In the crypto community and beyond, there has long been an ongoing debate about whether bitcoin can be classified as defensiveassets along with gold, the Japanese yen, the Swiss franc and US government bonds.

Some experts say that the unique properties of the first cryptocurrency make it a safe haven in times of geopolitical tension and related turbulence in global markets.Skeptics who think this theory is far-fetched recall how bitcoin fell and rose with the S&P 500, or did not react at all to the volatility of indices or the price of gold.

ForkLog magazine tried to find out if digital gold has matured to a protective asset status.

Iranian drama

The beginning of 2020 was marked by a sharp aggravation of US-Iranian relations, which had a significant impact on financial markets.

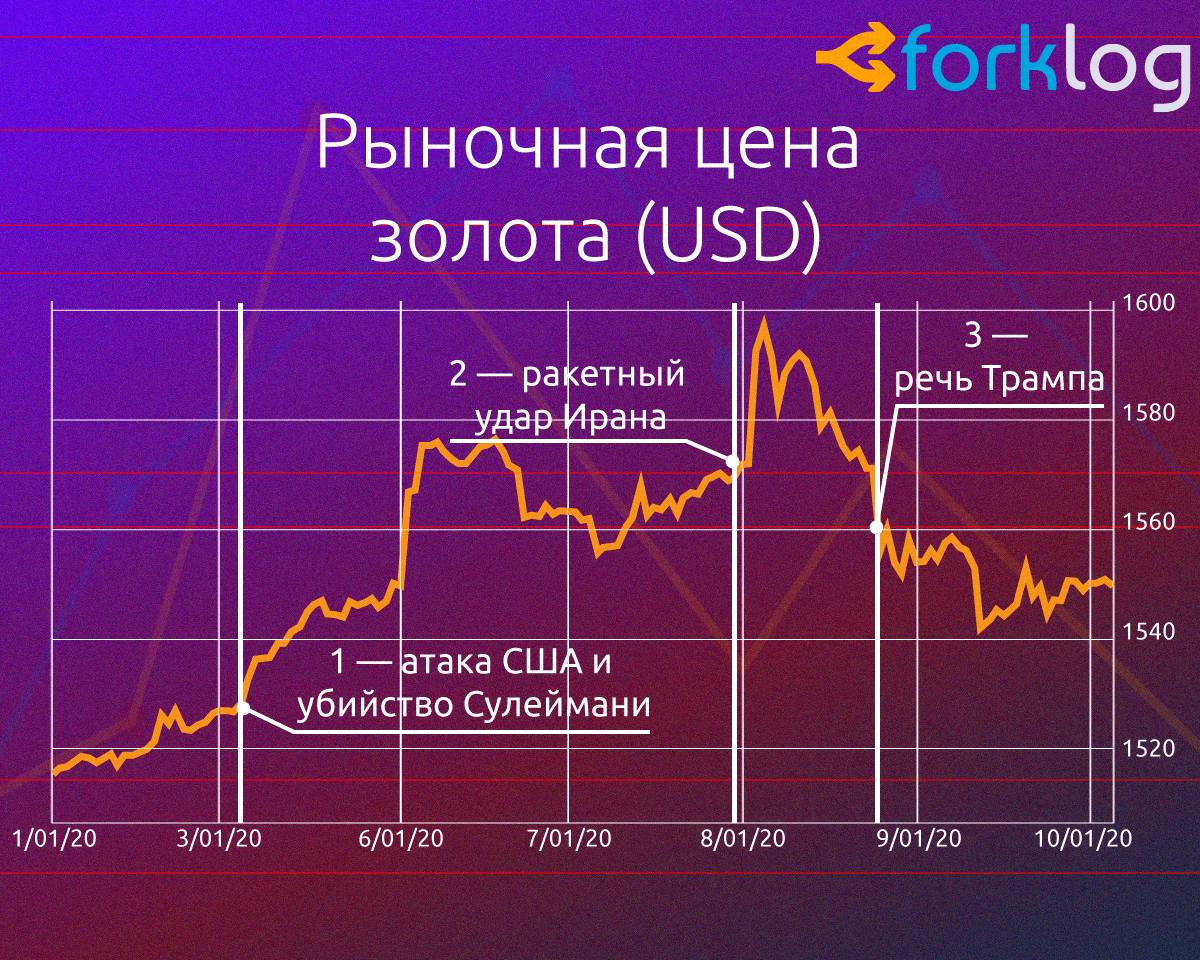

On January 3, against the backdrop of the US attack on a military base in Iraq and the assassination of Iranian commander-in-chief Qasem Soleimani, the price of traditionally defensive assets - gold and the Japanese yen - increased.Bitcoin, on the other hand, jumped by almost $500 (>5%), returning to levels above $7,000.

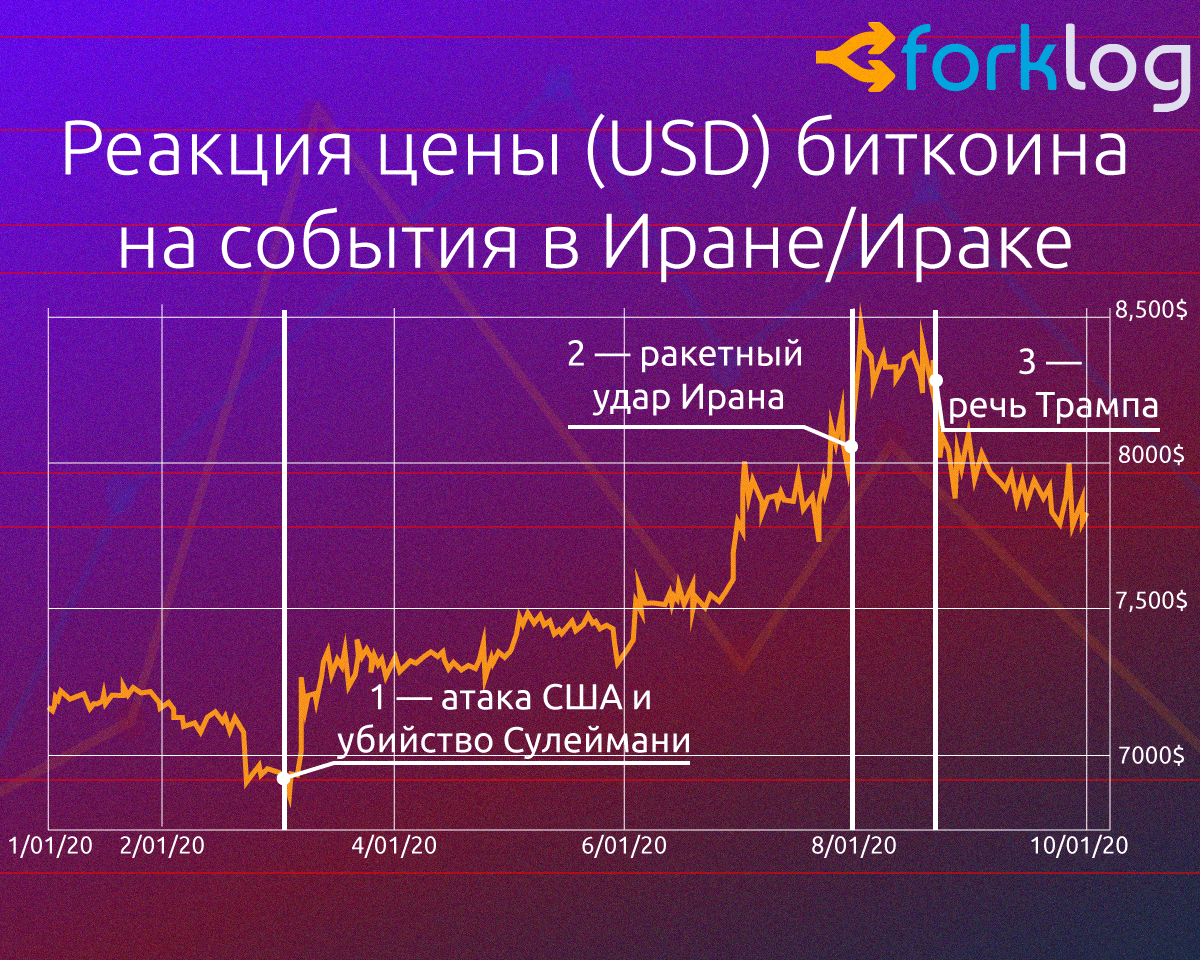

Bitcoin price dynamics amid the aggravation of the Iranian conflict. TradingView Bitstamp BTC / USD hourly chart

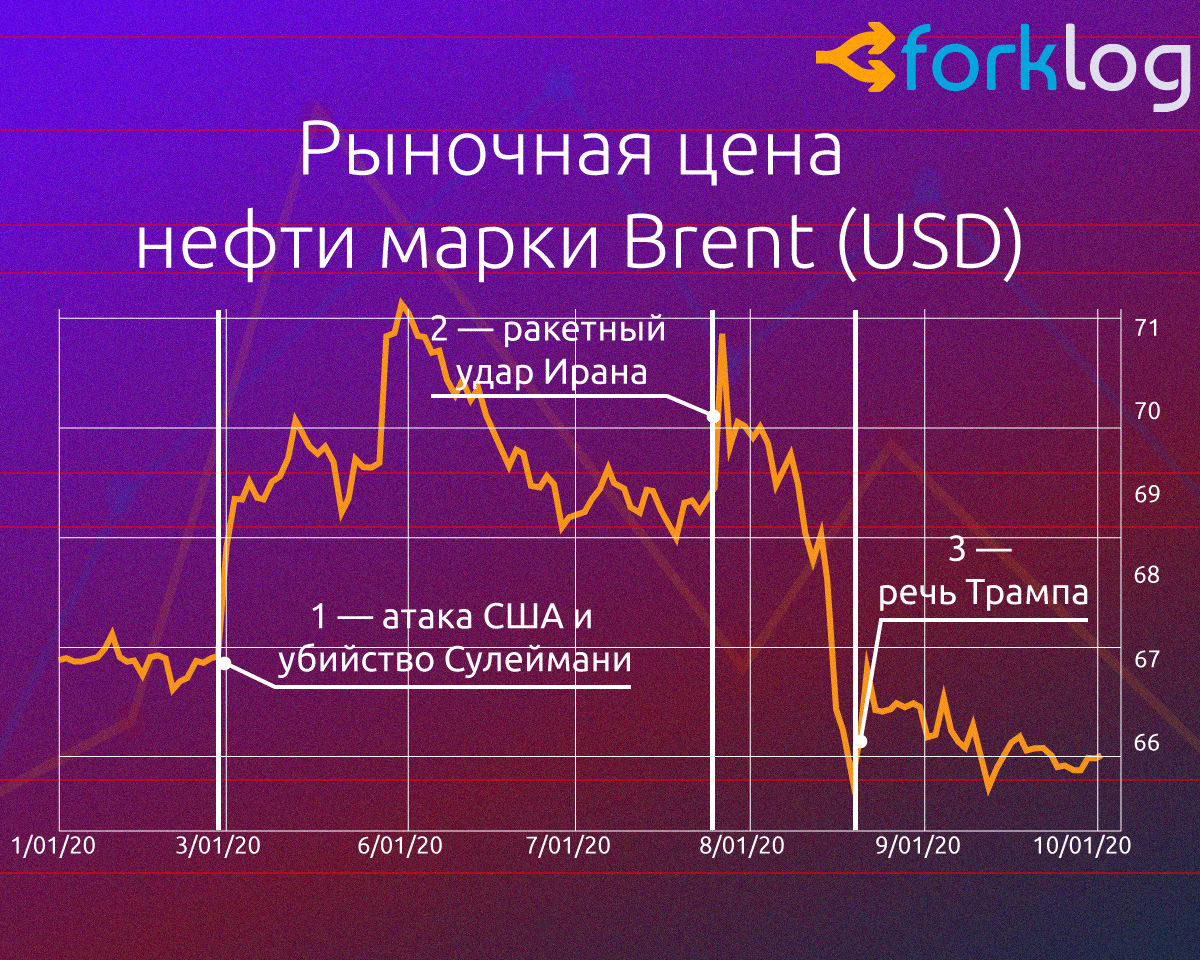

On January 8, Iran fired several military missiles.US base in Iraq. The reaction of the markets was not long in coming: oil and gold updated their highs, and BTC rose above the $ 8400 mark, which until then was relevant in November last year. In just a week, against the backdrop of dramatic events, bitcoin grew by almost 20%.

Soon, Donald Trump addressed the nation with the wordsthat "the United States is ready to live in peace with all who strive for it." He also emphasized that America is independent of oil and that the strike on facilities in Iraq cost no casualties.

Bitcoin reaction to the US-Iran conflict: 1 - US attack and the assassination of Suleimani; 2 - Iran missile strike; 3 - Trump's speech.

Oil price reaction

Gold price reaction

Amid weakening geopolitical tensions, oil and gold fell in price. Bitcoin also dipped short-term, again manifesting itself in this way as a protective asset.

Opinions and technical factors

Joshua Green, head of the Digital Asset Capital Management trading division, said the recent rally was BTC’s obvious reaction to the events in Iraq.

“You can also notice that oil and gold are growing steadily.”- added the analyst.

Solidarity with him was expressed by CNBC Crypto Trader host Ran Neuner.

</p>“Bitcoin and gold together move down in the backgroundTrump's speech. This is undeniable evidence that investors do enter the BTC, viewing it as a safe haven during political events. No investor will deny this anymore. ”

Bitwise Hong Kim, co-founder and technical director, shared similar observations.

</p>“The price of bitcoin fell to $ 8100 (from the range$ 8300-8400) immediately after Trump announced at 11 am EST that the United States would not escalate the conflict with Iran. It’s fun to watch how the price dynamics of bitcoin is becoming increasingly correlated with global events. ”

CoinDesk Markets analysts conducted a survey on whether US-Iranian relations affect the price of bitcoin. Most participants responded positively.

</p>Arcane Research experts noted that in the light of recent developments in the markets, the first cryptocurrency really manifests itself as a safe haven.

“As tensions grow between the US and Iran, bitcoin is demonstrating the properties of digital gold.”- says the report of the company.

CoinMetrics experts are not so straightforwardjudgments. According to their observations, on January 3, oil and gold futures instantly rose amid a U.S. attack and the assassination of Suleymani. The growth of bitcoin began only a few hours after the reaction of the world of traditional finance.

One possible explanation for this delay is theycalled the lack of effectiveness of the emerging market for digital assets. In other words, unlike traditional investors, crypto enthusiasts may not be so closely monitoring significant political events and, importantly, not particularly in a hurry to respond to them.

On the other hand, according to CoinMetrics, bitcoin often showed sharp movements without any “news catalysts”:

“Price changes may be due toforced liquidation of futures products. This can have a significant short-term effect on prices and often cause short-term spikes in volatility. ”

Nevertheless, CoinMetrics are sure that against the backgroundrecent events, the "theory of the safe haven" as a whole has proved its worth. Experts emphasize that the reaction of the BTC price in response to the speech of the American leader was already immediate.

“We have witnessed perhaps the mostconvincing evidence of a safe haven theory for all 11 years of Bitcoin history. This turning point marks an important stage in the development of the first cryptocurrency as a universally recognized asset class. ”

Thus, under certain conditions, whenmany market participants closely monitor important news and are ready to respond to them as quickly as possible, the efficiency of the bitcoin market can be extremely high.

In the context of technical analysisIt was only at the beginning of 2020 that the formation of an inverted head and shoulders reversal pattern became apparent, the exit from which coincided with the events in the Middle East.

</p>Subsequently, the price finally broke through the impregnablethe border of the downward channel. However, Bitcoin soon adjusted to its border in a short-term, which turned from resistance to support. This movement took place against the backdrop of easing geopolitical tensions and was a reaction to the de-escalation of the Middle East conflict.

Such dynamics are evidence ofthat fundamental and technical factors correlate with each other. Therefore, these factors can complement each other perfectly and both approaches can be combined for a more efficient and comprehensive market analysis.

Reaction to past events

Representatives of Grayscale with crypto assets$ 2.2 billion in conversation with The Block emphasized that trading volumes in the shares of their flagship product - Grayscale Bitcoin Trust (GBTC) - grew against the backdrop of most key global events.

The graph below shows that on December 18, the price of the first cryptocurrency more than convincingly reacted to the announcement by the House of Representatives of impeachment to Trump:

A sharp increase in prices against a surge in volumes on December 18, 2019. TradingView Bitstamp BTC / USD hourly chart

Digital gold showed volatile growth in the second half of 2015 - January 2016:

Bitcoin price dynamics amid worsening economic situation in China, which at that time was the epicenter of crypto-investor activity. TradingView Bitstamp Daily BTC / USD Chart

In August 2015, the Chinese economy beganserious problems. The People's Bank of China devalued the renminbi by 1.9% due to export problems. However, the stock market continued to fall, and the outflow of capital from the country reached one trillion US dollars.

The head of the Swiss company Amun Hani Rashwannoted that trading volumes of their financial products based on cryptocurrencies (ETP) significantly increased amid the introduction of new duties on US goods by China in August 2019.

“As for the impeachment of trump, the volume of tradingjumped sharply on December 17, just before his announcement. This may indicate that investors awaited transactions ahead of time while waiting for news. ”- added Rashwan.

On the other hand, ETP trading volumes were small amid the death of an Iranian military leader. The head of Amun explains this by saying that on the first trading day of the year, investor activity is usually negligible.

Everything is not so clear

In most cases, BTC responds positively to the turbulence of world markets - its price often correlates with gold and other protective assets.

However, such dynamics are far from being observed.always - for example, in August, Bitcoin critic Peter Schiff noted that against the backdrop of a new round of the trade war between China and the United States, the Japanese yen, Swiss franc, gold and silver showed growth, and bitcoin and the stock market showed a collapse. Watching what is happening, the expert expressed his firm belief that the first cryptocurrency failed the test for a protective asset.

However, after Trump’s tweet about the disruption of tradingnegotiations and the introduction of 10% duties on Chinese goods worth $ 300 billion, bitcoin, gold, the Japanese yen, the Swiss franc and 10-year treasury bonds almost simultaneously increased in price.

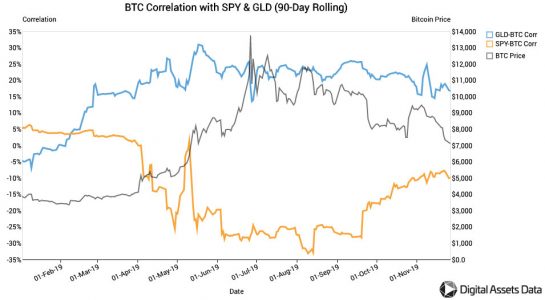

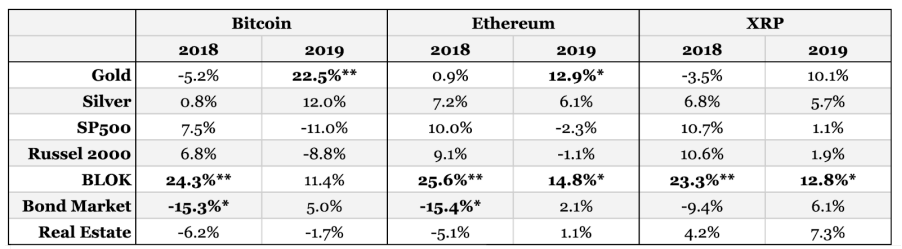

Also digital gold is repeatedly positivereacted to changes in the Fed's base interest rate. On the other hand, for most of last year, BTC showed a negative correlation with the S&P 500 Index:

The positive relationship of bitcoin and gold was most clearly seen in the first half of 2019

Since October, the correlation of Bitcoin with the "barometerof the American economy ”was near the -10% mark, indicating a slight correlation of indicators and that BTC could hardly be used at that time to hedge global risks.

Last year, Bitcoin's correlation with gold and altcoins increased significantly, but the correlation with the S&P 500 became negative. Data: The Block 2020 Research Outlook.

On the other hand, co-founder of Digital AssetsData Eddie Alfred is sure that long-term investors should not worry about the protective properties of bitcoin. According to him, the trend observed at the end of the year is an anomaly.

findings

Though not always, but quite often bitcoincorrelates with defensive assets amid globally significant events. The latter include not only wars, but also, for example, protectionist measures by giant countries or even a reduction in the Fed rate.

BTC price volatility is significantly higher thanUS Treasuries, S&P 500 and even than gold. Thus, Bitcoin still lacks almost the main property of a defensive asset. However, judging by the price dynamics in early January, for many investors the first cryptocurrency is relevant during periods of global uncertainty.

Digital gold has been and remains uniquean asset that can establish itself well as an investment diversification tool. Despite the relatively large range of BTC price fluctuations, its use with other financial instruments can increase portfolio profitability at an acceptable level of risk.

The degree of correlation of bitcoin with otherscrypto assets are gradually declining, as is volatility. At the same time, the efficiency of the BTC market is growing, which is especially noticeable in the recent reaction of bitcoin prices to exacerbations and declines in geopolitical tensions.

All these are signs of the growing industry, which over time becomes more attractive in the eyes of institutional investors.

Alexander Kondratyuk