Since the beginning of the year, Bitcoin has grown by 72%, while the S&P500 broad market index is only up 20%, and golddemonstrates negative profitability. Excellent investment dynamics attracts not only crypto enthusiasts, but also institutional investors looking for insurance against rising inflation.

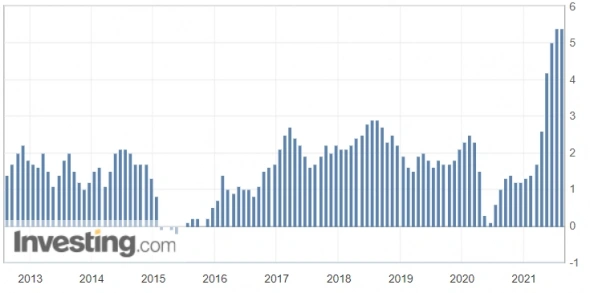

Consumer Price Index in the USA,% (YoY)

To support the economy, the US Federal Reserve printsdollars, buying bonds worth $120 billion every month. This provided explosive growth for stock markets, which on average grow by only 5% per year, and also led to the devaluation of the national currency. At the end of August, we anticipated Bitcoin's rise to $50,000 due to continued uncertainty about the tapering of the bond buying program, while many market participants expected an announcement on the date of winding down monetary stimulus, which would lead to a stronger dollar.

However, the situation can change dramaticallyin case of aggressive inflation growth. The figure for August will be published on September 14. The Fed has the authority to both suddenly wind down bond purchases and urgently raise the key rate (the latter is unlikely).

The statistics also call for caution:in September, Bitcoin grew in two cases out of eight, with the best result being only 6%. The worst was in 2014 and 2019: a drop of 19% and 13%, respectively.

Image source: cointelegraph.com

At the same time, over the past 6 days, Bitcoin has already grown by 10%, which is significantly higher than the average.

Image Source: Cryptocurrency ExchangeStormGain

JPMorgan believes that the trend of the last twomonths is associated with the transition of aggressive investors from the stock market to cryptocurrencies. Of particular interest are NFTs, which is why Ethereum, Cardano and Solana demonstrate the greatest dynamics, while Bitcoin's trade turnover, on the contrary, decreased from a peak of $ 64 billion in June to a maximum of $ 46 billion in September. According to JPM, this confirms the “hype” nature of the bullish trend of recent days: if the price rises and volumes decline, then there is a risk of correction, since the rise is not provided with wide interest.

If the statistics turn out to be stronger than the sentiments,Bitcoin will move to correction in the middle of the month. However, traders have nothing to worry about, because exchange trading implies not only long, but also short positions.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)