Decentralized finance (DeFi) is considered by many to be the first use case for Ethereum that is not closed to itself.Ethereum The most significant events in the sector in recent weeks, especially for ForkLog, were told by co-founder of Zerion Vadim Koleoshkin.

Capitalization, DEX volumes and value of frozen assets

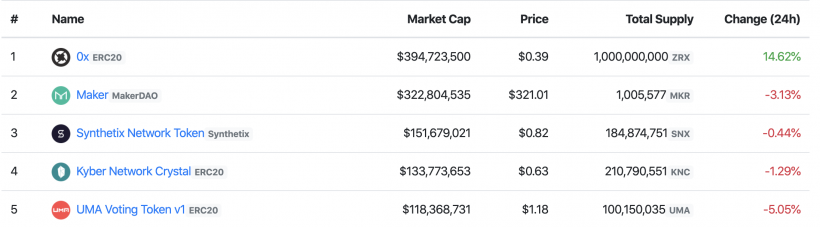

According to the DeFiMarketCap service, at the time of writing, the capitalization of DeFi tokens amounted to $1.659 billion.The list is topped by the basic tokens of the protocols.It has one newcomer — the UMA token, and the permanent leader Maker has been squeezed out by ox.

DeFiMarketCap Data

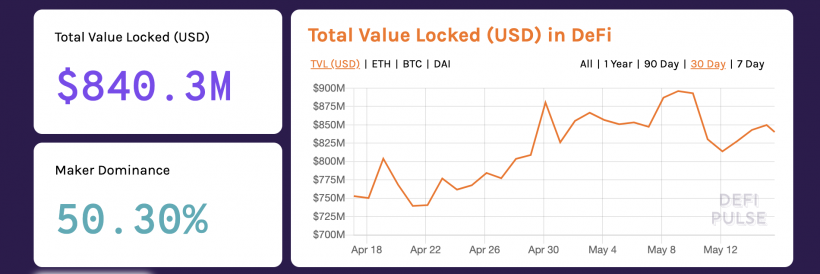

Funds worth $ 840.3 million were frozen in DeFi services. According to DeFi Pulse, the Maker dominance index is 50.3%.

DeFi Pulse Data

Trading volume on decentralized exchanges (DEX) in 2020 overcame the mark of $ 2 billion.

</p>Bitcoin Captures DeFi

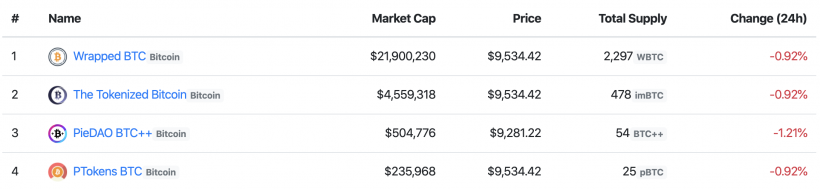

In early May, MKR holders approved the use oftied to the first cryptocurrency Wrapped Bitcoin token (WBTC) as collateral on the MakerDAO platform. WBTC became the fourth after the Ethereum (ETH), Basic Attention Token (BAT) and USD Coin (USDC) collateral asset for obtaining loans in the stablecoin DAI.

In just two weeks, WBTC entered the top ten DeFi Pulse ratings.

</p>According to DAI Stats, at the time of writing, 334 109.6 DAIs are provided with WBTC tokens.

DAI Stats Data

Probably soon MKR holdersthey will also consider tBTC support as a collateral asset. This is an Ethereum-based token tied to bitcoin in a 1: 1 ratio. tBTC does not use centralized storage for bitcoins, unlike WBTC. Its listing on leading DEX is expected in the near future.

</p>The list of Bitcoin-linked tokens on Ethereum is available on DeFiMarketCap. Read more at the link.

DeFiMarketCap Data

MakerDAO discontinued support for Sai

MakerDAO community shuts downmonolithic SAI (Single-Collateral Dai). Thus, the service accelerated the transition to a multi-security stablecoin Dai (Multi-Collateral Dai, MCD or DAI).

</p>Learn more about switching to DAI at ForkLog.

New DAI: Collateral Priority Race Begins

Compound switched to a decentralized management system

In early February, Compound announced a switch to decentralized management. Instead of completely controlling the protocol, the company decided to transfer control to its users.

Due to regulatory uncertainty, more and more developers are thinking about how to transfer protocol management and decision-making to the blockchain, thereby moving away from binding to a specific jurisdiction.

Half of the COMP tokens belong to the team and investors, and half will be distributed among users of the protocol. Read more at the link.

The first offer was the addition of support for USDT (Tether). USDT holders can earn 0.71% per annum (each block changes) on deposits at Compound.

The second proposal came from Dharma. Since the deposit rate on Maker (which is fundamental to the Compound rate) was 0%, she proposed increasing the deposit rates on DAI and thereby attract more depositors.

The proposed model change parameters did not affect the protocol code base and were approved.

UMA Holds Tokensale on Uniswap Decentralized Exchange

Universal Market Access has placed tokens on the Uniswap exchange. This has become unique in terms of the distribution mechanism, the initial placement of tokens.

</p>The company is creating a platform forsynthetic assets through contracts for difference (CFD). The solution proposed by the platform allows you to reduce the dependence on centralized methods of communicating the price of an asset on a blockchain.

The event has already been called IDO (Initial DEX Offering). However, the mechanism found a number of disadvantages.

</p>FutureSwap Alpha DeFi Protocol Launched

Within three days after the launch, the trading volumeamounted to more than $ 7 million, and FutureSwap became the largest DEX in daily volume. At the same time, liquidity providers earned up to 550% of annual yield on the ETH-DAI pool.

As a result of testing, the team turned off trade in order to cool demand and prepare for a full launch.

</p>In the meantime, DEX dydx derivatives opened bidding for perpetual bitcoin contracts with settlements in stablecoin USDC and leverage x10.

Longrid at ForkLog

Zerion startup co-founder Yevgeny Yurtayev spoke about the profitability of some DeFi services in the first quarter of 2020.

DeFi-swing: entrepreneur compared the profitability of DeFi-assets, Ethereum and bitcoin in the first quarter