This week CredAnd DonAlt, mailing list authors Technical Roundup, focused on the mainemerging breakouts. They wrote about Bitcoin for $ 50K, Ethereum for $ 3K and potential risks when trading an altcoin / bitcoin pair.

</p>

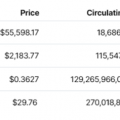

https://coinmarketcap.com/coins/views/all/

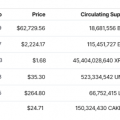

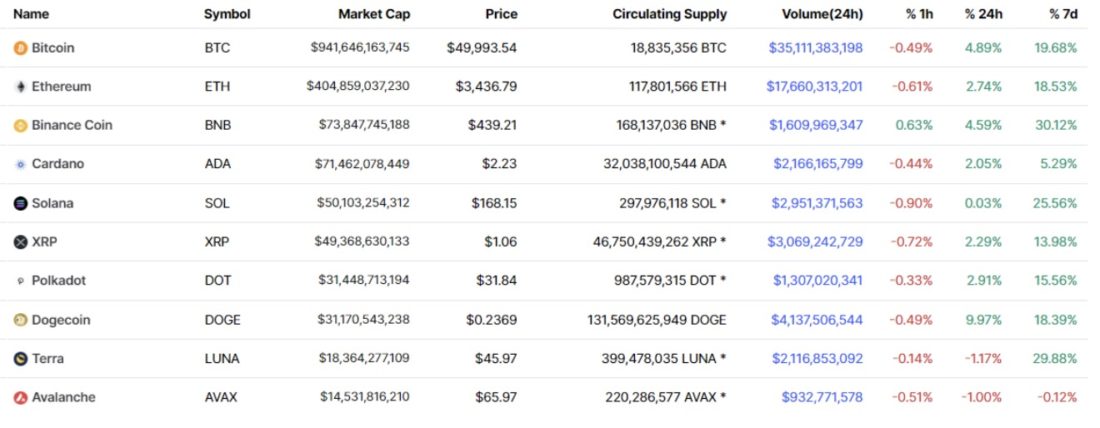

Bitcoin Shakes Off S&P Weakness

Chart executed in TradingView

Chart executed in TradingView

The negative correlation with the S&P 500 index was broken in a volatile manner when the price closed through the $45,000 resistance.Not only is this technically bullish (Bitcoin buyers are strong enough to ignore the stock sell-off), but it also confirmsThe status of a safe-haven asset for troubled times.

Our general macroeconomic view isthat bitcoin is still a risky asset, but when Petya sees red in his Bloomberg terminal, everywhere except for Bitcoin, it's at least good PR.

The obvious nuance is that, despiteinto this obvious division, if stocks do start to move sharply (COVID style), then we probably screwed up. This seems unlikely at the moment, but keep in mind that there are likely still limits to how far the crypto market can ignore traditional markets.

As for the technical characteristics, the pricebroke through the $ 45K resistance. This is a bullish sentiment. The final resistance level is located around $ 50K and is currently being tested. Not the best place to open new long positions from the resistance level, however, the location of quotes on the daily timeframe above $ 50K will most likely lead to a continuation of the impulse to the top of the range ($ 60K, with some intermediate areas).

Don said it best:"Until we lose $ 45K on the weekly timeframe, this shit continues." Also looming over the market is a Bitcoin ETF based on CME futures. We will find out about this in mid-October.

The approval would probably lead to strong growth.Most commentators consider rejection less likely (given the narrow reach of futures-based ETFs), but if Gensler agrees, a possible dip is likely to occur.

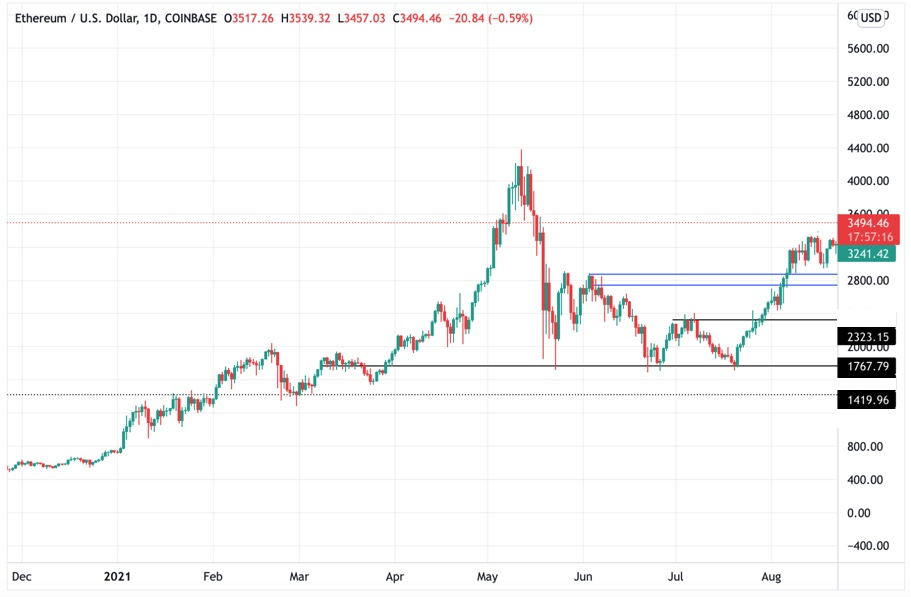

Ethereum Double Top looks vulnerable

Chart executed in TradingView

Chart executed in TradingView

ETH / USD is holding $ 3K., and like Bitcoin, it is at the last reasonable resistance level ($ 3.5K). This is one area where new long positions are difficult to justify on a purely risk basis, but resistance is not something to sell based on.

Instead, at best, one can hope that it will offer effective support. Three things are on our radar regarding Ethereum.

First, the move is above the $ 3.5K resistance.will have a lot of space until the next tech area at $ 4K. Even there, the triple top is unlikely to last forever, so it will be possible to catch a further stage of growth to new highs. Positioning from support / above resistance levels based on record highs makes trades attractive for this very reason; the chances of going to new highs are pretty high, so naturally there is more room for growth.

Second, just like Bitcoin / Dollarshould hold restored resistance at $ 45K, Ethereum / USD should do the same with $ 3K. The loss of these levels would signal weakness. Finally, if bitcoin / dollar stays in the driver's seat and the ETF / institutional narrative really picks up steam, ethereum / bitcoin could plummet.

The pair has been contracting and consolidating for a long timetime, and at this point, the bullish catalysts for bitcoin are more obvious. So technically above $ 3K could lead to $ 4K and probably higher, but a Bitcoin catalyst meltdown is likely to lead to an Ethereum / Bitcoin split (and altcoin discounts to boot).

Povorooooot

There's a crypto meme on Twitter that's really special to us. «Growth in dollars».

It refers to the times when couplesaltcoin / dollar (spot and futures) more or less did not exist and the main way to trade altcoins was buying bitcoin and then trading the altcoin / bitcoin pair to accumulate more bitcoins. The conventional wisdom was that the sole purpose of the altcoins was to accumulate more bitcoins through these trades.

The logical consequence of this was that if youbought an altcoin and it was inferior to bitcoin, it was a bad trade because you ended up with fewer bitcoins than if you hadn't made a trade. Participants confronted with this inconvenient truth would argue that the value of their portfolio in USD has increased, not realizing that it would have increased even more if they were simply holding their bitcoin (given that their altcoin was performing poorly).

The reason we raise this eternalthe anecdote is that there is a nontrivial chance if we assume that we are in some kind of double pump territory, and that the next stage of the market is led by bitcoin. The above ETF approval will accelerate this scenario. When Bitcoin is in the lead, it is very difficult to keep up with it. The move to altcoins eventually occurs as risk trickles down the curve during pullbacks or during periods of consolidation, but the lack of allocation of bitcoins during a trend formation can be very difficult in terms of opportunity cost.

In the future, it will become clear if the story is true,based on bitcoin, but either way, this section serves as a gentle reminder not to take your eyes off the orange coin for too long. Bitcoin trend-shaping breakouts are often driven by altcoin valuations, but they also create incredibly attractive discounts later in the cycle.

Thus, if Bitcoin starts to move to new highs, it is best not to weaken it. This phenomenon is something that has yet to be faced in 2021.

BitNews disclaims responsibility forany investment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

�

</p>