Different central bank digital currency proposals contain different technical solutions from differentproblems.I am interested in the implications for monetary policy of those that allow anyone to place deposits in an account with the Federal Reserve System (FRS), either directly or using conventional banks as brokers.

</p>Ten years ago I published an article"Central banks as a source of financial instability", which argued that, contrary to popular belief, central bank monopolization of paper money was an important historical cause of the instability of the financial system. Here I want to show that the provision of digital money by central banks, and in particular retail deposits, can also be destabilizing.

Old-fashioned bank forays

How can a Fed account be destabilizing?Consider an example of a "classic" systemic financial crisis. It does not consist of a foray into one or a small number of banks, but of a flight from bank deposits to central bank currency.

As anyone who has studied money and banking knowsIn fact, in a fractional reserve system, every paper dollar withdrawn from the banking system can lead to a much larger reduction in bank deposits and, therefore, in the total money supply. In principle, aggressive expansion of the central bank can prevent a contraction in the money supply. But since central banks generally do not lend to private sector borrowers, replacing central bank fiat money with deposits cannot preserve private credit, which falls with commercial bank deposits. As before, there may be a serious reduction in "credit channels".

Because to save up paper currency and settleinconvenient and risky, most of the bank raids were fleeing from suspected unreliable banks to still trusted banks. This is especially the case for banking systems with national branch networks, as most large communities in such systems have access to more than one commercial bank. Despite their notoriety, bank raids were rare. They were rare even before the creation of the Federal Deposit Insurance Corporation in the United States, when panic was more than enough. Even an almost systemic panic in February-March 1993 was no exception, since it was associated not so much with banks as with growing fears that Roosevelt was planning to devalue the dollar. In other words, what looked like a general loss of confidence in American banks was in fact a loss of confidence in the government's willingness to follow the established dollar standard.

Fed accounts

Now let's consider a case where instead of two options - to keep liquid payment claims against private intermediaries or fiat currency - there is another third: to put funds into a personal account with the Fed.

According to many of their supporters, private accounts inNot only are the Fed completely safe, they will also offer many of the benefits of regular bank accounts and even be cheaper. For example, in a recent speech to Congress, Morgan Ricks noted that, according to his FedAccount proposal:

“The Fed will not take commissions and will notestablish minimum balance requirements. FedAccount will also have all the special features that are now available for commercial bank accounts at the central bank: real-time payments, high interest rates compared to conventional bank accounts, and full government coverage without the need for deposit insurance. "

However, the FedAccount plan will not allow contributorswithdraw more of the balance in their Fed account. This condition is necessary if the Fed does not want to act as the lender of last resort, not only for banks, but for anyone who cannot balance their checking account. In normal times, such restrictions may make personal accounts at the Fed less attractive to those who can afford to keep accounts at regular banks and pay periodic overdraft fees. But this will not necessarily make them unattractive to those who would otherwise be left without access to banking services.

Morgan Ricks, Michael Bordeaux, Andrew Levin and othersproponents of individual accounts with the Fed assume that the Fed will pay about the same interest rate on such accounts as it pays on bank reserves. For example, as suggested by Bordeaux and Levin:

“Consumers and businesses will be able to receivepractically the same interest on checking deposits and other checking accounts that commercial banks receive on reserves held at the central bank, that is, the interest rate on reserves minus a very small margin to cover operating costs. "

Even if there are no personal accounts at the Fedyielding interest, they will be a much closer substitute for private liquid dollar assets than Fed paper notes. But I will follow most of the suggestions that individual accounts with the Fed will yield interest equal to the reserve rate.

Suppose then that the accounts at the Fed are initially inwill mainly be used by those who previously did not have access to banking services. This state of affairs is consistent with the outcome that many proponents of personal accounts at the Fed envisioned. However, it is easy to imagine a general rate hike that could widen the gap between private intermediary rates and the reserve rate enough to encourage a massive flight from private sector intermediaries to Fed accounts. In fact, any significant transition from near-zero to positive returns may be sufficient, given: 1) the need for private intermediaries to fully cover their non-interest intermediary costs by paying depositors less than their asset income; and 2) the fact that the Fed's reserve rate is usually higher than the yield on short-term US Treasury securities and other liquid low-risk assets.

The threat of a systemic raid on intermediaries fromthe private sector becomes even more serious if accounts with the Fed can - as some of their supporters argue - “squeeze out” not only regular bank accounts, but also repos, Eurodollars, and money market mutual fund stocks. According to Ricks:

"FedAccount is likely to reduce the likelihoodfuture financial crises by “crowding out” volatile deposit substitutes such as repo transactions, Eurodollars and money market mutual fund stocks, which are a significant source of financial instability. ”

Ricks' remark begs the question: if the Fed's private accounts can overtake other private substitutes for bank deposits, what prevents them from doing so only intermittently and perhaps suddenly?

Providing a new haven for funds, not onlySafe, but also relatively profitable, accounts with the Fed may ultimately increase, rather than reduce, the volatility of money markets, making short-term money more popular than ever. If private substitutes for deposits are at least sometimes more attractive than accounts with the Fed, this risk can be eliminated only by completely banning such substitutes - that is, by allowing only the Fed to compete with banks and credit unions for depositors' funds. And even such an extreme step will not prevent banks and credit unions from falling victim to periodic systemic transfers of funds from them to the Fed.

Commenting on this argument, David Andolfattosuggested that the Fed could eliminate the described crisis of withdrawal from private intermediaries by adjusting the interest paid on individual accounts so that they are not attractive enough to bankrupt private sector intermediaries. In principle, he is right, and the Fed has already considered paying a lower rate on the balance sheets of tax-to-pass private investment companies (PTIEs) than on bank reserves, with the stated goal of preventing them from undermining financial stability.

However, there are good reasons to doubt thatthe procedure recommended by Andolfatto will work in practice. In particular, it will embarrass Fed account holders - primarily those who have already been at a disadvantage and who should be particularly attracted to Fed accounts - by forcing them to accept less favorable yields than are available to those who can afford private substitutes. market. Therefore, while it might be more prudent to pay personal account holders at the Fed less than banks earn from their reserve balance sheets, it may not be politically acceptable.

Postal savings precedent

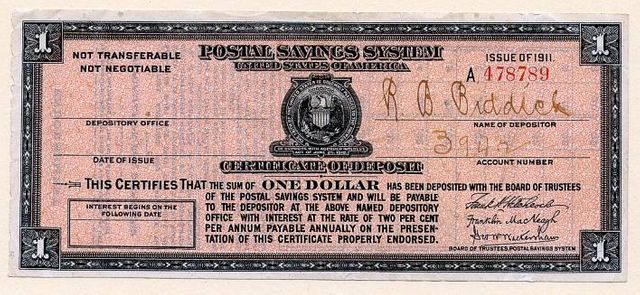

: Scripophily.net

The concerns expressed here are of historicalprecedent in the experience of the postal savings system established in the United States in 1911. In a recent article by Matthew Yaremsky, Sebastian Fleitas, and Stephen Schuster, means prolonging the effects of depression. " The postal savings experience is highly relevant as many Fed account proponents would prefer the US Postal Service to team up with the Fed to provide it with a ready-made retail banking infrastructure network. Jaremski and his coauthors conclude:

“The resumption of postage savings may haveunintended consequences, luring clients away from private lenders and reducing the funds available for public lending and investment. Policymakers can learn from the Great Depression by thinking about the broader economic implications of programs like postal savings. ”

Whether or not there really will bethe US Postal Service is involved, plans to offer the Fed retail deposit accounts definitely fit the definition of "programs like postal savings."

Fed knows

The Fed itself knows the risks of personal accounts inthe central bank represent for financial stability. This issue came up not in connection with proposals to allow anyone to have an account with the Fed, but in response to a request from Narrow Bank in 2016 for such an account. In their "advance notice of proposed regulations" for such PTIEs, Fed officials explained that they could potentially "complicate the implementation of monetary policy", in particular "adversely affecting financial stability." In particular:

“Deposits at PTIE can significantly reducefinancial stability by providing an almost unlimited supply of highly attractive safe haven assets in times of financial market tension. Deposits with PTIE may be considered more attractive than US Treasury bills because they will offer instant liquidity, may be available in very large quantities, and will yield adjustable interest rates that may not necessarily decrease as demand rises. As a consequence, during busy times, investors who could provide short-term financing to non-financial firms, financial institutions and regional governments can quickly withdraw these funds from such borrowers and invest them in PTIE. Sudden deprivation of funds from these borrowers can significantly increase systemic tension. "

Of course, what concerns PTIE is also true inany plan to give all "individuals, businesses, and institutions" the right to have an account with the Fed. In fact, the argument for limiting individual accounts at the Fed is much stronger than the argument for excluding PTIE: while PTIEs may pose a threat to other private intermediaries, their presence generally does not threaten to disrupt private money markets.

Financial and technological alternative

: Unsplash

Some supporters of individual accounts at the FedThey may say that, if my concerns are justified, a possible solution is to simply ban private money and near-money - and with them private credit intermediation.(After listening to Martin Chorzempa's talk at the 2020 Cato Institute monetary conference, I tend to call this a 1984-style decision.)

With all due respect to those who can givepreference for this option, I believe that the more logical and definitely not so draconian solution would be the cooperation of the Federal Reserve with both banks and non-bank ("financial and technological") payment service operators in order to maximize the benefits of high-tech private alternatives specially designed to replace paper money - what Neha Narula called "digital cash" - and especially those that should serve the financial needs of people with no or limited access to banking services. Unlike PTIE, instead of seeking deposits paying attractive interest, many financial technology payment service providers specialize in providing cheap, convenient and fast payment services, including peer-to-peer payments, which, despite offering low cash income, can very effectively provide banking services to those who did not have access to them. Such services do not have to expose established intermediaries to serious risk of loss.

The Bank of England actually welcomed privatedigital cash operators in 2017, inviting hundreds of financial and technology companies, including many offering prepaid payment cards and prepaid online and mobile accounts, to open checking accounts there. The stated goal of the Bank of England was to enable fintech companies to compete more effectively with banks and construction companies that previously had exclusive access to such accounts. But Bank of England policies also make it easier for fintech companies to compete with the central bank itself by providing smart prepaid cards and other better digital substitutes for its fiat currency, which can be credited and debited through the Bank of England's payment channels.

Considering our topic, it is especially worth noting that,In announcing the Bank of England's decision, Governor Mark Carney noted that he does not believe that it poses great risks, but on the contrary, will "support financial stability through greater diversity and risk-reducing payment technologies." Specifically, according to the Bank of England, its new policies will contribute to stability:

- by creating more diverse payment methods with fewer single points of failure;

- identifying and developing new technologies that reduce risks; and

- expanding the range of transactions that can be carried out electronically with settlements in central bank money.

Pay attention to what value BankEngland appropriates the promotion of constant innovation, which is difficult to expect from a central bank that has a monopoly on all means of payment. Think of how central banks' long-standing monopoly of hand-to-hand currencies limited innovation in this space until non-bank private market innovators finally forced them to consider alternative technologies.

Only time will tell if the optimistic ones come trueexpectations of the Bank of England. But to me, at least, his approach seems like a reasonable compromise between the status quo and making the Fed our sole source of payment.

</p>