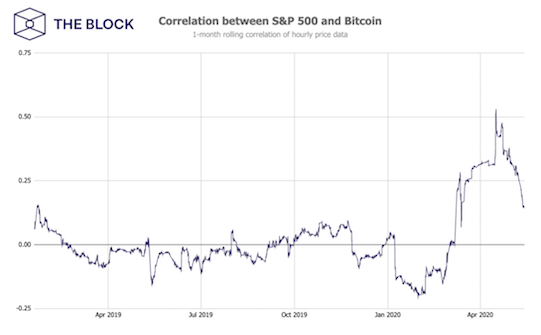

The correlation between Bitcoin and the S&P 500 stock index has dropped significantly. Two asset classes are now moving towardsdifferent directions.

The correlation between Bitcoin and the S&P 500, as measured by BTC/USD on Coinbase and S&P 500 futures, has reached a two-month low.

Currently the correlation level is 0.15 – that is, practically absent. About a month ago, on April 16, this figure was 0.53 – moderately positive correlation.

Correlation is expressed as a number between +1 and -1.

- +1 means an absolute positive correlation between two assets;

- -1 means absolute negative correlation, that is, two assets are moving in opposite directions;

- zero correlation between assets means that there is no connection between them or that they are not moving in the same direction.

Let us remind you that this week the third halving took place in the Bitcoin network.

Subscribe to ForkNews on Telegram

Based on materialswww.theblockcrypto.com