewards being reduced after the halving:

«Yes, I still stick to myforecast at 50K by the end of the year. I am fully aware that this is a bold statement, but it is based on fundamental principles, and even based on them, the momentum is changing», - commented Trenchev in an interview with a Bloomberg journalist.

This optimism is shared by the CEOBlockstream Adam Back. The seasoned executive and programmer expects BTC to hit $ 300,000 in the next five years. Like Trenchev, Beck recalled the active work of money printers, adding that bonds and real estate are likely to have a low risk-reward ratio.

Back is a supporter of the Stock-to-Flow model that PlanB applied to Bitcoin, which resulted in a forecast that the asset price would rise to $ 288,000.

</p>Rate this publication