On the preliminary vision of new digital currencies by the central banks themselves (based on documents from the ECB and the IMF).How do they represent the key characteristics andfeatures of CVCB? What standards should they meet? How can this affect private banks? And finally, how do you feel about the idea of a dual-currency fiat system with a negative cash rate?

Central bank digital currencies (CBDs) are getting closer. Their discussion has been going on for several years, and with the onset of the COVID-19 pandemic, efforts in this direction have doubled.

Today, if you go looking for information about the CVCB, you will find yourself inundated with the usual set of some kind of eccentricities, conspiracy theories and dire predictions about an impending dystopia.

“I'm soon launching my premium service, which includes valuable one-on-one instruction over the phone (for as little as $1,000 an hour) to prepare you forWHAT IS COMING! "

Pay with digital dollars

This story will have serious conclusions, but so far we still have a lot more questions than answers.

Where do all these conspiracy theorists get it from?your ideas? You don't have to go far, just look, for example, at this selection of headlines from the World Economic Forum and the International Monetary Fund:

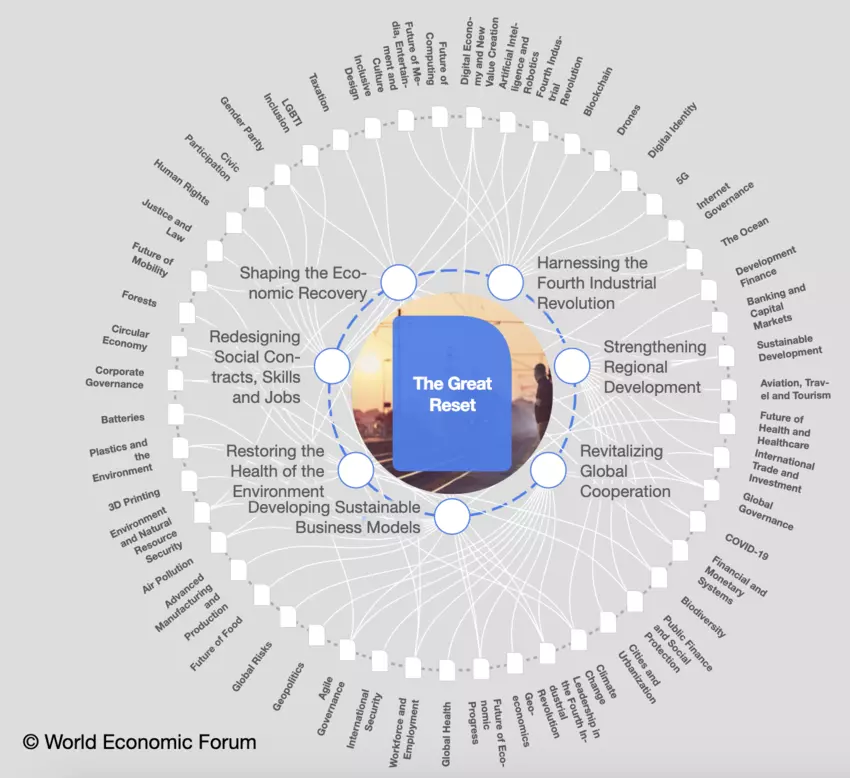

- Time for the Great Reset (World Economic Forum);

- The Great Reset (International Monetary Fund);

- “Global Economic Restart. Supporting More Inclusive Recovery ”(IMF Blog);

- Time for a New Bretton Woods Agreement (IMF);

- Cross-Border Payments: Looking Ahead (IMF).

This video from EEF 2016 also fits into the general line…

"You will not own anything and you will be happy!"

See how happy he is!

Why do the authors bring this topic to suchextremes? It's just that it fits well into the usual agenda of recent times: less racism, inequality and climate change. More equality (in income), social inclusion and assistance to the poor. No practical ideas, just a list of desirable ideals.

In general, about the same thing could be said much more simply:

"Stop being poor!"

And that's it, the problem is solved! Why complicate things?

However, the general message is clear:

It's time to build our new utopia.

Capitalism and socialism must merge into one.

Although anyone who thinks about it is likely to find that elements of capitalism and socialism are already present in any developed society. But I digress.

This is the "plan":

Or maybe it's just a bunch of cutesy, idealistic buzzwords…

Why am I pointing out all this here (cynically)?Because all this superficial noise is complete nonsense. It’s just that groups of progressive activists at a fairly high level are promoting their utopian ideas for restoring and changing our societies in this way. Are we really supposed to believe that these huge institutions of intellectual masturbation suddenlyall comprehended and calculated?

And now they have convinced the constantly failing inTo achieve their goals, central banks (and governments) suddenly unite on this one point, even though they generally have difficulty reaching an agreement within their own councils or political parties? They will act quickly and efficiently to implement all this, right?

Okay, that's all for me, the tirade is over. Let’s now try to discard all the nonsense that is winding around this topic and look at the CVCB with an unclouded glance.

What are central bank digital currencies?

We should probably start with the fact thatwhile stillthey don't exist. Although research is in full swing. All the major central banks are in play, and it's definitely a "when" question, not an "if." However, much remains to be done.

Retail CVCBis a central bank-issued digital currency with peer-to-peer (p2p) settlement and decentralized governance (no intermediaries), widely available for consumer use.Will serve as a supplement or replacement for physical cash, as well as an alternative to traditional bank deposits.

Wholesale CVCB— digital issued by the central banka currency with peer-to-peer (p2p) settlement and decentralized governance (no intermediaries), available only to commercial banks and clearing houses for use in the wholesale interbank market.

(definitions: WEF whitepaper[English, PDF])

As shown in this ECB report (and in the infographic below), the level of centralization is far from certain.

Will everyone get a central bank account?

Or is it about keeping the current system with banks as intermediaries?

Quite a lot depends on the answer to this question. If everyone can open an account at the central bank (Fig. 1), then banks should be redefined as creditbrokers,instead of creditissuers... We will return to this later.

Why can the central bank switch from paper money to digital money?

It all comes down to innovation.The collective genius of humanity always creates problems for politicians. Digital currencies already exist in the private sector. Central banks have been caught off guard (and not for the first time). Now they have a simple choice: adopt the new technology or stay behind and eventually lose control of the monetary system. And we know what they will choose.

At the autumn press briefing of the Bank for International Settlements, two participants admitted that they were very late in reacting and shared their thoughts on the matter.

Benoit Coeuré (former ECB member):

"The private sector is growing rapidly and in many ways ahead of us in terms of developing new means of payment and digitalization of payments, and the Covid-19 crisis has accelerated these processes."

"We are seeing a new payment ecosystem emerging with new forms of payments and possibly new forms of currency with a different status from the current one."

John Cunliffe of the Bank of England:

"We need to think about what this means for our work to ensure that reliable, efficient and convenient money continues to be available to everyone."

Facebook's Libra and China's Alipay are proof of concept. And the private sector is, of course, far ahead of central banks.

Starting today, people across India will be able to send money through WhatsApp? This secure payments experience makes transferring money just as easy as sending a message. pic.twitter.com/bM1hMEB7sb

— WhatsApp (@WhatsApp) November 6, 2020

WhatsApp Inc. (@WhatsApp):

Will people all over India be able to send money via WhatsApp from today? This secure payment method makes money transfers as easy as sending messages.

The Chinese PBOC is also lagging behind (although it is much ahead of the Central Banks of other countries):

“Alibaba and Tencent are far ahead of anyoneanother financial services provider in the field of digital payments. Through their payment services, Alipay and WeChat Pay, the tech firms process nearly 90% of all mobile payment transactions in the country.”(, eng.)

China is already taking its first steps in the CVCB with a digital yuan pilot project.

“As part of the pilot program, the centralThe bank handed out “red envelopes”—a reference to the traditional way of gifting money in China—in the form of online wallets containing 200 digital yuan ($29.75) in balance to each of 50,000 randomly selected consumers.

Skeptical reaction of some recipientsA giveaway in Shenzhen, long accustomed to scanning item codes with a smartphone to pay through other systems, showed that the central bank and government have work to do to convince consumers of the benefits of the central bank's digital yuan.

“Alipay and WeChat Pay have been around for a long time,” says one of the experiment participants, an accountant by profession. "The new digital currency is similar to them, so it's too late to conduct such pilot tests."

Another PBOC online wallet user working in the financial industry agreed with this opinion, noting that paying with the digital yuan is less convenient than using other payment systems:

“I don't plan on using it again,” she said. "Unless they'll send me another 'red envelope'."

(: Reuters)

In short, "give us this money for free, and then we will use it."

This is an important point.If private payment providers are so far ahead, what should be the incentives for consumers to switch to a government digital currency? We will come back to this issue later.

What standards should a central bank digital currency meet?

That is, what will the CVS actually be used for? To track and control your behavior in the new Orwellian dystopia, no other way.

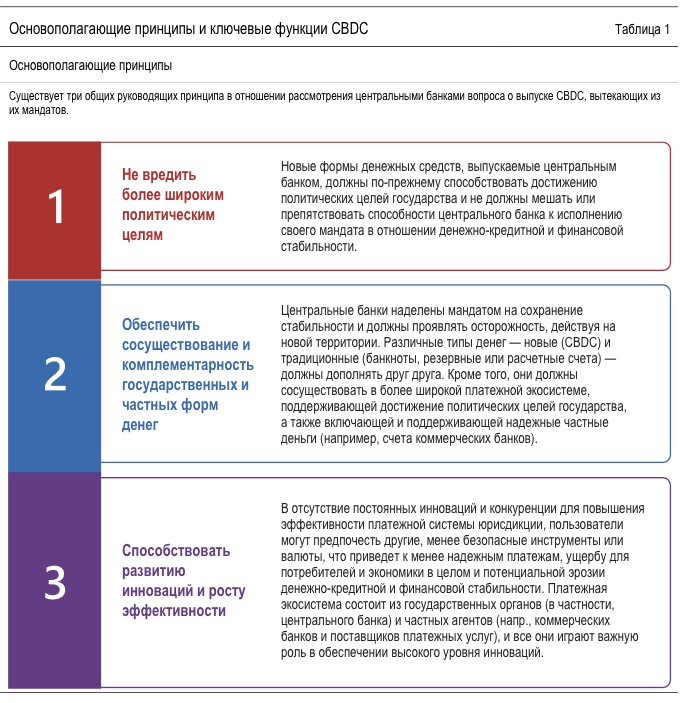

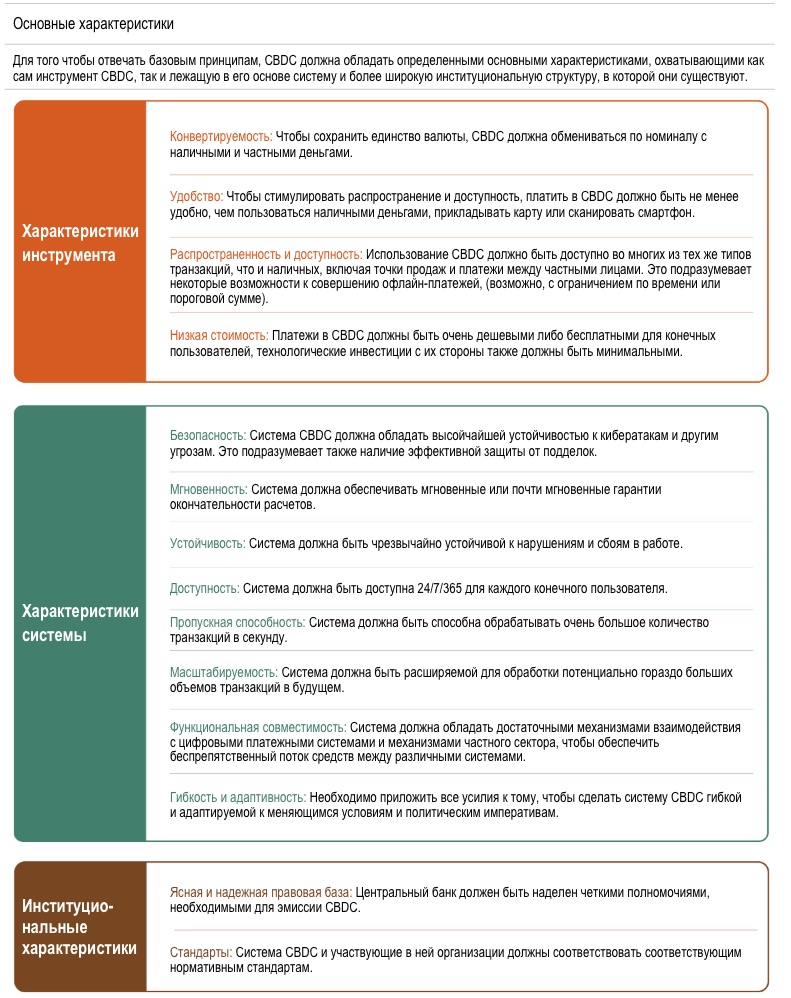

Okay, the Bank for International Settlements (BIS) has kindly released this summary report (English, PDF), in which everything is outlined in some detail.

(:[English, PDF])

The idea is pretty simple. Any CVC must be compatible with current policies and systems and have zero negative impact on stability.

What are the key characteristics and features of the CVCB?

Again, BIS answers this question quite thoroughly:

(:[English, PDF])

Today they are focused onnational means of payment... CEBs must supplement cash (and,maybe one day completely replace them). Obviously, if the Central Bank of Central Banks will work within the country, then further this story will develop already on an international scale.

To summarize, central banks lag far behind private payment systems, risk losing control of the money supply, and are forced to act.

But despite all the criticism of the slow reactioncentral banks - with such and such power - try to imagine what it would be like if we all started using Libra every day. I guess it wouldn't take long before someone figured out how to bypass the system and turn it into DeFi on steroids. But let's get to the fun part.

Irresponsible speculation about the future

Foil caps are not required. We focus only on genuine publications of the IMF and the ECB.

This research has always fascinated me. What is the problem? Cash is not directly affected by negative rates.

So, instead of paying negative interest, you can simply keep cash at zero interest.

Cash is a free zero interest option that acts as the bottom line of the interest rate.

(:IMF blog)

To avoid negative deposit rates,people can simply "hide" in cash. As long as there is no inflation, this money retains its value, which makes the Central Bank's policy ineffective (since there is no incentive to spend).

But don't worry, the IMF has a solution:rundual currencysystem and set negative rates on EVERYTHING, including cash:

“One option for overcoming the zero bottom line is to phase out cash. But it's not easy to do. Cash continues to play an important role in payments in many countries.

To work around this problem, in your ownin the IMF study (eng.) of August 2018 and in the previous study (eng., PDF), we are examining the proposal (eng., PDF) for central banks to make cash as costly as bank deposits with negative interest rates, so thereby opening the door to deeply negative interest rates while preserving the role of cash.

In a cashless world, there will be no lower limit forinterest rates. The central bank in the face of a serious recession will be able to reduce the interest rate, say, from 2 to minus 4 percent. The decrease in the interest rate will affect bank deposits, loans and bonds. Without the cash option, depositors will have to pay a negative interest rate to keep their money in the bank, making consumption and investment a more attractive option. This will spur lending, boost demand and stimulate the economy. "

“To illustrate, let's say the bank today announced a negative rate minus 3 percent on your $ 100 bank deposit.

Suppose also that the central bank has announced that cash dollars are now becoming a separate currency that will depreciate against the digital dollar by 3 percent per year.

Consequently, the conversion rate of cash dollars to digital for the year will change from 1 to 0.97. After a year, 97 digital dollars will remain in your bank account.

If, instead, you take $ 100 in cash today and keep it at home for a year, then exchanging it for digital money after that year will also generate $ 97 digital. "

(:IMF blog)

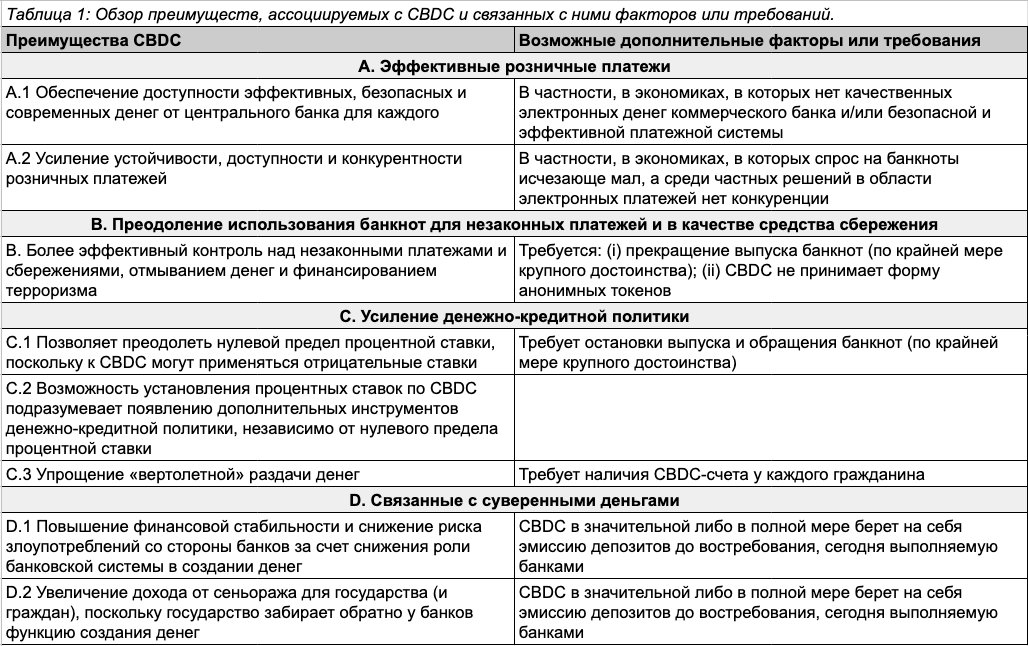

The ECB is, of course, fully aware of this (as well asabout many others) the potential use of the CVS. In January 2020, they published a working paper (English, PDF) titled “The Tiered CVS and the Financial System”. Point C.1 from there:?

What about Section D, Sovereign Money?

“Finally, the arguments about sovereign money (D)are also generally controversial, and, again, most monetary economists are likely to reject them. “In addition, as will be discussed in Sections 3 and 4, the rejection of intermediation by the banking system is seen as one of the main disadvantages and risks of the Central Bank of the Securities Market.”

"Oh well! Damn the banks! " (The crowd roars in approval.) But what if the alternative turns out to be even worse? The ECB document also talks about this option:

Huber, one of Germany's key supporters of sovereign money, summarizes the sovereign money proposal as follows:

“Grant the central bank unlimited full control over the total money supply on the legal basis of the general prerogative of money creation.

In other words, the entire monetary base - both cash and non-cash - should be controlled exclusively by the central bank. ”

Huber continues:

"This implies the abolition of the ability of the banking sector to create non-cash money in the form of demand deposits."

(That is, the end of fractional reserve banking.)

“Sovereign money does not require special changes in institutional and market structures.

Simply put, banks will be loan brokers, not loan originators.

Compared to today's situation, they will lose seigniorage, the additional profit from the creation of non-cash money.

In addition, the normal profitability of the banking business will remain unchanged. Banks will be able, without any restrictions, to continue to engage in all types of business that they are engaged in today ... ".

Yes, except for this small detail, everything will remain the same:

“It seems important to be able tomanage the issuance of CBTS in such a way that it serves the efficiency of retail payments, without necessarily calling into question the general monetary order by making CBTS the main form of store of value."

What does this mean for Bitcoin?

Bank of England Governor Andrew Bailey made his point clear (English, PDF):

“Crypto assets like Bitcoin, … Nothave nothing to do with money. They may have extrinsic value—for example, you may want to collect them—and therefore represent a high-risk investment opportunity.

Unsurprisingly, their value can fluctuate wildly.

They seem to me unsuitable for the world of payments, where certainty of value is important. "

Sounds like regulators aren't planningthreaten Bitcoin. Maybe it will eventually become digital gold. Apparently, if it is not suitable for payments (it is not digital money), then it is not considered as a competitor for them. It seems that this consensus extends to the cryptosphere as a whole.

However, they need this entire industry to continue to innovate and show them the best way forward. Regulation will come here much later when it is needed.

Let's speculate a little more about the future.

What is the biggest challenge for central banks with their digital currencies? It's about getting people to really use them.

As one of the participants in the pilot Chinese digital yuan distribution said,

“I don't plan on using it again. Unless they will send me another 'red envelope' ”.

But how can central banks simply give money away for free while maintaining perceived value? I have a theory about this.

You may have noticed that the rhetoric of our beloved central banks (in developed countries) has recently becomea littlemore politicized. If not, here are a couple of examples:

- Christine Lagarde, when buying bonds of the ECB, prioritizes environmental policy: “I want to try all possible ways to combat climate change. This is my firm conviction. "

- Jerome Powell, head of the Fed, focuses on inequality in the US economy, referring to the "pain of racial injustice."

The days of the Phillips curve are a thing of the past. We now turn to tackling inequality and climate change. So how can they use this agenda to spread the CVD?

Would you like to receive a subsidy / grant / loan for the installation of an electric car charger at home?

- Available in Digital Euro ™.

How about a subsidy to buy an electric vehicle from a European manufacturer?

- Cashback in Digital Euro ™ for every purchase.

Hiring an employee who will be hired to check these custom discrimination boxes?

- Submit the relevant documents and we will send the grant directly to your Digital Euro ™ wallet.

Unconditional Basic Income?

— Payments in Digital Euro™…

Etc.Here I am focusing only on the ECB, because they have even bothered to register the digital euro trademark. But the same applies to other central banks. It seems that this will be the best way for them to achieve the spread of their digital currency.

Central Banks can become a very powerful monetary andsocial tool. They could potentially bypass the turtle slow shenanigans of government legislators, deliver money straight into the pockets of consumers and into those areas of the economy that need it most.

But who will make these decisions?And which system will be chosen? One in which independent central banks pursue public goals? Or are governments and central banks changing societies together, abandoning the illusion of independence?

Be that as it may, change is already comingsoon. At the autumn forum of central banks, Christine Lagarde suggested that the digital euro will be ready for use in "2, 3 or 4 years".

Let's enjoy irresponsible speculation while we can. At some point in this decade, a brave new world is bound to come.

</p>