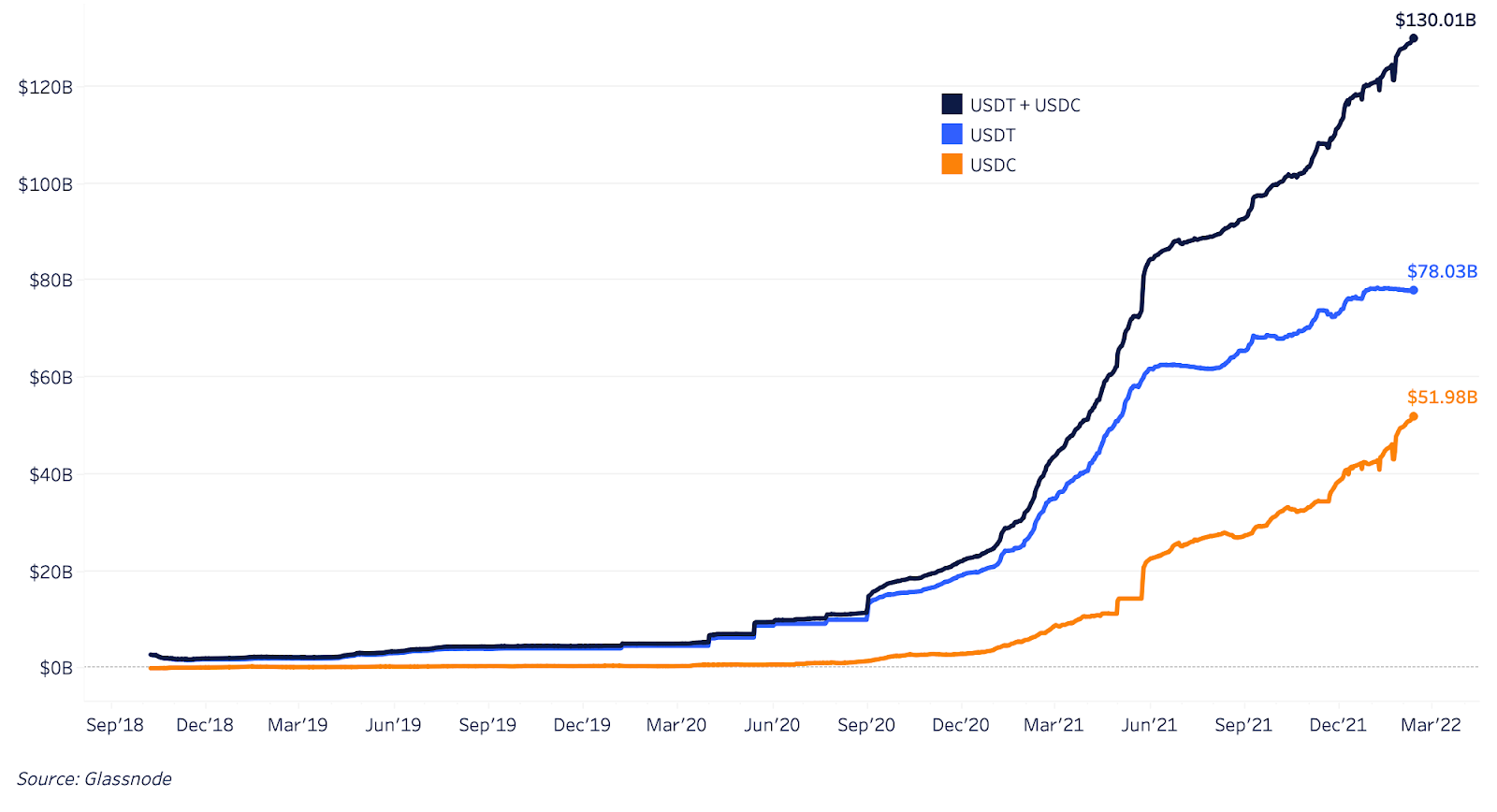

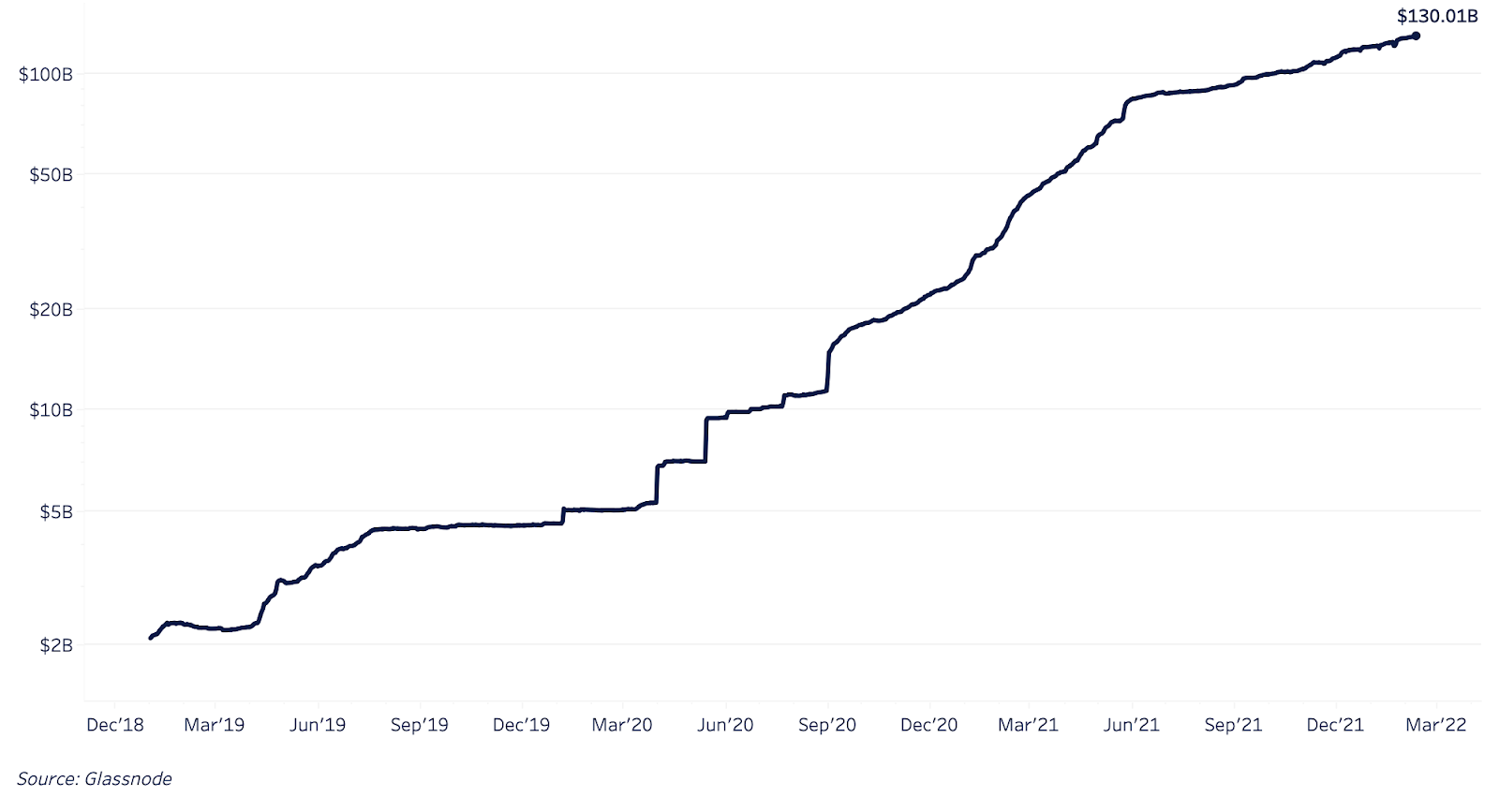

The first thing we'll look at in this review is the latest trends in the ecosystemstablecoins, where the overall supply continuesgrow exponentially. Specifically, we'll measure the growth of the market's two leading stablecoins, USDC and USDT, issued by Circle and Tether respectively. These two stablecoins make up approximately 72% of the total supply.

USDT and USDC stablecoin supply

USDT and USDC stablecoin supply (log chart)

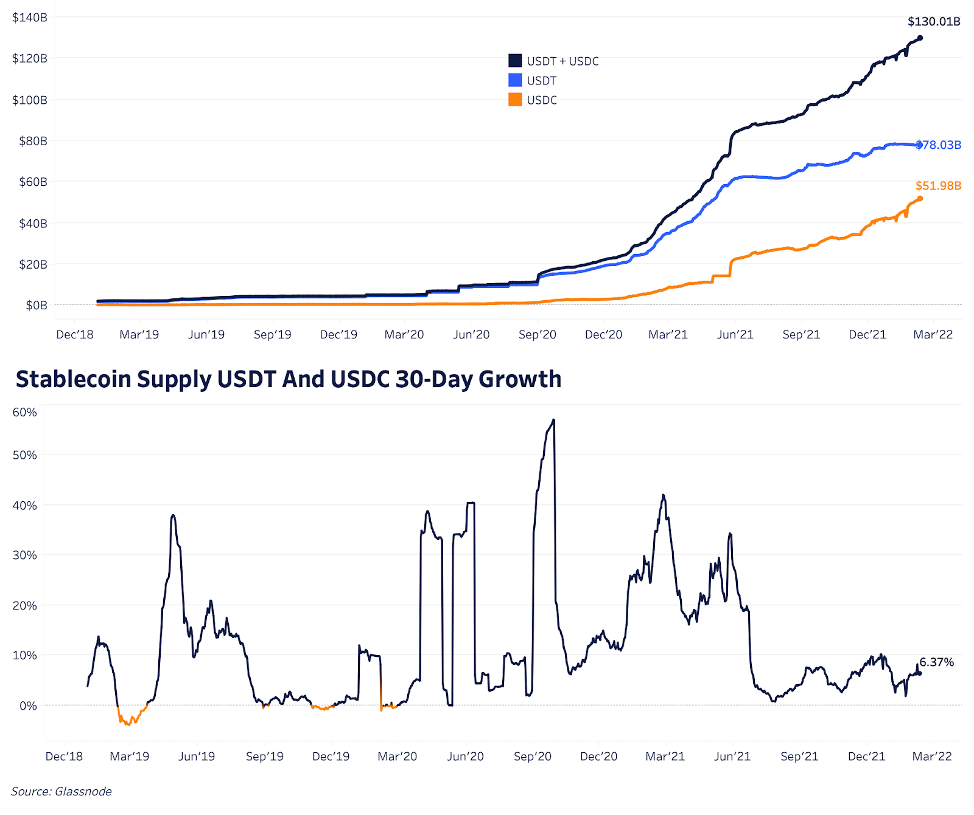

At the time of writing, the volume of circulatingThe supply of these stablecoins totals $130.01 billion, with USDT accounting for $78 billion and USDC accounting for $51.98 billion. Below are the 30-day USDC and USDT supply growth rates since December 2018, with the last month the overall growth accelerated.

USDT and USDC stablecoin supply, 30-day rise

If we take the supply of stablecoins with respect toto bitcoin's market cap, it can be noted that the growth of stablecoins has far outpaced the growth of bitcoin's market cap, which is by no means an unhealthy dynamic. Stablecoins are just an easier way to store and move fiat capital than through the traditional system, and hence are expected to grow rapidly as the market matures.

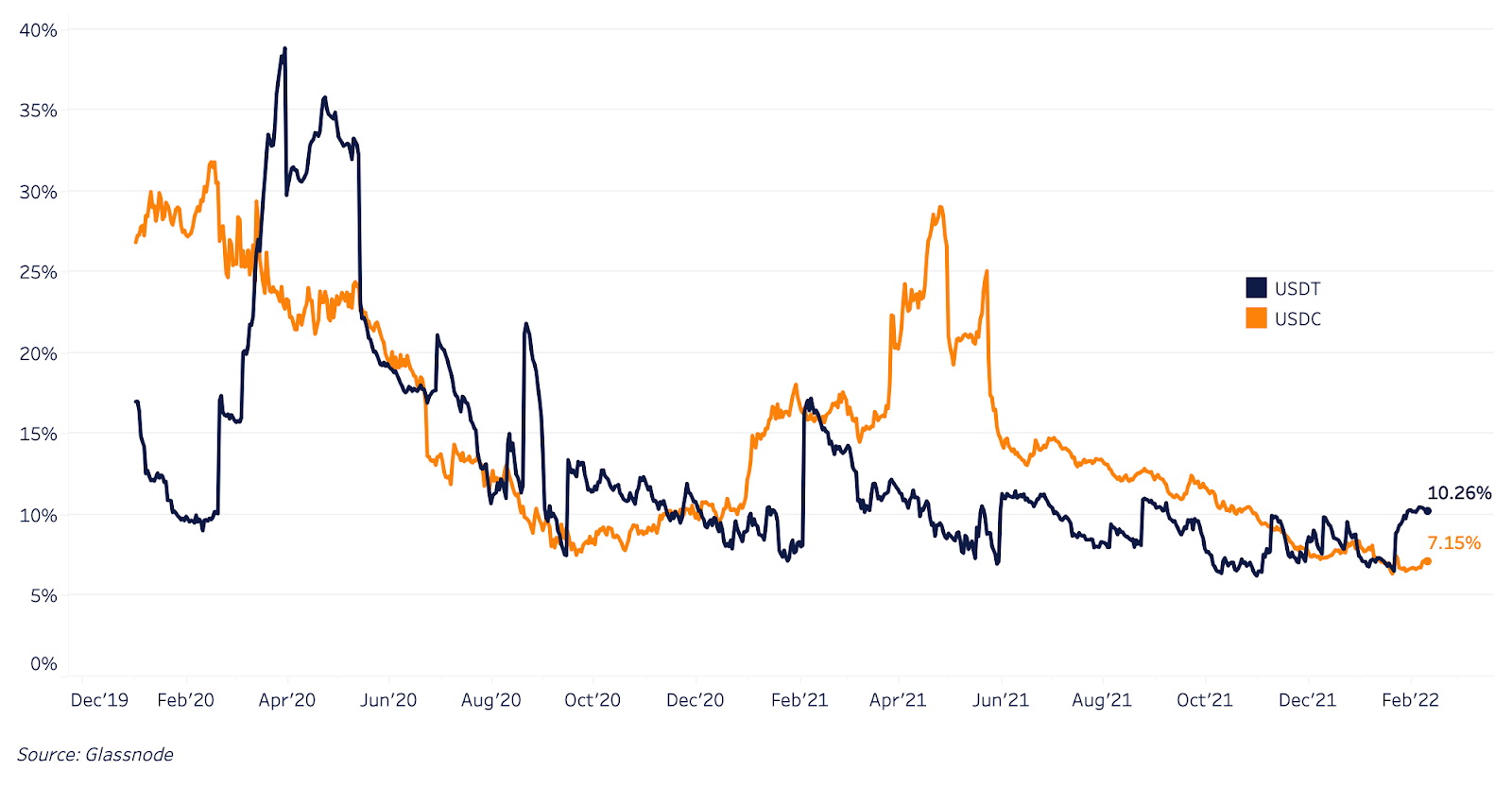

Stablecoin Supply Ratio (SSR)

When the SSR is low, the purchasing power of bitcoin is high, as the same amount of US dollars can buy relatively more BTC, and this is an indicator that the price of bitcoin is more likely to rise.

Conversely, a high SSR means fiat hasweak purchasing power. Hence, even when the general sentiment is bullish, it becomes increasingly difficult to push the price of bitcoin up — and even selling pressure is created.

Top and bottom bands applied tocoefficient, are 200-day moving average Bollinger bands to account for volatility, and breakouts above/below the line signal an increase in the trend. We can observe this relationship in the SSR oscillator, which is obtained by the position of the SSR relative to the upper and lower bands. The metric is currently slightly above the lower band, signaling that the free margin supply relative to the Bitcoin market is high, which is an encouraging sign for the market.

SSR Oscillator

The caveat will be thatthe relative supply of stablecoins on exchanges is currently quite low compared to historical standards. This is most likely the result of the growing use of stablecoins outside of centralized cryptocurrency exchanges, reflecting their potential market impact (which has grown significantly in recent years).

Supply of stablecoins USDT and USDC, percentage of supply on exchanges

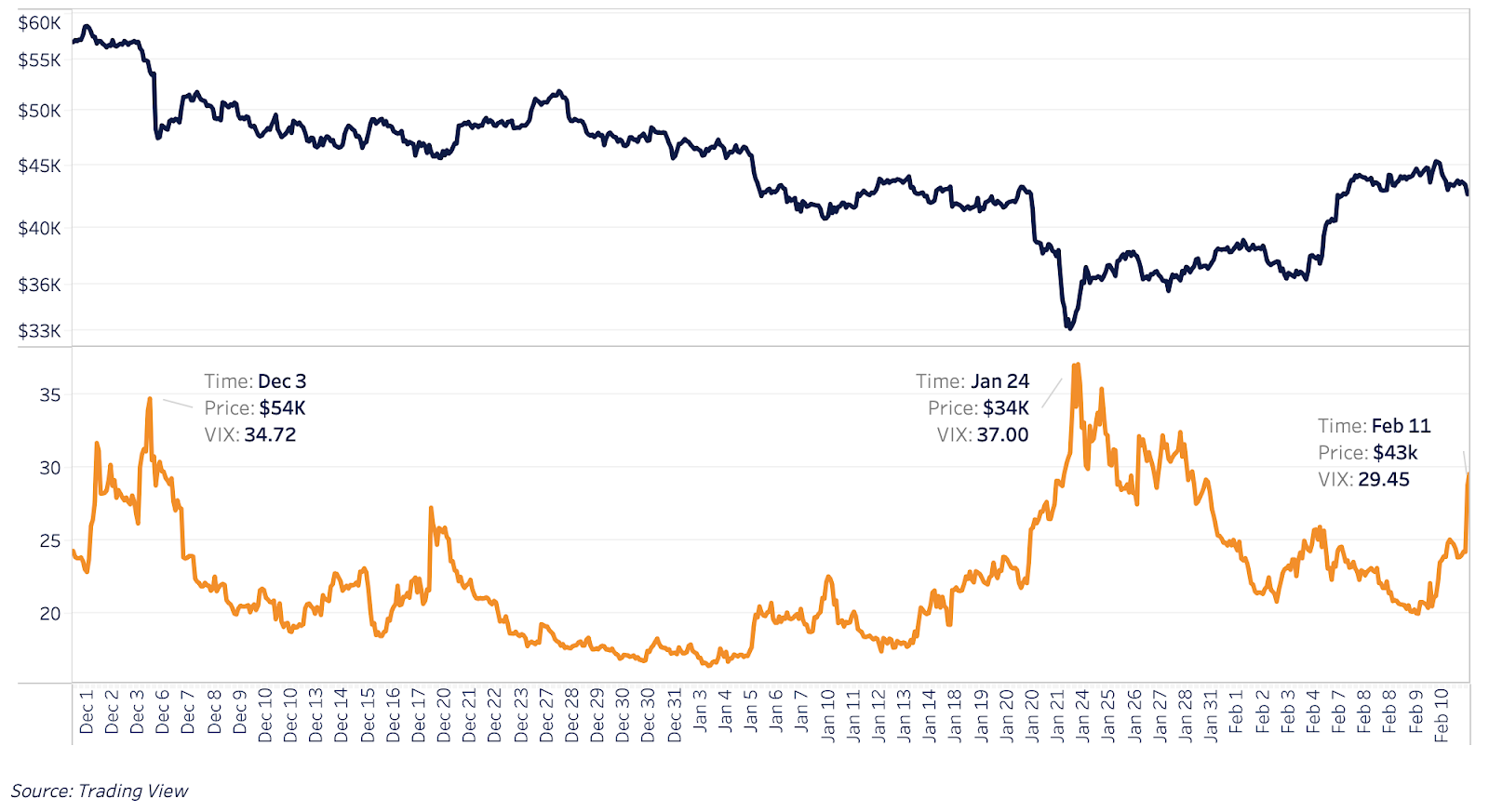

Relationship between Bitcoin and TraditionalMarkets we've been following closely for months are once again turning heads. The VIX (S&P 500 Volatility Index) has risen sharply due to geopolitical uncertainty and the growing likelihood of a Fed rate hike in 2022.

Bitcoin price and VIX

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.