Charlie Munger, a famous economist and professional investor, likes to say: «Invert, alwaysinvert», meaning the resolution methodquestions. Today I will try to apply this advice to investing in Bitcoin. Instead of answering the question of when you should buy bitcoins, I will try to formulate when you should not buy them. If you can identify a likely bad period, then you can recognize likely favorable periods for buying. The point of inversion is that it is often easier to find a solution to a problem by starting from the opposite. The method is borrowed from mathematics.

First you need to determine what exactly I have inreferring to an unsuccessful period for a purchase. In this article, I will call unsuccessful any period when buying BTC in which the return on your investment in the next 365 days turns out to be negative. That is, if I buy Bitcoin today and in a year it will cost less, then this was a bad time to buy. So simple. For your part, you can define this criterion in any other way and repeat the same exercise based on your own definition.

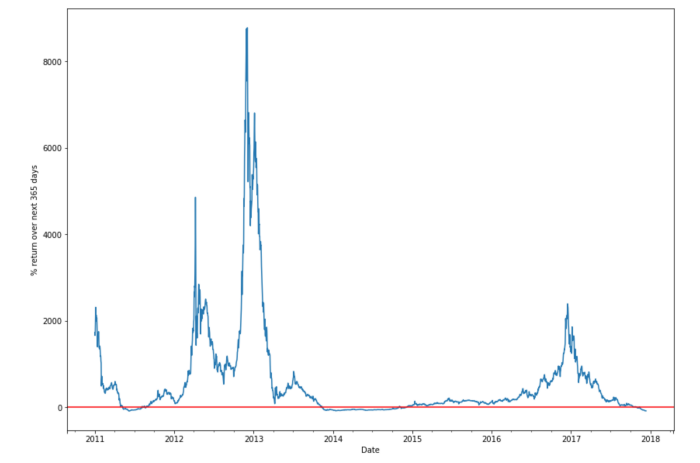

The criterion I selected allows you to build a graph of the future (after 365 days) bitcoin profitability, which clearly shows the unsuccessful periods for the purchase. Such a script is easy to write in Python.

365-Day Moving Yield ChartBitcoin So, you can see that part of 2011 turned out to be an unsuccessful period for investing in BTC, as well as the end of 2013 and most of 2014, and then the period until the end of 2017.

You can also get the actual length of the failed period in days for each year.

Thus, despite the most ambitious (on93%) drop in BTC price, days with a negative 365-day return in 2011 were «only» 95. Results 2013 and 2014 belong to the same bear market, so we can add them together for a total of 379 days. In 2012, 2015 and 2016 there were no bad days.

Now, let's determine the exact start and end dates of these unsuccessful periods, and then visualize them on the price chart to see the full context.

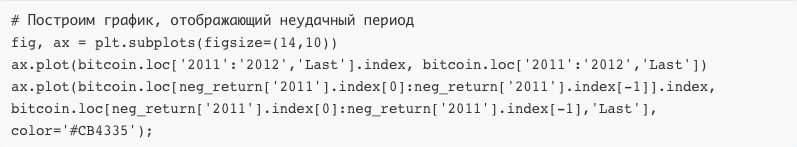

In the chart below, the corresponding failed period is highlighted in red.

Unsuccessful period for buying bitcoin is highlighted in red

Bad period begins shortly after the startvertical price increases and ends before the minimum levels of the bear market are reached. The total price decline from the maximum values of about $ 35 to about $ 10.30 at the end of the unsuccessful period was 70%. Below is the same chart for the failed period of 2013-2014.

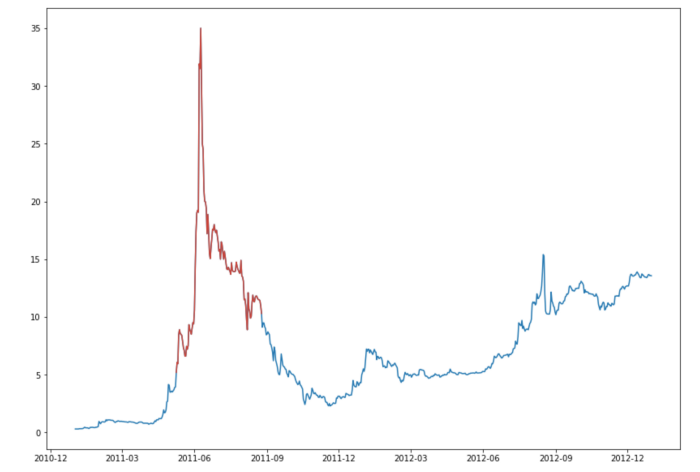

Unsuccessful period for buying bitcoin is highlighted in red

Again, the bad period begins soonafter the beginning of the vertical price increase, it ends before the minimum levels of the bear market are reached. The total price decline from the maximum values of about $ 1,151 to about $ 371 at the end of the unsuccessful period was 68%.

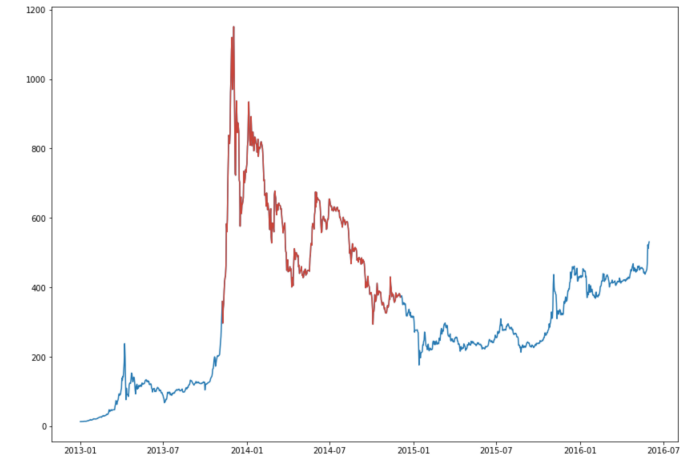

2018 year Carrying out this experiment in December 2018, I decided to proceed from the assumption that this whole year until November 13 will also belong to an unsuccessful period. On November 13, the price of BTC was about $ 6,400, and then in a short time fell to $ 3,400. That would mean 316 bad days in 2018, plus 41 days in 2017 - a total of 357 days for the last bear market, which is pretty close to the length of the bad period of 2013-2014.

The (alleged) unsuccessful period for buying bitcoin is highlighted in red

It is also worth noting that in bothprevious bearish periods, the overall decrease from the maximum price values until the end of the unsuccessful period (the red line in the graphs) was about 70%. A seventy percent price drop from the high of $ 19,498 set on December 17 gives $ 5,849.

What does all this mean? For me, this means that the last unsuccessful period for buying bitcoin (with negative 365-day profitability) ended in mid-November 2018. In the long term, a year or more (more is better), we can say that now, probably, not bad time for BTC to accumulate on local downturns, and this favorable period has already begun in December. At that time or at the beginning of this year, many in response to such a recommendation would have decided that I was crazy. But remember that often these are the same people who called for buying bitcoins at the end of 2017 at significantly higher prices. For long-term investment, the time to buy comes when the purchase seems the most counterintuitive step, and the time to sell - when everyone else is eager to buy.

Jupyter Notebook with full Python code has been uploaded to Github.

Note: nothing in this article should be regarded as an investment recommendation. All of the above is the personal opinion of the author. If you read up to this point, then you probably already understood that Bitcoin is an extremely volatile financial instrument. Before investing in Bitcoin or any other asset, please do your own research and make your own informed decision.

</p>