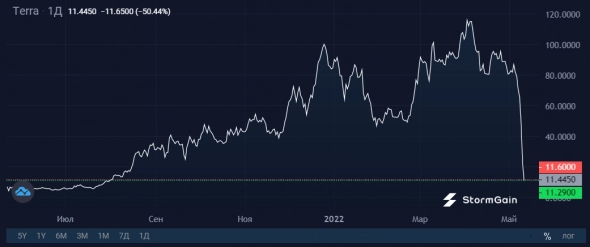

Until recently, Terra was one of the most promising projects: its stablecoin ranked third incapitalization from $18 billion in the rating of stablecoins, in the DeFi sector, it was second only to Ethereum, and the LUNA balance coin was the only one from the TOP-10 that updated its historical maximum in 2022. The fall was so loud that it caught the attention of US Treasury Secretary Janet Yellen.

Image Source: Cryptocurrency ExchangeStormGain

Terra's goal was to create a bridge betweentraditional finance and cryptocurrencies. To do this, the project has launched several stablecoins, including USD-pegged UST. The algorithm of interaction between UST and LUNA, the internal coin of the system with a floating rate, is responsible for the 1: 1 rate compliance. Because of this, UST is called an algorithmic or decentralized stablecoin. We have written about the advantages and disadvantages of this approach more than once, including in the last article.

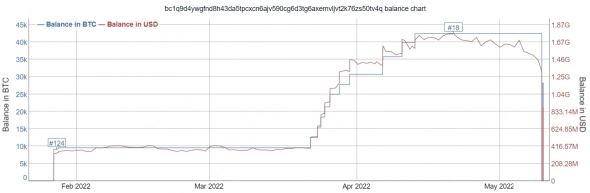

To strengthen the position of the stablecoin, in March, Terraannounced the future peg of UST to its own cryptocurrency reserves. After accumulating $3 billion, half of which was Bitcoin, the funds were transferred to market makers on May 09 to support the falling UST rate.

Image source: bitinfocharts.com

The initial reasons for the decline in UST to 0.98 USDand lower were the sell-off in the cryptocurrency market and the attack by an unknown seller who sold a stablecoin for $300 million on May 8. This was accompanied by a discussion of the weakness of UST in social networks, which led to panic and significant pressure from other market participants. For a while, market makers tried to hold back the UST rate by selling Bitcoin and other crypto assets, but this did not save the situation.

At the moment it is not known for certain - lostwhether Terra has all its reserves in an attempt to keep the UST rate, or has decided to stop stabilizing it at the expense of the reserve. With the reserves out of the game, the balance coin LUNA has taken the brunt, with its weekly drop reaching 90%.

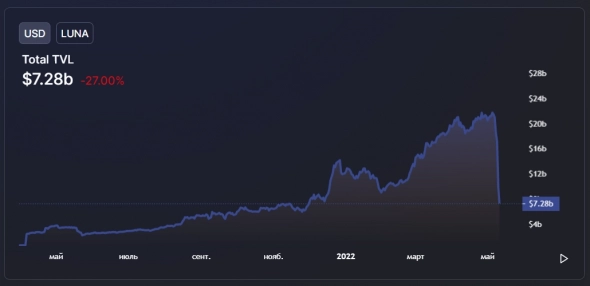

The yield of UST staking reached 20%, whichwas reflected in the growth in the number of investors and the amount of blocked funds, despite the general decline in the cryptocurrency market in 2022. However, the fall in the UST rate made further staking unprofitable, due to the flight of investors, the volume of blocked funds in DeFi decreased threefold in a few days. At the moment, UST is trading at $0.82, which indicates the absence of normalization and the risks of a further decline in LUNA.

Image source: defillama.com

Investor Lyn Alden compared the UST peg andBitcoin с попыткой развивающихся стран спасти экономику за счет сжигания золотовалютных резервов, намекая на закономерный итог такого шага. А Джанет Йеллен 10 мая призвала Конгресс как можно скорее разработать законопроект о регулировании стейблкоинов, приводя в пример UST.

Для выравнивания ситуации фонд Terra планирует raise an additional $1 billion in investment, and project developer Do Kwon wrote on Tuesday that a recovery plan would be unveiled soon. However, the reputation has already been undermined, and the probability of restoring the project to historical performance is assessed as extremely low.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)