Mathematical law suggests that the future of the oldest cryptocurrency is predetermined.

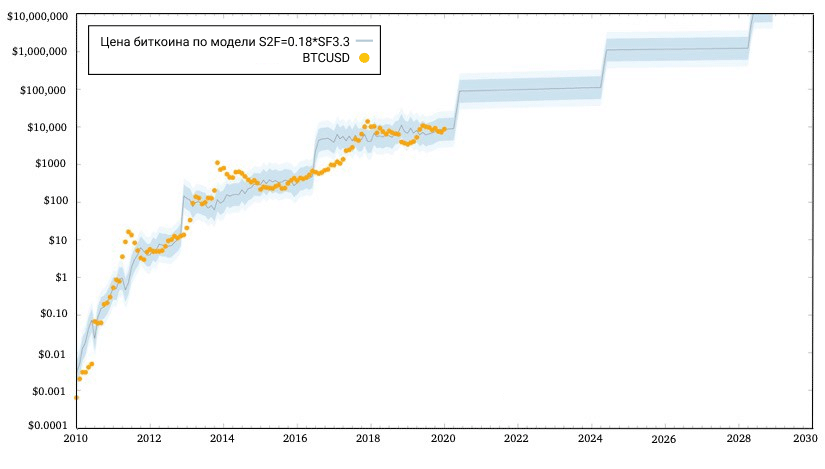

Stock / Flow Model (S2F) appeared in March 2019, and according to this concept, bitcoin can grow sharply, especially after the halving that will happen in May of this year. But there are critics.

One popular counter model is the hypothesis.Efficient Market Hypothesis (EMH). Its essence lies in the fact that the S2F model is based on information that is widely available, and on this basis, all possible increases in bitcoin prices in the future are “won back” in the value of the cryptocurrency, which means that you should not expect significant growth.

Rarity is an important property of Bitcoin.

But what is the S2F talking about? It is based on Nick Szabo's concept of the rarity of bitcoin, as well as a similar analysis conducted by analyst Seyfidin Emmaus. S2F, therefore, is primarily a concept of bitcoin rarity. A rarity that has an impact on the price of bitcoin in accordance with the effects of the network, which were described by Trace Meyer.

In the S2F model, the S2F parameter itself reflectsthe ratio of the total amount of available asset (bitcoin) and available for sale, to the amount of bitcoins that appear for the financial period, that is, for the year. As a result, the ratio is a fraction, in the number and denominator of which are dollar meters. When dividing one by another, a dimensionless quantity is obtained, which participates in the bitcoin price formula.

According to the first edition, it was the following equation:

Bitcoin Price = 0.4 * S2F ^ 3

The later version looks like this:

Bitcoin Price = 0.18 * S2F ^ 3.3

It does not fundamentally differ from the first version, however, it is adjusted taking into account the analysis of cointegration conducted by mathematician Nick Fradst.

The last formula was tested by the analystMarcel Burger, who for this conducted a series of static experiments. The formula was also verified by Manuel Anders of BayernLB, who was the first institutional investor to test this formula.

Types of markets

Critics of S2F may also claim that EMHalso a well-developed concept. It is based on approaches to the economy that were formulated by the famous economist, 1974 Nobel Prize laureate, Friedrich Hayek.

According to Hayek, markets are systems that are engaged in information processing, and at the output they give fair prices for all assets, goods and services that circulate in the market.

Another economist, Eugene Fama, who is also a Nobel Prize winner (2013), identified three key, in his opinion, options for the functioning of markets at EMH:

- Weak market: the historical dynamics of assets has already been taken into account in asset prices, which means that it is impossible, by studying such data, to play in the market so as to make a profit. Technical analysis and time series analysis do not work in this case.

- Market average in its properties: the news about the market coming from leading economic agencies, Bloomberg, Reuters, as well as financial publications like The Wall Street Journal and well-known analysts, are already taken into account in asset prices and cannot be used to make a profit. Fundamental market analysis also does not work.

- Strong market. Even some kind of insights, that is, any kind of information, are not able to become the tool on the basis of which you can build a trading strategy that will lead to profit on the market, since absolutely all information, news and data are already reflected in prices.

Most investors and economists agree onthe fact that modern financial markets are sufficiently effective, that is, they correspond in segments to the first two market options. However, in practice, there is absolutely no third type market.

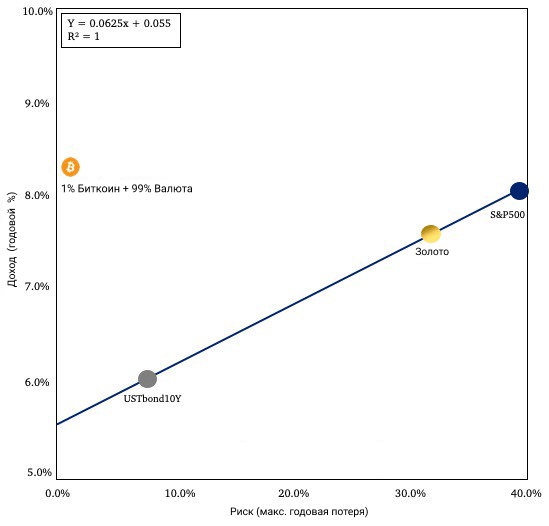

Based on the EMH concept, the S2F model is based onwell-known information. But what does it mean? EMH says that you can earn only by taking the risk, that is, the higher the expected income, the greater the risk of it.

Bitcoin market seems to be effective thenis really working, and the possibilities of arbitration, that is, earnings on the difference in exchange rates on different cryptocurrency exchanges are sharply reduced. A market in which daily transactions worth about $ 10 billion are made with a total liquidity of $ 110 billion - this is what the bitcoin market today is.

Income - risk payment

All income in the bitcoin market can be understood throughthe concept that "income is a payment for the risk of loss of funds invested in an asset." This concept was developed by the portfolio theory of Harry Markowitz. William Sharp introduced the 1990 Capital Asset Valuation Model (CAPM).

What do we have now? Corporate bonds of US companies have one of the lowest risks, 8%, which can be avoided in minutes for such investments, and, accordingly, there is a small income - 6% per year on average.

For gold, respectively, 33% and 7.5%. Shares have the highest risk (40%) and higher returns - 8%. Therefore, looking at EMH, one can understand that S2F critics themselves give an explanation of why it is difficult for them to believe in the high profitability of bitcoin.

The fact is that market participants, based on EMH,seeing the potentially high profitability on bitcoin, they believe that "this is too great to be a reality." The classic investor therefore continues to shy away from bitcoin, since it needs to find an explanation why, at a risk of “only” twice as much as stocks, the yield on it is on average 200%.

The market does not accept investor fears about bitcoin

All this leads to confusion, and investorsA number of fears arise in your head, which, in fact, could not be analyzed if you invest only 1% of your investment portfolio in bitcoins, and keep the rest (99%) in currencies. In this case, it is impossible to lose more than 1%, even if Bitcoin collapses by 99%.

But here are these fears and risks:

- Bitcoin will “die”

- regulatory uncertainty (bitcoin willlimited in circulation in a particular country, it is reset to zero in the investor’s portfolio of that country if he does not move to the country where such investments are allowed),

- a problem with the bitcoin code (the threat of quantum computing),

- hacker attack on the crypto exchange,

- 51% attack by a group of cryptocurrency miners,

- halving and reducing bitcoin mining to zero,

- hard forks.

In theory, if markets perceived these risks as real, then investors who invest in bitcoins should automatically see the reflection of these concerns in the price of bitcoin. But what do we see?

Conditional portfolio of 1% in bitcoins and 99% inFor 11 years, currencies received an average income of 8%. This is similar to stocks, however, given the above risks, the yield should have been much higher. What is this talking about? This says only one thing: the market rejects that these risks are really real, not fictitious.

Moreover, the fact that the S2F modelabout 10% of professional investors who are interested in Bitcoins know this, also works in favor of the fact that it will be effective and indicate a noticeable increase in the price of bitcoin after halving.

#Bitcoin halving .. 4 months to go?

IMO halving is priced in correctly and marketsare efficient, in the sense that few people (10%) know, understand and believe S2F model, and most people (90%) don’t know S2F, don’t understand stats&math behind it, think demand is missing etc pic.twitter.com/Z9nBPmRBvK

- PlanB (@ 100trillionUSD) January 1, 2020

This proves how futures markets behave.and options for bitcoin in anticipation of halving. These derivatives are excellent “thermometers” for measuring the concerns of institutional investors. If they believed that Bitcoin would collapse in price, then this would affect such derivatives. There would be a large spread between the current price of bitcoin and strike, the price of an asset in the future. But this is not observed.

In an efficient market, bitcoin will show growth. However, there is a nuance. The same futures: on the one hand, it is a risk hedging tool. On the other hand, this is the tool that can lead to the fact that Bitcoin can begin to become an object manipulated from the outside, just like the price of oil has become largely artificial due to the wide spread of trade on non-deliverable futures contracts.

However, the assumption by Meltem Demirors that cryptocurrency derivatives can adversely affect the price of bitcoin, most likely, will not materialize.

1/ there is a very real possibility the price of bitcoin does not go up after halving.

for the first time, there is a robust derivatives (futures, options) market for bitcoin. most firms looking to speculate on bitcoin will trade a derivative, not the underlying.

- Meltem Demirors (@Melt_Dem) December 24, 2019

The fact is that futures traders are notThey put neither on a significant increase in the price of bitcoin, nor on its strong decline. Another important point pointed out by the critic of the opinion of Demirors, Jack Mullers: derivatives in the end do not affect the basic value of supply and demand for bitcoin.

1 / @Melt_Dem, I respectfully disagree. This is incorrect.

Yes, derivatives do help market efficiency and general price discovery.

However, no, of course they do not affect basic supply and demand. https://t.co/cQvxHWCjJU

- Jack Mallers (@JackMallers) December 25, 2019

Mining is effective and attracts giants of the investment industry

Meanwhile, given the special nature of thisan asset, an attempt to manipulate the price of bitcoin to the downside may turn out to be ineffective, and to the upside - here such players will simply follow the dynamics of the market in accordance with the S2F model.

Thus, the Bitcoin hashrate shows a new maximum, 126.13 exahash per second. On average, miners spend at least $15 million per day to ensure the security of the Bitcoin blockchain.

Bitcoin miners are paid > 15 million dollars/day as incentive to secure the network

This makes up > 80% of total miner salary across all major PoW coins

Since mid-2017, Bitcoin’s miner salary share has increased ~ 250% and is nearing pre-Ethereum levels pic.twitter.com/8OkSwrfIDf

- Yassine Elmandjra (@yassineARK) January 10, 2020

Bitcoin reached its highest level last week.the beginning of the year, 9.2 thousand dollars, and is currently at the level of 8.7 thousand dollars, which is notable for the break-even point of 8 thousand dollars, which was previously cited by analyst Alistair Milne.

However, in each specific case, much depends on the type of equipment used.

Bitcoin mining continues to attract suchinvestment industry giants like Fidelity Investment. Evidence of this is that the fund is expanding its activity in this area, hiring new specialists in this area.

This means they expect demand to continue.for bitcoins. Charles Hwang, managing partner at hedge fund Lightning Capital, thinks so too. According to his estimates, in 2020 the demand will be 633 thousand bitcoins, despite the fact that the volume of bitcoins mined this year will fall to 328.5 thousand dollars. In such a situation, Bitcoin will go to a “fork” of 20-50 thousand dollars.

May 2020 will be the first Bitcoin halving where people can easily trade via their brokerage accounts (GBTC, Swedish ETN’s, derivatives, etc.)

- Alistair Milne (@alistairmilne) December 16, 2019

BayernLB estimates halving will lead to higher pricesBitcoin up to 90 thousand dollars. An increase in the number of opportunities for institutional investors to invest in bitcoins may, according to Milne, become a factor in an additional increase in the price of bitcoin.

</p> 5

/

5

(

1

voice

)