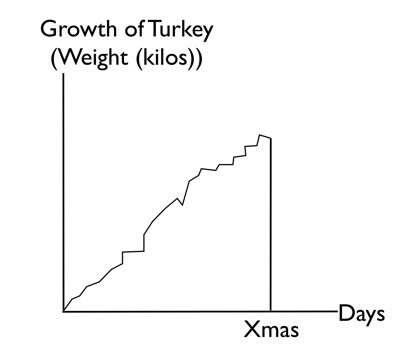

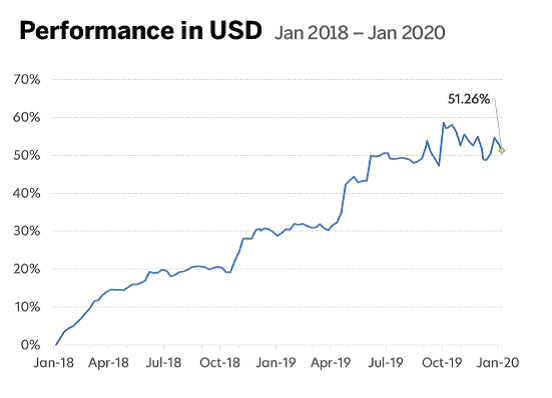

It seemed like a commonplace story. I gave the money to management, all the money disappeared. Truth, disappearancehappened within a few days after my request to unsubscribe from the fund. The NAV line turned out to be similar to that of the Taleb turkey.

The word “arbitration” captivated me.I was once involved in this business myself, and therefore had confidence in this market-neutral investment strategy. Other parts of the fund's strategy were "Trend and counter-trend trading strategies", "with minimal correlation". The founders of CryptoLab Capital Dmitry and Rostislav impressed me as smart guys, Moscow State University and Stanford, the quant team in California, etc.

https://cryptolab.capital/#executives. (already worn out, but it’s in the archive)

Of course, as soon as I invested in JuneIn 2019, the beautiful performance ended. The NAV jerked back and forth, but by the end of February 2020 remained at about the same level where I went. And then I decided to take the money.

On March 8, I inform you that I want to unsubscribe.

On March 10, one of the fund managers calls: “I have bad news, our fund suffered a loss of 20%, but we know how to return everything. Do you still want to unsubscribe?” - “Of course I do!”

March 12: “Sorry, but our fund lost 100% of its money today and will be liquidated..”.

Managers describe what happened this way:The “Glassman” algorithm began to gain a long position in XBTUSD on March 7th. By the end of March 8th, increasing the position in a falling market, the algorithm brought the position to ~70m USD (my estimate for two funds) and leverage to almost 3X AUM. The next morning, the managers decide to manually short the position. No such luck, liquidity disappeared in the market. By the end of March 10, it was possible to reduce only by a third. On March 11, the company continues to try to close longs by placing limit orders to sell... (What were they counting on?). On March 12, the market began to fall even more, the managers tried to sell at the market, but then the BitMex exchange rejected market orders. As a result, the exchange itself liquidated all positions, and the fund went bankrupt.

The administrator confirmed that there was no asset withdrawal, all the money was honestly lost.

Of course, I signed up to accept the risks andI know that I can lose everything. "This is the market." But I don't need a fund to buy Bitcoin with leverage. I can do this myself. I was committing money to a specific investment strategy that I could not carry out on my own. However, instead of a set of uncorrelated algorithmic strategies, the managers planted all assets in Bitcoin with leverage. Such mistakes are typical only for inexperienced investors who are trading in the market for the first month. But such mistakes are not typical for experienced asset managers. And it was strange.

/////////

End of Facebook story.