The beginning of the topic and here is the whole base. Big and easy earnings based on probability theory

The essence of the strategies is hereonly in the first post

A cook earns a lot and blindly in a small insurance business at 2.5% per week

SOMETIMES I FORGET TO CORRECT THE NUMBERS. THEREFORE, IF SCREEN CONTRAINS THE TEXT, BELIEVE THE SCREEN.

OVERVIEW of the second strategy:

As you remember, I was forced to make the last dealopening with risk, because there were no monthly deadlines at that time. The position was opened on 08/13/21, and expiration was on 08/27/21. We need to close this position, because monthly options have appeared. We will transfer to them. As happens in the insurance business, we are again on horseback. We have a long series of successful deals. This is how it should be according to statistics, but sooner or later a decent amount will be taken away from us once, but we will still remain in the black.

Grew to 46194 for Bitcoin.

When we opened positions, the price was 45931.It is necessary to close the old position and open a new one. Mathematics and the laws of probability are still with us and work for us. This is often the case in the insurance business. And this I am showing the simplest strategy for beginners, which implies being in the market forever, without looking for good entries. We observe the rule and buy back in 2009 what we sold at 3140. We are talking about a 45000 put. This gives a plus of 1131 dollars. Then we sell at 552 what we bought at 1430. We are talking about a 40,000 put. This gives a minus of $ 878. From 1131 we subtract 878 = 253: 1000 * 3 = 0.69 dollars. The previous result was $ 4.02. This means that the total profit is $ 4.71.

OLD POSITION:

Expiration 27.08.21. Bitcoin price 45931.

Bought put 40,000 at 1430 and sold put 45000 at 3140

Today is 08.16.21. Expiration 27.08.21.

The price was 46194.

Bought 45,000 puts in 2009 and sold 40,000 puts at 552.

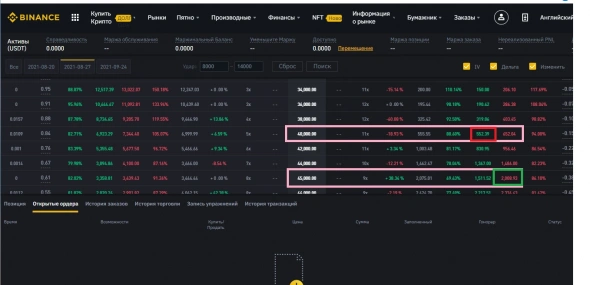

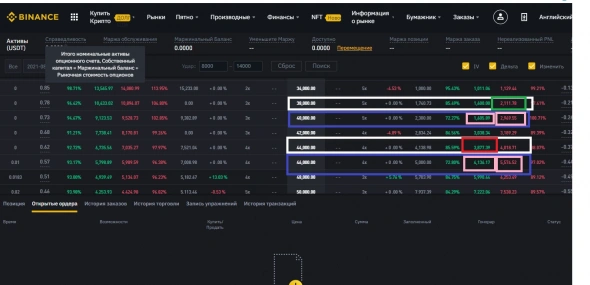

Now for an interesting technical point.I wanted to buy 40,000 and sell 46,000 as standard, but I saw in the blue squares that the price between the pink bid and ask was very high. I went into a specific contract of 46000 and saw that the theoretical price there was 4800, and they wanted to take it from me at 4136. Of course, I did not make such a concession and sold the spread lower, which is marked with white squares. These are 44000 and 38000. There the difference is no more than 3% of the theoretical price. As it should be.

We choose the same period from 24.9.21. Then, we follow the rule and first buy the more distant green put and then sell the near red put, as it is written in the “new position”.

BASIC STRATEGIES.

We start from 05/27/21. At a share price of $ 42054.

FIRST STRATEGY: For those who want to have an average of 400-500% over 10 years.

Sell blindly monthly spreads with a difference of 500dollars. With a share price of $ 41,544, we finally need $ 12,000, with a 10% risk of losing them. But keeping 12,000 in your account is wrong, because 10,800 of them will be needed only 50% of the time. Therefore, it is easier to spend those 10,800 on another business or put on a deposit. 1200 is enough for now.

Close the position at the end of the expiration or when the stock rises by $ 5 and open a new monthly spread.

OLD POSITION:

Expiration 25.08.21. The price is 440.59.

Bought 435 put at 486 and sold 440 put at 623.

Today is 08.13.21. Expiration 25.08.21.

The price was 444.96.

Bought 440 puts at 1.71 and sold 435 puts at 1.08.

NEW POSITION: at the 444.96 junction.

Expiration 10.09.21.

Bought 440 puts at 4.16 and sold 445 puts at 5.56.

Position: 429

Deposit $ 1200 for 3 attempts (out of 30 attempts).

SECOND STRATEGY: On Binance. Here we will also trade monthly insurances.

I recommend to those who do not have at least 300dollars to trade insurance for Sberbank on the Moscow Exchange. And it makes no sense for non-residents of Russia to go to the Moscow exchange if they have less than $ 3,000. And if there is $ 3,000, then it is better to trade options on the RTS futures.

It is very easy to open and replenish an account without leaving your home.

Trading has been conducted since 06/07/21, I brought in $ 16, but $ 4 of them is a deposit. Only $ 12 works per try. We trade 0.0003 lots

OLD POSITION:

Expiration 27.08.21. Bitcoin price 45931.

Bought put 40,000 at 1430 and sold put 45000 at 3140

Today is 08.16.21. Expiration 27.08.21.

The price was 46194.

Bought 45,000 puts in 2009 and sold 40,000 puts at 552.

NEW POSITION:

Expiration 24.09.21. Bitcoin price 46194.

Bought put 38000 at 2112 and sold put 44000 at 3877.

Deposit 16 dollars

The result is: $ 4.71.

But the whole amount is $ 120 for 10 attempts.

&list=PLC1-T8QPDnKKIHUaKwusfFIRUGQXaIxNs&index=1