The beginning of the topic and here is the whole base. Big and easy earnings based on probability theory

The essence of the strategies is hereonly in the first post

A cook earns a lot and blindly in a small insurance business at 2.5% per week

here at the end there are two posts for those who, after 100 trades in trading, only break even https://smart-lab.ru/blog/719482.php

SOMETIMES I FORGET TO CORRECT THE NUMBERS. THEREFORE, IF SCREEN CONTRAINS THE TEXT, BELIEVE THE SCREEN.

OVERVIEW of the second strategy:

Grew up to 65,100 for bitcoin.

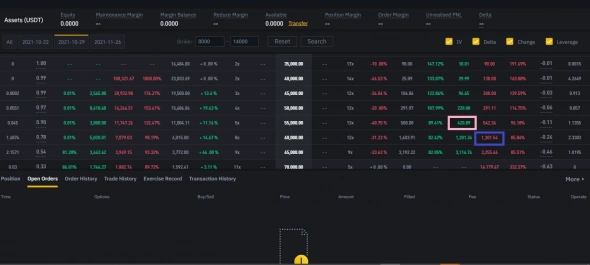

When we opened positions, the price was 60130.It is necessary to close the old position and open a new one. Mathematics and the laws of probability are still with us and work for us. This is often the case in the insurance business. And this I am showing the simplest strategy for beginners, which implies being in the market forever, without looking for good entries. We follow the rule and buy back at 1302 (blue) what we sold at 4148. We are talking about a put of 60,000. This gives a plus of 2846 dollars. Then, we sell at 421 what we bought at 2275. We are talking about put 55000 (pink). This gives a minus of $ 1,854. From 2846 we subtract 1854 = 992: 1000 * 3 = 2.976 dollars. The previous result was $ 13.66. This means that the total profit is $ 15.976.

OLD POSITION:

Expiration 10/29/21. Bitcoin price 60 130.

Bought put 55,000 at 2275 and sold put 60,000 at 4148.

Today is 10/20/21. Expiration 10/29/21.

We look at the first picture.

Bought put 60,000 at 1302 and sold put 55,000 at 421.

Yes, Bitcoin jumped out very quickly.And three days have not passed since I opened an old position. It’s a pity that this cryptocurrency does not have government support. If there was this support, then it would be an ideal tool for insurance. I advise everyone to trade this way. It’s good that new monthly options have appeared and we need to open a simple insurance position there again.

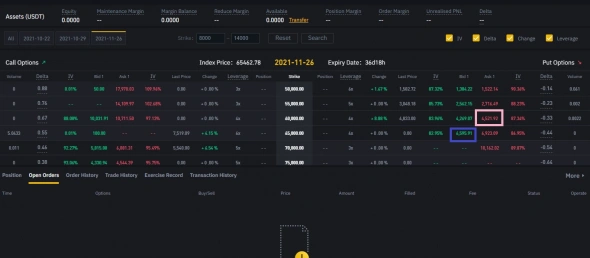

We choose the date 11/26/21. Then, we follow the rule and first buy the more distant pink put and then sell the near blue put, as it is written in the “new position”.

BASIC STRATEGIES.

We start from 05/27/21. At a share price of $ 42054.

FIRST STRATEGY: For those who want to have an average of 400-500% over 10 years.

Sell blindly monthly spreads with a difference of 500dollars. With a share price of $ 41,544, we finally need $ 12,000, with a 10% risk of losing them. But keeping 12,000 in your account is wrong, because 10,800 of them will be needed only 50% of the time. Therefore, it is easier to spend those 10,800 on another business or put on a deposit. 1200 is enough for now.

Close the position at the end of the expiration or when the stock rises by $ 5 and open a new monthly spread.

OLD POSITION:

Expiration 22.10.21.

Bought 445 puts at 4.17 and sold 450 puts at 5.68.

Today is 19.10.21. Expiration 22.10.21.

We look at the first picture.

Bought 450 puts at 2.7 and sold 445 puts at 0.93.

NEW POSITION: at the 449.14 junction.

Expiration 11/19/21.

Bought put 444 at 4.94 and sold put 449 at 6.44.

Result: $ 474.

A deposit of $ 600 for 1 attempt (out of 30 attempts, about 18,000 are needed).

SECOND STRATEGY: On Binance. Here we will also trade monthly insurances.

I recommend to those who do not have at least 300dollars to trade insurance for Sberbank on the Moscow Exchange. And it makes no sense for non-residents of Russia to go to the Moscow exchange if they have less than $ 3,000. And if there is $ 3,000, then it is better to trade options on the RTS futures.

It is very easy to open and replenish an account without leaving your home.

Trading has been conducted since 06/07/21, I brought in $ 16, but $ 4 of them is a deposit. Only $ 12 works per try. We trade 0.0003 lots.

OLD POSITION:

Expiration 10/29/21. Bitcoin price 60 130.

Bought put 55,000 at 2275 and sold put 60,000 at 4148.

Today is 10/20/21. Expiration 10/29/21.

We look at the first picture.

Bought put 60,000 at 1302 and sold put 55,000 at 421.

NEW POSITION:

Expiration 11/26/21. Bitcoin price 65100.

Bought put 60,000 at 4521 and sold put 65000 at 6596.

The result is: $ 15.976.

Deposit $ 18.

But the whole amount is $ 120 for 10 attempts.

THIRD STRATEGY: from 24.09.21

Deposit 2900 at the Moscow Exchange.

Profit 58 dollars

Now, along the way, I am leading the simplest and most profitablea newbie strategy called dynamic deltahedge. We bought 1 call at 1.175 at 127. After 5 days it costs 101. But we opened the opposite position on Forex and there profit was $ 18 more than the loss on the option. Deposit 3600 dollars. Now we sit and equalize the delta of two positions. And it makes no difference to us whether the price falls or rises. We are just collecting profits. This is a profitable active option lock. There will be a white turn to yellow 1.118 or a blue turn to red 1.255 in 100 days. We can easily make money on this. With feet, let the professionals spoil their nerves.

FOURTH STRATEGY - PASSIVE INSURANCE

passive variant of deltahedzha-strengl until 3.12.21 ... opened on 24.09.21

A deposit of 900 points on CME or $ 11250.

&list=PLC1-T8QPDnKKIHUaKwusfFIRUGQXaIxNs&index=1