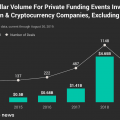

According to a new report from CB Insights, the volume of venture capital funding in blockchain companies last yeardecreased by a third from $ 4.2 billion to $ 2.8 billion, while the number of transactions decreased only from 822 to 807.

</p>The company explains the revealed difference of highbase of 2018. That year, several concluded agreements at the last stage of venture financing were closed at once. For example, selling $ 400 million in Bitmain shares, raising $ 300 million for Coinbase following the results of the Series E funding round, and getting Hyperchain $ 234 million for Series B.

In this regard, 2019 was rich only in Ripple and Figure deals, which raised $ 200 million and $ 103 million in Series C financing rounds, respectively.

Geographically, the share of transactions increasedprisoners with companies from China. In 2019, their number increased by 22%, while with the participation of companies from the United States it decreased by 31%. A similar trend has been observed over the past five years.

Investments in corporate solutions on the blockchain still account for a smaller amount of the total - out of $ 2.8 billion, they accounted for only $ 434 million. Cryptocurrency companies received $ 2.35 billion.

Recall that according to Pitchbook since the beginning of 2020, the total amount of venture investments in the crypto industry has decreased by about 40%.