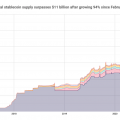

In recent weeks, months and years, there has been a lot of noise about the impact of stablecoins on the Bitcoin market andcryptocurrencies in general.Overall, the total global supply of stablecoins continues to grow and set new highs; at the time of writing, the total circulating supply is $110 billion.

Total circulating supply of stablecoins: $110 billion

In particular, there was a lot of noise around the legitimacyTether (USDT) in connection with accusations of only partial backing in US dollars (the owners of the project declared full backing of 1:1) and an artificial “pump” of the BTC price. At the time of writing, the circulating supply of USDT is 62.9 billion tokens.

USDT circulating supply: $62.9 billion

Tether Releases Results on Aug 6audit dated June 30 (PDF), which analyzed the asset allocation and maturity of promissory notes held by the stablecoin issuing company. This is an important step taken by Tether to increase the transparency of the largest stablecoin on the crypto market.

With the increased transparency and legitimacy of a leading player, an interesting trend has emerged in the stablecoin and bitcoin markets.

Stablecoin Supply Ratio Values(Stablecoin Supply Ratio, or SSR), which tracks the ratio of Bitcoin's market capitalization to circulating supply of stablecoins denominated in BTC, is close to record lows and well below those seen for much of 2021.

What does this mean?The market seems to be sitting on a huge mountain of dry powder, ready to pour into the market. If you plot Bollinger Bands on the SSR chart (to make it easier to adjust to changing market trends over time), then breakouts above the upper Bollinger Bands line and, conversely, below the lower line, can signal relatively attractive levels for opening a position in Bitcoin.

In this case, a signal to sell is rathera reason to refrain from impulsive buying under the influence of the FOMO and to exercise caution in the market, possibly freeing up more cash in order to resume the position later at more profitable levels.

On May 11, the SSR dipped below the lower Bollinger Bands shortly before the big liquidation on May 19 and is currently near record lows.

Stablecoin Supply Ratio (SSR)

Although, without a doubt, the downtrendthe SSR ratio is associated with the entry of an increasing number of stablecoin projects to the market, as well as with a significant increase in the circulating supply of existing issuers (USDT is a vivid example here), it should be noted that the value of this indicator is currently much lower than in the period from March to April, when bitcoin was trading at about the same level as today.

In general, this is a bullish factor for BTC.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>