There is no doubt: Bitcoiners are revolutionaries. Libertarians were doing it wrong. They strivedreduce the influence of the state by participating indemocratic process. This was and remains a hopeless task, Sisyphean labor. The hunger of the state, like that of Ungoliant from Tolkien’s works, is insatiable, and the most active electorate diligently rewards him with votes for further growth, receiving in return more and more social programs. In a word, libertarians remain fools. Like the jelly-like monster in the film The Drop, the state is growing no matter what they throw at it. Participation in democratic processes empowers him and secures a regular civil ritual as the only legal way of political activity.

</p>Bitcoiners reject this: they understand that the only winning move in politics is not to participate in the game.

They overturned the chessboard and began to behavelike winners. Bitcoiners chose to throw out the rules of participation and began to work on a monetary system that was completely outside the control and oversight of the government and free from restrictions. They envision a system that makes possible seamless commerce and free banking with provable reserves(unlike the unintelligible mess with the socialization of losses that we rely on)obsolete traffic controlcapital, which saves savers from robbery authorized by the state through inflation and, ultimately, completely deprives the state of influence by reducing its monetary instruments.

Such a proposal is predictably furiousstate-dependent intelligentsia, the academic class, and the press, transformed from a "fourth force" and a proud critic to an insignificant mouthpiece of the establishment. It is not at all surprising that the most hysterical critics of Bitcoin enjoy considerable advantages due to their proximity to the Washington bureaucracy or its analogues in other countries. Academicians are beneficiaries of a frantic bubble of government guaranteed student loans; current and former politicians who manage to turn their political ties into personal wealth every now and then (how curious!); Journalists who have rolled down to simply transmitting state messages in a futile attempt to shield themselves from the rebellious media startups and YouTube, who have a thousand times larger audience; economists forced to promote Keynesian theories for grants and posts.

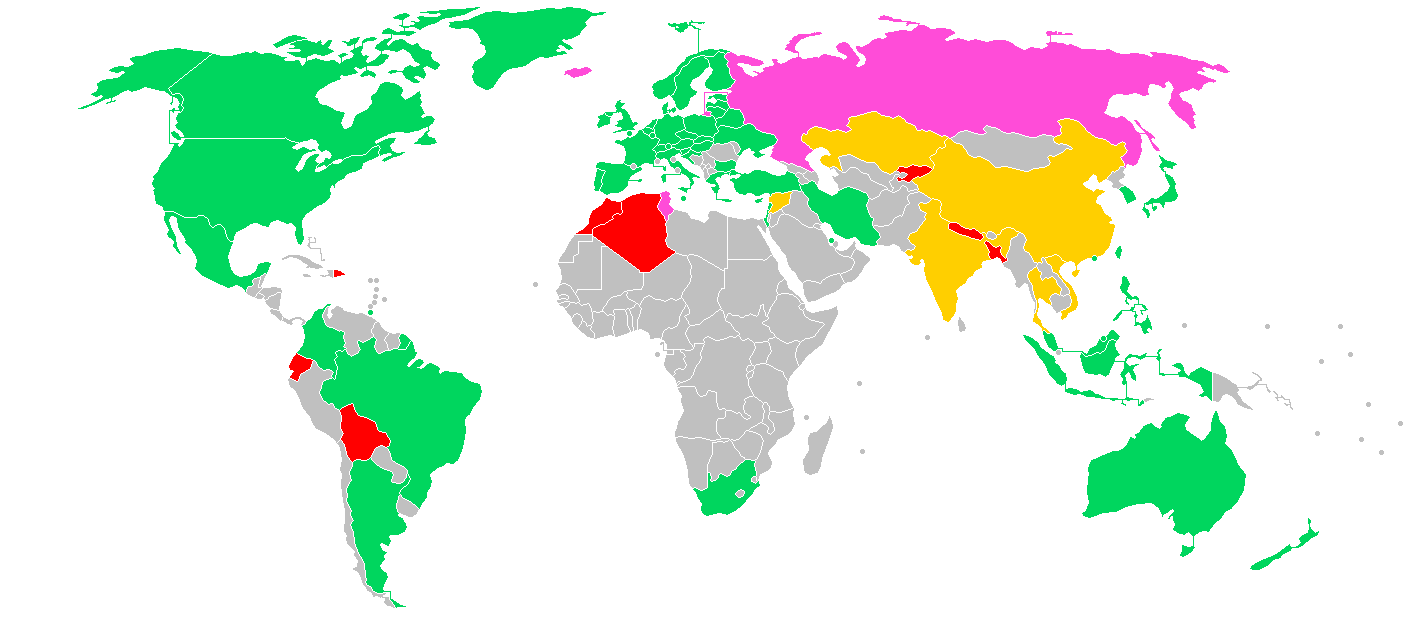

Bitcoin legality level in different countries of the world. Infographic: Wikipedia

Thus, faced with screeching bileProfessional talkers, Bitcoiners quickly went from utopian experimenters to dissidents - while the movement was still in its early days. Take a look at the financial sections of newspapers: you will only find mockery and ridicule(and maybe a rare mean approval). And it's about a class of assets whose marketcapitalization over the decade has grown from zero to $ 200 billion without venture support, without initial public offerings, without a corporate structure, with an unknown creator and with a community of developers using exclusively open source code. The US authorities considered it appropriate to give Ross Ulbricht two life sentences without the possibility of early release, plus forty years for creating a free market with settlements in bitcoins. China has banned the formal exchange of bitcoins, while India is contemplating outlawing only their possession.

We are not on the verge of war; war is already on. Of course, we are not talking about the wild fuss of the past. She has long been a thing of the past. The days have long passed when the men nobly lined up opposite each other and exchanged fire until one of the sides is able to stand in line. We no longer crawl out of the trenches by a whistle under the crackling of machine guns. Maneuver warfare is almost outdated. Modern conflicts are a mixture of rebellion, terrorist attacks, sanctions, attacks of soulless drones and operations to undermine strategic infrastructure in the spirit of Stuxnet. If the methods of warfare migrated to the virtual world, then why not rebellion also migrate there?

And we are really talking about rebellion. Cryptocurrency, despite the strenuous protests of some of its cowardly supporters, remains frankly independent and, ultimately, hostile to the state. It is impossible to regulate, seize or force to obey. Silk Road was not some kind of deviation or historical joke that could be embarrassingly laughed at in retrospect. It was a deep demonstration of Bitcoin's ultimate goal and its complete indifference to the shackles that bind the financial system. Today’s state, in its bloated and insatiable form, not only craves your physical obedience, but also requires an endless stream of metadata and analytics. Your finances do not belong to you. They are under scrutiny and require approval at every step. If you deviate at least a little from the course, you will face the irretrievable confiscation of your savings. Someone has to pay for armored personnel carriers.

Cryptocurrency challenges the state

Just as in the 16th century Protestantsdoubted the official doctrine of indulgences and the authority of the Pope, a motley group of techies and cypherpunks doubted the need for inflation. In a free economy, should central banks have the right to arbitrarily determine the price of money? Should the government really have complete control over our savings and spending? Should savers be forced to trust that banks(and, ultimately, taxpayers)will they pay them back their savings? What is the actual purpose of an entry in a banking database?

Genuine Cryptocurrencies –alternative money systems– threaten the state and its minions. Bitcoin openly encroaches on the state. It challenges its most precious privilege: the ability to finance itself through inflation and seigniorage.

Cryptocurrency - at the moment mainlyBitcoin has already begun to influence the policies of central banks. I do not exaggerate when I emphasize its geopolitical significance. If you combine the free money market with the capabilities of the Internet, you get an explosive mixture. Let's look at a few examples of how cryptocurrency began to influence states.

First of all, as Gina Peters (2016) notes,The existence of Bitcoin's liquid markets poses a significant threat to states that rely on capital controls to control the exchange rate.

“Bitcoin is creating a problem for Argentina andsimilar countries, making it easier to bypass capital controls. Attempts by governments to regulate globally accessible bitcoin markets are generally unsuccessful, and bitcoin exchange rates reflect the market, not official rates. If bitcoin flows become sufficiently large, in all countries there will be, by default, unlimited international capital markets. ”

This is important. A large proportion of the world's population lives in countries with capital controls, including Brazil, Russia, Indonesia, Taiwan, China and Argentina. The critical component of the monetary instrumentation of states is undermining.

Being extremely liquid and traded throughoutTo the world, Bitcoin also sheds light on the manipulation of exchange rates, as discussed in another article by Dr. Peters. Bitcoin trading can be used to obtain an indirect estimate of the “street” price of local currencies, even when authorities publish fake exchange rates. Bitcoin is growing rapidly in its role as a universal measure.

Example: publishing information on the street value of a bolivar in Venezuela is illegal, because the regime is strongly interested in tightly monitoring information about its currency. The most popular exchange rate tracking site in Venezuela, DollarToday (administered from Miami) uses LocalBitcoins to calculate the street US dollar to bolivar exchange rate.

Not surprisingly, the busiest p2p marketsbitcoins are concentrated in states with capital controls, highly inflationary currencies, or unreliable governments. Analysis by Matt Ahlborg, also relying on data from LocalBitcoins, shows that the most bitcoins traded per capita are in Russia, Venezuela, Colombia, Nigeria, Kenya and Peru. It is sometimes said that currency competition is like racing a bear: you only need to overtake the slowest opponent. The existence of Bitcoin probably doesn't threaten the dollar, but it certainly threatens the top ten or so most inflationary currencies in the world.

As Hasu wrote, Bitcoin provides a stable system of property rights without the need to rely on the state(and related implicit threats of violence). This is not so true in the West, where rightsproperty is more or less respected, but it is a matter of life and death in other parts of the world. Thus, it is very ironic that the most ardent critics of cryptocurrency are often just those people who never had reasons to not trust their authorities in the matter of savings. A person’s reaction to Bitcoin is a kind of marker that shows whether a person is aware of the danger of inflation and the unreliability of the banking system. Those who loudly deny Bitcoin simply demonstrate their ignorance and Anglo-centrism.

The new discoveries of Ruskin, Saleh and Ermak in the analysis of currency crises in Turkey and Argentina confirm that cryptocurrency is most directly applicable outside the developed world.

“At first glance, Nakamoto's vision did not crownsuccess, except that a new alternative has been created that most people prefer not to use. However, if you study developing countries, history takes a slightly different turn ... The first currency crises have occurred in Turkey and Argentina since the creation of Bitcoin, and therefore they provide an opportunity to study the impact of alternative digital currencies on unstable state currencies. If extrapolated, it may show that the vision of Nakamoto still paid off. Although non-state digital currencies did not supplant the dollar, their very existence allows us to analyze the impact of fiscal and regulatory policies. ”

In particular, the authors found—unsurprisingly—that"Citizens benefit from the existence of non-state digital currencies", namely from the new diversification option, which“Generates a welfare gain for citizens”.

The authors also found that“The existence of non-state digital currenciesdisciplines monetary policy, creating an alternative to local fiat currencies. This discipline of monetary policy reduces inflation and increases the return on investment, which, in turn, contributes to the growth of local investment ”.

As follows from economic theory, the destruction of a monopoly(and governments are actually local money market monopolies)by introducing competitors should dothe market is fairer from the consumers' point of view. Previously, having no alternatives, citizens were forced to save in local currency and endure inflation. Now, with an effective fallback option, citizens may choose to exit the local monetary regime, which will cause significant damage to the central bank (sales of local currency increase the velocity of money and exacerbate inflation). Thus, Bitcoin's very existence instills monetary discipline in central banks that might otherwise pursue ruinous levels of currency depreciation.

Not for the faint of heart

Due to extremely high stakes, inventiona new monetary system is a very unpleasant task. This requires irrational diligence and an unwavering commitment to a clear vision of the future. Given the scale of the task and its existential threat to the state, only the most convinced can take on it. The great sin of altcoiners is not that they did not put on that horse, but that they did it with insufficient conviction. They were selling a dream that they themselves really did not believe in.

How many cryptocurrency entrepreneurs will say withwith absolute sincerity, that they created a system that should last decades and challenge the state? How many of them are not afraid of the risk of being imprisoned for their beliefs? I think there are very few of them.

The sluggish tone of the apex pervades the wholeorganizational pyramid. Hence the difference between the "communities" of holders, calling on each other to buy coins when they fall in price, and a stable community that accepts volatility and maintains faith. At first glance, Bitcoin and many of its clones using the blockchain are similar. But the main difference is in their spirit. The point is not that alternative blockchains are immoral or oriented towards lower values, but that they are completely nihilistic. They pride themselves on progress and cosmetic innovations, rather than building long-lasting non-governmental institutions.

Yes, many are attracted to Bitcoin by motivation.arrived. But bitcoiners are also driven by something deeper and more primary - the possibility of building a reliable parallel financial system that will be functional, open and independent of governments or unaccountable corporations. Of course, this motivation drives not only bitcoin. But Bitcoin most definitely came close to the separation of money and state and caused the brunt of political attacks. No other project was exposed to such a great hysteria of the media and met with so many obstacles at the beginning of the journey.

In the case of the proposed alternatives, this is all.differently. For the creators of pretentious cryptocurrencies, success means a way out. Presale, margin, plum in the retail market. The attractiveness of launching a new blockchain is simple: money has the largest volume of the target market among all existing products, and the release of a new currency while retaining a certain share promises untold wealth. But wealth does not inspire, especially when it is obtained at the expense of potential converts. Merging your stake is not the way to win the dogmatic, unfading support of millions of volunteers.

As Taleb says:don’t say what you think, but show your portfolio. Could there be a better visual example than the fact that Block.one, which created EOS and claims to be blockchain 2.0, got rid of its currency reserves and chose to keep 140,000 BTC on its balance sheet?

The only relevant questions

For ten years of experiments, irrationalcapital allocation and arrogance we learned valuable lessons about value addition. Scientists and engineers mistook the monetary and political revolution for a technological revolution. Their experiments were imbued with an insistent prescriptivism:“If we create a more efficient and productive database structure or algorithm that is resistant to Sibyl attacks, then we will solve the problem and create the best cryptocurrency”. Amazingly, such a mentalityprevails today. But it is hopelessly mistaken. First of all, these are political and social experiments. The most important factors in creating a completely new monetary system are not the details of technical implementation, but the provision of convincing answers to questions of the following kind:

- What gives you the right to create a new currency and have a disproportionate effect on its fate?

- Why do you prefer to drop all alternatives and propose your own instead?

- What is your authority based on?

- How do you guarantee fairness and equality of opportunity in the distribution of new money?

- How do you guarantee that the system is free from corruption, even if the US Federal Reserve System (FRS) is vulnerable to political influence?

Bitcoin has clear answers to all these questions. His imitators are not. Not only do they have no reasonable answers, but their creators generally do not realize the importance of addressing these issues.

A list of utilitarian tokens that could match their original purpose.

We now know that utilitarian tokens arechimeras. It was not necessary to be a genius to notice this, but empirical reality has conclusively proved it. The world of utilitarian tokens is similar to where exchange-rate currency loss transactions are not required for international travel, as today, but when traveling from one store to another. Utilitarian tokens offered an ominous regression, and their rejection is only for the best. Only cryptocurrencies that seek to become money are worth creating, and this necessarily means a challenge to the state.

However, in order to come face to face withgovernment requires tens or hundreds of millions of followers who believe in a stable set of values and are willing to invest capital in their support. Clever cryptographic primitives and experiments with new algorithms that solve the problem of the Byzantine generals are unable to inspire and attract supporters. There must be some basic set of values that are placed above everything else. Most money pluralists in the industry justify their position by appealing to tired clichés such as“The need for innovation”. This is inconsistent. If they deny existing options, such as Bitcoin, and are campaigning for some kind of alternative project, then they will also meet with objections from the new cryptocurrency progressivists.

“Why dwell on the blockchain x? Why not p, q or r? ”, — this is a valid question.In the absence of shared, deep-rooted values clearly espoused by the project of choice and that project alone, cryptocurrency progressives have nothing to show for their defense of an alternative blockchain other than their investment. And then progressives, by necessity, become reactionaries.

Bitcoin Values

What are these values that are so treasured?bitcoiners? Bitcoinism is an emerging political and economic philosophy that combines elements of Austrian economics, libertarianism, strong property rights, social contract theory, and the philosophy of individual self-sufficiency. Some libertarians do not accept the theory of the social contract, understanding it as coercive(since no one is actually offered to sign a political contract at birth or coming of age). In the case of Bitcoin, this is not so. No one joins it by default: it offers potential users a very clear contract. You have the right, but not the obligation, to participate in the most transparent, verifiable, devaluation-free and structured monetary system known to the world.

Other values that I consider critical to Bitcoin include cheap validation(allowing everyone to participate), full auditability(which means the absence of unexpected inflation), fair emission(anyone, regardless of status, pays for their BTC "full market price", either on the exchange or through mining), backward compatibility(soft forks are preferred over hard forks)and, of course, an open set of validators,which prevents their collusion and the censorship that inevitably follows from it. Ask your favorite Bitcoin alternative: What values motivate the project? If they are, you will notice that they are generally loosely adhered to; innovation is prioritized over consistency.

Thus, Bitcoiners stand in stark contrast toopportunists for whom success means financial exit from their token project. For Bitcoiners, success is the arrival of a day when there is no need to go anywhere. Their distinctly eschatological philosophy looks forward to a time when they can participate in a closed-loop Bitcoin economy, free from the vicissitudes of the old financial system. They do not dream of a financial exit, at least not in the sense of an adventure. Instead, they strive for a system built on a monetary standard without arbitrary depreciation of savings, because anythere is no monetary arbitrariness.

And they are serious about preserving thesefundamental qualities. The predefined schedule of the proposal should not only be respected, but it is so fundamental to the protocol and system of property rights that changing it will lead to the cessation of the former system. Limited offer is not a property of Bitcoin; this is Bitcoin itself. It is ontologically critical, just as the consent of citizens is an integral part of the Constitution of any country. Of course, you can overthrow the government and establish an authoritarian government with the same name, but it will be something else. Essence based on fundamental values will change. Ideals are not a convention. This is not just an implementation detail. Values - this is the system itself. The system codifies values.

And is a better role model possible thanSatoshi himself? Satoshi is a model selfless hero. He spent more than one year creating Bitcoin from scratch, published the code, coordinated the project for a short time, and then left forever. The coins he mined - by virtue of the need to maintain the network when no one else did this - remained untouched. The Promethean act is the most successful description for this. Satoshi boldly stole from the state what he values most - the right to freely create money - and gave it to people in the purest form.

But what about the state? If the threat is so serious, why doesn't it intervene? Bitcoiners have answers to any objections.

The reality is that the ban will not stopBitcoin, unless you believe that the international community, increasingly striving for chaos and anarchist quagmire, will unite to counter this threat. Just imagine it! North Korea, Iran, USA, China, Russia and Saudi Arabia will coordinate efforts for a common cause! And critics of Bitcoin consider this one of the best arguments against him.

Persecution in vain

But suppose the largest countries agree onBitcoin ban. It will only turn bitcoins into black market goods. However, this is not enough to destroy it. Take, for example, another universally banned product that relies on substantial energy consumption, produced by industrial and informal organizations, predominantly circulating on the black market and in demand by millions. Of course, I mean marijuana. It is probably possible to get it from the nearest dealer - legal or not - in less than half an hour. To believe that the ban will reduce the popularity of Bitcoin is ridiculous. This will only strengthen the literal meaning of the existence of Bitcoin as a defense against the whims of an unreliable state. A state that is so obviously sensing a threat from a financial product will show itself to the world as paranoid and controlling and expose its true parasitic nature.

Paradoxically, the best reaction of the stateon Bitcoin and non-state money inspired by it - to yield to the demands of technological followers of the Austrian school and reform. For this, it will be necessary to put an end to the depreciation of the currency, increasing the inequality of the easy money regime, interfering in economic cycles (only exacerbating them), arrogant attempts to set the price of money and using financial institutions as weapons of war.

In the near future, such changes seemunlikely. Now the Neo-Keynesian “modern monetary theory” is in fashion, according to which the state can buy an unlimited number of goods sold for its currency, and the consequences do not matter. At the moment, an increasingly cautious electorate is extolling politicians professing socialism that borders on full collectivism: Bernie Sanders, Elizabeth Warren, Alexandria Okasio-Cortez, Jeremy Corbin and others. If we talk about developing countries, then in Argentina control returns to Kirsnerism, which sent everything financial assets in a free fall to zero due to the newly assertive collectivism. In neighboring Chile, usually more friendly to the free market, two openly communist-minded lawmakers are now setting the tone. In Venezuela ... well, everything is clear. In the UK, Laborites are surprisingly confiscated, advocating illiberal measures such as mass forced property expropriation. And the world capital of free markets - Hong Kong - is literally under attack from the bloody and authoritarian occupier.

Clearly, free markets and strong rightsproperty - the cornerstones of a functioning capitalist economy - are oppressed around the world. And this is unlikely to change. The global lower class, increasingly helpless, craves intervention and is prepared to endure impoverishment if it means reducing inequality.

And our monetary institutions have discarded allsemblance of judgment. We are witnessing a fascinating and at the same time sad performance, where the US president is fighting with the head of the Fed for the price of money. At stake is the opportunity to squeeze some more juice out of a fully financialized American economy on the eve of the next election. And that turned out to be enough to take control of the allegedly outside the Fed policy. Hedge funds are now spending millions of dollars on machine learning algorithms that predict interest rates for twitching eyebrows of high priests while they themselves are guessing at the coffee grounds. Reasonably spent money, you will not say anything.

At your service: uninterrupted financial machine

Negative interest rates have become the norm forcentral banks of almost all developed countries. The IMF is openly speculating about applying increasingly negative rates, including through the forced depreciation of physical cash. Regardless of whether you believe in God this right of savers to positive profitability, they will definitely begin to resent if they offer to confiscate their savings. If arbitrary negative rates are acceptable to achieve political goals, then at what point will central banks pause and give the savers a respite? It is unlikely that something will limit such an approach to monetary policy, where “the end justifies the means” if this is already being done without hindrance.

Savings may not panic whena rate of -1%, reasoning that the bank, after all, provides a useful service. At -3%, they may begin to grumble and wonder if the monetary authorities are doing the right thing. At -5%, they will invest in gold and become interested in Bitcoin.

Since many do not understand the merits of the system, let's summarize the first decade of Bitcoin:

- A total of $ 1 billion in transaction fees were paid.

- Miners received a total of $ 14 billion for their network security services.

- The average base value of all Bitcoin holders is approximately $ 100 billion.

- The market value of all bitcoins in circulation is approximately $ 190 billion.

- The approximate value of all transactions in the network is $ 2 trillion.

- The Bitcoin network now calculates 80 exheshes (8 * 10¹⁹ hashes) per second. Performing these calculations on specialized equipment costs about $ 19.8 million per day.

And it doesn't matter if you reject Bitcoin.Bitcoin will be at your service whenever you need it. You may not need it right now; you may never need it. But as the world becomes even more oppressive, authoritarian and chaotic, one day you will be able to take comfort in knowing thatwealth protection system with the best guarantee in world history patiently waiting for you.

Until then, she will just continue to work…

</p>