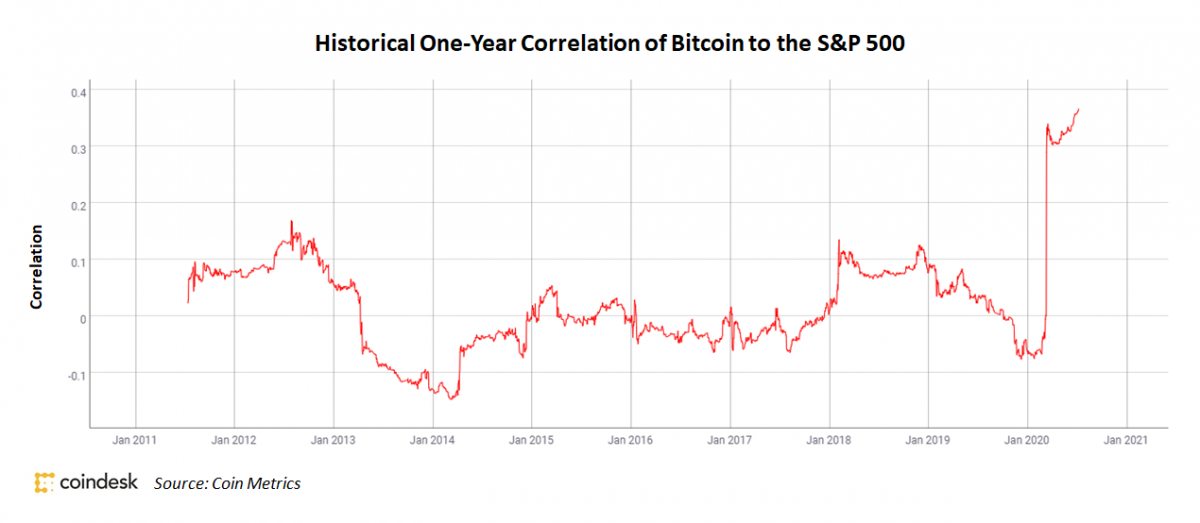

According to Coin Metrics, Bitcoin's correlation with the benchmark US equity index, which measures the relationship betweenby two assets, on Thursday reached .367 compared with -0.06 on January 1. Prior to this, the previous maximum was set on July 5 and lasted one day.

It is worth noting that the coefficient 0.367 is not excessively high: the closer the correlation coefficient to 1.0, the greater the likelihood that both assets will move in the same direction.

On Wednesday, Bitcoin's monthly correlation with the S&PThe 500 hit a multi-year high at 0.79, indicating a much stronger short-term correlation, according to Skew data. Levels of investor uncertainty and expected volatility remain high, with analysts expecting the trend to not only continue, but also intensify.

Bitcoin performance improvement relativeMarch lows stimulated demand for the purchase and trading of BTC. The fact is that investors continue to look for inflation protection by investing in gold or bitcoins, which is due to an aggressive monetary policy, which simultaneously triggered a rise in stock prices.

Historically, bitcoin almost did not correlate withtraditional asset classes. However, according to former Bloomberg stock analyst and cofounder of Delphi Digital research cryptocurrency company Kevin Kelly, more consistent correlations are likely as cryptocurrencies develop.

«One of the main reasons why we don'tWhat we're seeing in this development is that the average investor profile is different from traditional markets dominated by large institutional players»- added Kelly.

Rate this publication