Analytics startup ByteTree has developed an indicator to assess miners’ confidence in market growth. Ifminers sell more than they mine, then the MRI value is above 100%. If on the contrary — below. Some analysts believe that the indicator can predict market movements.

</p>ByteTree explains that MRI below 100% indicatesminers' uncertainty that the market will withstand massive sales. If the indicator is above 100%, this supposedly indicates the opposite — The market is strong enough to absorb any sales volume.

The head of the company Charlie Morris said that this is confirmed historically.

</p>In January, MRI fell to 79% — lowestfigure for the last two years. This allegedly spoke in favor of the formation of a bull trap in the market. Already in mid-February, the price of the first cryptocurrency began to decline.

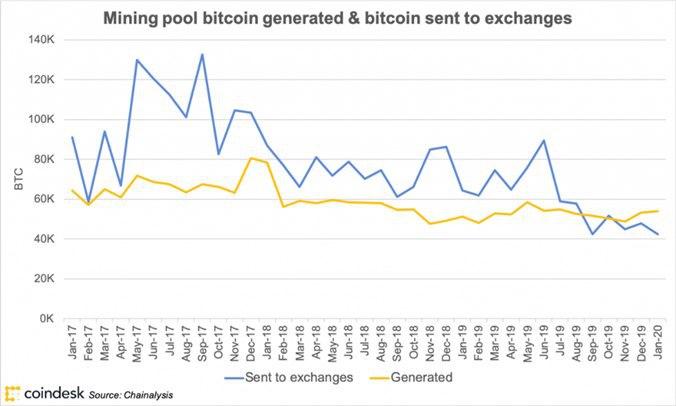

At the end of January, miners mined 53,955 BTC, and only 42,451 BTC were sent to exchanges. This is more than a quarter of all bitcoins sent to exchanges that month.

Mined bitcoins (in blue) versus those sent to exchanges (in yellow), CoinDesk data

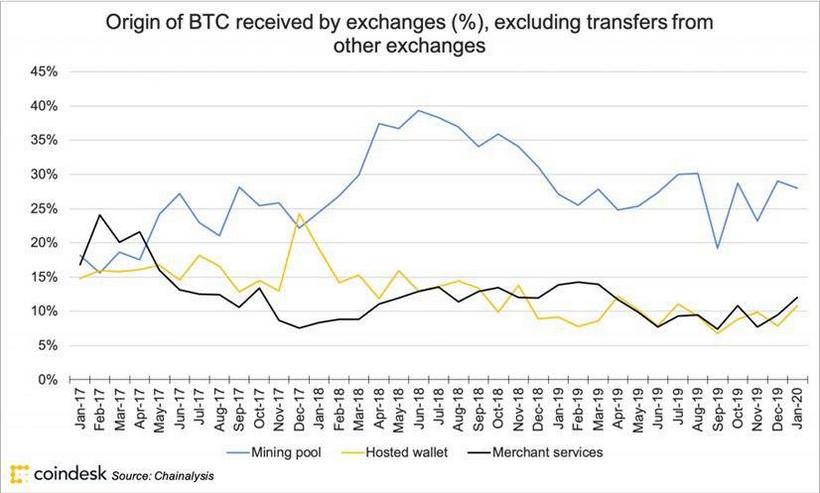

The share received by the bitcoin exchanges by the source of the sender, CoinDesk data

According to Poolin, bitcoin mining on such popular ASIC miners as AntMiner S9 and Avalon 851, is now on the verge of profitability.

</p>Miners focus on the medium andlong-term periods, including including halving in May. Not only the historical maximum of the hash of the network, but also the update of the line of devices from Bitmain and Whatsminer indicates the preservation of optimism.