The collapse of Terra has pushed some long-term bitcoin investors to take losses, but many hodlerstook advantage of the price drop below $30,000 to build positions. These are the conclusions made by Glassnode analysts.

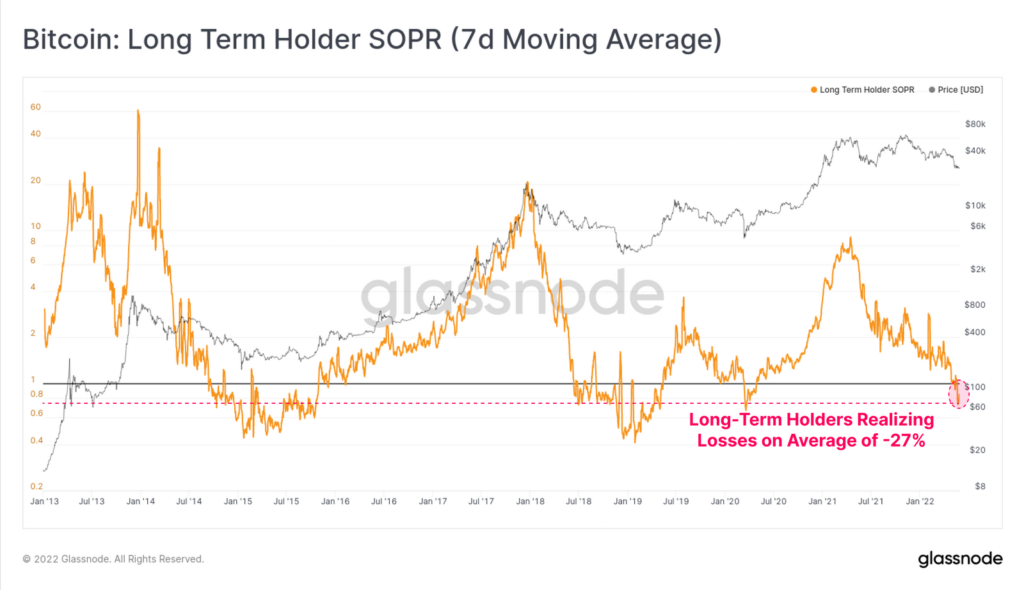

Last week, LTH-SOPR posted an average loss of 27%.

Experts have recorded signs of surrenderhodlers for the first time since summer 2020. In the bear markets of 2015, 2020 and the correction of 2018, this event marked the subsequent reversal of the negative momentum.

Data: Glassnode.

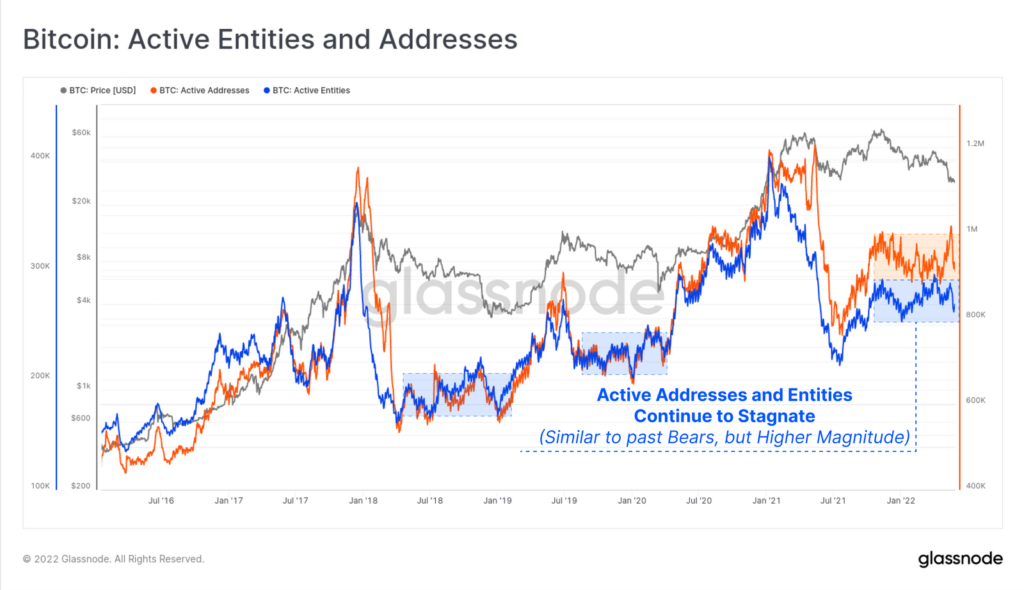

In contrast to similar situations in the past, the current wave of decline did not lead to an influx of new users — the number of active addresses continued to stagnate.

Accumulation Trend Score indicator interruptedobserved from January to April, a wave of periodic accumulation and distribution of coins, reflecting the uncertainty and rotation of capital. Over the past 1.5 weeks, the metric has indicated the dominance of buying by existing investors.

Data: Glassnode.

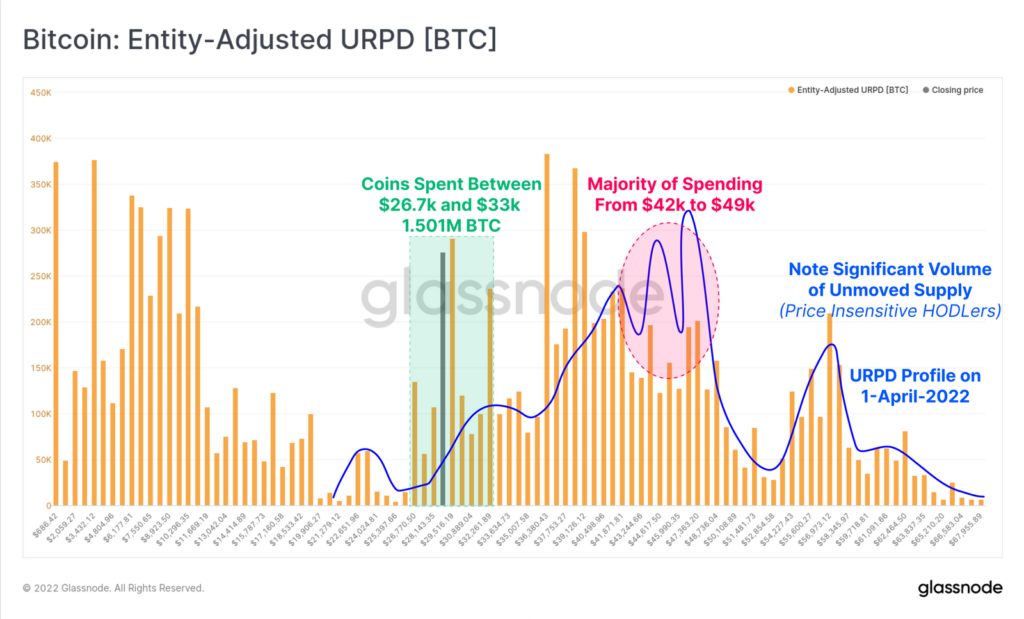

Analysts compared the state of the current market profile as of March 1.They concluded that most of the "young" coins that have moved in the past three months have proven to be insensitive to recent price fluctuations and mayGo to the "mature" category.

As a result, the actions of long-term investors have become a key factor in the market.

Glassnode predicted an update “in the coming months” of the historical maximum in the number of coins held by hodlers.

The chart below illustrates a significant “offload” of 1.5 million BTC in the $42,000 to $49,000 range, and the transfer of coins to buyers in the $26,000 to $33,000 range.

Data: Glassnode.

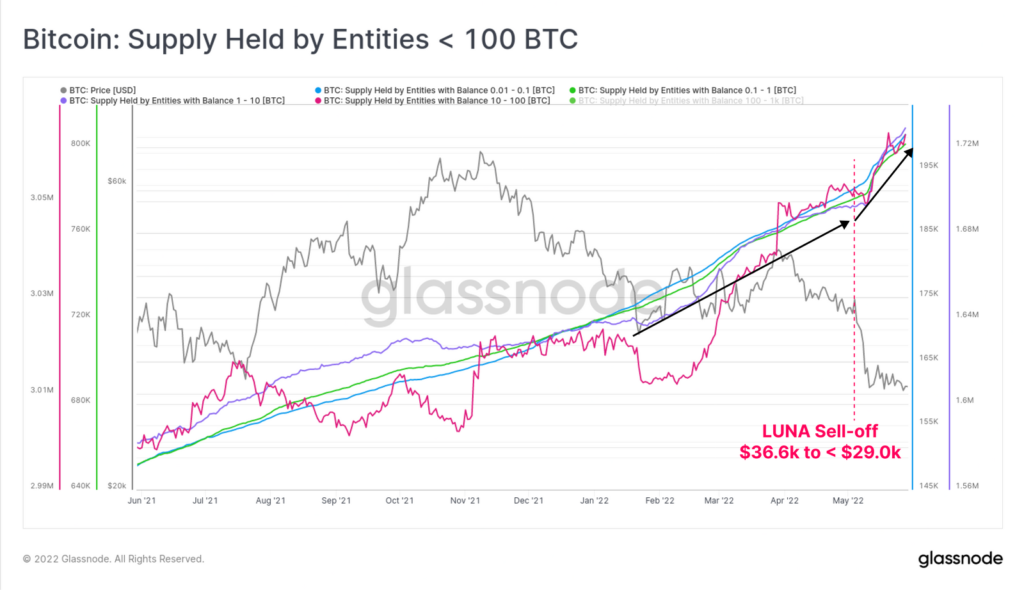

Sold LFG 80,081 BTC went to privateinvestors and organizations, among which stand out the owners of wallets with a balance of less than 100 BTC. Their combined position rose by 80,724 BTC, absorbing the increased supply from the nonprofit behind UST.

Data: Glassnode.

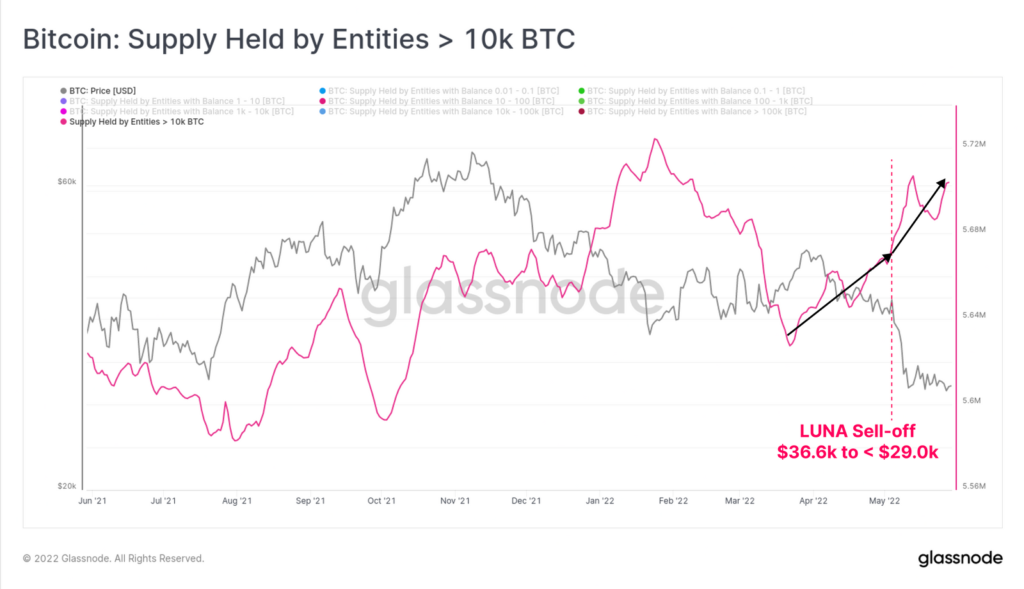

Significant accumulation activity was also shown by whales with balances over 10,000 BTC. During May, they purchased 46,269 BTC. This figure includes 80,081 BTC sold by LFG.

Data: Glassnode.

“We are closely monitoring the macroeconomic environmentand signals of decoupling between digital assets and stocks. Will the correlation increase and how will the market react to monetary tightening? However, the growth in the number of hodlers cannot but impress", experts concluded.

Recall that JPMorgan analysts called the fair price of bitcoin at $38,000.

Guggenheim Partners investment director Scott Minerd and critic of the first cryptocurrency Peter Schiff allowed digital gold quotes to fall to $8,000.