Grayscale Bitcoin Trust has become the first instrument for investing in digital assets, according to which the10-K reports are submitted to the U.S. Securities and Exchange Commission (SEC).

Managing Grayscale InvestmentsThe Bitcoin Trust company, filed an application with the regulator to register a 10-K form for GBTC in November. The company considered that this would increase investor confidence in a product that would take on a familiar structure.

According to the law, 60 days after the filing, the application became automatically accepted by the regulator.

Grayscale should now file quarterly and10-K annual reports. However, the status of an instrument reporting to the SEC gives investors in GBTC new opportunities - in particular, they will be able to sell trust securities on the secondary market after 6 months, and not a year later, as before.

Grayscale manages ten investmentdigital asset-based products, but the vast majority of funds investors invest in GBTC. At the end of 2019, the value of the assets of the Bitcoin Trust amounted to $ 2.3 billion.

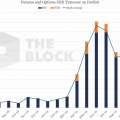

Over the past year, the company attracted to its fundsinvesting in digital currencies of $ 600 million. The most successful was the fourth quarter with $ 225 million, of which $ 193.8 million came from investments in the Grayscale Bitcoin Trust.

Recall that Grayscale Investments expects an influx of investments in bitcoin after the transfer of $ 68 trillion of savings between generations.