CEO and founder of financialdeVere Group’s consulting company, Nigel Green, believes the next month’s historic event, which will halve the reward for bitcoin miners, will increase the price of BTC proportionally.

The publication Financial Mirror cites the point of view of the financier, who also believes that other facts will have an equal impact on the value of cryptocurrencies.

Historical parallels of halving

After a rapid fall in mid-MarchBitcoin has been showing a good recovery over the past few weeks. Over the past week, the price of bitcoin has grown by about 12%, and this Monday by another 6% - ahead of almost all major indexes.

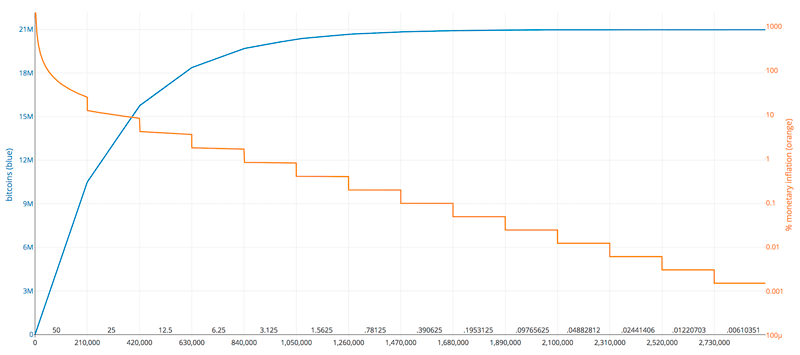

</p>The offer of the world's largest cryptocurrency on the market capitalization of bitcoin is limited to 21 million units, and cannot exceed this amount.

Every four years, during halving, the reward for each block mined in the bitcoin network is reduced. Thus, with each four-year cycle, BTC emissions are getting smaller.

In 2012, the number of new bitcoins,produced every ten minutes, decreased from 50 to 25. In 2016, it decreased from 25 to 12.5. Now, in May 2020, this figure will drop from 12.5 to 6.25 BTC.

“History teaches us that as a result of halvingthere is usually a significant increase in bitcoin prices due to a sharp decline in supply with stable demand and increased awareness. There is no reason to believe that halving in 2020 will be different. ”“Said Nigel Green.

The deVere CEO said that there are also other key factors that will have a significant and lasting impact on the price of digital currency.

“This is an approach to the era of zero interestrates, which reduces the incentive to store fiat currency. In addition, lower rates usually lead to higher inflation, which reduces the purchasing power of traditional currencies. ”, - he said.

Therefore, Bitcoin and other decentralized cryptocurrencies, according to Green, are becoming more attractive, and the price will increase accordingly.

“During economic instability, the belief that Bitcoin is becoming an asset for asset security has been further strengthened. This is digital gold status. ”- said Green.

Green added that coupled with the fact thatBitcoin and other cryptocurrencies are digital and global, and the world is becoming more digital and globalized, while institutional investors, central banks and large corporations are fading into the background, the long-term trend is inevitably upward.

“Halving is likely to have a significant positive impact on the price of bitcoin, but it is the real problems and their solution that will affect the price increase exponentially”- concluded the CEO of deVere.

Recall, the analytical company Coin Metrics announced the rapid growth in the number of retail investors entering the bitcoin market.

</p> 5

/

5

(

1

voice

)