Chainalysis KYT - third-party software integrated into payment solutionsmost cryptocurrency exchanges and detecting dubious operations.

The main task of KYT is to carry out realtime analysis of blockchain transactions. The development is aimed at large companies that need to conduct a detailed assessment of the solvency and reliability of the counterparty, and also know whether their cryptocurrency assets were involved in illegal financial transactions.

——

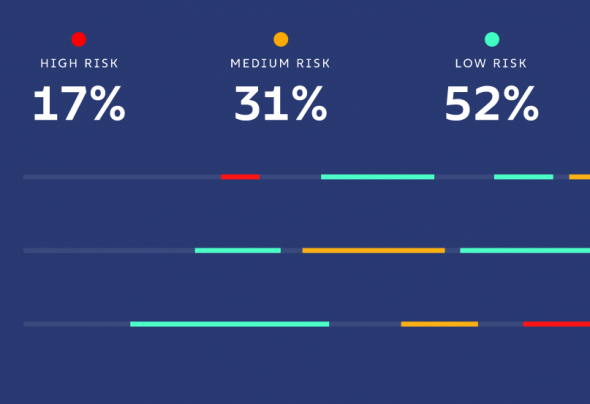

Identify high-risk activities

KYT discovers many high-risk activity patterns, from OFAC-approved addresses and darknet markets, to fraud and abnormal transactions.

Reduce false positives

Our complete data covers thousands of services,working in crypto mode, preventing false positives that harm the user experience, or creating unnecessary work for your matching team.

Real time alerts

Use the real-time KYT API to prevent OFAC and terrorist financing campaigns from being lifted and freeze deposits from hacks.

——–

Some such analogue of our list of 550-p, onlyhere on the 3-4th knee of the blockchain chain research, you come across coins stolen from various exchanges and, what is most dangerous, wanted by the US special services according to criteria they know only.

—-

The company’s analysts have determined the location of 650,000 BTC missing from the MtGox exchange. The MtGox collapse is still one of the biggest examples of fraud in the industry.

At a hearing in the House of RepresentativesUS co-founder of Chainalysis Jonathan Levin said: “Chainalysis participated in the official investigation into the bankruptcy of MtGox, we now know the exact location of the coins.”

From that moment on, the reputational weight of Chainalysis began to grow by leaps and bounds.

The company entered into a contract with the US Internal Revenue Service.

The task specified in the contract was to develop a protocol for tracking transactions and reaching the sender to combat money laundering through cryptocurrency.

Similar services were provided by the FBI to the USA and a number of other special services (it was with the help of Chainanalysis that the FBI succeeded in exposing illegal operations on the anonymous Silk Road site).

Apparently, the company with the task reallycoped. What kind of final development was carried out for government agencies is unknown, but the Chainanalysis KYT tool (KYT - “know your transaction”, an allusion to KYC - “know your customer”) was presented to the general public.

———–

What risks does this bear directly for crypto investors ???

Someday I will write a separate post about this butin short - if you don’t have such software - and you most likely don’t have it - then if you receive a bitcoin or satoshi from some anonymous wallet or OTS, you risk running into “blackening of your entire wallet” and your background on the exchange, with the freezing of funds etc.</p>

In short, all the charms of the anonymous blockchain are slowly coming to naught.</p>