Cryptoassets are a promising innovation in the evolution of money and the modern financial system. However, manyIssues related to the assessment of crypto assets are still open.

Fundamental concepts on the basis of whichformalized methods for evaluating crypto assets are being created; they are just beginning to emerge. Nevertheless, experiments in this field have been conducted for more than 10 years.

In the first part of an article by Kevin Liu from CoinMetricsSix basic approaches to the study of the assessment of crypto assets were briefly reviewed: the exchange equation, the discounted future utility model, Metcalfe's law, price regression models, production cost models and market bubble detection.

In the second part, five more approaches are considered:

- relationships used in fundamental analysis;

- “Age-based” analysis based on the distribution of unspent transaction outputs (UTXO);

- analysis based on realized capitalization;

- factor investment;

- analysis based on social media content.

Fundamental relationships

Fundamental Relationship Approach -one of the most widely used in the evaluation of crypto assets. Drawing inspiration from the analysis of stocks, including the price / earnings ratio, fundamental ratios are often used to identify periods of revaluation and undervaluation of assets.

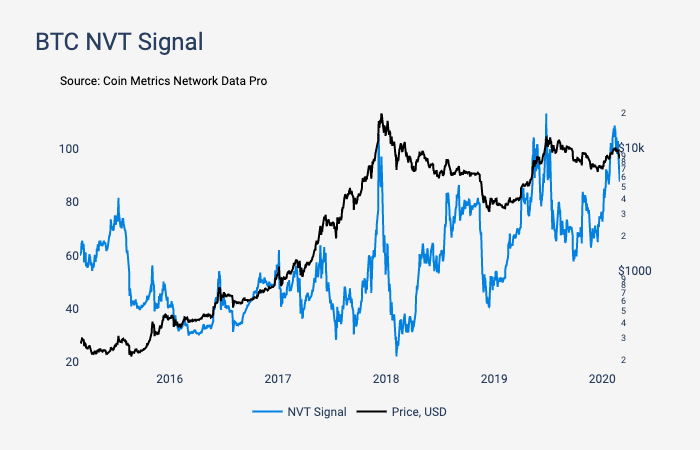

Willy Wu first applied fundamentalratio to crypto assets by presenting the NVT (Network Value to Transactions) indicator, calculated by dividing the market capitalization of the asset by the daily volume of on-chain transactions.

The logic of this approach is that the dailytransaction volume indicates the degree of use and usefulness of the cryoptoactive. High values of the NVT indicator indicate the formation of price bubbles, and low marks can serve to identify attractive entry points to the market.

Dmitry Kalichkin of Cryptolab Algorithmic in 2018year, he developed this idea by proposing an improved version of the indicator - NVT Signal. In particular, the researcher was able to eliminate some of the shortcomings of the metric that prevented its use in real time.

NVT Signal indicator and Bitcoin price. Source: CoinMetrics

CoinMetrics co-founder Jacob Franek in 2018introduced a new ratio for evaluating crypto assets, arising from Metcalf's law - Network Value to Metcalfe Ratio. This metric is empirically tested by Dmitry Kalichkin and analyzed in his article.

Ledger Capital co-founder Vikram Arun alsoinvestigated alternative approaches to more accurate asset valuation based on daily transaction volume. Based on the law of Metcalf and NVT Ratio, Arun describes the Network Value / Transactions to Growth (NVTG) indicator. This tool more accurately estimates the value of transactions, since the model eliminates mixing-related payments, repeated transfers of funds between exchange wallets and other “non-economic” operations.

Presented in 2018 by Philip SwiftBitcoin Network Momentum does not use fundamental ratios, however, the daily volume of on-chain transactions, expressed in native units, is involved.

Some other relationships are based on revenue.miners, which is the amount of capital in dollar terms, ensuring the safety of the network and affecting the internal value of the crypto asset. Miners are also a constant and significant source of sales pressure.

With all this in mind, The ResearcherBlock Matteo Leibovitz proposed the Fee Ratio Multiple tool, which represents the ratio of the income of miners and transaction commissions. According to the analyst, this indicator shows how safe the network remains as the reward for the block decreases, and can also “implicitly” indicate the effectiveness of the asset as a means of maintaining value.

Researcher cryptopoiesis suggested in 2019“Bitcoin market cycle barometer” - the Puell Multiple indicator. It represents the ratio of the daily issue volume in dollar terms to the same indicator, but already smoothed by the 365-day moving average.

In studies where involvedfundamental relationships, affecting a variety of aspects. Thanks to the “age-based” UTXO analysis and the use of realized capitalization, several additional fundamental relations were introduced:

- The indicator of "mobility" (Liveliness ratio);

- The ratio of market capitalization to realized (Market Cap versus Realized Cap, MVRV);

- Spent Output Profit Ratio (SOPR)

- the ratio of realized capitalization to transaction value (Realized Capitalization to Transaction Value (RVT), etc.

Fundamental relationships are perhaps the mostthe developed direction of the analysis of crypto assets due to the relatively simple interpretation of indicators and their applicability for timely adoption of market decisions.

However, some such tools are subject tocriticized for the lack of accuracy of forecasts. In particular, the effectiveness of NVT decreases as the popularity of chain transactions increases. Also, forecasts distort the large movements of funds between wallets of exchanges and custodian services.

UTXO age analysis

In the "age" analysis, aspects are studiedoffers of crypto assets by studying the behavior of holders. UTXO refers to a user-controlled transaction output that is intended to become an input to a future transaction. This accounting model is used in bitcoin and some other networks. Some UTXO analysis concepts have also been successfully adapted to account-based systems such as Ethereum.

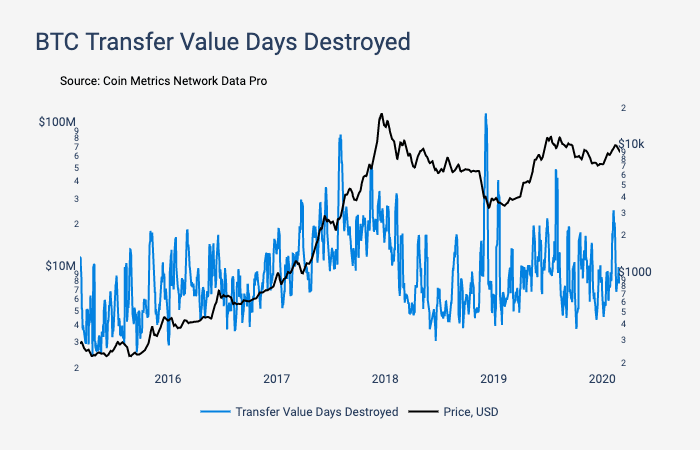

Earliest contribution to this area made in 2011year ByteCoin, proposing the concept of Bitcoin days destroyed. It is an alternative way to measure transaction costs. The metric is calculated by multiplying the transaction amount in BTC by the number of days since the last movement of the coins participating in it. At the same time, more weight is given to BTC, which lay motionless for a long time, and less to coins moving relatively recently.

For example, lying motionless for 100 days 1 BTChas a hundred times more weight than one bitcoin, the transaction with which occurred a day ago. The approach based on the analysis of time since the last use of coins laid the foundation for further research.

The graph below illustrates the dynamics of value movement in BTC in accordance withBitcoin days destroyedsmoothed by a seven-day moving average.

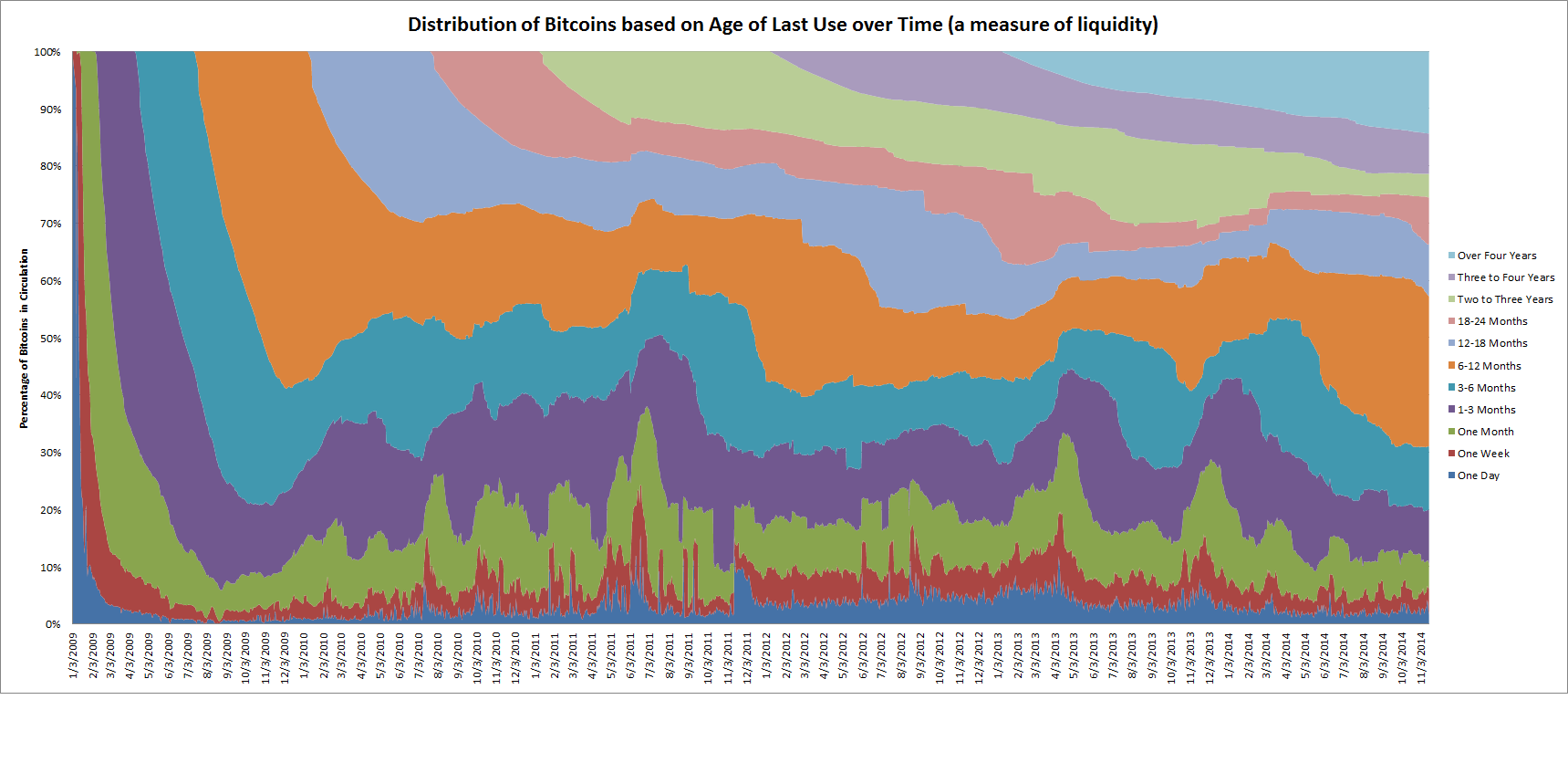

A significant contribution to this area of research was made by jratcliff63367 in 2014. He divided the total supply of BTC into various groups according to the age of the last use of coins.

In subsequent years, the term “active offer”, as well as the more informal one, “HODL waves”, was fixed in industry terminology.

Several years ago, this topic was raised again.Co-founder of Unchained Capital Dhruv Bansal, promoting the concept. The researcher was the first to draw conclusions based on the dynamics of active monetary mass, proposing the use of the model in forecasting market cycles and the field of trading.

Using the terminology presented above, independent Bitcoin developer Tamas Blummer proposed a metric in 2018Mobility (Liveliness), designed to provide a better understanding of the behavior of long-term and short-term investors.

Ikigai Asset Management researcher Hans Hauge slightly expanded the model in 2019Bitcoin days destroyedby proposing categories such as Binary Adjusted BDD, Value of coins destroyed, and Reserve risk.

The essence of the “age” approach to the assessment of crypto assetsconsists in the fact that different groups of holders have their own motivation, risk appetite, informational advantages and moods, depending on the preferred coin holding time. For example, long-term investors hold huge amounts of various crypto assets, while their behavior significantly affects prices.

This area of research is one of the most promising, promising the emergence of new fundamental concepts.

Realized capitalization

It is relatively new, specific tocryptocurrency valuation approach, which has made a significant contribution to the field of onchain analysis. Unlike market capitalization, according to which each coin is valued at the current price, realized capitalization takes into account the price of the crypto asset during its last on-chain movement. For example, if 10 BTCs last moved when Bitcoin was worth $ 1000, then these ten coins will be valued at $ 10,000 (10 x $ 1000). If, say, 5 BTCs were last in motion at a price of $ 10,000, their realized capitalization would be $ 50,000 (5 x $ 10,000).

If the UTXO analysis is related to the “age” of the coin from the moment of the onchain transfer, the price of the asset at the time of its movement in the network is taken into account in the analysis based on realized capitalization.

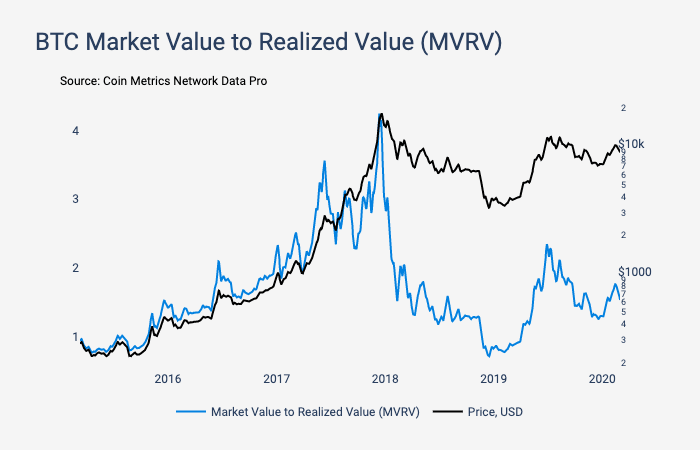

In an article from CoinMetrics about using the method onThe basis of realized capitalization also includes the Market Capitalization to Realized Capitalization (MVRV) metric, which Murad Makhmudov and David Puell tested in 2018 to identify overvalued and undervalued assets. Cryptanalyst Awe & Wonder has made several improvements to MVRV, adapting the indicator for more reliable trading decisions. The modified version of the tool is called MVRV Z-Score.

MVRV indicator and bitcoin price. Source: CoinMetrics

Checkmate on-chain analyst introduced in 2019metric "The ratio of realized capitalization to transaction volume" (Realized Capitalization to Transaction Value). This tool works on the same principles as NVT, except that it uses realized capitalization instead of market capitalization.

Nick Carter of CoinMetrics introduced a concept closely related to realized capitalization in 2018"Thermocapitalization"according to which each coinIt is taken into account at the price at the time of its extraction. Based on the assumption that in the long term, the profitability of miners is slightly higher than the break-even level, “thermocapitalization" can be interpreted as the total cost of maintaining network security.

Bitcoin analyst David Puell in 2019 introduced yet another metric related to capitalization implemented - “Delta-capitalization”, calculated by the formula:

Realized capitalization — smoothed moving average market capitalization

Founder of Adamant Capital Tour Demester,Researchers Tamas Blummer and Mihil Lekrauvit developed a metric to determine the unrealized profit and loss of investors by subtracting realized capitalization from market capitalization. Using an indicator of “mobility,” the researchers illustrated changes in the behavior of long-term investors.

Researcher Renato Shirakashi in 2019presented the profitability ratio of the spent output (SOPR, Spent Output Profit Ratio). It is calculated by dividing the realized value (in USD) by the value when creating the output and can be used to determine local lows and highs.

The approach based on implemented capitalization is unique to the cryptocurrency market, where it is supposed to be able to extract information directly from the blockchain.

The ability to assess the book value of the assets of each of the investors can find serious application in the analysis of market sentiments, as well as in the context of behavioral economics.

Factor investment

This approach involves identificationspecific characteristics of crypto assets to explain the dynamics of their profitability. This direction is based on research in the field of traditional financial assets and, in particular, on the three-factor Fam-French model, which includes the following parameters:

- market risk;

- premium for size - additional profit received for ownership of shares of small companies;

- Additional return on equity value.

Researchers have significantly expanded this model by adding many factors, applying it to various asset classes, including cryptocurrency.

The first serious approach to assessing crypto assets withUsing the methodology of factor investment, Stefan Hubrich proposed in 2017. His work contains an innovative interpretation of the Value factor as the relationship of market capitalization to the on-chain volume of transactions. The use of the momentum factor in the context of crypto assets is also described. Also taken into account is such an aspect as the rate of issue of coins. According to the expert, the factor approach to investing in crypto assets allows achieving a high rate of return.

Yale University researchers Yukun Liu andAlech Zivinski in 2018 made a significant contribution to this field of research. They tested a wide range of traditional, macroeconomic and crypto-specific factors. Scientists came to the conclusion that the momentum factor and the “investor attention effect” to a large extent explain the dynamics of asset returns. However, many other factors are not as effective in predicting.

CEO of Quantigic Solutions and Professor of FreeTbilisi University Zura Kakushadze in 2018 confirmed the significance of the momentum effect, revealing, however, the relative inefficiency of the liquidity factor. In 2019, Liu, Zivinski, and Si Wu from the Leonard N. Stern School of Business tried to apply the previously identified factors in portfolio management.

Further development of this directionResearch depends on the evolution of the cryptocurrency market. Factor investment involves the assessment of a large number of assets, identifying their various characteristics, as well as building portfolios based on various parameters. Also a prerequisite for further research is the ability of researchers and data providers to identify conceptually consistent information on various assets.

Social media

The relationship between crypto asset prices and datafrom social networks have been studied for quite some time. The methodology for estimating the value of crypto assets is still in the early stages of development, however, based on the available historical data, it already follows that prices can deviate significantly from fundamentally sound values over time. Thus, quantifying investor attention is also an active area of research.

Czech researcher Ladislav Kristoufek in 2013the year he was the first to use the volume of search queries on Google and Wikipedia as an indicator of investor interest, and also examined the correlation of this indicator with the BTC price.

David Garcia, Claudio Tessone, Peacock Mavrodiev andIn 2014, Nicolas Peroni used a wider range of data for this purpose, including information from social networks Twitter and Facebook. Researchers emphasized the importance of word of mouth and new BTC users on market dynamics.

Using a very similar methodology, complemented byIn several on-chain metrics, researchers at the University of Athens University of Economics and Business in 2015 came to the conclusion that Twitter sentiment is affecting the price of BTC in the short term.

Scientists from the University of Nicholas Copernicus found that mention in newspapers and magazines can also influence the price.

Conclusions about the significant impact of social media on prices are contained in later studies.

findings

It is widely believed that crypto assets are difficultamenable to assessment due to underdeveloped methodology. However, a more detailed study of the current state of this field of research shows that this statement may not be entirely true.

Over the past 10 years in the field of evaluationThe concepts of classical economy, monetarism, elements of discounted cash flow analysis and other areas of financial analysis have been successfully applied to crypto assets.

Some researchers have achieved notableprogress in onchain analysis specific to cryptocurrencies. Containing the history of all transactions, data from open blockchains allows you to study investor behavior with unprecedented transparency, inaccessible to the world of traditional finance.