A recent report from research firm Arcane Research states that the correlation score of the firstcryptocurrencies with the stock market declined markedly.

Experts note that the panic due to the spread of coronavirus and a sudden supply shock led to uncertainty in the financial markets.

Because of this, world indices fell rapidly.Bitcoin, still perceived by the majority as a risky asset, was no exception. As a result, the correlation of “digital gold” with the S&P 500 index reached its highest level in history - 0.584.

“However, the price dynamics of recent days may indicate a reversal of this trend”, - say the specialists of the Norwegian company.

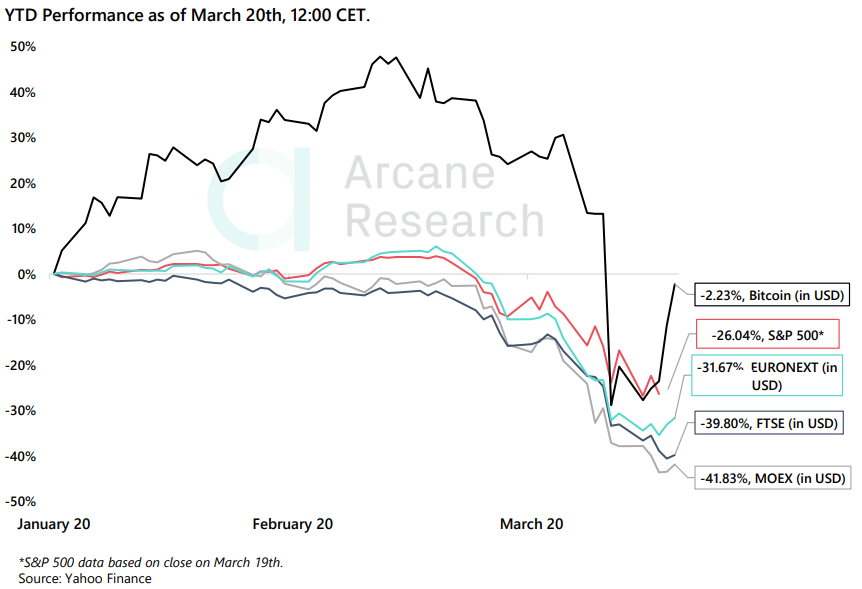

According to the latest company data, the ratioBTC’s correlation with the “barometer of the American economy” is now at 0.48. The chart below shows how Bitcoin is recovering much more confidently than the S&P 500, EURONEXT, FTSE and MOEX indices.

By the way, in relation to the peak levels of the S&P500 has already fallen by 32%. The collapse of shares of American companies is happening much more rapidly than during the last global economic crisis in 2007-2008 or against the backdrop of the collapse of the “dot-com bubble”.

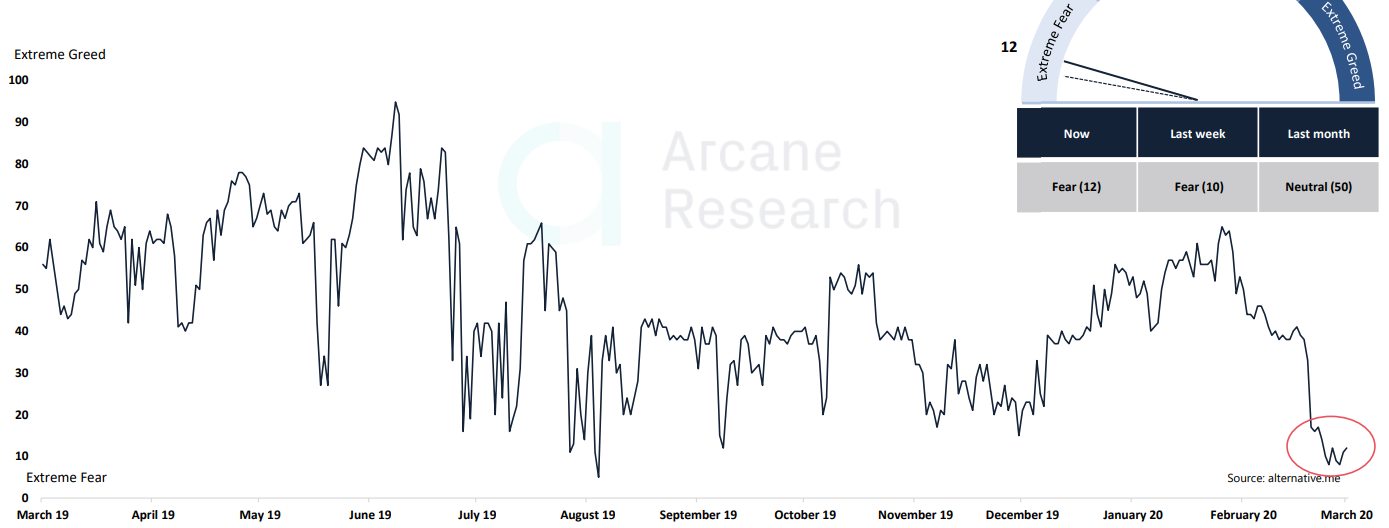

</p>Nevertheless, the cryptocurrency “fear index” is still at extremely low levels, which indicates a low degree of investor confidence:

There is still “extreme fear” on the market.

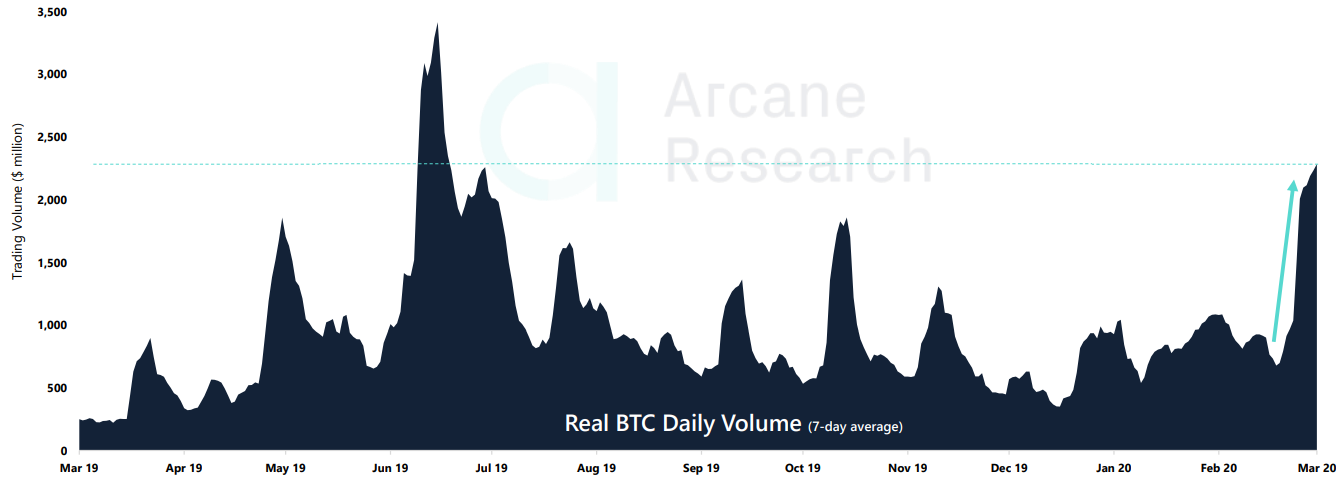

Against the backdrop of general turbulence, trading volumes on cryptocurrency exchanges rose to the levels of July 2019:

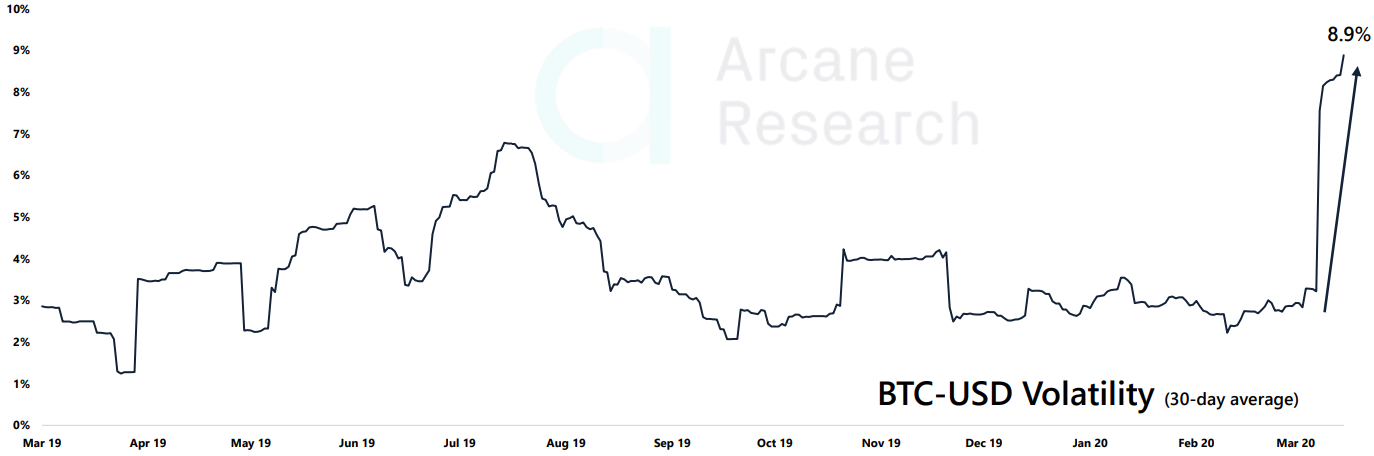

The volatility index almost reached 9%. According to analysts, “this is a lot even for bitcoin”:

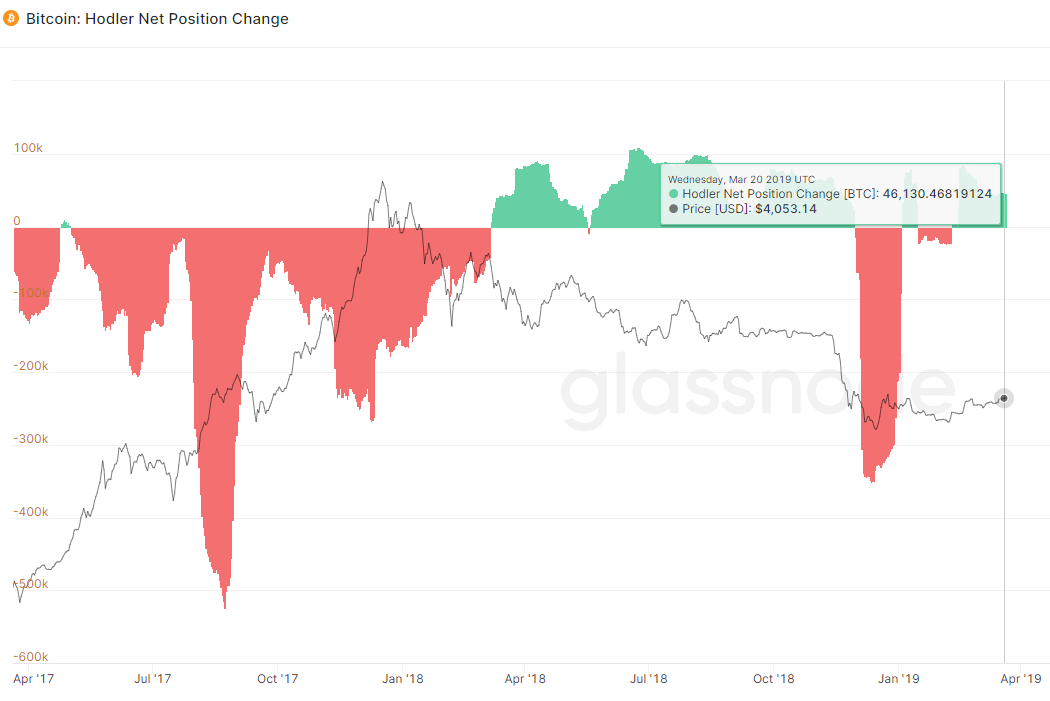

Based on Glassnode data, experts note an increase in bitcoin purchases by long-term investors.

Hodler Net Position Green Bar Graph MetricChange indicates that long-term BTC holders are accumulating positions. The red color indicates sales in the “Hodler” camp in order to take profits.

Recall that on March 19, the price of bitcoin rose above $ 6,000 after falling to around $ 5,000.