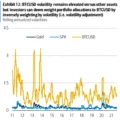

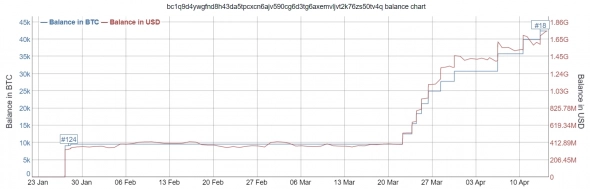

At the end of March, the co-founder of the Terra blockchain project, Do Kwon, announced his intention to create a reserve of Bitcoin forproviding liquidity to the UST stablecoin.In three weeks, the company spent $1.5 billion, and the address balance increased to 42.4 thousand BTC. This brings it closer to Tesla, whose cryptocurrency assets are valued at 43.2 thousand BTC.

Image source: bitinfocharts.com

UST is an algorithmic stablecoin, and itsthe issue is mathematically related to the money supply of the internal LUNA coin. In case of increased demand for UST, LUNA validators receive additional rewards. If demand falls, some of LUNA is burned. Simply put, a developer cannot print more UST if he wants to.

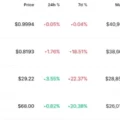

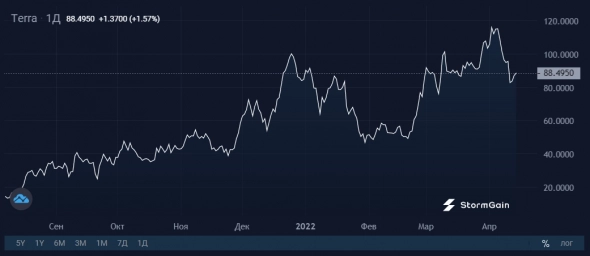

Image Source: Cryptocurrency ExchangeStormGain

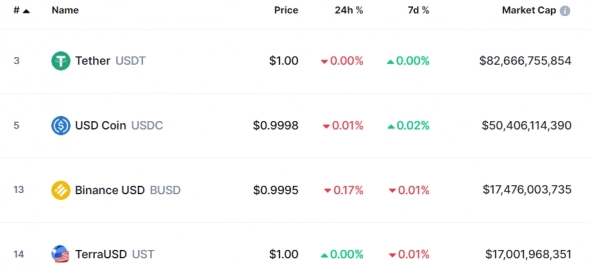

This fundamentally distinguishes algorithmicstablecoins from centralized ones, where the liquidity of a coin depends on the volume and quality of reserves. For example, Tether instead of the promised currency savings in US dollars holds about half of the reserve in publicly undisclosed securities. This means that the company often lends stablecoins in exchange for debt. Previously, this has already led to scandals, so in January 2018, Tether printed tokens for $ 850 million to provide a loan to Bitfinex.

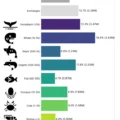

Even though UST is mathematicallybalanced stablecoin, Terra decided to strengthen its position with an additional reserve from Bitcoin. At the initial stage, the company plans to spend $3 billion from its own fund, and in the long term to bring the reserve to the equivalent of $10 billion. Now, such a purchase would make Terra the largest public holder of Bitcoin, leaving MicroStrategy far behind with its reserve of 125 thousand BTC ($5 .2 billion).

Image source: coinmarketcap.com

UST has less than $0.5 billion left to raisecapitalization to overtake BUSD and become the third largest stablecoin. At the same time, in DeFi, the Terra blockchain already occupies the second position with $19 billion of blocked funds, and the LUNA coin is the only coin from the TOP-10 that was able to update its historical maximum in 2022.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)