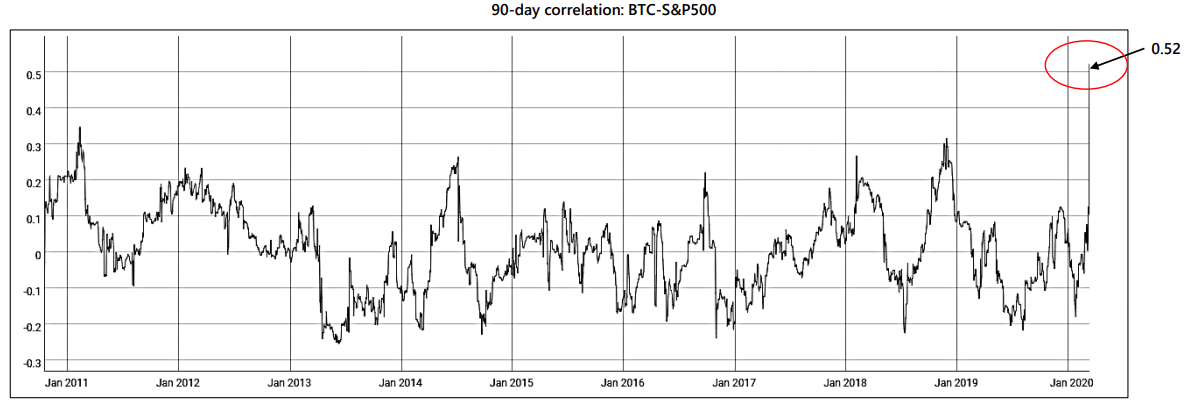

Analysts at Arcane Research found that against the backdrop of the collapse, the correlation between the price of bitcoin and the "barometer of the USof the S&P 500 index reached its highest level in history.This is reported in a special release of the company's report.

The 90-day BTC-S&P 500 correlation index jumped from 0.1 to 0.52 in just one day

“Despite the expectation that the correlation will again fall substantially, the thesis of an uncorrelated asset was dealt a crushing blow”, - analysts say.

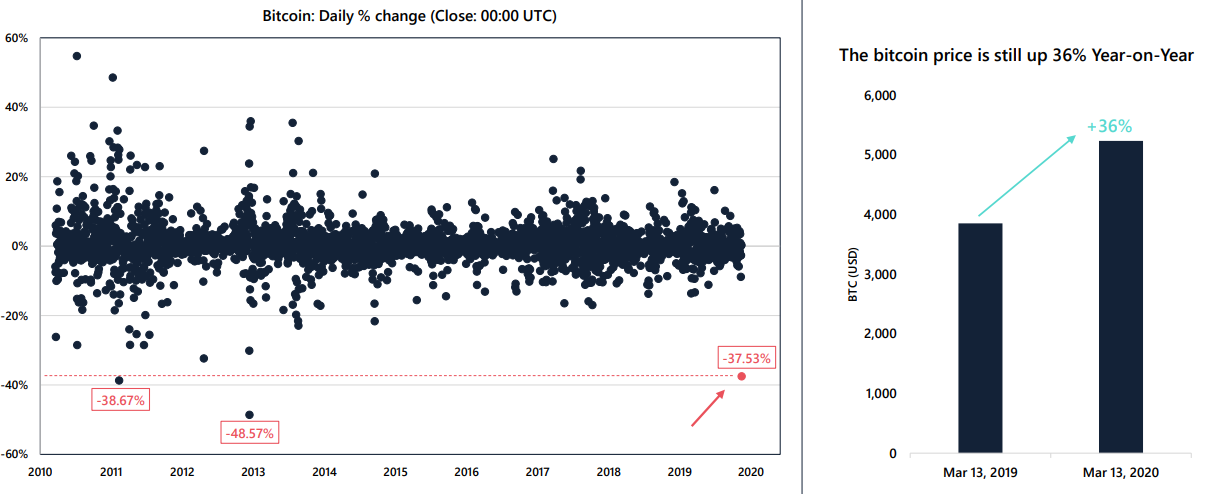

On March 13, the third deepest daily price drop in the history of BTC occurred:

Nevertheless, the cost of bitcoin is still 36% higher than a year ago. Due to the almost synchronous fall in altcoins, the market share of digital gold has remained almost unchanged.

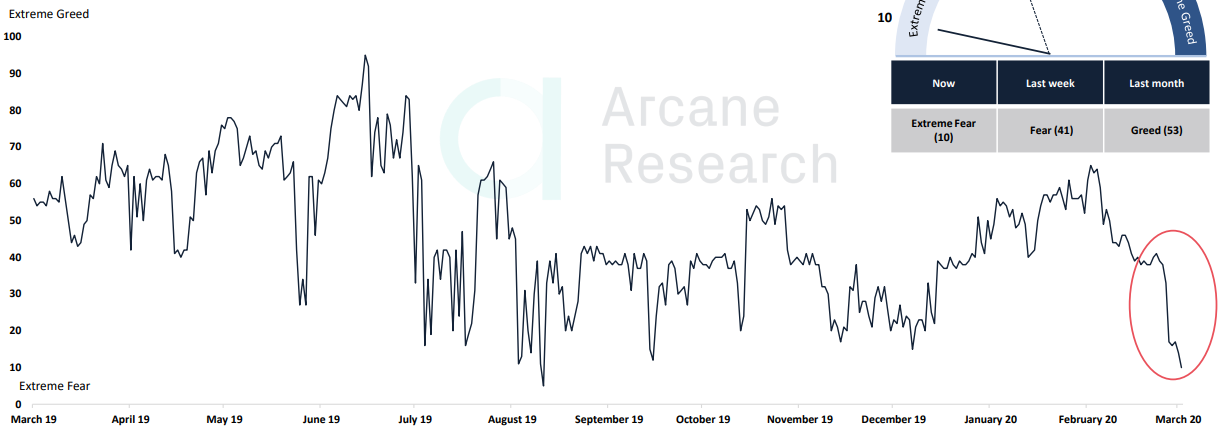

On Black Friday, fear reigned in the market — The Fear & Greed Index dropped to 10.The last time the "fear index" was lower was only in August 2019.

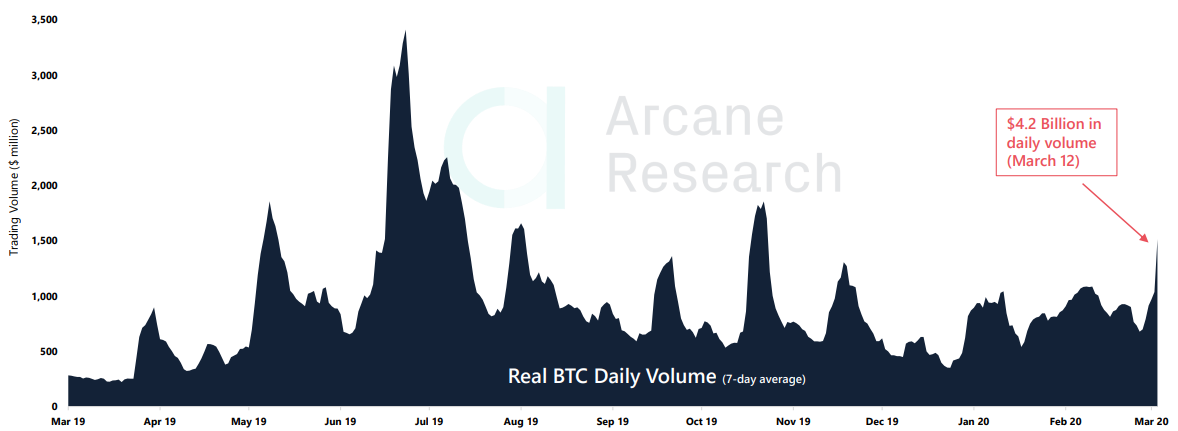

Also, amid the collapse, the trading volume on exchanges increased significantly:

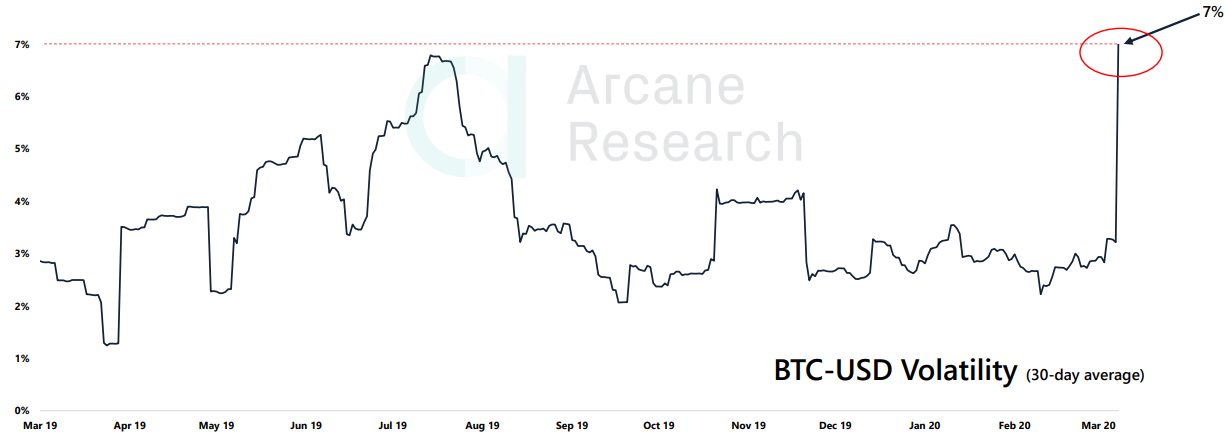

Bitcoin volatility index soared to the level of 7%, which until then was last observed in 2014:

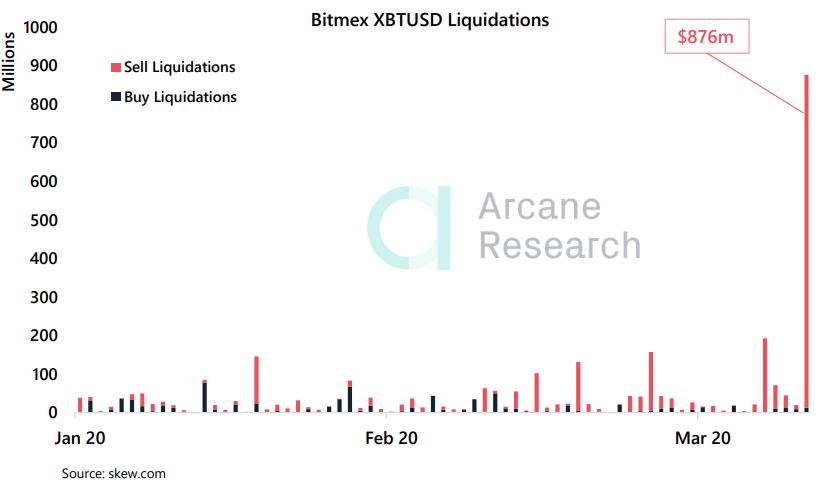

Among the likely causes of the crash in Arcane Researchthey call the sale of bitcoins the organizers of the PlusToken pyramid, as well as the unprecedented scale wave of elimination of marginal positions provoked by a global panic.

During the rapid market decline, liquidations on the BitMEX derivative exchange reached $ 876 million

Experts say that this week the firstcryptocurrency caved in many levels, falling even below the 200-week moving average. In their opinion, the historically strong level of $ 4000 can now play the role of long-term support.

Recall, against the background of the recent collapse in the market, the Gemini, BitMEX, Huobi and Bithumb exchanges faced various problems in their work.