The price of bitcoin has fallen by 5% from $9224 to $8749 over the past day.But this time, the reasons for the decline are more obviousthan usual.

Analyst Jacob Canfield argues that traders should not rely too much on non-stop growth in anticipation of halving and suggests turning to the story.

“This graph shows how volatile Bitcoin can be within 60 days of halving. Get ready for anything. ”He writes.

If you’re thinking that #bitcoin will just go up non-stop because of the halving, let history be your guide.

This chart form @Pladizow shows you how volatile $ BTC can be 60 days out from the halving event.

Be prepared for anything. pic.twitter.com/OPgQlThR1R

- Jacob Canfield (@JacobCanfield) March 7, 2020

What caused the depreciation of the BTC?

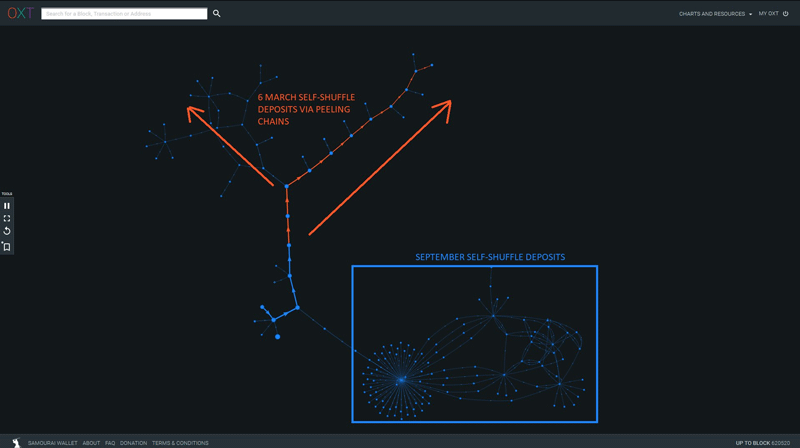

About 13,000 bitcoins ($118 million) from addressesassociated with the activities of the largest crypto-pyramid PlusToken, in recent days it was sent to the wallets of coin mixing services. Ergo analyst, who is following the development of the situation around PlusToken, draws attention to this.

PlusToken fraudulent nature revealed itself inmid-2019, when users of the alleged wallet began to experience problems with the withdrawal of funds. According to various estimates, the damage from the activities of attackers could amount to more than $ 3 billion, including 200,000 bitcoins, 790,000 Ethereum and 26 million EOS.

Ergo notes that the organizers of the scheme continue to liquidate the assigned assets through exchanges such as OKEx and Huobi:

“They periodically sell from August. Recently, they began to sell much more slowly. In the blockchain, we can see transfers to exchanges, but we don’t know anything about their glasses. Asset allocation depends on market behavior. They stop when the market weakens. ”

The analyst is inclined to believe that the redistribution of assets on crypto-exchanges and their sale occur almost simultaneously, since otherwise they can be frozen.

“Thanks to Ergo for his hard work. It looks like the Ponzi PlusToken scheme is again transferring bitcoins. Time to be more careful in the market "- writes analyst Jacob Canfield.

The direct impact of these transfers on the marketwill be determined by how exactly the attackers decide to liquidate the assets. With the gradual or one-time sale of 13,000 bitcoins on the market, the effect can fundamentally differ.

In mid-February, it was noticed that about 12,000 BTC PlusToken were transferred to two new addresses.

The liquidation of the assets of the pyramid was associated withnegative pressure on the bitcoin market in the second half of last year. Observations that PlusToken has slowed sales lately are consistent with a market upturn earlier this year.

The founder of Ikigai Asset Management, a digital asset management company, Travis Kling noted:

“PlusToken. CloudToken OneCoin. Probably, we will turn around for this period in the history of bitcoin, when the price did not rise despite the fact that the rollback in the macrocontext was extremely bullish, and to realize that this was due to seller pressure in the face of exit scams for billions of dollars. Everything is so simple. ”

5

/

5

(

1

voice

)