The largest American cryptocurrency company Coinbase has entered the final stage of negotiations onthe acquisition of the Tagomi broker, which previouslyraised $ 28 million from Peter Thiel, Pantera Capital, Digital Currency Group and other venture investors. This is reported by The Block, citing informed sources.

According to some experts, Tagomi would perfectly complement the large-scale ecosystem of Coinbase, including previously acquired Keystone broker-dealer and decentralized Paradex exchange.

Tagomi began work in December 2018.offering services to investors in Bitcoin, Ethereum and other digital assets. These include intermarket order execution, money management, post-trading reporting, settlement and custody services.

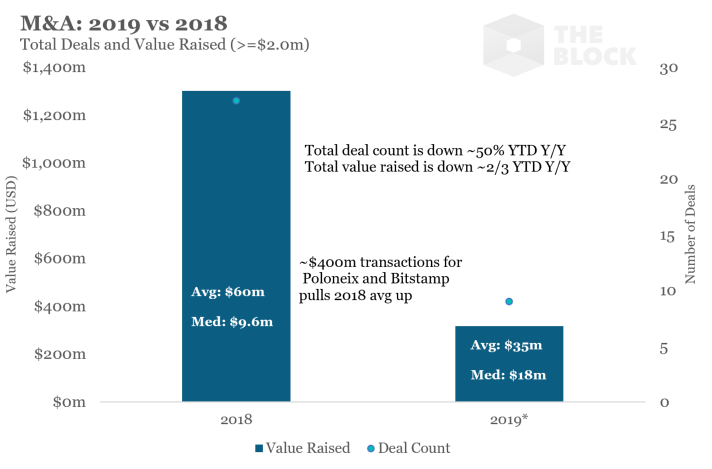

If the deal between Coinbase and Tagomi takes place, thenit will be one of the largest acquisitions in the crypto industry. By the way, M&A activity this year fell by more than 50% compared to 2018, both in the number of transactions and in amounts:

Data: The Block, Pitchbook.

To date, Tagomi has raised $ 28 million.venture capital investments. So, in March, the company received $ 12 million from Pantera Capital, Paradigm, and before that - $ 16 million from Digital Currency Group, SV Angel, Founders Fund and billionaire Peter Thiel.