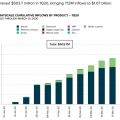

The total volume of the largest cryptocurrency managed by the investment fund Grayscale reached 589,000 BTC.

Investment fund Grayscale has made anotherbuying bitcoins for the benefit of their customers. This time we are talking about the amount of $ 300 million and 12.319 thousand BTC units. Thus, the total amount of Bitcoins managed by Grayscale reached 589 thousand BTC. Grayscale Bitcoin Trust now has the # 1 cryptocurrency worth $ 11.1 billion, which is about 2.7% of the supply of these digital assets. Also, $ 2.6 billion was invested in other digital assets, in particular, in Ethereum.

The organization noted that the volume of Bitcoin (BTC) acquisitions is currently at a record level:

"The trend was noticeable back in the third quarter, when in three months we purchased more than $ 1 billion worth of bitcoins."

Analyst Kevin Ruuke commented on the Grayscale numbers:

“Such news is a bad sign for those traderswho are guided by the fact that Bitcoin can go significantly down in price. After all, over the past week, Grayscale bought more than 11,512 thousand BTC on the market, and this despite the fact that Bitcoin was as expensive as never before.”

Thus, Grayscale has become another organization, along with MicroStrategy, that is not afraid to invest in this digital asset at its price peak.

Bad news for Bitcoin bears.

Grayscale's Bitcoin Trust just added 12,319 BTC to $GBTC in a single day.

That's more than the 11,512 BTC they added during all of last week, when Bitcoin broke its ATH.

? pic.twitter.com/0ozzioNXBZ

- Kevin Rooke (@kerooke) December 23, 2020

There are currently at least 10 on the marketcompanies, each of which owns more than 10 thousand bitcoins. Moreover, each organization from the top three has bitcoins in the amount of more than 140 thousand BTC.

COMPANIES ARE HOLDING MORE THAN 10,000 $ BTC. $ BTC #BTC pic.twitter.com/EdUWf2gfYk

- Coin98 Analytics (@ Coin98Analytics) December 23, 2020

Analysis of purchase volumesBitcoin survey conducted by BlockFi shows that many of these institutional players buying Bitcoin are using not only centralized crypto exchanges, but also the over-the-counter market and decentralized platforms to do so.

Rate this publication