Cryptocurrency exchanges and competing applications are engaged in a race to master and, ultimately,account, the democratization of traditional financialservices. The three simplest and most obvious targets for them are (1) interest-bearing accounts, (2) payments and (3) tax services. Due to the low cost of switching for users, this transformation of exchanges into crypto-banks will occur much faster than expected, leaving those exchanges that do not follow the general trend, far behind in a cloud of dust.

In addition to the native assets of public blockchains, the main winners in the crypto sphere today are exchanges: Coinbase, Binance, Liquid Global, BitMEX and Kraken are valued at more than $1 billion each, according to confirmed data or rumors, and Binance has managed to achieve unicorn status even faster than any company in history.

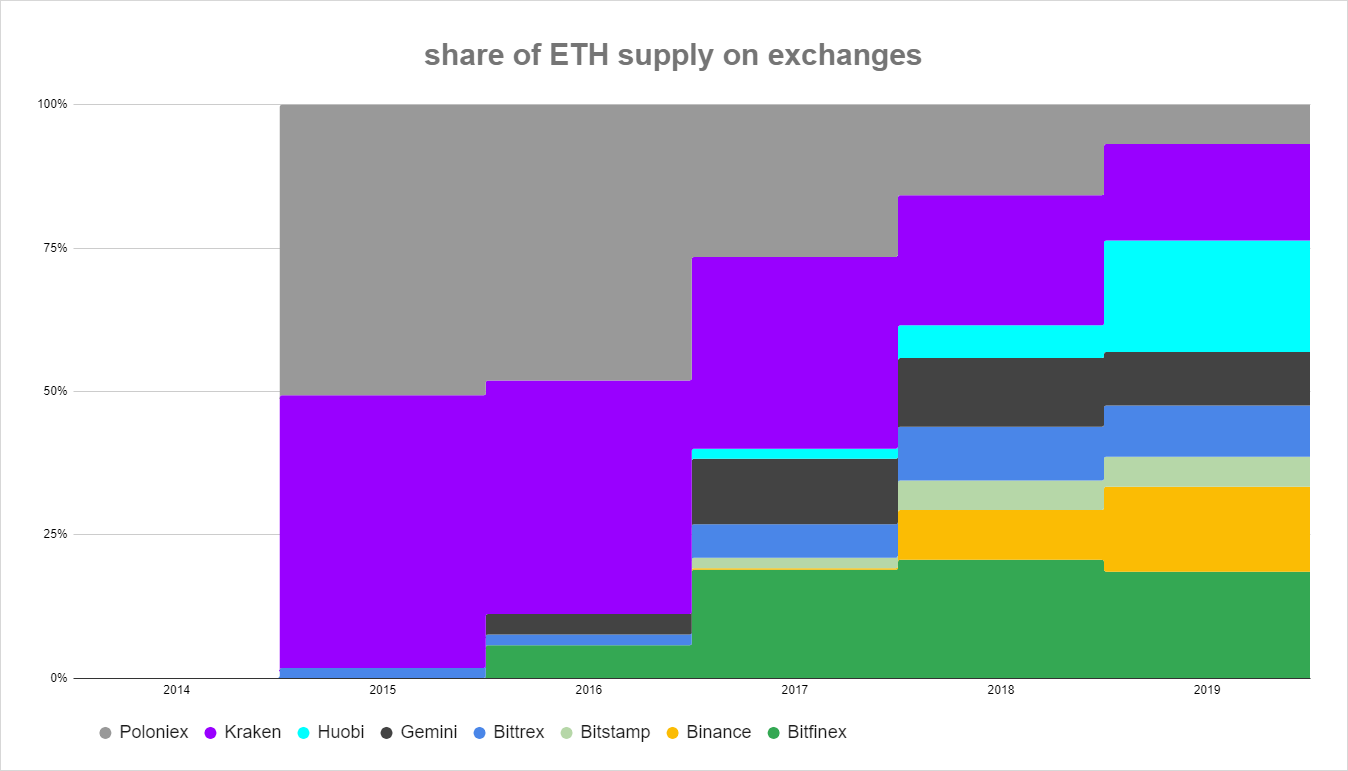

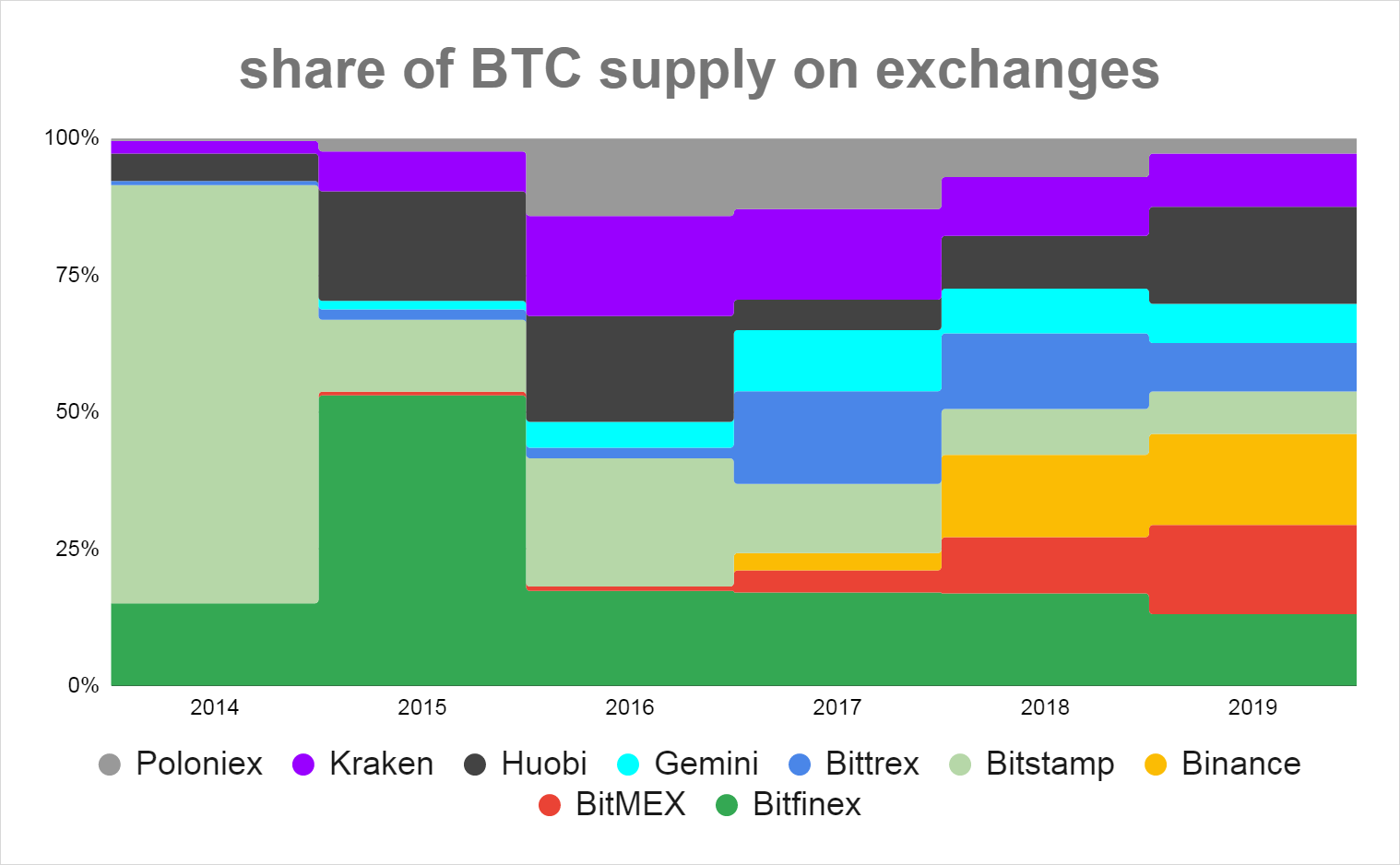

At the same time, the cryptosphere remains exclusivelya dangerous industry for its key players. The list of market leaders in terms of spot trading volume has changed several times since 2016. For deposits in BTC and ETH, a similar picture is drawn on exchange accounts:

Cryptocurrency amounts held by users on accounts of selected exchanges as an indicator of market dominance. : CoinMetrics Network Data Pro

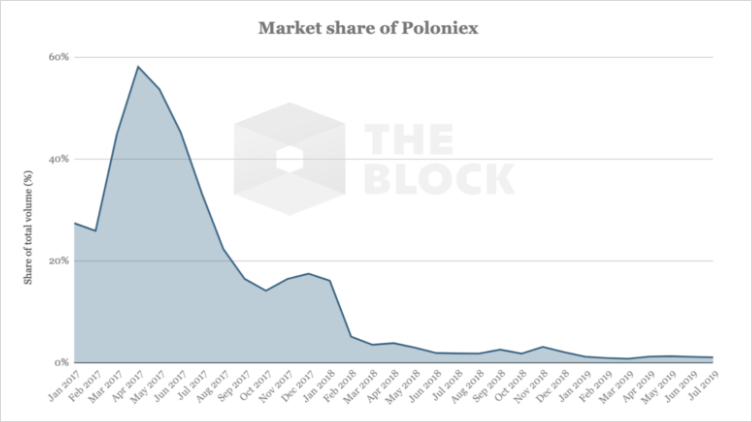

The Poloniex example looks especially intimidating. Without any significant shocks, such as hacking or significant regulatory issues, Poloniex's market share fell from almost 60% at the beginning of 2017 to just 1% in May 2018, and has since fixed at that level.

Share of Poloniex in the total trading volume of crypto exchanges (including altcoins). : The block

Such a high volatility of ups and downs can be explained by two factors:

- Network effect:Liquidity generates new liquidity, both on the way up and on the way down.A margin user is likely to choose the largest exchange for a particular asset or service, as it canoffer the deepest markets and the lowest spread, but thisThe user will leave the exchange at the same time as the rest of the users leave.

- Low switching cost (for customers):If users don't like the service offered by one exchange, they canwithdraw your assets and move to another service provider in a few minutesDue to the openness and accessibility of public blockchains, no paperwork is required for this.

As a result of such high mobilityusers formed a much faster feedback cycle for business decisions made by exchanges. If one exchange offers a new function, others need to provide the same function for their users as quickly as possible, otherwise they risk losing their position in the market. Cryptosphere companies as a whole are among the fastest in history to introduce innovations thanks to the unique combination of a dynamic new market, regulatory arbitrage and a purely digital offer.

With all the advantages for customers, this serves as a stronga source of additional pressure for exchanges that need to constantly get ahead of their competitors. In this article, we will consider the features that, according to our forecasts, will become the standard offer for any spot exchange in the next couple of years.

(1) Interest charge accounts

Because the cryptosphere is now consolidating lessof invested assets, it makes sense for exchanges to start optimizing work with assets under their management and monetize through the offer of additional services, and not just at the expense of trading volume. The idea of interest-bearing accounts, when the exchange compares and selects borrowers and lenders corresponding to each other for a small commission, essentially copies the original business model of an investment bank.

Against the backdrop of the increasing spread of zero andnegative interest rates in fiat monetary systems, cryptocurrency accounts with interest accruals can become an important competitive advantage for maintaining existing and attracting new users. We believe that the main income of the exchanges will come from three sources: staking (PoS-mining of tokens), providing loans (for example, to margin traders or market makers) and providing the exchange with loans and liquidity to other market players (for example, in the field of DeFi).

1.1 PoS mining as a service

Most recently launched networks, such asCosmos, Tezos and Algorand, as well as those planned to be launched in the near future, such as DFinity, Polkadot, NEAR and Ethereum 2.0, use the Proof-of-Stake algorithm as a mechanism for resistance to Sybil attacks. In PoS, cryptocurrency holders can participate in the consensus process by blocking part of their tokens as security.

If users store their tokens on the exchange,they too could use these tokens for PoS mining in order to try to get a small additional profit. As a result, it makes no sense for the exchange to include a PoS token in the listing and not offer its own service for its staking. In the case of Tezos, Coinbase, Binance and Kraken - one after another they introduced support for PoS mining with a monthly difference.

Overview of the largest crypto assets for staking (data as of October 24, 2019, source: Binance Research)

1.2 Domestic markets

The most natural type of loan market canexist between users of the same exchange, while tokens do not even need to leave the cold storage. There are two main sources of demand for loans in tokens: leveraged traders and market makers.

The largest structural demand for borrowingcomes from margin traders. At Bitfinex, Huobi, OKEx and Binance, traders need to borrow funds and place them in a separate margin wallet. After that, they can use these funds to trade in the same order glass as spot traders. This is different from derivatives exchanges such as BitMEX or Deribit, where users simply trade derivatives.

Therefore, structural borrowers forcryptocurrencies are often speculators who play downsides without coverage, while structural borrowers for USD and stablecoins are often people who want to buy assets with leverage.

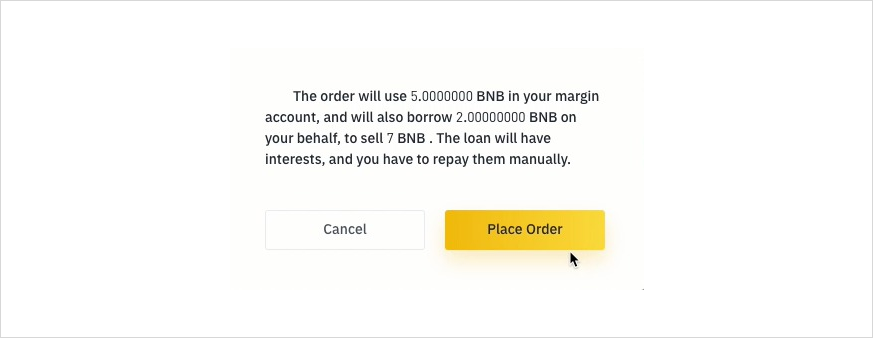

At Binance, a margin trader automatically connects to a lending pool and pays BNB depositors interest on borrowed funds. (: Binance Margin Trading Guide)

Less permanent source of borrowing demandthe funds are market makers who, in order not to inflate their balance sheet, can borrow crypto assets, paying in dollars or USDT.

1.3. Foreign markets

In addition to participating in the over-the-counter marketlending, there are additional investment options for users who are ready to withdraw their funds from the exchange and experiment with other counterparties or even DeFi- (decentralized financial) protocols.

Exchanges, for their part, are not interested inso that their customers withdraw funds and independently look for opportunities for additional income, so they can begin to act as a primary broker. This approach has many advantages:

- Economies of scale. For example, Binance Broker could offer its users lower fees on another exchange.

- The exchange has a more complete picture of the user's risk profile, which makes it possible to reduce capital requirements.

- Users have the opportunity to trade on various platforms without even withdrawing funds from their Coinbase Vault.

Another big advantage isthat such a primary-level broker can offer various options for interest-bearing accounts that would otherwise be available only outside the user's main exchange.

A vivid example is syntheticdollar bills. On BitMEX and Deribit, the user can deposit a certain amount in BTC (in the case of Deribit, and in ETH) and sell financial contracts for the same amount. As a result, the user takes a long position in the underlying asset (e.g. 1 BTC) and short in a derivative (e.g. futures contracts for 1 BTC).

The reason investors can usederivatives for interest is the rate of financing. Since perpetual swaps (by definition) never expire, there is no natural price binding for them to track the price of the underlying asset. To mitigate this problem, BitMEX developed the idea of a financing rate that is paid between traders with open long and short positions every 8 hours. Due to the bullish bias of the cryptocurrency markets, historically longs paid shorts at this estimated financing rate of about 6% per annum.

As a result, investors get the opportunityopen a kind of high-yield synthetic dollar account by making a deposit in BTC or ETH as collateral and open a short position for the amount of the deposit. Arthur Hayes dedicated a separate blog post to this strategy on the BitMEX blog.

Exchanges may also on behalf of their usersConnect to DeFi protocols like Maker, Compound, Kyber, DYDX or Uniswap. The first such example was set by OKEx, which recently added the Dai Savings Rate option, a stake for% DAI stablecoin.

There is no reason that users cannot invest their assets in Compound or Uniswap in a couple of clicks.

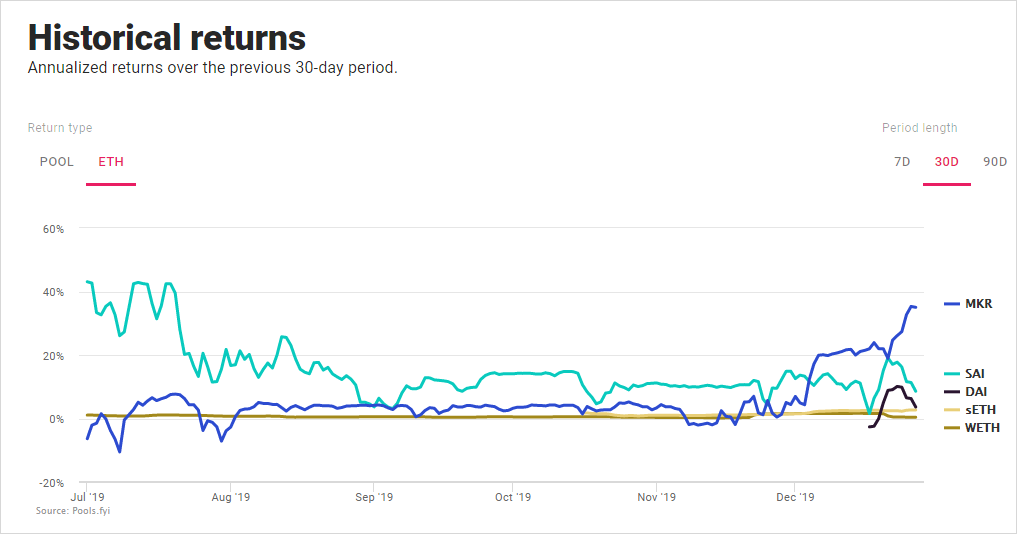

Historical yields on various pairs with ETH in Uniswap for a relatively recent time. (: https://pools.fyi)

Exchanges, acting as the primary broker, mayoffer its customers all the opportunities existing in the cryptosphere to generate additional income in the interface familiar to users, without having to worry about chain transactions and funds security on their own.

(2) Payments

As our understanding of blockchainsgrowing, it is becoming increasingly apparent that high commissions are needed to ensure their safety. And even despite the fact that after the take-off of 2017, the commissions remained small, it would be wise for the exchanges to plan that, at some periods, using the basic layers of Bitcoin and Ethereum will again become expensive.

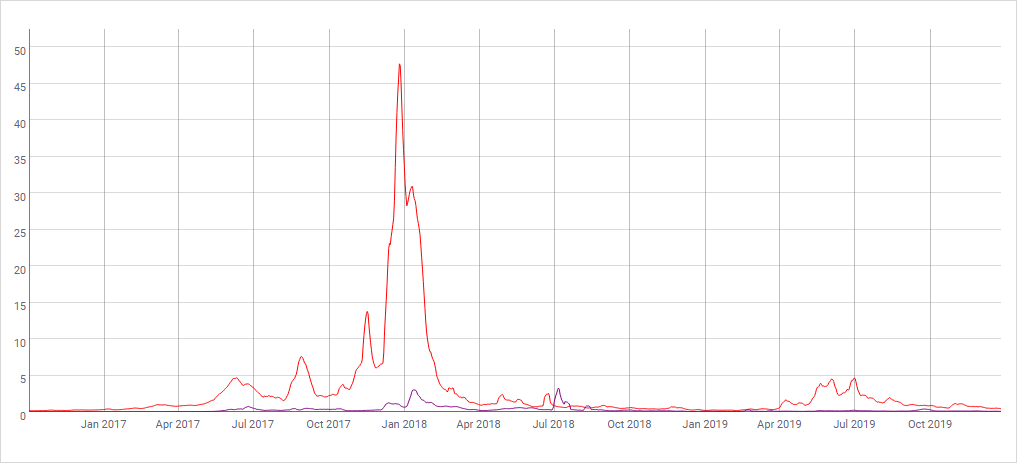

Average commission (in USD) for transactions in Bitcoin (red line) and Ethereum (purple line). : CoinMetrics.io

Exchanges will develop payment networks thatwill cover both other exchanges and sellers of goods and services with which users can make transactions. Making small payments in secondary closed ledgers between parties with relative trust makes sense for several reasons.

- Such transactions do not particularly benefit from the benefits of public blockchains, and their participants may not be willing to pay a high network fee.

- A private register can process transactions faster and more confidentially than a public blockchain.

- It’s easier to offer a good user experience with the ability to recover an account and translations by human-friendly account names instead of public key hashes.

2.1 Exchange <> Exchange

Several crypto firms dream of becoming the equivalent of "DTCC in the Bitcoin world."The list of those who offer clearing services and settlement services for enterprises includes BitGo and Liquidity Offset Network, a joint venture involving Circle, Coinbase, Galaxy Digital, Bakkt, etc.

Reluctance to join a competitor's financial stack may play into the hands of more "neutral" solutions, such as Liquid fromBlockstream, which are essentially multisig wallets that work between major exchanges.While the actual adoption and widespread adoption of Liquid wallets has not yet occurred, we believe that this will change as they growCore network fees.

If the commissions on the base layer become prohibitively high, federated sidechains such as Liquid can see an influx of new users. (: Liquid)

Then the exchanges will be able to allow their customersexchange fast and confidential transactions, which is beneficial for users who are annoyed by slow transactions and high commissions on the base layers of blockchains.

2.2 Buyer <> Seller

Exchanges will facilitate cryptocurrency settlements for both sellers and buyers.

Sellers of goods and services are naturalsellers of crypto assets, so it makes sense for exchanges to process their operations directly. And this is another example where Coinbase offers a leading service in terms of vertical integration: Coinbase Commerce.

On the user side, it seems that the concept of crypto-backed Visa or Mastercard cards, which in 2017-2018 fell short of expectations – mainly for regulatory reasons – hasThere is already Coinbase Card and Crypto.com on the market (only available in the US and Singapore), Binance is now launchingThese cards serve two purposes, allowing users to spend their cryptocurrencies more easily, and for the exchanges themselves, serving as an additional source of trading volumes in trading pairs with fiat currencies.

: Crypto.com

Another example is Bitrefill (a cryptocurrency gift card store) that integrates with Bitfinex.

(3) Tax services

Today, surprisingly little attention is paid to this topic. We believe that exchanges should invest much more in their own development in this direction for two reasons:

- Both exchanges and their users are completely united in their efforts to minimize the leakage of money from crypto assets to the tax service by deducting tax losses and managing liquidity.

- Uncertainty about taxes and how they should be calculated increases both the mental and financial costs of storing and spending cryptocurrencies.

3.1 About the cost of training

Given the novelty of the topic, most lawyers inin the field of taxation and financial consultants do not have experience working with clients, in the declaration of which it is necessary to take into account income received in cryptocurrencies. It is all the more important for users to independently learn this process so that it is easier for them to calculate their own taxes and prevent costly mistakes. To help them with this, Coinbase has developed a tax guide for customers from the United States.

3.2 Easy integration with tax authorities

However, exchanges can do much more toHelp your clients with tax returns at the end of the year. An indispensable condition for any tax consultation is the full awareness of the exchange about cryptographic portfolios and trading operations of clients.

Each exchange has access to asset andtrading operations on their own platform, but for users trading on several exchanges, there should be ways to either obtain important external data (for example, through an agreement on the exchange of information), or easily export data to a third-party tax program, such as TurboTax, CoinTracker, ZenLedger or CoinTracking.

An integrated profit and loss tracker that works exclusively with Coinbase products and eliminates the need for any third-party programs for some investors. (: Coinbase)

3.3 Tracking Tax Forming Events

Biggest obstacle to spendingcryptocurrencies today are not necessarily the absence of acceptance / distribution or the expectation of potential profit. The main obstacle is that every cryptocurrency payment is a tax-generating event. While CoinCenter and other similar organizations are trying to alleviate this burden on the part of regulators, crypto banks can contribute to this process by registering all transactions in detail.

3.4 Deduction of tax loss

If users incurred tax relatedlosses in crypto assets, they can compensate for this loss due to taxes on other income. If used correctly, the final tax bill will be lower. Not later than last December, Kraken just provided its customers with clarifications on this subject.

3.5 liquidity management

The important part of investing is the rightrequired liquidity management. Whenever users are forced to dispose of an asset due to lack of liquidity or to pay taxes, they usually sell assets at a much lower price than they would otherwise have received.

Imagine that an investor held 1 BTC infor eleven months. If he could extend the tenure for another month, then this 1 BTC would already belong to the category of long-term assets, with a more favorable tax rate. But by selling his asset right now, the investor loses the right to this tax benefit.

For such cases, exchanges may offeremergency liquidity in the form of loans secured by crypto assets. Like loans for margin trading, a user can take a loan in fiat secured by crypto assets to pay his bills without creating a tax-generating event as a result of the sale of crypto assets.

(4) Where does the competition unfold?

Exchanges are not the only companies in thiscrypto industries seeking to achieve their desired goal and become providers of a full range of financial services. Custodians and wallets also try to move in this direction.

A still from the film "It's a Mad, Crazy, Crazy, Crazy World" (1963).

BitGo Prime, for example, offers featuresreceiving and granting loans, and OSL (the leading custodian of Asia) - term deposits (that is, they borrow customer funds for a fixed period of time). Blockchain.com also has its own service for obtaining and providing loans, but only for institutional clients. And it is only a matter of time before they open these financial products to retail customers.

Meanwhile, Crypto.com approaches the same market from the opposite side. Having initially made a wallet, they first added peer-2-peer loans, and only after that opened their own exchange. Although so far the competition from other market players, in addition to exchanges, has been relatively sluggish, we expect it to intensify with the advent and development of new players such as Matrixport and Babel Finance in Asia or BlockFi in the USA.

After all, BTC and ETH are just capital, andcompanies compete to consolidate as much of it as possible. With capital come financial services and the ability to generate more capital.

Conclusion

In the next few years, competition betweencryptocurrency exchanges, wallets and custodians will move from the logic of horizontal expansion (more and more assets) to vertical integration (more opportunities for users to operate with existing assets). Approaching the solution of the problem from different angles, all these crypto companies pursue a common goal - to become a full-fledged crypto-bank. And the main indicator of success for them will be the number of assets in management that they monetize through the provision of financial services. In the process, these financial services will become more widely available and cheaper than ever before.

The authors thank you for contributing to the article by Su Zhu, Mike Co, Tiantian Kullander, panek, and Dan Burke.

</p>