So, 2019 has come to an end. Having celebrated at the start the 10th anniversary of the launch of the Bitcoin network, the cryptocurrencythe industry went through periods of hotexcitement, and through bitter disappointments. According to the already established tradition, we have witnessed ups and downs in the market, failed predictions, numerous speculations and mutual criticism.

Summing up the year, ForkLogsuggests recalling the key events of 2019, which largely determined market movements and laid the foundation for future trends, which, as you can expect, will determine the further development of the industry.

FATF Recommendations, Fifth EU Directive and Tighter Regulation

What many representatives are worried aboutThey said over the previous few years, it happened in 2019 when the Financial Action Task Force on Money Laundering (FATF) released the final version of the guidelines for the cryptocurrency industry. In a published document, the FATF obliged the bitcoin exchange and other cryptocurrency service providers (VASPs) to follow AML and CFT (anti-money laundering and counter-terrorism financing) procedures similar to traditional financial companies.

Experts and analysts have tried to convince the FATF thatthat in the blockchain industry it’s quite difficult, if possible at all, to follow the same rules as in the banking sector. There were also warnings that the cryptocurrency business could partially go into the background, and that privacy of users and the effectiveness of law enforcement operations would suffer.

However, in June, new recommendations wereadopted and approved by the G20 countries, after which 12 months are allotted to businesses and governments for their implementation. New standards will also apply to organizations working with cryptocurrencies and tokens, for example, exchanges and hedge funds. It is expected that the first review of the implementation of the FATF recommendations will be carried out in June 2020.

All this has led many governments tocountries, including those not members of the FATF, for example, Ukraine, began the practical implementation of these recommendations, and already in the second half of 2019, tightening the regulation of the cryptocurrency sector took on a specific shape.

So, with more stringent requirements fromlocal banks collided with South Korean exchanges, some of them even announced the delisting of anonymous coins like Monero, ZCash and DASH. Other major exchanges began to introduce specialized tools designed to track suspicious transactions, and some even began to block the withdrawal of funds to wallets with support for CoinJoin transaction anonymization technology (coin mixing).

All these events clearly indicate that the industryis on the verge of tremendous change. This process will not be short-term, but many people should already think about whether they are ready to play by the rules or continue to uphold the ideals and philosophy of a world free of state censorship of cryptocurrencies.

The fact that the new reality will be for many verydisappointing, confirms the closure of several companies that declared the impossibility of continuing work due to the Fifth EU Directive (5AMLD EU). The latter comes into force on January 10, 2020 and imposes stricter reporting obligations for companies working with cryptocurrencies, and also gives financial intelligence units the authority to receive addresses and identifiers of digital asset holders.

Digital currencies from Facebook and Telegram

David Marcus, CEO of Calibra

In June, the world's largest social network Facebook announced the creation of its own digital currency calledLibra. Global Stablecoin Project BasedThe “safe, scalable and reliable blockchain” was met with hostility by world governments and regulators, who almost immediately declared their rejection of this initiative.

According to authorities, such a private currency putsthreatening the stability of the global financial system, leads to a decrease in the solvency of banks and a reduction in their reserves, the outflow of capital from the economies of developing countries, and also increases the risks of money laundering and terrorist financing. Also in the light of previous incidents with data leaks, Facebook expressed concerns regarding the protection of users' personal data.

The series reached its apogeecongressional hearingsthat Facebook head Mark was called toZuckerberg and Calibra CEO David Marcus. They had to answer numerous questions of American lawmakers, but as of the end of 2019, the position of governments remains unchanged: until the regulators' doubts are dispelled, the project cannot receive a green light. Some countries, such as Germany, have gone even further by adopting a strategy to combat the issue of private digital currencies.

Due to concerns that participation in the Libra Associationwill have negative consequences for their core business, some major players have left the organization, including payment companies PayPal, Mercado Pago, Visa, Stripe and Mastercard.

Be that as it may, the creators of their plansThey don’t refuse the project: at the end of December the Libra Association published the second Libra Core software development roadmap. At the same time, the organization confirmed that it was continuing to prepare for the launch of Libra, however, the specific dates (previously called the first half of 2020) would depend on negotiations with regulators.

In parallel with this, the attention of a significant part of the community was focused on another project —Telegram Open Network (TON).Work on it began last year, when the messenger raised about $1.7 billion following two closed preliminary rounds of placing Gram tokens.

TON was expected to be launched as early as 2019,however, the US Securities and Exchange Commission (SEC) stood in the way of the project. In October, the regulator announced the adoption of “emergency measures and restrictions” in relation to the offshore companies Telegram Group and TON Issuer Inc. related to the TON token sale

According to the Commission, Telegram proposedinvestors unregistered securities in the United States and beyond, selling at a reduced price about 2.9 billion Gram 171 tokens to the original buyer. Of these, 1 billion tokens were sold to 39 American buyers.

Investors, apparently, continue to believe inproject: by a majority vote, they refused to demand a refund and approved the postponement of the launch of the platform to April 2020. Nevertheless, it cannot be ruled out that proceedings with the SEC may drag on.

It is noteworthy that the initiatives of Facebook and Telegramforced some major players in the cryptocurrency market to act more actively in the direction of creating their own digital assets. So, in August about plans to launchVenus projectwhose goal will be the development of regionalstablecoins and digital assets tied to fiat currencies in different countries around the world, Binance announced. It is possible that to launch Venus it will be used not the Binance Chain network, but a specially created public blockchain.

China— hyped «blockchain revolution» and pressure on crypto business

Xi Jinping, Chairman of the PRC

Having successfully squeezed out a significant part of the countrycryptocurrency business at the end of 2017 and in 2018, the Chinese authorities continued this “tradition”, increasing pressure on the remaining companies and traders in the country.

This trend became especially noticeable in November,when CCTV1, the mouthpiece of the Chinese Communist Party, called cryptocurrencies “unregistered securities, scams and Ponzi schemes,” and Shanghai authorities initiated a new audit aimed at curbing activity related to crypto trading and token sales. Around the same time, the social network Weibo blocked the official accounts of the Binance exchange and the Tron Foundation, citing “violation of laws and regulatory requirements,” and residents were encouraged to report crypto traders they knew.

It is noteworthy that the mining industry is powerChina is still bypassed. It is in the Celestial Empire that significant capacities are concentrated today (according to some sources, only 70% of all bitcoins are mined in the Sichuan province).

The beginning of a new wave of pressure on the crypto industrypreceded by a statement made on October 25 by Chinese President Xi Jinping about the need to support the development of blockchain technology and its integration into related information technologies - artificial intelligence, Big Data and the Internet of Things.

Almost immediately after this blockchain for the first timeHe was at the forefront of the Chinese newspaper People’s Daily, which said that the leading universities of the Celestial Empire are already launching special courses on the study of technology, and local municipalities will soon present their own initiatives in this area. For example, the Guangzhou authorities announced the allocation of 1 billion yuan (about $ 142 million) to subsidize blockchain projects.

However, the news was even more remarkable.that the PRC parliament approved the law on cryptography, standardizing cryptographic applications and the process of managing public and private keys. The law comes into force on January 1, 2020, and the cryptography will be regulated by a special agency reporting to the leadership of the Communist Party.

Alarmed by the news that the leading bankcountries, China Merchants Bank invested in BitPie, a once-one of the most popular cryptocurrency holders among local holders. What exactly will be the cooperation between China Merchants Bank and BitPie is still unknown, however, some analysts believe that the deal can be considered the beginning of the nationalization of the crypto industry in China.

“For me, this is a sign of the beginning of nationalizationbitcoin’s infrastructure and cryptocurrencies in general ... In the end, everything can belong to the state, at least in part (mining, ASIC, exchanges, wallets) ”,— Dovi Wang, partner at the investment company Primitive Ventures, commented on this news.

Further developments in China will undoubtedly haveinfluence on the development of the entire industry, but at this stage what is happening causes more anxiety than optimism. So far, the tightening of policies by the authorities has encouraged traders to transfer their assets to safer places.

Bitfinex vs New York State

On April 25, the cryptocurrency industry was hit bya real information bomb — The New York State Attorney's Office charged the Bitfinex exchange that, having suffered multimillion-dollar losses, it concealed this fact, using funds from its affiliated stablecoin issuer Tether to cover the damage.

According to the prosecutor, during the investigationmanaged to establish that iFinex Inc. (operator Bitfinex and Tether) was involved in operations to conceal the alleged loss of $ 850 million owned by both the company and its customers. It is assumed that precisely because of this, the exchange in the past had problems with the withdrawal of funds.

Bitfinex is supposed to have passed the specifiedthe amount, both corporate and client funds, to the payment service provider from Panama Crypto Capital Corp., which could hold assets of other exchanges, including Binance, Kraken and BitMEX and the bankrupt QuadrigaCX. When in December 2018, Crypto Capital's accounts in several countries were frozen, Bitfinex ran into problems.

The exchange itself immediately stated that categoricallydenies the allegations, however, the news nevertheless caused a sharp drop in the price of bitcoin and provoked a massive withdrawal of funds from the exchange. So, within a few hours, almost 19 thousand BTC (more than $ 98 million at the exchange rate at that time) were withdrawn from unknown Bitfinex cold wallet, and impressive amounts in ETH were also withdrawn.

Eight months later, the situation is still farby permission: throughout this time, the parties continued to exchange mutual attacks and statements. The exchange continues to defend its line, insisting, among other things, that the New York State Attorney's Office has no jurisdiction over Bitfinex and Tether.

Added confusion to this matter$ 1.4 trillion class action lawsuit filed in early November against iFinex Inc. and its subsidiaries. The defendants in the case are Bitfinex CEO Jean-Louis van der Veld, CFO Giancarlo Devazini, former Strategy Director Philippe Porter, the same processing of Crypto Capital, as well as Global Trade Solutions AG, which previously appeared in the case of shadow banking for bitcoin exchanges .

They were accused of violating the US Trademark Actstock exchanges, RICO Act (Racketeer Inventory Act), money laundering, Pump & Dump, market manipulation through the issuance of USDT and deliberate deception of investors.

It is now impossible to predict how all these proceedings will end, however, any outcome will probably have considerable significance for the entire market.

Bakkt platform launch

Expected last year and several timesThe postponed launch of the Bakkt cryptocurrency platform eventually took place in September. Deliverable Bitcoin Futures became Bakkt's first product. This type of contract will allow market participants to bet on future changes in bitcoin prices and receive payments in cryptocurrency, which distinguishes them from the existing regulated futures of the Chicago Mercantile Exchange (CME), which allow you to receive only the fiat equivalent of the earned bitcoins.

However, at the start of trading the volumes wererather modest, the expected market growth in connection with the launch of the platform not only did not take place, but moreover, in the following days the price of Bitcoin sank noticeably, falling within a week by an impressive 20% — from $10,000 to $8,000.

Despite the fact that the launch of Bakkt largely contributed to the continuation of the bear market in the second half of 2019, the company continued its expansion, introducing several more new products.

Thus, on December 9, settlement trading was launchedBitcoin futures and options, and a few days later the first block trade with Bakkt monthly Bitcoin options was announced on the ICE Futures U.S. platform. — the deal was concluded between Mike Novogratz's company Galaxy Digital Trading and the crypto-financial platform XBTO.

In addition, in November Bakkt begantesting a consumer payment application, with which users can pay with bitcoin for various goods and services. The first Bakkt partner connected to the application will be the international Starbucks coffee shop network (mass adoption!), And its launch is expected in the first half of 2020.

However, the main focus of analystsriveted precisely to supply Bitcoin futures, which are believed to increase interest in the first cryptocurrency from institutional investors. And as you can see in the graph below, despite the correction during the New Year holidays, the trading volumes for this type of contracts and the number of positions to be opened continue to grow, however, this has not yet had a positive impact on the price of bitcoin:

</p>Speaking about Bakkt, we cannot ignore the cryptocurrency initiative of the financial corporation Fidelity Investments. After almost a year of testing in OctoberFidelity digital assets, a digital asset division of the company, has launched a bitcoin storage service for institutional investors in the form of hedge funds, family offices and financial advisors.

In December, Tom Fidelity Digital Assets presidentJessop also said that the company is working to support Ethereum in the context of custodial services, and the corresponding service can be launched in 2020.

Ethereum — on the way to Proof-of-Stake and ETH 2.0

In 2019, two events took place on the Ethereum network.planned hard forks (Constantinople and Istanbul). Despite delays and postponements, the ecosystem of the second largest cryptocurrency by capitalization, according to the developers themselves, has entered the initial stage of ETH 2.0 — a new stage in the evolution of the project, providing for the transition from the Proof-of-Work algorithm to Proof-of-Stake.

According to the creator of Ethereum VitalikButerina, “switching to PoS will make Ethereum safer than bitcoin,” while other developers have repeatedly stated throughout the year that this task is necessary to keep Ethereum competitive.

As stated, Ethereum 2.0 will be a separate blockchain (Beacon Chain) with a new token, which at the initial stage will work in parallel with the current version.

Despite the ambitious plansdevelopers are under some doubt, a comprehensive security audit of Ethereum 2.0 as part of the zero phase should be held in February next year. Also this winter, a test network with the support of various clients can be launched. In addition, a deposit contract will be tested for approximately three months. If everything goes according to plan, the core network of Ethereum 2.0 will begin work no earlier than mid-summer 2020.

The boom of decentralized financial services (DeFi) and IEO

Rapidly gained popularity in 2019DeFi sphere, consisting of open source projects and designed to make the world of finance more open and free with the help of blockchain and smart contracts.

Innovative cryptocurrency market suddenlyarose against last year's collapse in the prices of bitcoin and most other assets. In an effort to avoid fixing losses, some holders in the midst of cryptozymes borrowed funds secured by digital assets, or deposited coins to get a small but passive income with minimal risk.

Key Asset and DeFi Services Protocolis Ethereum, and tokens based on it have recently been used as collateral for loans. The main users of these services are traders, ICO / IEO projects and borrowers experimenting with an alternative to expensive and bureaucratic banking services.

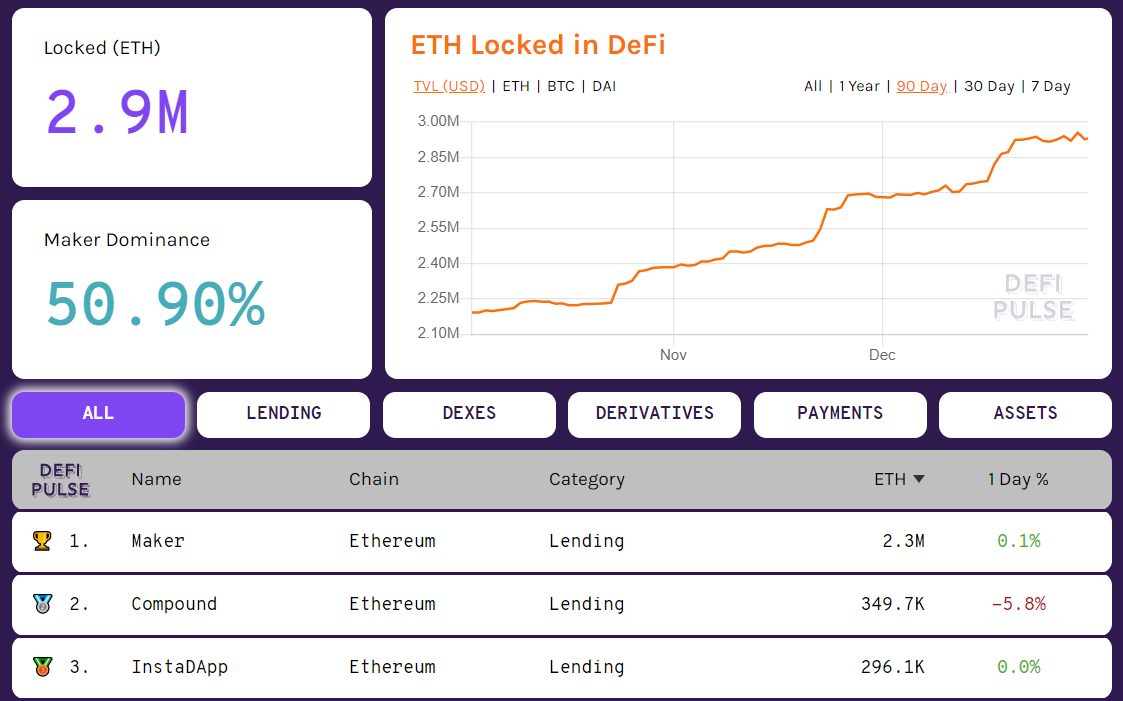

Recently, the decentralized marketfinancial services is rapidly growing and developing, expanding the list of supported assets and enriched with additional functions. If a year ago, the cost of blocked airtime as collateral was $ 189 million, then by the end of 2019 this figure was about $ 680 million:

Data: defipulse.com

Absolute leader in this segment for a long timetime is Maker, on whose smart contracts as of the end of 2019, 2.3 million ETH (> $345 million) were blocked. The dominance index of this service in the DeFi ecosystem has already exceeded 50%.

The service is also rapidly gaining popularity.Synthetix It offers decentralized trading in synthetic assets derived from digital currencies and traditional instruments (fiat money, gold, silver, etc.). The service has a native SNX token, the holders of which can block it to create assets of the ERC20 standard called Synths and then trade them. The third place in the DeFi Pulse rating is occupied by the Compound service, similar in functionality to the Maker.

Undoubtedly, a very young market is still tinycompared to the traditional counterpart. Nevertheless, this sector deserves attention, given the pace of its growth and the introduction of innovations, the value proposition of services and the potential for the development of market infrastructure.

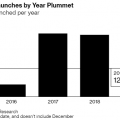

Another trend of 2019 was the so-calledInitial Exchange Offers (IEO), largely conceived as an alternative to ICO. The first large-scale IEO project of this year was the January BitTorrent crowdsale on the platform. The campaign ended in less than 18 minutes, according to its results 59.4 billion BTT tokens were distributed (about $ 7.2 million). The example turned out to be contagious, and over the course of the year, the IEO platform opened a number of other exchanges, while the Bitfinex exchange, howling with the state of New York, even held a private placement of its own LEO token, collecting a target amount of $ 1 billion.

Bittrex, Binance, and KuCoin: Will IEO Be a Complete Replacement for Initial Coin Offers (ICOs)

Doubts about the effectiveness of this toolfundraising, however, arose quite quickly, which was confirmed by the December study of BitMEX. According to him, investors in IEO tokens lost up to 98% of their investments.

Sidechains growing in popularity

The first sidechains based on Bitcoin — Liquidfrom Blockstream and RSK from RSK Labs — were launched back in 2018, thanks to which companies and their clients were able to quickly and efficiently move funds between exchanges, as well as use the L-BTC token to exchange them for assets created in alternative blockchains.

By May 2019, the most popular onlineThe Liquid sidechain had more than 30 participants, including major exchanges such as Bitfinex, BitMEX, OKCoin, Huobi and CoinCheck. Shortly thereafter, Blockstream introduced the first product based on Liquid — a platform for launching security tokens, the security of which is ensured by smart contracts operating on the Bitcoin network with a multi-signature function.

In July, the Liquid Network was implementedsupport for atomic swaps and the Lightning Network, and with the participation of Tether the stablecoin USDT was also launched, after which the fourth crypto asset for capitalization today has become available for arbitration.

“The growing popularity of alternative assets -stablecoins and security tokens - in the Liquid network it says that sidechain technology is quickly becoming mature. We expect that in 2020, the use of Liquid will only increase. ”— said Blockstream Chief Strategy Officer Samson Moe.

There is every reason to believe that these expectationsdestined to come true. For example, in early December, the launch of its own token sale on the sidechain Liquid announced the Dubai-based BTSE bitcoin exchange. The platform’s ambitions are very high - BTSE hopes that in 2020 it will be able to earn $ 103 million, and by the end of 2021, monthly trading volumes should reach the figure of $ 70 billion.

Other versions of sidechains do not stand still. So, in October, developers of the Horizen cryptocurrency user-oriented cryptocurrency developers announced the launch of a sidechain in alpha mode, which allows developers and companies to quickly and inexpensively create their own blockchains. According to them, the Horizen sidechain is the first important milestone on the way to creating an environment with numerous applications, which will allow in practice to realize such advantages of blockchain technology as privacy and decentralization.

The startup Money on also presented an interesting solutionChain, which launched a DeFi platform based on the RSK Bitcoin sidechain in December. On top of it, the project developers intend to create products in the field of lending. It will also be interesting to watch the future of the Sun Network, which includes DAppChain, a sidechain designed to “unlimited scale” the TRON mainnet, as well as Arbitrum — Ethereum sidechain, whose developers have already attracted investments from Pantera Capital, Compound VC, Blocknation and Coinbase.

Mimblewimble - a new technological breakthrough?

Mimblewimble technology was originally conceived inas the second layer of bitcoin, designed to increase transaction confidentiality and network scaling. However, subsequently, the developers came to the conclusion that creating your own cryptocurrency may be the easiest way to test it in real life.

To implement their plan, it took them about16 months, however, Grin, which was initially developed over, was not the only cryptocurrency based on Mimblewimble. A bit ahead of Grin with the launch, the Beam project was presented on January 3, choosing a model with funding and a more rigorous corporate ethic. On January 15, the Grin network was launched, the launch of which was not preceded by an ICO or premine, and the development was carried out on a voluntary basis.

Over the past year, both cryptocurrencies have woncertain popularity and are available for trading on a number of large exchanges. The underlying Mimblewimble technology is also attracting more attention. So, in October, two proposals to improve the protocol, providing for the integration of MimbleWimble to ensure transaction privacy, were published by Litecoin developers.

It is these properties of technology that canthe potential to become the “secret weapon” that will push the industry towards its wider adoption, especially in light of the increasingly stringent rhetoric of regulators with respect to the more well-known anonymous coins.

Infrastructure projects and community initiatives

In 2019, two important releases took place at oncethe most popular client of the first Bitcoin Core cryptocurrency. In May, Bitcoin Core 0.18.0 was released, one of the main functions of which was support for hardware wallets; in November, Bitcoin Core 0.19.0 was released with native generation of bech32 addresses. Also in this release, support for the BIP-70 payment protocol is disabled, which, due to the risks of tracking transactions in blockchain entries, is subject to considerable criticism from the crypto community.

Meanwhile, Bitcoin's second layer protocolThe Lightning Network has also had its share of important releases. Among these, we highlight c-lightning v0.8.0 from Blockstream, LND 0.8 from Lightning Labs, which became, among other things, a response to the identified vulnerability, as well as Lightning Loop - another solution from Lightning Labs, the main goal is to simplify the process of accepting coins.

Reaching new technological frontiersaccompanied by a growing interest in the Lightning Network from the wider community. It’s enough to recall the unique Lightning Torch relay, launched on Twitter by the user Hodlonaut (thanks to his confrontation with the self-appointed creator of bitcoin Craig Wright, in 2019 he became one of the most recognizable memes in the community.

The action was organized on the basis of the relayOlympic flame - to the initial payment of 100,000 satoshi (0.001 BTC) each new participant adds more than 10,000 satoshi, challenging the next user. The aim of the experiment was to demonstrate the capabilities of the second layer protocol of the Lightning Network.

The Lightning Torch relay race lasted 83 days, in itIt was attended by users from 56 countries who made a total of 293 Lightning payments. Among those who transmitted the Lightning torch, there are such well-known representatives of the community as Pierre Rocheard, Jack Mullers, Nicholas Dorier (BTCPayServer), the Bitrefill team, Anthony Pompliano, Andreas Antonopoulos, CEO Twitter Jack Dorsey, Elizabeth Stark, Samson Moe, Ricardo Spagni, Alena Vranova, WhalePanda, Giacomo Zucco, Binance CEO Changpan Zhao, Tron founder Justin Sun, Eric Vorhes, Charlie Shrem, Adam Back, Slush Pool mining pool, Peter Velle, Fidelity Digital Assets and even Miss Finland Rosa-Marie Ryuti.

All bitcoins (0.4108021 BTC) collected during its course were donated to the Bitcoin for Venezuela humanitarian initiative.

***********

Happy New Year 2020!

Andrew Asmakov