The mechanisms inherent in the design of cryptocurrencies make them a standard of security in comparison with banks andother payment systems. Hacking top blockchains is an impossible task even for the Pentagon.

In the entire history of the Bitcoin network, no one has everwas able to hack: neither hackers in search of easy money, nor intelligence services in an attempt to freeze suspicious assets, nor banking specialists in order to weaken a growing competitor.

Unfortunately, the situation regarding cryptocurrency exchanges iscompletely different. Every year, hackers break their security system and steal coins worth millions of dollars. It doesn’t matter whether it’s a small exchange or a large market giant that promises unprecedented resistance to hacking.

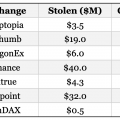

Over the past 2019, cybercriminals hacked seven large crypto exchanges, leaving a huge hole in their budgets totaling $164 million. Who, when and how became the target of hackers and what consequences did this lead to?

January - Cryptopia

During the New Year holidays, family and friendsCryptopia users probably wished them well-being and financial stability, but these wishes did not come true. The beginning of the year was marked for them by the loss of all digital assets that were once on one of the largest cryptocurrency platforms. On January 15, the exchange went offline, publishing a message about significant losses and security breaches.

Until the end of February, there were no eventswere commented on, but work was not resumed. Management explained that they had no right to say anything during the police investigation. It is possible that there is a certain amount of slyness in this. The real reason for the silence could lie in the usual fear of telling the truth.

As it turned out, Cryptopia was hackedhackers, and the estimated damage amounted to $16 million. The number of victims was 900,000 people. It is still unclear which security gap the cybercriminals took advantage of. In August, an investigation revealed only that the platform did not create separate wallets

for users, but kept all the money in one place and never verified the assets of the client base with a common "treasury".

The New Zealand platform tried to recover fromhappened and resumed trading in March, but no miracle happened. Users lost trust in her, so already in May she began the liquidation process and ten days later she declared herself bankrupt. The victims have not yet received compensation, and it is not a fact that they will ever receive it.

March - DragonEx

At the end of March last year, the Singapore ExchangeDragonEx shocked its customers with the sad news of a hacker attack. Initially, the site’s team refused to name the extent of the damage, but four days later, in its Telegram channel, it reported losses amounting to $7 million as a result of hacking the security system.

The argument that in the work of the exchange there wascritical vulnerability, did not convince management of the need to provide users with a full refund. Instead, the platform said it was working on a “pre-compensation plan” under which those affected would receive compensation in the equivalent of Tether and/or local Dragon Token. Today, the exchange continues to operate with a daily turnover of about $200 million.

March - BitHumb

Less than a week after the DragonEx hackhackers took advantage of the vulnerability of the South Korean giant Bithumb and transferred 3 million EOS ($13 million) and 20 million XRP ($6 million) to their addresses. The total damage was about $19 million, but what is most noteworthy is that this is not the first time for Bithumb.

The hacking occurred a year after a large-scale hack in 2018, when the South Korean exchange lost $31 million as a result of cybercriminals allegedly covered by the DPRK authorities.

This time Bithumb suspects hackingwas carried out by one of the platform’s internal employees, since management recorded an “abnormal output” on one of the exchange wallets. The management assured that the losses concerned her exclusively and would not affect her clients in any way. Bithumb continues to operate with a daily turnover of about $70 million.

May - Binance

At the end of spring, attackers encroached onThe largest cryptocurrency exchange by turnover with the most active community is Binance. Changpeng Zhao has repeatedly positioned his platform as super safe, but in fact his words did not match his deeds. On May 7, hackers emptied the exchange's hot wallet and withdrew more than 7,000 BTC in one transaction. They were able to access user API keys, 2FA codes and other information. Losses at that time amounted to $40.7 million.

The hackers quickly moved the coins andmanaged to convert a lot of stolen coins into fiat. In response, the exchange closed input/output for a week to strengthen security protocols and troubleshoot problems, resuming full operations only on May 15. The site team assures that the losses were insignificant - only 2% of the total volume of all assets was stored on the wallet. But this is still more than $40 million that belongs to users. Management has promised to reimburse 100% of all losses from its #SAFU emergency fund.

In August, the hacker attack on the exchange continued.An unknown person under the pseudonym Bnatov Platon reported that he hacked into the account of a Binance employee and tracked down the funds stolen in May. He also said that he owns the personal data of 60,000 verified users, so he began to blackmail the exchange, demanding a ransom of 300 BTC for silence. The management of the site refused to cooperate and offered a reward of 25 BTC to anyone who would reveal the identity of the cybercriminal.

Having not received satisfaction of your demand,the hacker began to upload user KYC data on social networks and Telegram channels. In the hands of the cybercriminal were also photos of documents of Russian traders. Binance said that the leaked data is not true, but one of the victims confirmed the authenticity of his personal information. Binance continues to operate with a daily turnover of about $ 500 million.

June - BiTrue

In addition to DragonEx, another one suffered this yearSingaporean crypto market giant - BiTrue. Hackers broke into the security system and managed to log into the accounts of different users. They moved 9.3 million XRP coins ($4.01 million) and 2.5 million ADA coins ($232,000) to other exchanges. Thus, the site lost access to $4 million of user funds.

As soon as it became known that digital moneywent to the accounts of other exchanges, BiTrue tried to negotiate with them, asking them to freeze the stolen assets. Ultimately, management promised that they would compensate all victims. BiTrue continues to operate with a daily turnover of approximately $70 million.

July - BITPoint

In the spring and summer, hackers were especially active andmissed the opportunity to look into the Asian market. In July, the Japanese cryptocurrency exchange BITPoint fell victim to hackers. Information about how exactly the attackers took advantage of the vulnerabilities is not disclosed, but it is known that as a result of the hack, 50,000 clients were affected, who lost a total of $23 million on their accounts, and another $5 million were stolen from the exchange itself. The total amount of damage is $28 million.

To cope with the consequences, the platformstopped work for a whole month, but was unable to do it on our own. As a result, the parent company Remixpoint agreed to assume responsibility and pay damages to the victims of the hacking. In August, the BITPoint crypto platform resumed trading.

November - Upbit

Almost all autumn from hackersThere was a lull until November 6, when they cleaned out their last significant victim in 2019 - the South Korean giant Upbit, which once took an honorable first place in terms of turnover on CoinMarketCap. The once largest exchange on the planet lost 342,000 ETH coins in a few minutes - that’s exactly how much went to the hacker’s address. The damage amounted to $49 million, and the stolen coins have already successfully started to move.

Representatives of the South Korean platform assured thatthat the losses will not affect users, and the damage was suffered solely by the exchange team. However, trading was suspended for two weeks. Now Upbit continues to operate with a daily turnover of about $30 million. Despite the fact that, according to management, the situation should not have affected clients, on the same CoinMarketCap there is an inscription with all its might: “We have received messages about obstacles to the withdrawal of funds and deposits on Upbit. Please be careful with your funds."

What conclusions can be drawn?

2019 showed that in terms of exchange securitystill remain extremely ineffective. Large sites, screaming to the whole world about their invulnerability, were hacked all year round - in winter, spring, summer and autumn. Some users lose all their money. Others receive compensation, but still suffer damage:

- Compensation is not credited immediately;

- It is not always adequate to losses;

- The sites are forced to stop work for an indefinite period, so during this period the opportunity to earn money at the auction disappears;

- In certain cases, hackers “merge” passport data into the network.

Moreover, on the Internetunconfirmed rumors that in some cases no one hacks anyone, and all the “hacks” are really just fiction of cryptocurrency exchanges. Allegedly, some go to such a step in order to appropriate funds, others want to show how cool they are, that compensate for all losses and continue high-quality work even after a multimillion-dollar “hack”.

Not the fact that in 2020 the situation will get better, so draw conclusions. We at Mining-Cryptocurrency.ru believe that they beg for themselves:

- Do not store cryptocurrency on exchanges, use a personal wallet. Remember: the exchange exists only for trading.

- Periodically withdraw profit, do not accumulate capital on trading floors.

- If you are not going to trade now, withdraw large assets.

- Diversify trade, do not operate with all the capital on one platform.

2019 showed that exchange size is not important.Any one can be hacked at absolutely any time. If you store money there, remember that you may lose it. Take a closer look at decentralized exchanges - they are the future.

</p>Rate this publication