Another review from Cred and DonAlt, authors of the Technical Roundup newsletter. The authors discuss consolidation near record highshighs, accompanied by a “haircut” on the lowstimeframes, in major cryptocurrencies. For BTC and ETH, they redefine key levels and share thoughts on market positioning. They also formulate possible setups for altcoins in conditions of greater or lesser volatility. The S&P 500 index also returned to our radar, forming a larger high and recovering above the 50d MA.

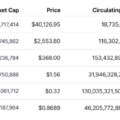

https://coinmarketcap.com/coins/views/all/

Bitcoin: haircut above $60 thousand.

Chart executed in TradingView

Chart executed in TradingView

On Tuesday, trading in shares of the first US exchange-traded investment fund (ETF) for Bitcoin began, and BTC/USD is again trading above $60 thousand.

The bitcoin rate went up, one might say, in a straight lineand after the highest weekly close in history, it looks like it is ready to go on and on. In addition, the move completely refutes the "shoulder of complacency" narrative, and even the most die-hard bears are now likely looking for buying opportunities.

ETF approval does not appear to trigger“Selling on the news,” and structurally, it would not be such a self-evident deal, given the proximity of new record highs amid favorable news background.

Overall, we believe that the movement towards newall-time highs are highly likely (what a bold prediction!) and that any dips to re-established support, especially the $56-$58k area where the daily and weekly levels coincide, should be viewed as buying opportunities for new highs.

The futures market doesn't look insanely overheated,considering how close bitcoin has come to a defining breakout. The funding rate for perpetual swaps has remained relatively flat, with a quarterly basis of around 15% (YoY). This is much higher than the lows, but does not look intimidating yet. Open interest with cryptocurrency margin surged sharply in the second half of the current rally. These are pretty funny contracts, because with them you open a long on an asset backed by a long on the same asset, but you need to understand that these participants are the first to discover the true "paper" nature of their positions in the fall, since the bulge in this type of contracts works against the buy side. A squeeze and a forced reduction in open interest with cryptocurrency margins could be a welcome signal to continue the trend and provide additional opportunities to enter the market, especially if this happens after the highs refresh.

A small note on the invalidation of the trade thesis. Weekly close below restored support

($56-58k) would most likely mean the market is not yet ready for a breakout. The weekly market structure will still remain bullish, with support at $50 thousand.

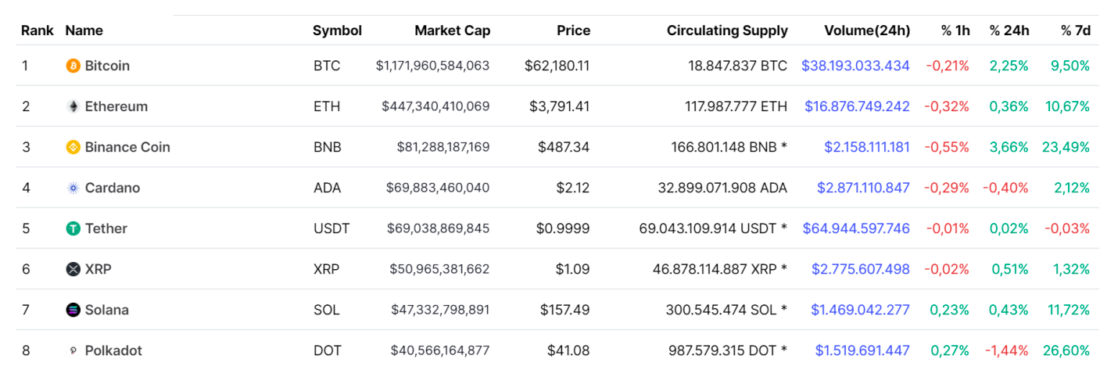

Ethereum: Triple Top Consolidation

Chart executed in TradingView

Chart executed in TradingView

The ETH / USD rate returned to the top of the $ 4000 range.

The pair to BTC is technically still in a wide range, albeit with a noticeable downtrend on the daily timeframe.

Our main thesis is that ETH / BTC most likely will not show strength in the breakout in BTC / USD, but will show it later in the event of a new large-scale wave of growth in Bitcoin.

After a significant pump in the Bitcoin market, capital begins to partially flow into assets with a smaller capitalization, usually starting with Ethereum.

From a "technical" point of view, the market is inthe range between ~ $ 3000-3300 support and $ 4000 resistance. Given the relative strength of the market and the proximity to new record highs, a breakout of the range upwards seems more likely than a retest followed by a breakout of its lower boundary. As a rule, horizontal triple tops do not provide convincing resistance, especially when they are forming near previous record highs.

The refutation of the thesis occurs when the daily support is lost at $ 3000.

Having opened a long ETH now and being right,you will probably earn less than long BTC. If you open long ETH now and find yourself wrong, you will probably lose more money than long BTC. Our confidence in this is by no means absolute, but the likelihood of a big breakout led by Bitcoin certainly needs to be taken seriously.

From our point of view, a more favorable timeto enter Ethereum will come when the dust from the movement in BTC settles. The current weakness in ETH / BTC with the likely prospect of even greater drawdown does not look like a good moment to place.

When Altseason ™

Given that the major cryptocurrencies look poised to renew record highs, positioning in the altcoin market does not seem timely to us.

From our point of view, when opening a position on altcoins, one should remember that long for altcoins = short for volatility in BTC.

Altcoins are most attractive when bitcoinis in range and / or calming down after a strong upward impulse. When bitcoin is so close to all-time highs, the bet on lower volatility in this market does not appeal to us at all.

When it comes to altcoins, we can distinguish two general trading ideas.

First:if bitcoin breaks up, we expect altcoins to plunge as holders dump their coins to catch a big move in BTC. This could cause cascading liquidations and create really good entry opportunities in the short term, waiting for a return to average levels as bitcoin calms down somewhat and stops generating hefty green dildos on the chart. Thus, for experienced practitioners, the possibility of buying altcoins on the wave of liquidations in anticipation of a short-term rebound is, in our understanding, a reasonable trading idea, and we ourselves are closely following the development of the situation from this perspective.

The second idea is that in the medium termLooking ahead, altcoins will become much more attractive in relative terms when Bitcoin, after a likely defining breakout, first moves into consolidation and trading in a new limited range. By this point, many participants will sell their altcoins - often forcibly - and altcoins to BTC pairs will drop by 30-60%. Prices are likely to reach clear support levels for both BTC and USD. In our opinion, this could be the right time to shift the focus to the altcoin market.

To summarize, altcoins don't appeal to us untilthe charts of the major cryptocurrencies look ready to draw a series of large (and hopefully green) candles at any time. If these expectations are fulfilled, then altcoins will become more attractive to buy either ahead of a rebound after likely cascading liquidations, or with the perceived grounds for greater capital rotation as the dust settles in the bitcoin market.

Now is the time to explore on your own.coins and their ecosystems, create watchlists, note key levels, etc. in anticipation of discounts and bargain buying opportunities if the market is so generous to us. (This is all, of course, if you have already read the basics, the Bitcoin whitepaper.)

Remember Evergrande? Neither are we

Chart executed in TradingView

An excellent headline for the formation of a “leverage of complacency” with a subsequent collapse of the S&P 500, which at the same time destroys all the bright prospects for the crypto market. I hope not.

But seriously, the S&P 500 looks good.

The crypto market collapsed significantly against the backdrop of a ~6% rollbacktraditional markets, and countless analogies with Lehman Brothers, of course, were drawn near the lows. To date, the crypto market has been the first to overcome correlation during declines (a fantastic and extremely convincing sign of strength), and now the S&P 500 is again approaching all-time highs.

From the point of view of TA, the situation now looks likemuch better. Price is making a larger high on the daily timeframe after the bottom in the form of unconvincing inverted heads and shoulders and then retracing above the 50-day moving average.

We're not experts at trading the S&P 500, but it would be nice if the index continued its upward trend, if only to give us less to worry about.

Give it at least a few weeks (or at most a couple of months) before the boomers start worrying again about scaling back support programs and fair market valuations.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

�

</p>