The article describes an unfavorable confluence of factors that, taken together, are beginning to underminefinancial systems of developed countries. The emergence of a long-term trend towards an increase in social obligations today is combined with more and more obvious signs of the approaching global credit crisis, which, in turn, come from a combination of a peak in the credit cycle and increased trade protectionism.

Protectionism is already noticeably underminingthe global economy, and it seems that few people realize that a new economic and systemic crisis will occur at a time when state financial systems are already extremely unstable. For the authorities, the consequences of this crisis will be unimaginable, and therefore I am sure that such a decline will lead to a significant increase in monetary inflation. To understand how destructive the coming crisis will be for state financial systems and, ultimately, for the currencies they issue, you need to realize the scale of the urgent problems.

Introduction

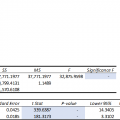

Based on recent comments about unsuccessfulREPO transactions in New York suggest that the system is short of money. However, as the graph below shows the amount of money supply for the dollar, the problem is not this.

Money supply for fiat currencies is the aggregatethe amount of fiat money (in this case, US dollars) in circulation and in reserve on the balance sheet of the central bank. Before the banking crisis of 2008, it grew at a fairly constant pace with an average rate of 5.86%. After the crisis, the money supply of the dollar grew at an average rate of 9.45%, even taking into account the slowdown that began in January 2017. Fiat money supply is now 5 trillion more than what would have been without the massive monetary expansion that would have taken place after this crisis. If there is a shortage of money, this is because the process of creating a new debt to finance current budget expenditures is getting out of control.

This is happening not only in the USA. If we take similar (but less detailed) figures for the fiat money supply of other large countries, summing up the broad money supply M3 and the reserves of the central bank, we find that it also grew for the most important economies - only growth rates varied. In China, the aggregate average annual growth rate was 12%, although in Japan (5.2%) and the Eurozone (4.9%) this growth was slower, reflecting stagnant levels of bank lending. In a situation where, due to the absence of any other indicators, statisticians use the total volume of GDP as a measure of economic growth, one should not be surprised that the economies with the highest growth in monetary terms are considered the most effective.

Just like GDP says nothing abouthuman progress and its benefits to society, other ways of using money as a mechanism to control the effectiveness of economic management are also misleading. A significant part of the monetary expansion of the central bank was designed to refinance inefficient budget expenditures. Most of the balance left after the government was used to speculate in the financial sector and finance consumer loans issued to those who lost their savings. Accelerating money supply does not shed light on the effect of the transition of wealth, in which every creative citizen becomes poorer, and the beneficiaries are governments, the banking system and privileged customers of the bank, which mainly include corporations and, directly or indirectly, hedge funds.

Decades of declining human well-beingdue to monetary inflation, which accelerated after the 2008 crisis, this is a very serious problem, which is the reason for the fragility of economic systems with a dominant budget deficit of the state. The reason for the lack of money is that the acceleration of growth of budgetary obligations in nominal currency terms is constantly catching up with them. Lawrence Kotlikoff's famous estimate of the net present value of future US government liabilities of $ 222 billion, which he presented in 2012, turned out to be more accurate than could be expected.

It would be even more accurate to say that for the United States this figuretends to infinity. It has almost reached infinity in Japan and the eurozone, where the basis for calculating the net present value are negative interest rates and government bond yields. As with most financial issues, most people are not aware of the true consequences of low and negative interest rates and ultra-low bond yields. They think that very low rates allow their governments to borrow as much as they need to provide the population with new hospitals, schools, etc. This is the case when the stupidity of politicians and bankers turned out to be contagious and spread to almost all people, and the few who realize this do not know how to reverse the process. What people don’t see is that the government can no longer finance public health and pensions, which make up a large part of future budgetary obligations, without further accelerating the depreciation of its own currency.

No one can know the exact numbers for the future.budgetary obligations, an increasingly important part of which is social security. However, the vast majority of politicians are so short-sighted that they see no problem in this. The few governments that raised their retirement age did this to cope with current social obligations without solving the problems of their future security, which ultimately will lead to the destruction of what we are accustomed to consider a civilized democratic society. This will be the problem of their successors.

History and economic theory tell us thatState requirements for loans will cease only with the complete destruction of state currencies. The fact is that inflation of money and loans created the illusion that we can all live outside our income, and our income is what we produce.

The only ones who can earn withoutthe need for promotion and advertising is central banks with their commission fees: seigniorage is simply charged without public consent. Extra money allows us to indulge in fantasies without asking ourselves uncomfortable questions - until at some point we are faced with reality. We're like Mr. Creosote from Monty Python's The Meaning of Life: can we afford a little more inflation before we explode?

Loan termination

Complaints about the current volatile situationlarge economies due to lack of money, far from reality. The problem is to increase costs, and the answer to any budget deficit is simply to release more money, as we have recently seen in the US repo market. But this is not a solution to the problem, it only exacerbates a likely crisis.

Increasing the amount of money is easy, but practicallyit is impossible to simultaneously increase the number of goods. For this reason, money supply growth is disadvantageous to ordinary people, small and medium-sized businesses. An increase in the amount of money in circulation with a constant level of supply of goods and services creates increasing pressure on prices. For some time, consumers can get around this problem by ordering cheaper goods from abroad. This holds back domestic prices. When people store money in savings accounts, this also contributes to price stability, because some large purchases are postponed for the future. But in the absence of bank depositors, which would somewhat offset the effect of inflation-driven demand, and at current US tariffs on imports from China, designed to limit it by eliminating the price advantage (which America itself transferred to China, increasing monetary inflation), a general increase in prices becomes inevitable .

As a result, a significant part of the representativesAmerican business hoped for prosperity in the absence of competition from Chinese manufacturers. For too long, they have observed an increase in production costs due to rising production costs, government regulation, an increase in their own bureaucratic structure, and a natural tendency to increase spending to the level of available income. Being tied hand and foot by bureaucratic red tape, they hope that tariffs protect them from foreign competitors, but no. They maintain their uncompetitive prices, only to find that consumers who have not received any benefit from the new money issue are not ready to buy their goods or simply cannot afford it. Sales volumes decline and losses begin to accumulate. The international problem, triggered by trade protectionism, is turning into a recession, from which America is now suffering.

We see signs of the coming crisis already inother countries that are not directly involved in trade disputes between China and America, but also depend on the two largest economies in the world that have started a trade war. All eurozone states report disappointing domestic market figures, as do virtually all other countries that publish these figures. And «inflationists» they say we need to issue more money.

This is a query that has already become almostthe requirement that borrowers should receive loans at negative interest rates - at the expense of those few bank depositors who still remained in developed economies. Om investments in production, which are considered necessary in order to prevent the collapse of the global economy, are no longer real savings, but a growing amount of money directly or indirectly obtained by the banking system literally from the air.

Benefit from inflation due to expansionbank lending to those who do not need it, because they are creditworthy and can always raise funds on the market. But the problem lies with those who are not creditworthy, and no amount of monetary inflation will save them, because banks - for example, in America - have already distributed almost the entire equivalent of equity capital to non-financial borrowers of less than investment grade (read «junk» ) class – both directly and through bonds secured by loan obligations. In the coming months (or the count may already be weeks), banks will protect themselves by turning away from liquidity providers and refocusing on its withdrawal. A sharp metamorphosis of banking policy will inevitably lead to an economic recession. A systemic crisis will arise and central banks will be forced to print even more money.

As we saw after the 2008 crisis, money will be printed to support bank reserves in exchange for an increase in government debt accumulating in the central bank, so that most of this newly issued money will ultimately cover the state budget deficit through the purchase of government bonds by the central bank.

The credit cycle should end: stabilization after the 2008 crisis, uncertain recovery and then return to normal. The normal situation turns into complacency, banks are expanding credit expansion in favor of increasingly risky borrowers. Now, the collapse is next in turn after a massive credit expansion, similar to what happened in the previous banking crisis.

This is a repeating cycle;monetary interventions of central banks. They cannot stop. The decision to abandon the support of Lehman Brothers, an investment bank of a different rank, nearly destroyed the entire global financial system. No central bank can take such a risk again. You can be sure: the solution to the next credit crisis will be to further accelerate the production of money and loans - no one in this financial system can fail. And the expansion of the monetary base, aimed at maintaining bank balance sheets, will favor mainly one class of borrowers remaining in any financial situation - governments.

But what we see is how the two forces merge intoone to accelerate the demise of sovereign state currencies, which ultimately rest solely on faith in their stability and the loans issued in them. The upcoming credit crisis will take place against the backdrop of the rapidly growing burden of social obligations, so vividly described by Lawrence Kotlikoff seven years ago and likely to increase significantly compared to his alarming assessment.

Inevitably prolonged suppression of profitabilitygovernment bonds will stop, and regardless of the central bank's policy on rates, they will rise, and investors will realize that, adjusted for a more realistic estimate of price inflation than government-published statistics, they are a valuable safe haven asset. Then state financial systems will get out of control so much that even proponents of modern monetary theory will return to their textbooks and look for what they missed there.

The phenomenon of monetary inflation to the general public

Today, the general public resides inblissful ignorance of the inexorable tendency to weaken currencies, enjoying the benefits of state social programs. Government economists tell them that moderate price increases - both a consequence and an excuse for a new increase in money supply and credit expansion - are good for them. And who are they to argue with experts?

Fortunately, people who continue to live their ownlife, usually adapt to the circumstances imposed on them by governments. A 2 percent price inflation rate is not too damaging, and governments have become quite adept at getting targets that suit them. At the same time, everyone perceives price inflation in their own way, which makes the figures published by the government plausible by default. However, for some time, the increase in people's salaries lagged far behind the rise in prices for goods and services that they usually purchased, which almost never overlap with the structure of state consumer price statistics. Having the financial freedom to receive loans, they have to cover the difference between income and expenses, like any modern government: taking loans with little or no intention to repay them.

The cause of the problems that people faceis the constant destruction of their personal wealth by monetary inflation. This led to a fundamental difference between the current credit cycle and the textbooks described earlier in the Austrian school of economics. Before Keynesianism, investment in production was financed by savings. These savings were substantially destroyed. Savings can no longer serve as insurance against uncertainty: in practice, they no longer exist.

From this circumstance there are two consequences,which inspire us with concern. The first is that the burden of investments and their inseparability now completely falls on the state and the banks licensed by it, and their only resource is even greater monetary expansion. The second is the almost complete dependence of today's employees on the receipt of a monthly salary, without which they instantly lose their livelihood. According to statistics, 78% of American wage earners live from paycheck to paycheck. They do not have the means to survive the conditions of the credit crisis and its economic consequences. This issue will place an additional burden on the government and the central bank, in addition to their already growing social obligations.

It’s not so difficult to imagine the day whenmost government spending will be financed by inflation and inflationary borrowings, amid lower tax revenues and increased budgetary obligations. There is also a significant imbalance between taxpayers, when the bulk of the tax burden is borne by the most mobile class, which can be removed at any time. And another question arises about how financial markets will react when awareness of the credit crisis, the sharply increased state budget deficit and the long-term escalation of social spending materialize in the public mind.

In anticipation of another credit crisis,the understanding that the system was not organized correctly still led to investors fleeing to the supposed safe haven: in some countries, investors are even willing to pay for the right to own public debt. In the US, the yield on 10-year treasury bonds fell from 3.2% a year ago to 1.4% in September this year.

When the next credit crisis materializes,perceptions of investment risk will inevitably radically change. The need to print money at an even faster pace will accompany the trend towards deeper negative interest rates that hit bank deposit holders and wash out the latest private depositors from the system. Therefore, even if the Fed simply considers the possibility of setting negative rates, this will put the entire commodity complex in a position lagging behind the monetary side, because all commodities are valued in dollars.

More widespreadlower negative rates guaranteed when the credit crisis enters the crisis stage. Last time, everyone was so glad that life after the bankruptcy of Lehman Brothers continued, that until now they considered public debt a risk-free benchmark for financial investment. It would be foolish to hope that the central bank will be able to play the same trick a second time. Just imagine how much higher the amount of fiat money should rise on the chart at the beginning of the article relative to the long-term trend line. And think about the damage to the purchasing power of the dollar and other major fiat currencies, the interest rate policy, which contributes to the mass cashing of bank deposits.

This time the coincidence of the credit crisis andThe rapid escalation of short-term and long-term social obligations adds inflation to a new dimension. It can be expected that the spread of zero and negative rates will not only not save the global economy, but will also reveal the true value of fiat currencies. The next crisis will differ in another respect: a new generation of educated men and women has appeared who, through cryptocurrencies, learned about the fallacy and vulnerability of fiat currencies even before the event. In the past, almost all people learned about this too late. Now, all over the world, and especially in America and China, millennials can accelerate the end of fiat money, initiating an early transition from fiat to cryptocurrencies. Bitcoin for a million dollars is no longer a figment of pure fantasy, but this does not necessarily mean preserving the current purchasing power of the dollar.

For most people, this will come as a surprise. The exception is those few who understand what is happening with money and the money supply escalation built into the system. These will include participants in the growing cryptocurrency community and those few who have studied this topic away from the influence of macroeconomists. I hope that now the readers of this article can also be attributed to them.

Anticipating the boom in consumer demand

As the credit crisis leads toincrease in monetary expansion or a hyperinflationary recession, people are forced to abandon their national currencies in favor of other goods that, in their opinion, they may need in the future. The minimum cash position becomes the desired position. This can quickly lead to the last short-term boom, which marks the collapse of unsecured fiat money, when it becomes clear to the general public that their country's currency may depreciate. As confidence in such an outcome grows, the speed with which people exchange their money for something more useful increases exponentially. In Germany, this lasted from about May 1923 until the next November, when the paper brand finally depreciated and was replaced by a new unit of account.

By that time, the inevitability of such an outcome had long been one of the main topics in the libertarian circles, urging them to prepare for survival in extreme economic conditions.

While there is an alternative in the form of physicalgold and silver, there is no need to accumulate basic necessities, unless an interruption in their supply is expected. In the event of a market fall, the price of goods in hard money will decline. This was firmly formulated by Keynesian inflationists based on the experience of the early 1930s, when prices denominated in gold substitutes plummeted. When gold and silver become more desirable than possession of goods, their purchasing power increases, and the purchasing power of fiat currencies decreases.

If as a result of the next credit crisiseconomic conditions similar to the 1930s return, those who use gold and silver as money will notice a drop in prices for basic consumer goods, so do not rush to stock them up.

</p>