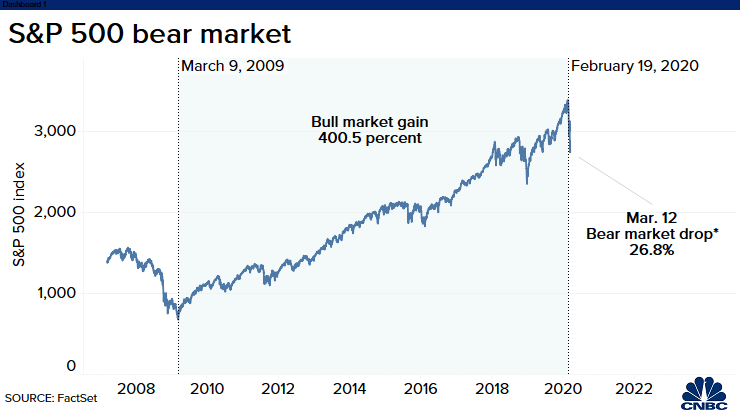

Experts from LPL Financial, the largest independent broker-dealer in the United States, said that it was the longest in historytraditional finance bull market is over. This was reported by CNBC.

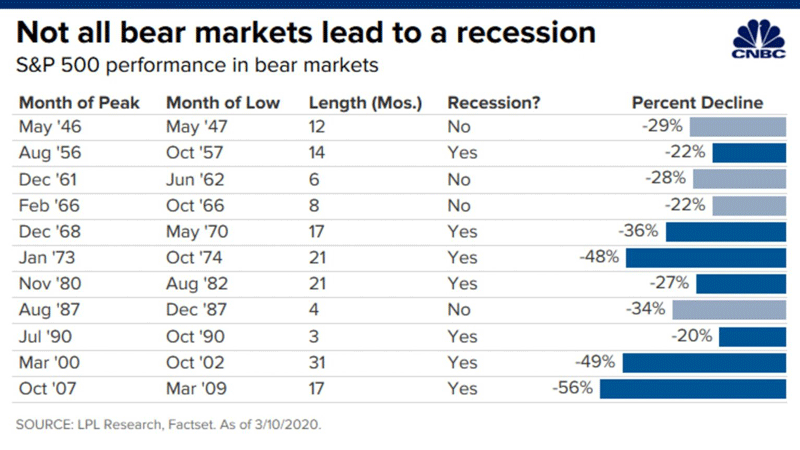

However, according to analysts, the beginning of a bear market does not mean the onset of a recession. Nevertheless, the latter happens in most cases after a reversal of a long-term trend.

The last three bear markets went into recession:

In the outgoing week, the S&P 500 index and the Dow Jones Industrial Average ended an 11-year bull rally, falling by 20% fromtheir maximum marks.

The stock market is a kind of leading indicator anticipating a slowdown in the global economy. However, any indicator does not always work.

For example, on the notorious "Black Monday" of 1987, the S&P 500 crashed 22% in a day, but the ensuing bear market lasted only 4 months and did not turn into a recession in the US economy.By comparison, the S&P 500 fell 9.5% on Thursday, the deepest one-day drop in the U.S. economic barometer since 1987.The bear markets of 1961, 1966 and 1947 did not go into recession either.

The probability of a recession is 70%

On the other hand, historically most bear markets - over 70% - have been accompanied by a recession, according to the LPL. In particular, this has been the case in recent decades - in 1990, 2000 and 2008.

Some economists are convinced that economicthe recession will last only a few months and the US will be able to avoid a technical recession. For example, JPMorgan expects business activity to recover in mid-2020, after a slowdown in the spread of coronavirus.

Bank of America experts remain moderate optimism:

“We believe that in the coming months, the economy will“ flirt ”with the recession. A negative indicator of GDP will be in the II quarter, and weak growth will begin in III, after which recovery will begin ”- said the chief economist of the bank Michelle Mayer.

A recession is usually considered a fall in GDP byfor two consecutive quarters. However, the National Bureau of Economic Research may call the recession a recession that lasts only a few months. At the same time, the department draws attention to other economic indicators, such as the dynamics of real incomes of the population, the level of employment, industrial production and wholesale and retail sales.

</p>Rate this publication