Silvergate Capital is the parent company of Silvergate Bank, founded in 1988 and until 2013 engaged in traditionalbanking. Now the lender is one of the leading providers of financial services for companies, one way or another connected with digital currencies.

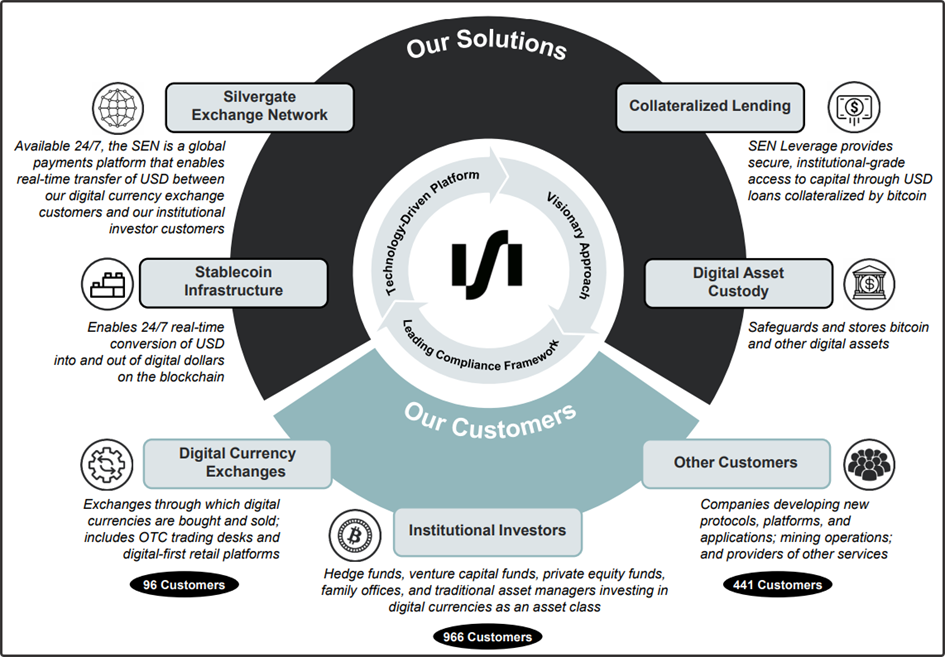

8 years ago there was no correspondinginfrastructure to enable the transfer of funds, account control for customers, and other security measures. So, 4 years later, in 2017, the Silvergate Exchange Network (SEN) payment network for cryptocurrency users appeared, which, among other things, helps developers create new products. The platform works 24/7, and allows you to quickly and efficiently transfer US dollars and euros to customers, regardless of which exchange they are on.

The great advantage of the bank is that itone of the first to plunge into the world of cryptocurrencies, having managed to get a number of largest crypto exchanges as clients, including Coinbase, Binance, Gemini, Bitstamp. Silvergate also works with nearly 1,000 institutional investors and over 400 other major companies.

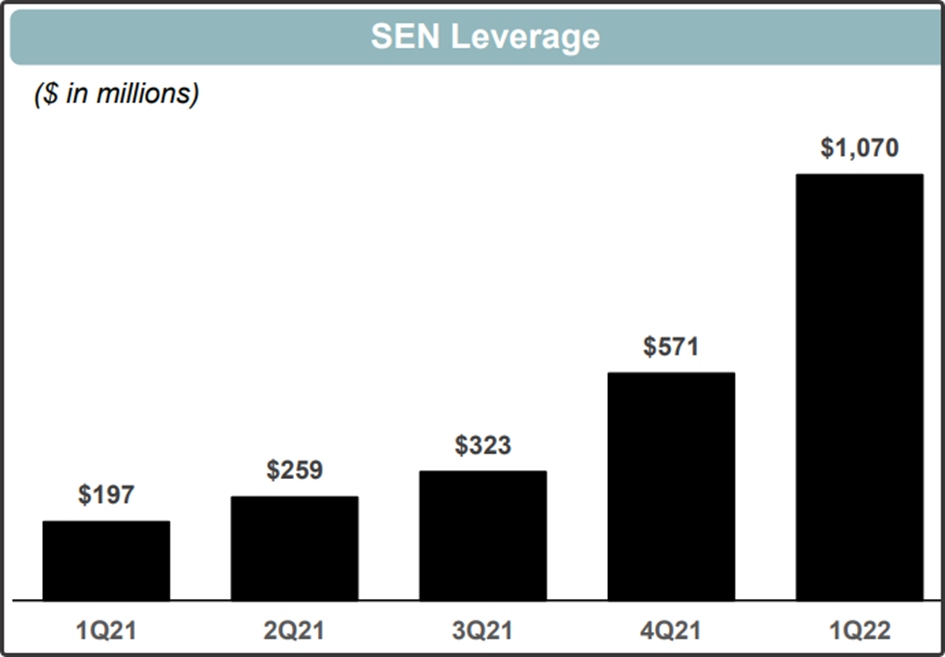

In addition to the above, the bank performs the functioncustodian of digital currencies. Another service of the lender is the issuance of loans secured by bitcoin, the product is called SEN Leverage (developed on the basis of the SEN platform).

The Silvergate IPO took place at the end of 2019.Since then, the stock has risen several hundred percent. Having a banking license, Silvergate successfully combines the advantages of classical banking and the innovations of the crypto industry. Let's talk about how the lender makes money below.

How does the bank make money?

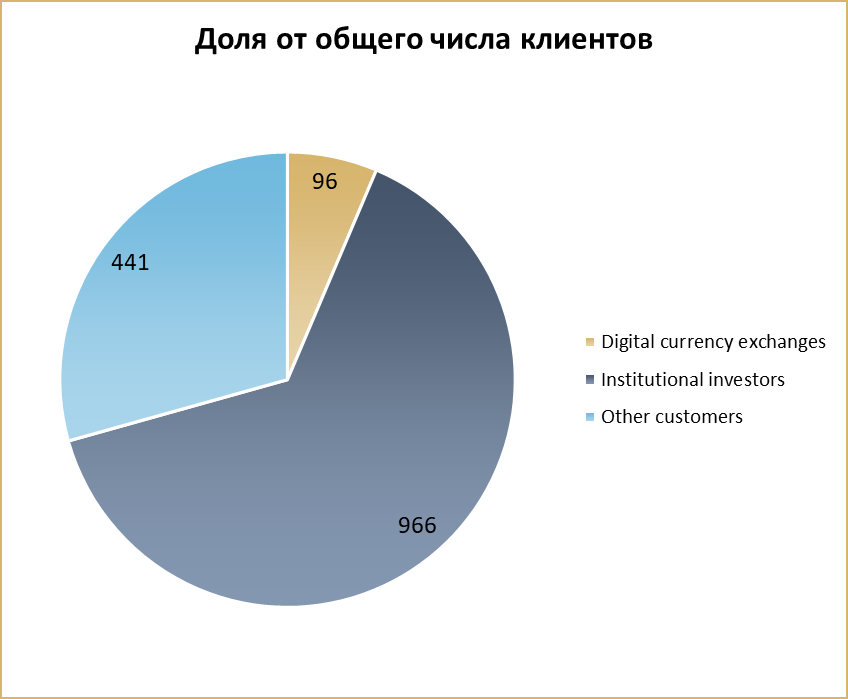

Like many other banks, Silvergate hasmost of the proceeds are in the form of interest income. Unlike many, the lender attracts interest-free deposits (an advantage of the SEN platform), which it places in deposits of other banks or buys conservative financial instruments (mainly bonds). So first you need to understand the dynamics of the total number of customers. Let's break it down by customer. As we wrote, the clientele is divided into 3 parts:

Approximately 2/3 of the total number of clients -institutional investors, there were not much less than a thousand of them. The "other clients" section includes 30% of all those who work with Silvergate. Crypto exchanges are the least of all, there were 96. The shares have not changed much since 2019, so we will leave here only the data from the report for the first quarter of 2022.

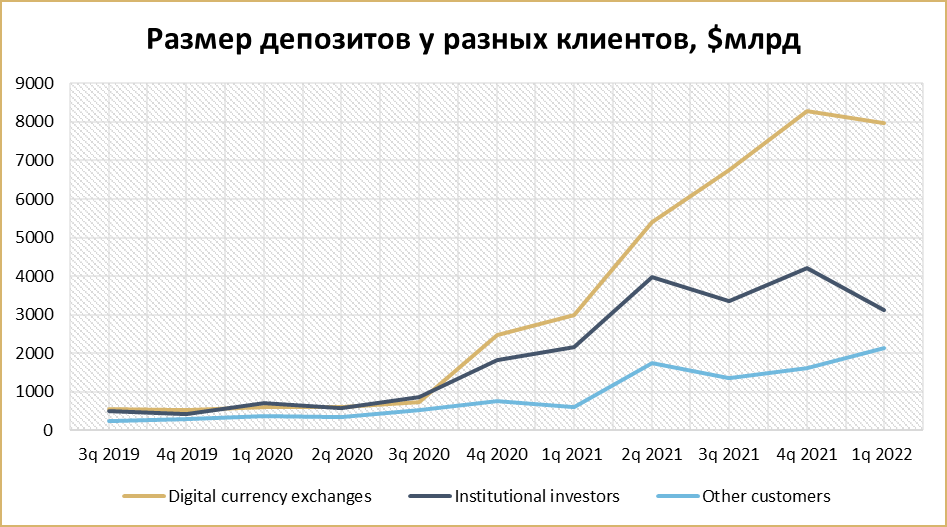

However, crypto exchanges hold the largest amount of deposits in the bank, their value is $8 billion. In total, institutional investors and other clients account for $5.2 billion.

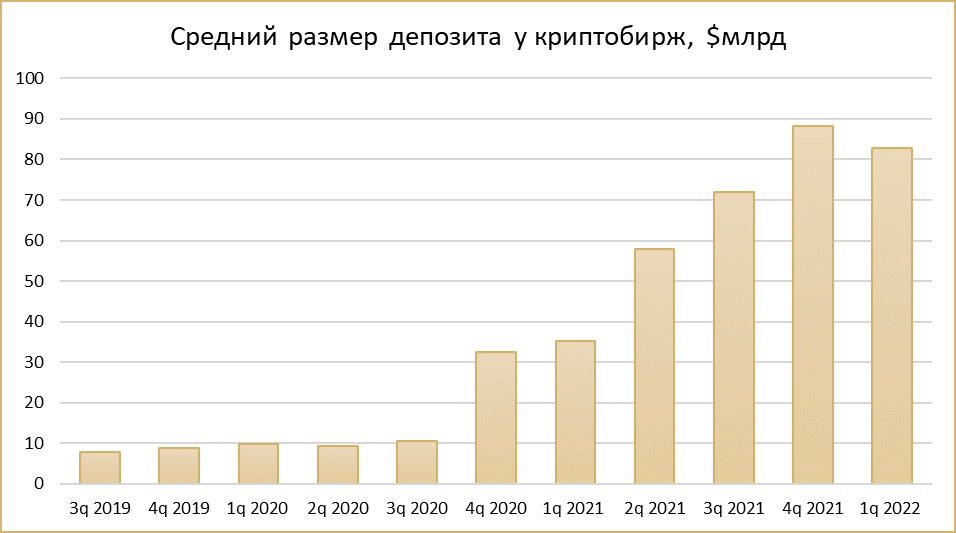

It should be noted that the growth of deposits for the most partpart was associated with an increase in the average deposit per client. Thus, since the 3rd quarter of 2019, the average deposit size of crypto exchanges has increased by 10.5 times. The growth of the indicator has been visible since the 4th quarter of 2020, when a sharp rise in prices for cryptocurrencies began. Remarkably, the average deposit did not begin to fall in the second quarter of 2021, when bitcoin (and other currencies) fell heavily in value. This gives cause for optimism.

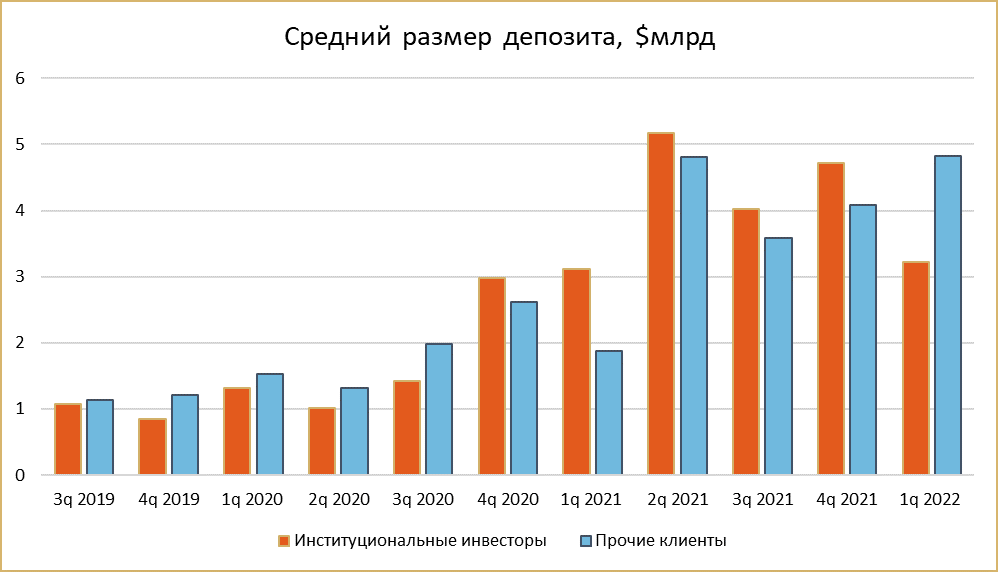

For institutional investors, the average deposit growth during this period was 200%. For other clients, the figure rose 4.3 times.

The graph below shows the relationship between the totalthe size of deposits to the price of Bitcoin. At the end of the first quarter of this year, cryptocurrencies were higher than now, and it will be important to monitor the dynamics of deposits. So far, everything is going extremely positively, and the business, despite moderate negative fluctuations, is coping very well.

What will happen if bitcoin and the whole crypto market doubles? Let's see, this will be an excellent test for the stability of the company in terms of increasing assets, but at the moment there are no big risks in sight.

However, there are also negative points.The number of crypto exchanges working with the bank has not been growing for several quarters. Apparently, the number of companies in this area is limited, and the lender is already working with key players in this niche. As for institutional and other clients, there is still an increase in the client base.

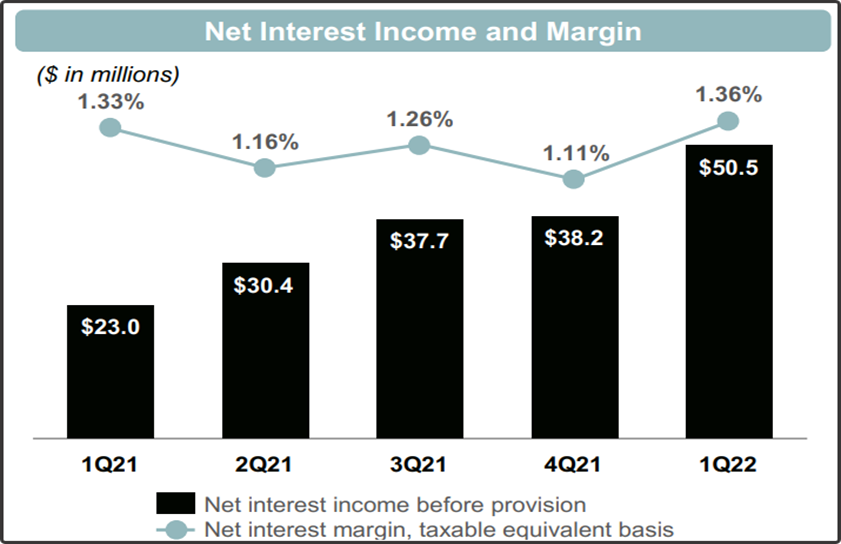

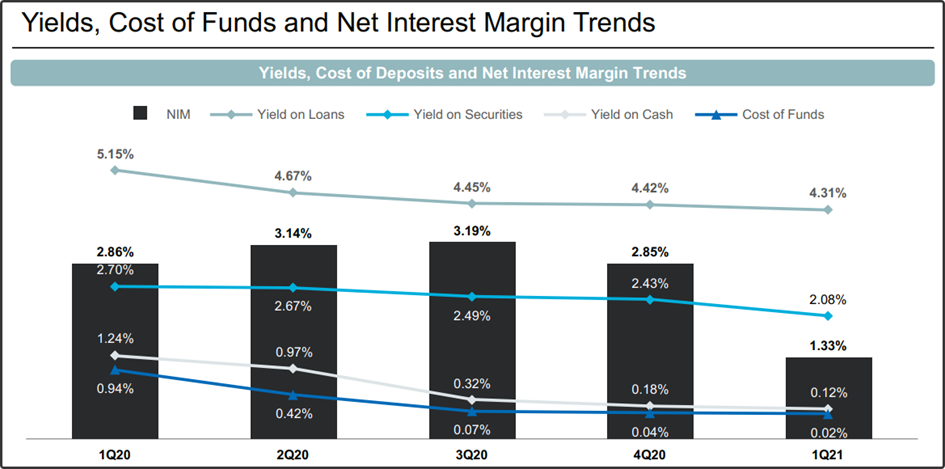

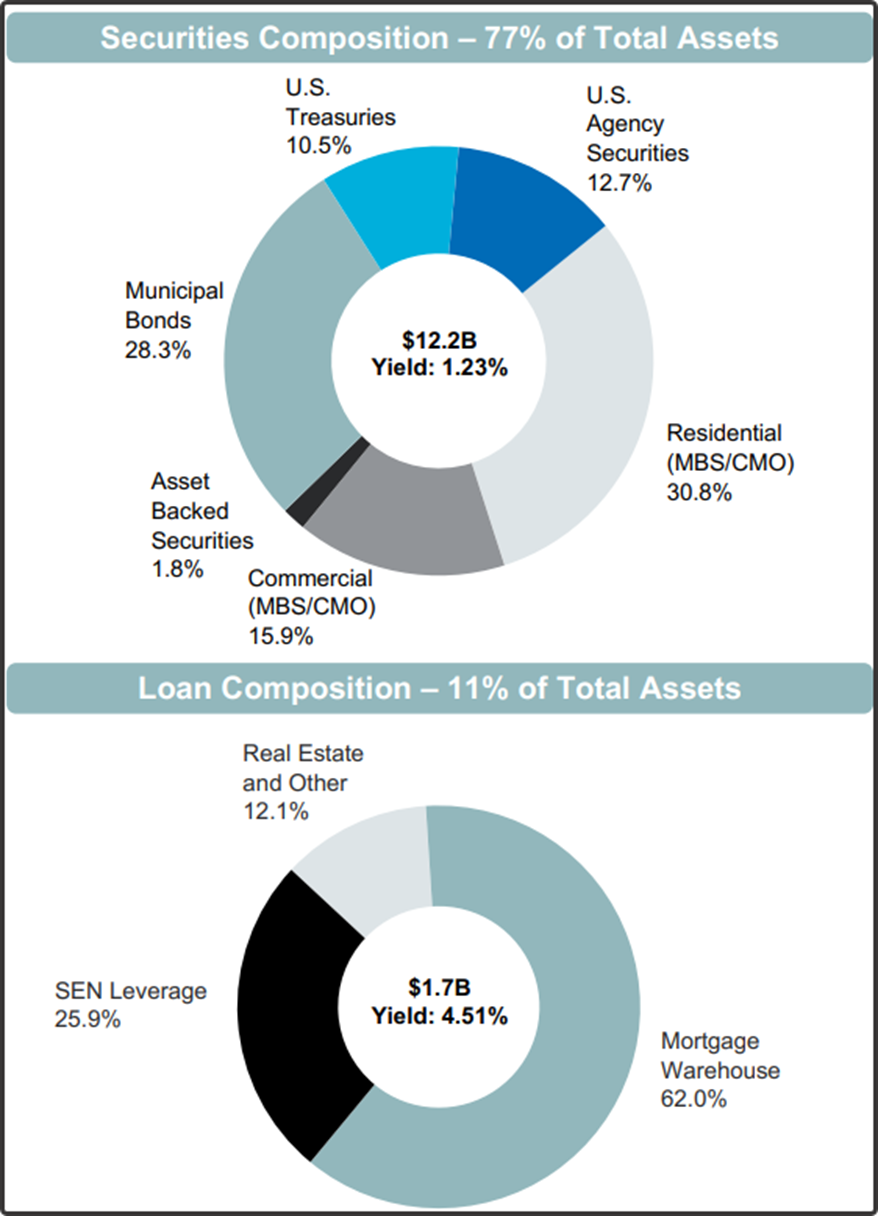

Now we need to understand the monetization of assets.Until recently, Silvergate deposited money primarily with other banks at low interest rates, but has now adopted a more efficient asset management policy. The consequence is an increase in interest income.

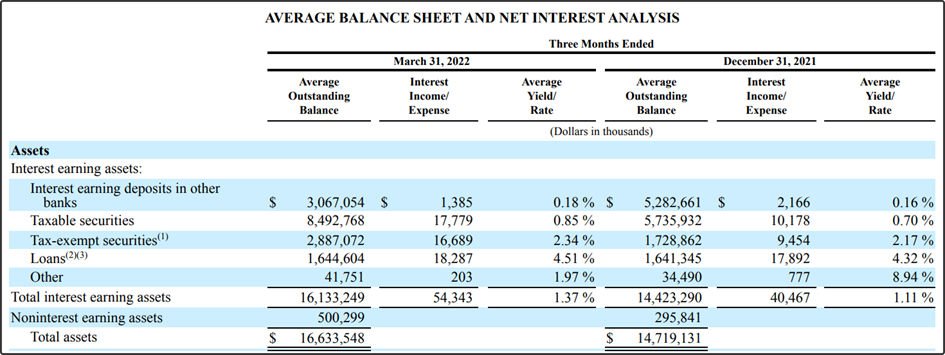

At the end of last year, the share of deposits in other banks from total assets was 36%, and now it is 18%.

Silvergate began investing in taxablesecurities and tax-exempt securities, which are much more marginal than deposits in other banks. The bank's current investments should generate strong returns in the coming quarters, as 55% floating rate securities are rising sharply in the US.

The most profitable direction is issuingloans, its margin is currently about 4.5%. But the share of issued loans in total assets is falling - if a year ago it was at the level of 21%, now it is only 11%.

Separately, we need to highlight a product called SENLeverage (issuing loans secured by Bitcoin). It is actively growing, and over the past year the volume of approved loans has grown more than 5 times, exceeding $1 billion.

Of these approved loans, about40% (in March 2021, about 60% were used) or $435 million. If we talk about used loans, they have risen 4 times over the year. Assuming a 100% growth rate of used loans over the next 2 years (conservative forecast), by the end of 2023 their volume will be almost $2 billion. This can greatly increase the bank's future income - with a margin of 4.5%, revenue will be about $90 million One of SEN Leverage's clients is Microstrategy. I must say that sharp fluctuations in bitcoin in the future can play a cruel joke - in case of a strong fall, clients will have margin calls, and they will have to take away their collateral. The bank itself will not be in the red from this, but the client will be lost.

90% of loans issued by the bank are floatingrate, which is positive due to the tightening of monetary policy. If we take Silvergate's net interest income as a whole, then the increase in the key rate by 25 b.p. promises an increase in revenue of about $23 million. With the rate going over 2% soon, and in the first quarter it was still low, we can expect a sharp improvement in financial performance. Suppose, by adding 1.5% to the rate at the beginning of 2022, we can expect an increase in net interest income for the year by $140 million. And in general, NPV for the year will be about $340 million. This is without asset growth (still questionable) and improvement in portfolio profitability by shifting to more marginal assets.

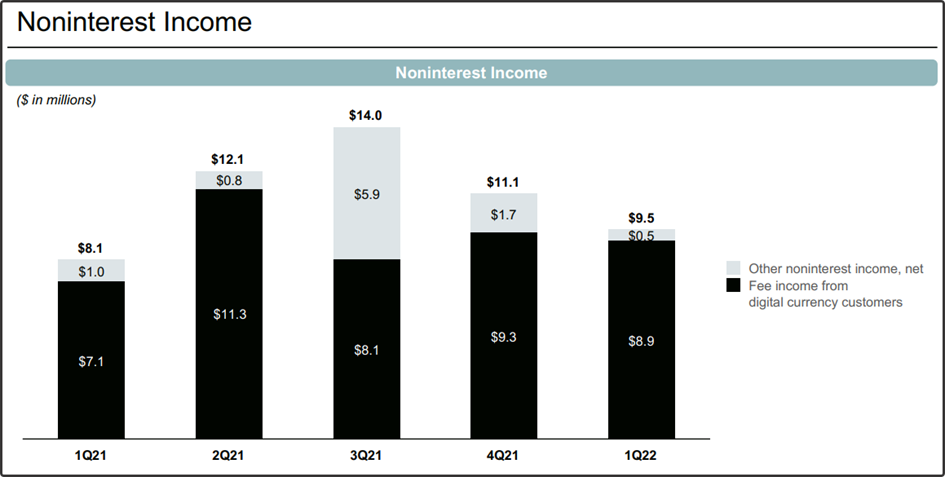

With regard to Commission and Other Income,here the key product is SEN Transfers. As part of it, a commission is taken for transactions of clients' digital currencies. Recently, this income item has not been growing, as the number of transactions has become less due to a decrease in activity in the crypto market. Nevertheless, the indicator does not fall much and is relatively stable (in the picture below, the revenue from SEN Transfers is shaded in black).

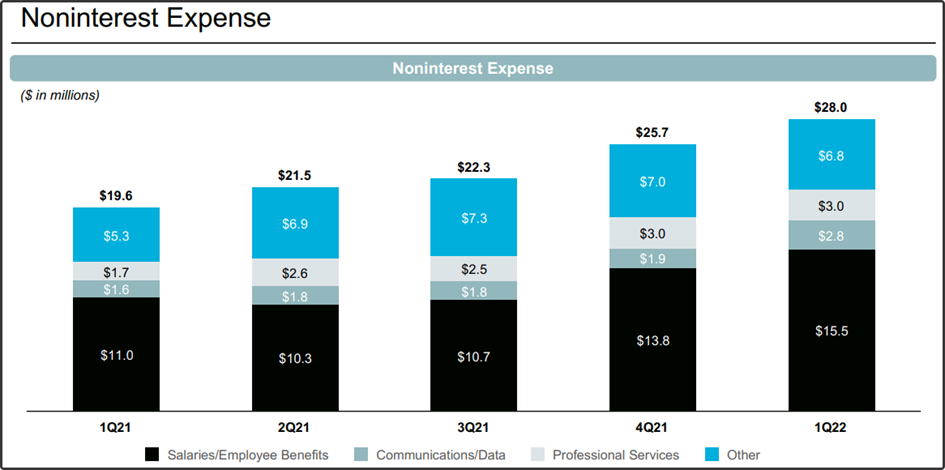

Bank costs, an important item on the balance sheet, are risingat a fairly fast pace - over the last year they increased by 43%. The pace is much lower than that of Net Interest Income, so there are no problems in this regard - it’s just that a growing business requires growing costs.

Buying DIEM and issuing Stablecoin

An important moment in the growth of the bank may be the issuanceown cryptocurrency (Stablecoin). In the middle of last year, Silvergate began collaborating with Facebook. At that time, Mark Zuckerberg's company was planning to issue its Stablecoin (U.S. Dollar Diem), and Sivergate was called upon to issue the currency. For the bank, this meant an increase in transaction income after the issuance of the currency; the ability to manage reserve deposits that provide Stablecoin; the influx of new customers for classical banking.

However, regulatory risks forced to abandonFacebook from this project, and at the end of January, a deal was announced for the bank to buy Diem's assets for $50 million in cash and 1.2 million new Class A shares issued. The total amount of the transaction was $182 million.

It should be noted that the project will not be launched in thisyear, but the bank plans to provide its main contours in the second half of the year. The stablecoin that is planned to be released will have a different name.

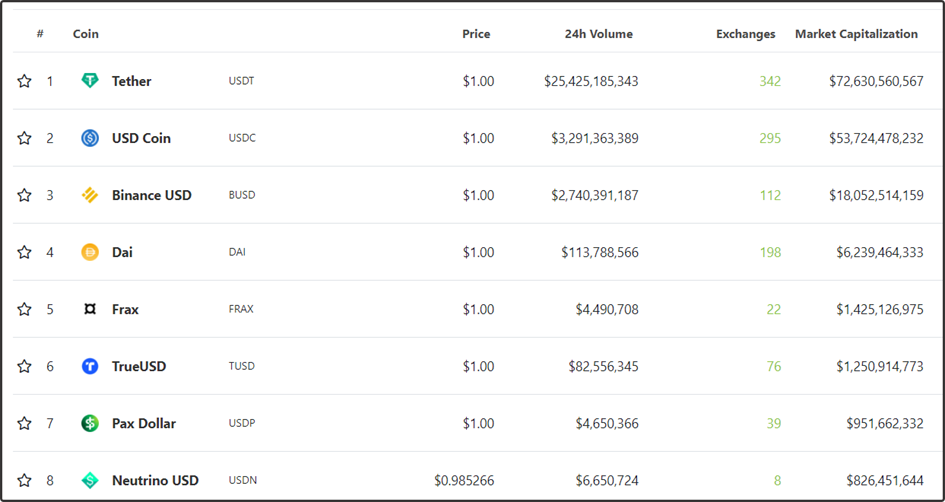

What capitalization can expectSilvergate is hard to say, but outside of the top 4, other Stablecoins have a Market Cap below $5bn. You have to be a big optimist to talk about $10bn+. Therefore, the chances of attracting a lot of funds do not seem to be the highest. Moreover, the Facebook audience, which was originally calculated, is no longer relevant. On the other hand, SEN's large customer base and the continued development of the platform could do a good job. Moreover, working with a large number of crypto exchanges (which do not have their own currency) increases the likelihood of currency advertising. But while the project is not at the final stage, and it is unlikely that we will be able to see any result before mid-2023.

Issue of new shares

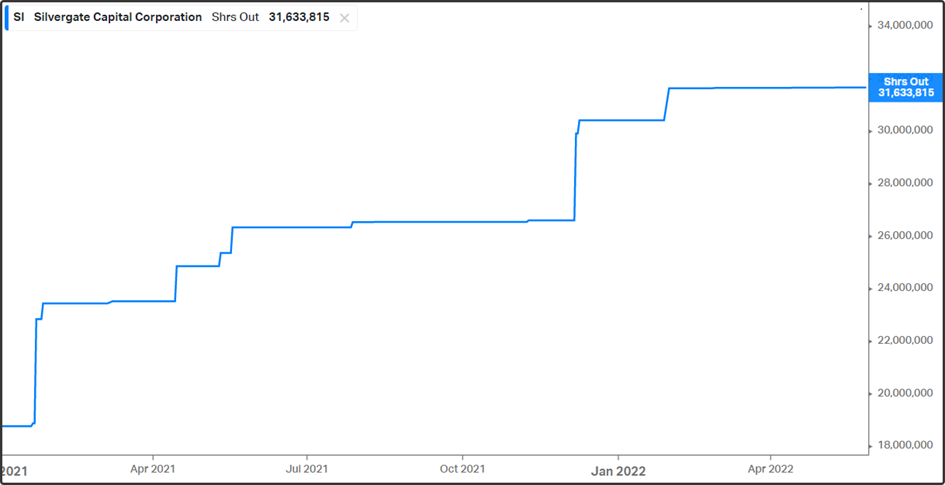

Due to the fact that banks must follow a number ofregulatory requirements, a sharp increase in assets must be accompanied by an appropriate amount of equity capital. In this regard, the bank has to issue new shares, thereby attracting new capital. Thus, the total number of Class A shares increased from 18.7 million shares at the beginning of 2021 to 31.6 million shares at the moment.

This means that if the market capitalizationSilvergate is up 80% in that time period, the share price hasn't really changed. If the bank continues to increase deposits and increase the size of assets, we should see new share issues in the future.

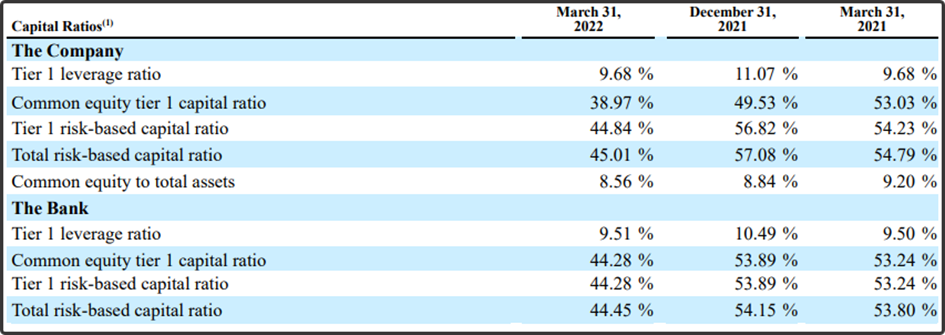

At the moment Silvergate satisfies everyonerequirements. According to regulatory standards, Tier 1 leverage ratio must be at least 5%, common equity tier 1 capital ratio - at least 6.5%, 1 risk-based capital ratio - at least 8%, and total risk-based capital ratio - not less than 10%.

Competition

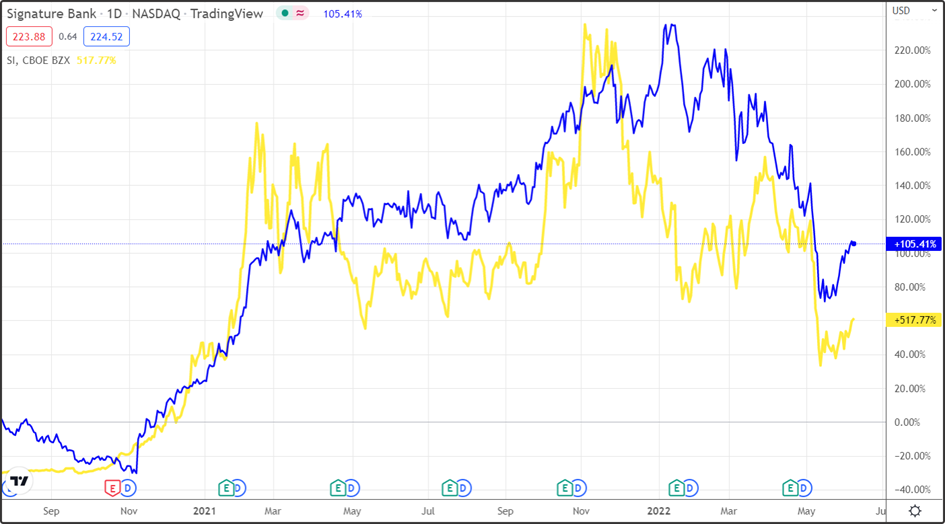

The main competitor of Silvergate Capital is consideredNew York Signature Bank. It is a larger lender with over $120 billion in assets that has built a SEN-like platform called Signet. However, unlike Silvergate, the competitor has a relatively large traditional banking business, and deposits from crypto clients amount to about $20 billion. We can say that the crypto business of the two banks is comparable.

Signature has more efficient creditbriefcase. We showed that the most marginal product is the issuance of loans, and Signature has a share of loans issued to deposits above 60%. Silvergate is several times inferior in this indicator. The pluses also include the payment of dividends (the dividend yield is about 1% per annum).

On the other hand, Si is able to uselow base effect and increase the share of loans in the portfolio thanks to SEN Leverage. In addition, almost all deposits for Silvergate are free, and this is a clear competitive advantage for Si. If for Signature an increase in deposits by $12 billion is only +10% to total assets, then for the bank we are considering this is almost a doubling.

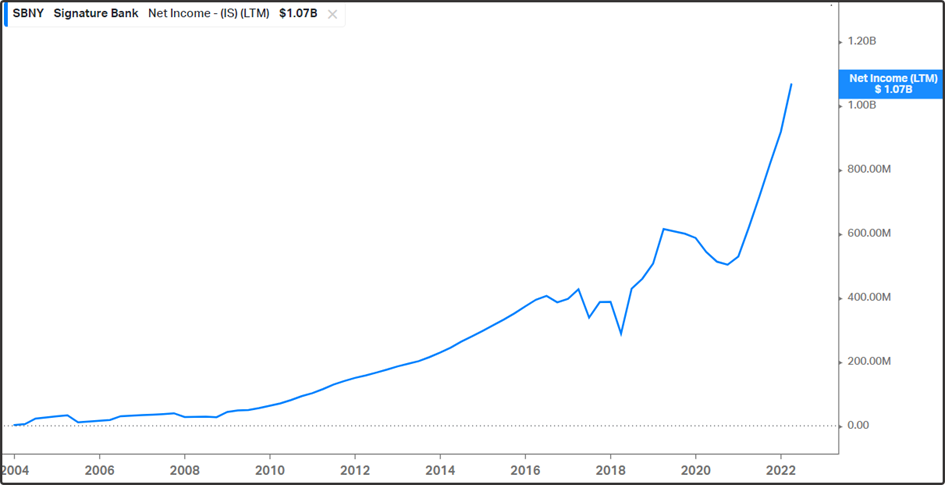

You need to understand that Silvergate is able to growmultiple, while Signature is more stable and possible drawdowns for the second one are lower. In general, SBNY is a very stable bank, which is steadily increasing profits and has not shown a single loss-making year. We will cover it in a separate review.

There is a certain correlation between assets, this must be taken into account.

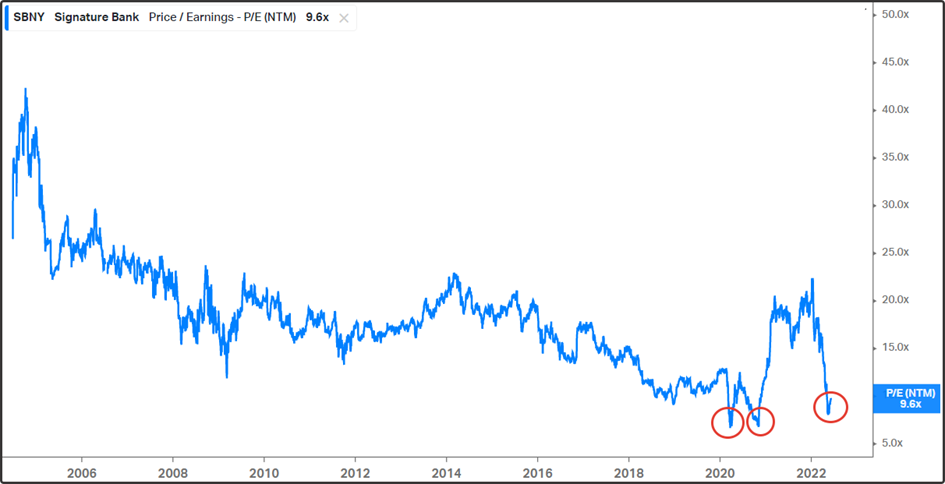

Historically by multiple P/E Signaturefluctuated around 10-20, and now dived below this range. Perhaps this is a signal to buy, although quotes have already rebounded from the lows. Since Si and SBNY are correlated, there is a chance for Silvergate to bounce as well.

Bank valuation

First of all, remember that the growth of the key rategives the bank an additional $23 million for the year. Above, we calculated that in the near future, excluding asset growth and the development of more marginal products such as SEN Leverage, Silvergate's interest income will be approximately $340 million. The bank's operating costs in the first quarter amounted to $28 million. Assuming that, on average, in a year and a half (when the rate is already high for a year), quarterly costs will amount to $40 million, for the year (for the last 12 months) the figure will be $160 million. year we can have the following picture:

Interest Income ($340 mln) + Noninterest Income ($40 mln) - Operating Expenses (160 mln) = $220 mln

Now the bank is worth $2.7 billion, and by the 3rd-4th quarter2023 P/E could be 12 (2.7 bln/$220 mln). At the moment, the forward P/E is estimated at 17.8. The indicator was below 10 only in March 2020. Recall that the bank has never been unprofitable.

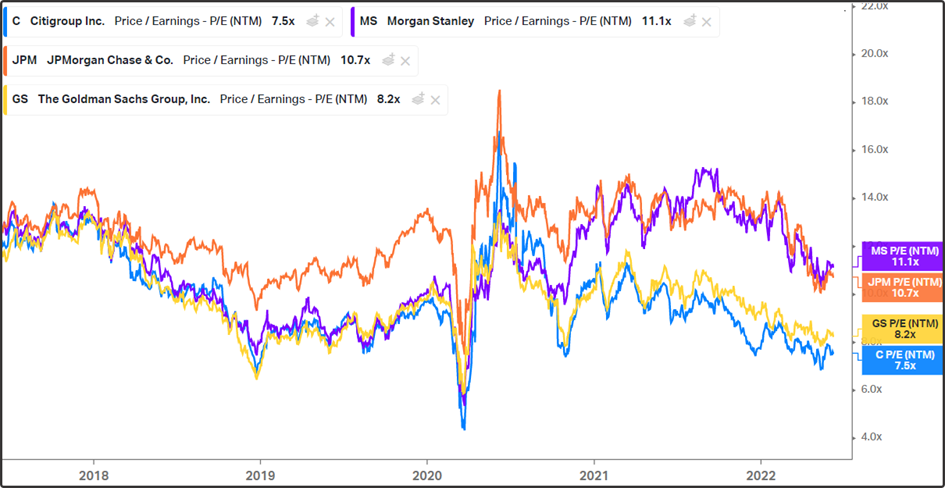

If we talk about large banks, then herethe average forward P/E is 9. However, the comparison is hardly the most successful - the business has significant differences, risks, growth rates of key indicators, etc.

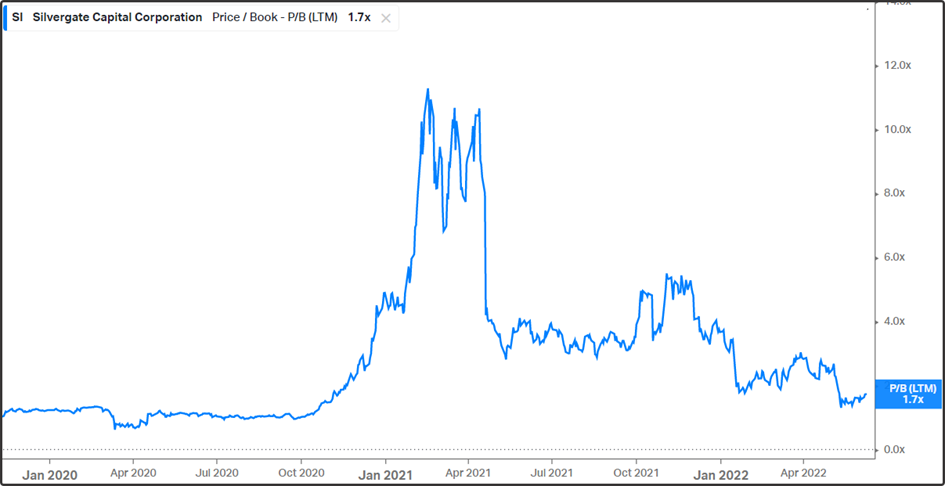

P/B, another key multiple for the banking sector, is at 1.7. The incredible 5-10 are already behind us amid the correction and growth of the balance.

It must be said that with the growth of depositsSilvergate will again have to issue new shares, which will increase the book value. Therefore, in the future, this indicator may fall, which, in principle, is not bad for the company's valuation.

The lender does not pay dividends, this is a classic growth story.

Bitcoin and Silvergate

At the moment, the market accepts Silvergateas a pure crypto asset, and the correlation of bank shares with bitcoin is extremely high. The fact that the lender's profit should grow with the tightening of monetary policy, and the size of deposits does not fall despite a noticeable correction in cryptocurrencies is still ignored by the market.

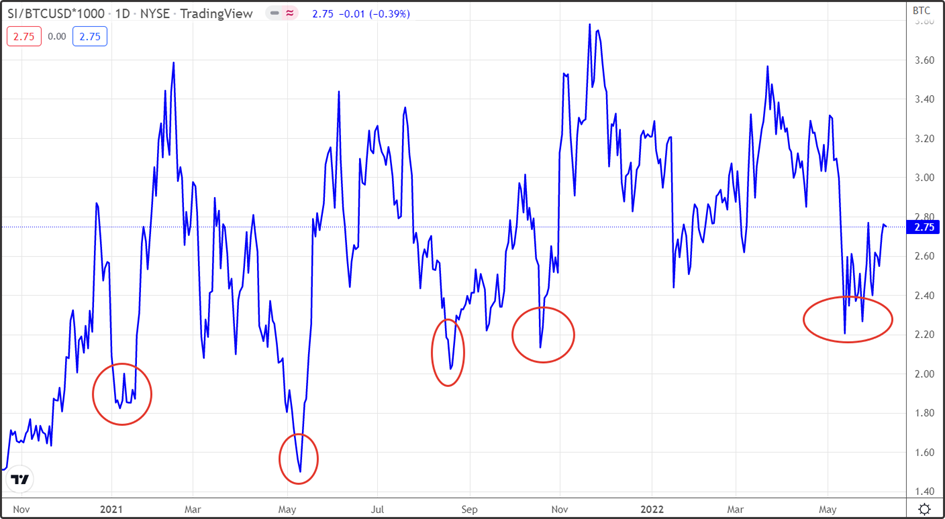

You can create an indicator by dividing quotes Sion Bitcoin. Over the past 2 years, he has given good signals to enter stocks several times. We believe that so far there are no prerequisites for the bank’s securities to move noticeably worse than Bitcoin.

findings

Silvergate Capital is a growing business thatover the past few quarters, it has been expanding regardless of fluctuations in cryptocurrencies due to an increase in the client base, a multiple increase in the average deposit size and optimization of the asset portfolio. All these factors remain relevant to this day. The bank also has a number of promising projects, including the issuance of its own stablecoin.

Key risks include those associated withwith the sphere of digital currencies (regulatory, etc.) and the possible fall of cryptocurrencies (it is not entirely clear whether customer deposits will decrease in such a scenario).

The volatility of stocks is about the same as that of bitcoin. This, in our opinion, is more of a plus than a minus - paper is capable of giving X's.

Enter the asset with a large percentage of the portfoliodangerous. The likelihood of Bitcoin falling further is high - in recent quarters it has had a high correlation with the S&P500, and US stocks are not so cheap. In a bad scenario where Bitcoin doubles or triples, Silvergate will almost certainly be dragged lower, but the growth of the business will already provide excellent entry points.

We would enter the asset in order to catch a rebound of 1-2% of the portfolio. And this is not an individual investment recommendation.

Read more analytical reviews in our telegram channel: t.me/kolchugacapital