Scalping is one of the strategies of intraday speculative trading, when a traderDoes a great thingthe number of low-profit transactions, resulting in a high total income.

In the global stock markets, the strategy of minutetransactions became popular at the end of the 20th century, when computer technology began to be actively developed and applied on exchanges. The more powerful computers became, the faster traders opened and closed positions.

Scalping began to be used in Russia for the first timenot traders of futures contracts, but buyers of shares of the Russian energy company RAO UES in the early 2000s. At that time, it was the most volatile security in our country; prices for it could rise and fall several times a day by about 15%, writes RBC Crypto.

Crypto market scalping

High volatility cryptocurrency market opened beforeProfessional scalpers have a ton of opportunities. Traders using this strategy choose those cryptocurrencies that constantly and most sharply fluctuate in price.

If an asset rises and falls within1-2% per day, then the scalper will not be able to earn much on such a coin. If the price of a cryptocurrency fluctuates during the day in a range of more than 15%, and in a few minutes can rise and fall by 2-3%, then quick transactions with such assets can bring a good income to the trader.

Scalping and Pipsing Strategy

Many people consider scalping and pipsing synonymous, these strategies are really similar, but they have one important difference, which is how long the trader has been on the market.

Using the pips strategy, the trader seesthe beginning of the trend and opens a long position with a minimum level of profit - about 10 pips or points (minimum movement of the price of an asset). When the coin rate reaches this result, the trader closes the order. Often this happens from a few seconds to several minutes.

If a trader, having seen the beginning of a trend, understands thatSince the cost of cryptocurrency continues to grow for a longer time, it may linger on the market and raise rates. In this case, pipsing will give way to scalping. A trader will not open a position at 10 pips, but will fix a profit at the level of 50 pips or more. From the moment of opening to the moment of closing such an order, it can take from several minutes to an hour.

Cryptocurrency scalping bots

Manual scalping requires constant concentration from the trader, as well as a considerable amount of free time. Today, many participants in the digital industry trust crypto exchanges to bots.

This is a specially created algorithm thatuses various indicators and software systems for transactions on behalf of the user. On the network you can find specialized bots for scalping on the exchanges Binance, Yobit, Bitmex and others.

Disadvantages of scalping

This strategy has a high percentageunsuccessful transactions. Due to the fact that the speed of closing and opening orders is too high, the trader does not have time to analyze the market in order to minimize losses and make each trade profitable.

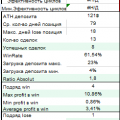

The bet is on speed and quantity, not onquality. Therefore, it is very important for scalpers to track the number of profitable and losing trades. A good indicator is considered if more than 50% of transactions were successful. If this indicator turned out to be lower, then it is better to change the strategy or choose another cryptocurrency asset.

</p>Rate this publication