The blockchain industry is changing dynamically — many business models are losing relevance, giving way to othersdirections.

For example, two years ago were extremely popularICO projects, which few people now recall. In particular, the Pantera ICO fund, in which the Galaxy Digital cryptocurrency bank invested by Mike Novogratz, suffers large losses. The company relied on little-known coins, but the “altcoin season” never came.

The fall in investor interest in the sector is promoted byand cases of overt fraud, ranging from relatively small projects like REcoin ($ 2.8 million) or Eastern Metal Securities ($ 11 million) to a $ 2.9 billion scam by OneCoin.

Undoubtedly, the hype around the blockchain and cryptocurrencies is not the same as it was before. However, money does not lie dead weight, there is some investment activity, especially among industry giants.

ForkLog magazine offers readers to consider the dynamics of hedge fund investments, activity in the field of mergers and acquisitions, as well as find out in which areas major players invested in 2019.

Sobering cryptozyme

Despite some market recovery afterthe fierce cryptozymes of last year, activity in the investment sphere has noticeably waned. According to Crypto Fund Research, since the beginning of 2019, about 70 cryptocurrency hedge funds have been closed, focused mainly on large investors.

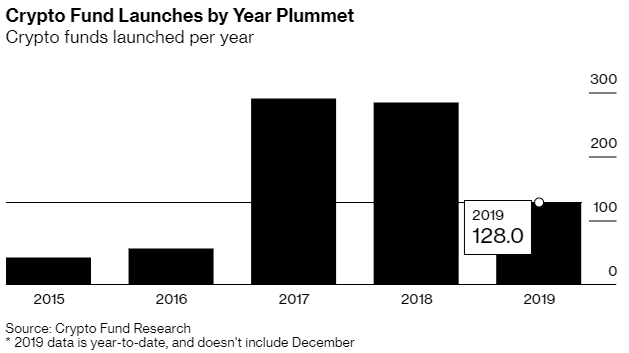

The graph below shows that the largest number of such funds were launched in 2017 and 2018 (291 and 284, respectively):

The number of funds opened this year is not even half of the indicators of the past two years.

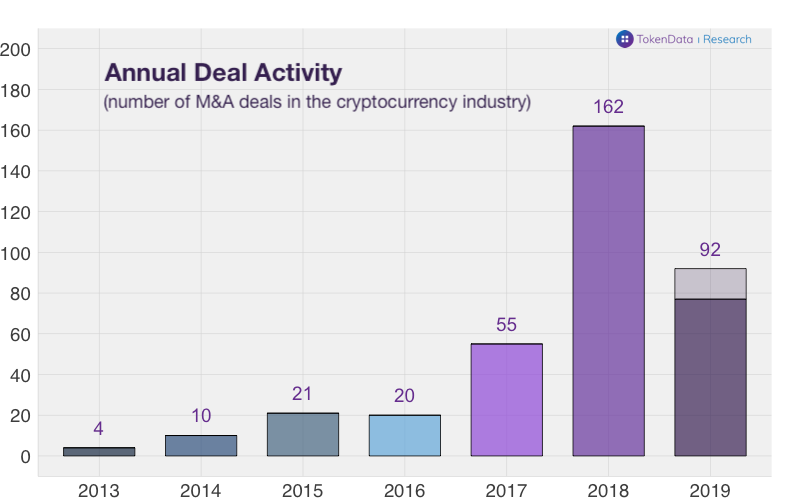

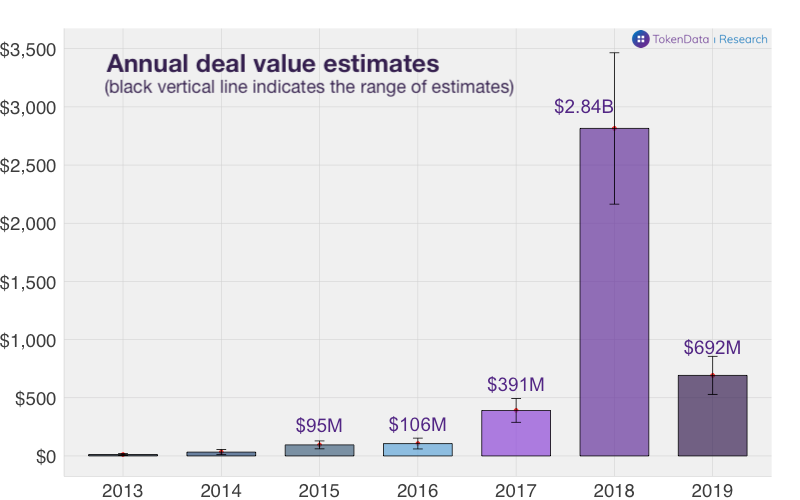

Statistics on M&A (mergers and acquisitions) are not impressive.Activity in this area peaked in 2018 with 160 transactions.This year, TokenData analysts predict only 90-100 major acquisitions in the crypto sphere:

Since 2013, 350 M&A deals have taken place in the crypto industry.The peak of activity in this area was in 2018, remembered for the collapse of the market after the dizzying rally of 2017.

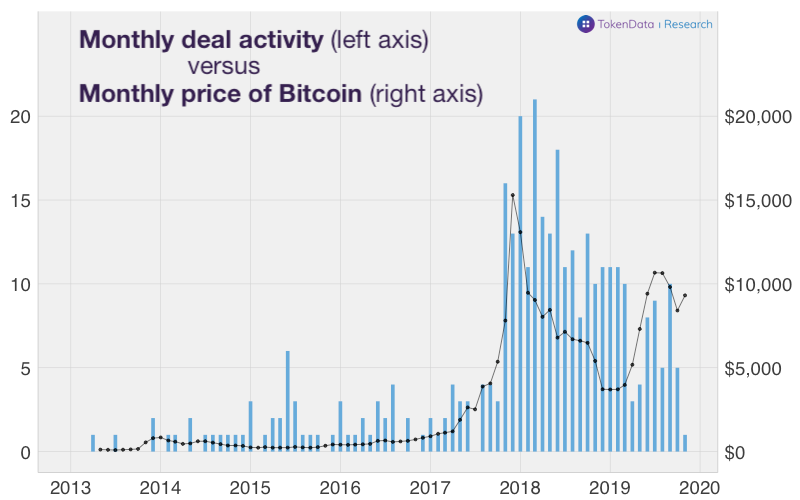

"M&A activity is volatile and seems to be positively correlated with cryptocurrency pricesMonthly activity peaked in early 2018 when prices and interest in the industry were high.", - the report says.

The left axis is the number of M&A transactions per month, the right axis is the price of bitcoin

According to TokenData, the total amount of M&A deals since 2013 amounted to $4 billion.At the same time, $2.8 billion fell in 2018 and less than $700 million in 2019.

The amount in the outgoing year is noticeably less than in the previous year, but significantly more than in 2017.

"These numbers may sound impressive, but they are small compared to the total capitalization of cryptocurrencies>This makes sense, given the early stage of the industry's development: most companies are less than 5 years old.", - experts explain.

In 2019, there was only one deal worth more than $ 100 million - the absorption by the Kraken exchange of the platform of derivatives Crypto Facilities.

In 2018, there were five transactions of comparable scale.

Not so bad

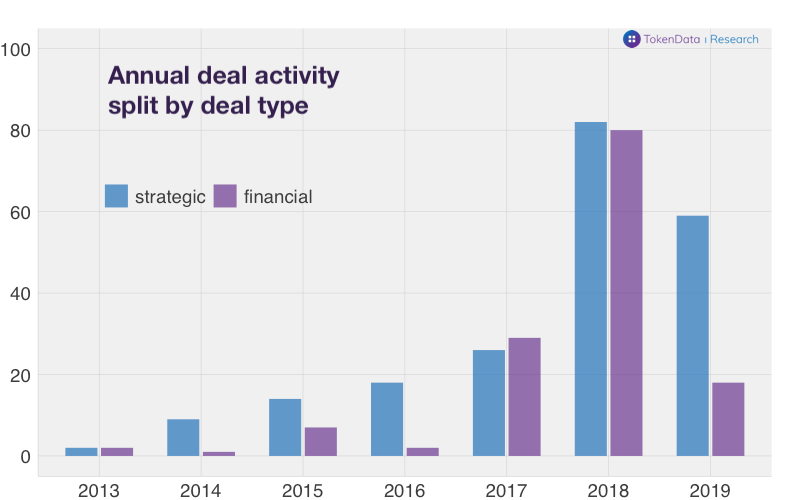

On the other hand, there are also positive trends: while in the past M&A was dominated by purely financial mergers, often with obscure motives, recently transactions have become strategic.

The dynamics of the ratio of strategic and purely financial mergers over the past seven years

"A closer look at the financial aspect of M&A activity reveals that many acquisitions involved non-industry and defunct companies that have become associated with blockchain (e.g., Long Island Blockchain) through acquisitions of small cryptocurrency startups and reverse acquisitions."

TokenData believes that against the backdrop of the sobering correction of 2018, "opportunistic and sometimes incomprehensible" deals began to disappear in the sphere, giving way to strategic M&A.

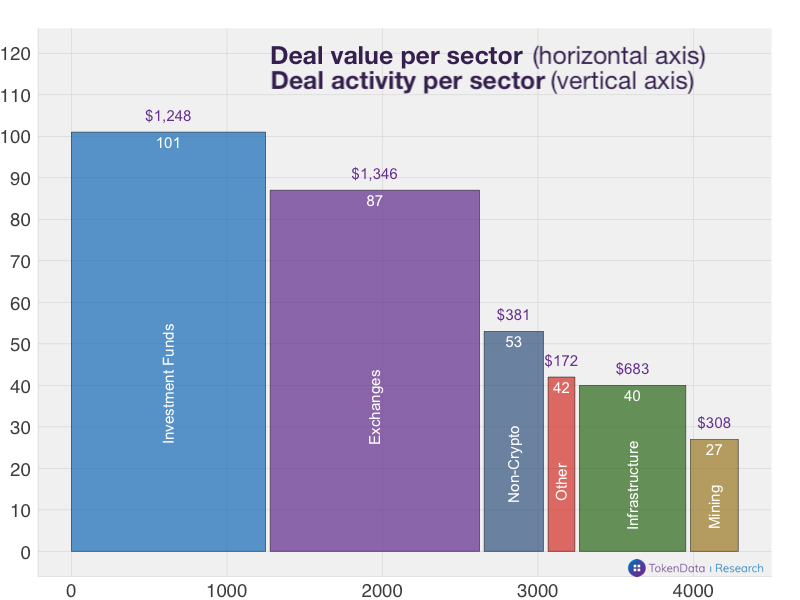

Investment funds more often than others are acquired by other companies; exchanges are also quite active:

M&A activity by sector. Funds and exchanges account for >50% of transactions.

Non-cryptocurrency companies oftenacquire blockchain startups to increase their presence in the new industry. Example: purchase of Chainspace and Servicefriend startups by the largest social network Facebook to engage them in work on the Libra project.

There is some M&A activity among infrastructure companies developing protocols and decentralized applications (dApps) — about 40 acquisitions.Mining players bought other companies quite often before the 2018 correction, but their activity almost evaporated in 2019.

Coinbase Palm

Coinbase, an American cryptocurrency company, is the undisputed leader in strategic mergers and acquisitions.The company has 16 M&A deals, among the largest deals are Earn (more than $100 million) and Xapo ($55 million).

The Kraken and Coinsquare exchanges are also quite active - 7 and 5 transactions, respectively. As for Binance, TokenData experts note the following:

"Despite its scale and the growing variety of offerings, Binance has made only three public acquisitions to date – Trust Wallet, JEX, and WazirX.However, Binance's track record includes significant investments in other cryptocurrency companies and partnerships, a strategic effectcomparable to M&A."

Many companies resort to mergers and acquisitions to overcome various regulatory obstacles.

"For cryptocurrency exchanges, M&A is a strategic tool for obtaining permits fromregulatory authorities in some jurisdictions and for certain products.Companies that have the appropriate licenses", - TokenData experts explained.

Where do the largest crypto industry funds invest?

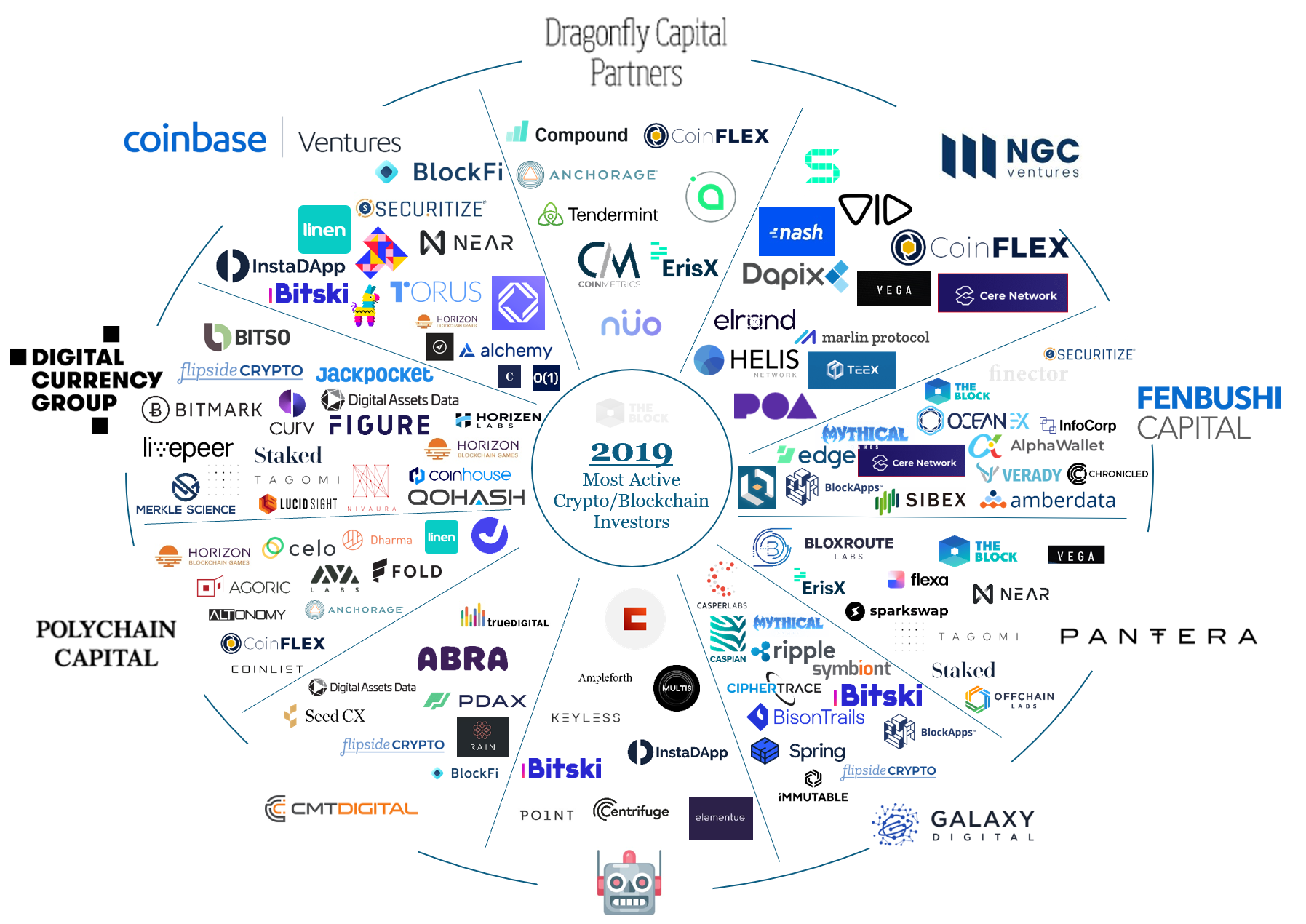

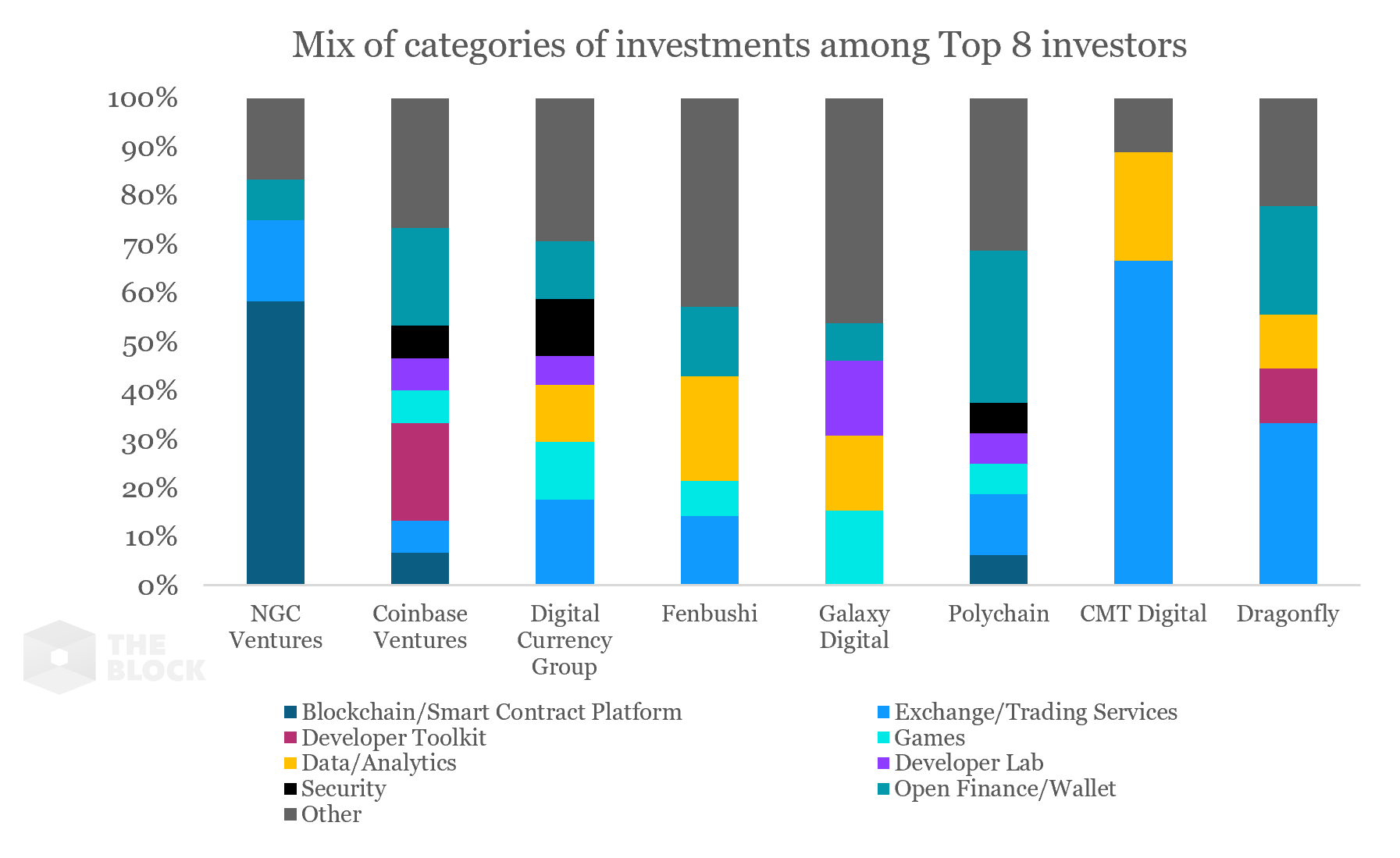

The Block publication presented an infographic that shows the main investment objects of the largest cryptocurrency funds in 2019:

Let us consider in more detail in which projects these funds were invested.

NGC Venturesis a Singapore-based venture capital firm specializing in blockchain.

Solana - working on a distributed cryptographic protocol using the Proof of History (PoH) consensus mechanism.

Vid is a blockchain-based social media platform.

Nash is a non-custodian digital asset exchange.

CoinFLEX is a supply cryptocurrency futures platform.

Dapix - Works on interoperability between wallets.

Vega Protocol is a protocol for creating derivatives and trading them in a decentralized network.

Elrond is a high-performance network based on the Proof-of-Stake algorithm.

TEEX - Second Level Solutions in a Safe Execution Environment (TEE)

Marlin Protocol - cross-chain solutions.

Helis Network is an aggregator of DeFi platforms.

POA Network - infrastructure solutions based on Ethereum.

Coinbase venturesis a division of the American company Coinbase, which invests in crypto and blockchain startups in the early stages of the life cycle.

Pinata - a set of development tools and APIs for interacting with IPFS.

InstaDApp is a “smart wallet” for decentralized finance.

The Linen App is a cryptocredit platform that plans to launch other fintech products in the future.

Securitize is a security token platform.

NEAR Protocol is a public PoS blockchain with support for sharding.

Textile - tools for scaling IPFS-based applications.

BlockFi - loans secured by digital currencies and asset management solutions.

BLADE - cryptocurrency exchange.

Alchemy - infrastructure blockchain solutions.

Torus - private key management solutions.

Horizon is a video game platform and Ethereum wallet.

Cadence is an alternative investment platform for accredited investors.

o (1) Labs - computer systems using cryptocurrencies.

Commonwealth - a portal of on-chain management.

Bitski - software solutions for the interaction of digital wallets with other applications.

Digital currency groupis one of the most active investment firms in the crypto industry.More than 100 companies.

Bitso is a Mexico-based cryptocurrency exchange.

Flipside Crypto is an analytic service specializing in the crypto industry.

Bitmark - digital rights solutions.

Livepeer is a decentralized streaming platform based on Ethereum.

Horizon is an Ethereum-based video game and wallet platform.

Digital Assets Data is an analytic platform for the crypto industry.

Qohash - data protection solutions.

Merkle Science - risk management solutions that allow companies to identify facts of the use of cryptocurrency in illegal operations.

Jackpocket - cryptocurrency lotteries.

Curv is an institutional oriented digital wallet.

Tagomi is a cryptocurrency broker.

Figure - credit lines secured by residential real estate; The startup uses its own Provenance blockchain.

Horizen Labs - enterprise solutions based on distributed registry technology.

Nivaura - blockchain solutions for the issuance and management of financial assets.

Coinhouse is a French cryptocurrency exchange.

Lucid Sight is a developer of blockchain games based on Ethereum.

Staked is a platform for institutional investors that allows you to earn income from cryptocurrencies based on the Proof-of-Stake algorithm.

Fenbushi capitalis Asia's most active venture capital firm specializing in blockchain projects.It was founded in 2015.

Amberdata is a research startup.

SIBEX is a Swiss cryptocurrency exchange.

Verady is a provider of accounting and tax solutions for the crypto industry.

InfoCorp is a FarmTrek-based blockchain platform that provides financial services for developing countries.

BlockApps - corporate BaaS solutions.

AlphaWallet is a mobile Ethereum wallet.

Mythical Games is a blockchain games developer.

Edge is a developer of digital wallet and custodial solutions.

finector - a provider of research and consulting services for the blockchain and crypto industries.

Chronicled - enterprise blockchain solutions for supply chain management.

OceanEX - cryptocurrency exchange.

Cere Network, Securitize, The Block Edition.

Galaxy Digital Ventures– manages a diversified investment portfolio, including infrastructure, custodial and B2B solutions.The company also manages a venture capital fund with $336 million in assets.

The aforementioned BlockApps, BlockFi, Digital Assets Data, Bitski, Flipside Crypto and Mythical Games, as well as:

- Spring Labs - data protection solutions;

- Casper Labs - developer of the PoS protocol based on the Casper solution;

- Immutable - a blockchain game developer who created Gods Unchained;

- Bison Trails - infrastructure blockchain solutions;

- Cipher Trace - developer of analytical tools for cryptocurrencies and blockchain;

- Ripple - California fintech startup, also known as the XRP token;

- Symbiont is a corporate sector-oriented startup that implements blockchain in traditional technologies of the financial market.

Dragonfly capital partnersis a venture capital fund with offices in San Francisco and Beijing.

CoinFLEX and Tagomi, as well as:

- Anchorage - cryptocastodial solutions;

- Compound - protocol of DeFi-applications;

- Sia - a decentralized cloud storage platform;

- ErisX - cryptocurrency derivatives exchange;

- Tendermint - the protocol on the basis of which Cosmos cross-platform platform works;

- CoinMetrics - research startup;

- Nuo is an India-based DeFi lending platform.

Polychain capitalis a San Francisco-based blockchain hedge fund.

Linen App, CoinFLEX, Horizon, o (1) Labs, Anchorage, as well as:

- Coinlist - token sale platform;

- Juno - neobank and alternative investment platform;

- Agoric - solutions for the security of smart contracts;

- Altonomy - cryptocurrency market maker, OTC service;

- Fold - an e-commerce application that pays remuneration in BTC;

- Dharma Labs - DeFi lending platform;

- Celo - a mobile application for cryptocurrency payments;

- Ava is “a platform for new assets, markets and decentralized applications.”

CMT Digitalis a division of the CMT Group, specializing in trading, infrastructure and other solutions using blockchain.

Flipside Crypto, BlockFi, ErisX, as well as:

- Seed CX - institutional cryptocurrency exchange;

- trueDIGITAL - exchange and provider of solutions based on digital assets;

- PDAX - Philippine Cryptocurrency Exchange;

- Rain - cryptocurrency exchange focused on the countries of the Middle East;

- Abra is an application that allows you to invest in cryptocurrencies.

Robot venturesis a company that invests in fintech and crypto startups at the early stages of their life cycle.

Bitski, Compound, InstaDApp, as well as:

- Coinmine - devices for cryptocurrency mining at home;

- Po1nt - mobile banking;

- Centrifuge - a decentralized platform for supply chains;

- Elementus - an analytical company specializing in blockchain;

- Ampleforth - stablecoin, positioning itself as a "smart commodity money";

- Keyless - secure authentication service;

- Multis is a cryptocurrency wallet for integration with landing and other services.

Thus, this year many funds invested in regional exchanges and other trading services.

Investments in wallets, DeFi landing services and blockchain games are also popular.

findings

In 2017 - early 2018, major transactions incrypto industries were concluded more often, and the amounts were larger. Thus, it becomes obvious that the activity of cryptocurrency funds positively correlates with the dynamics of the market.

The situation is similar in the field of M&A.Probably due to inertia after the stormy 2017, the bearish 2018 became the most fruitful year for mergers and acquisitions - 160 transactions. Only 90-100 major acquisitions are forecast this year.

However, there are also positive aspects, for example, ifPreviously, purely financial mergers, often with opaque motives, prevailed, but recently M&A transactions are more often characterized by a strategic nature.

Other companies are most actively acquiringinvestment funds and exchanges. Companies often resort to M&A to overcome various regulatory barriers and, in particular, to obtain broker-dealer licenses.

In 2019, the largest funds mainly invested in exchanges and other trading services, Landing DeFi applications, wallets and blockchain games.

Alexander Kondratyuk